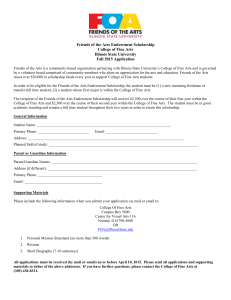

University of Florida Foundation, Inc.

advertisement