ORIE 568 Financial Engineering with Stochastic Calculus Fall Term

advertisement

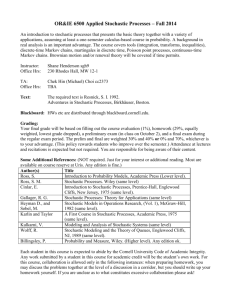

ORIE 568 Financial Engineering with Stochastic Calculus Fall Term 2005 Hours and location • Lectures: MWF 1010 – 1100A, Bard 140 • Sub-courses: Sec 1 W 0230 – 0425P, HO 401; Sec 2 R 0230 – 0425P, PH 203 Staff • Instructor: Stefan Weber, 279 Rhodes, (607) 254-4825, email: sweber@orie.cornell.edu • Teaching assistants: Spyros Schismenos, 287 Rhodes, email: ss525@cornell.edu Serkan Kirac, 283 Rhodes, email: ysk7@cornell.edu Office hours • Stefan Weber: W 0400 – 0600P, or by appointment. • Spyros Schismenos: to be announced • Serkan Kirac: to be announced Text book • Steven E. Shreve: Stochastic Calculus for Finance 2 – Continuous-Time Models Prerequisites A good knowledge of elementary probability theory is required (ORIE 360). This includes random variables, probability distributions, density functions, expectation and variance, and multidimensional random variables. Background knowledge on stochastic processes will be helpful, but is not required. Grading policy Your final grade will be based on homework (30%), two take home exams (25 % each), and a final exam (20%). • Homework (30 %): Homework assignments will be given approximately every two weeks. The due date can be found on each assignment. • Take home exams (25 % each): The first take home exam will be given on October 12 and is due by 10am on October 19. The second take home exam will be given on November 16 and is due by 10am on November 23. • Final exam (20 %): The final exam is scheduled for Thursday, December 8, 9–11am. About the middle of the term a complete list of final exam rooms will be posted at: http://registrar.sas.cornell.edu/Sched/finals.html 1 Academic integrity Direct copying of another’s work and representing it as one’s own is a violation of academic integrity that will be taken seriously. Similarly, allowing another student to copy one’s work is also a violation of academic integrity. It is your responsibility to make sure that no student copies from your paper. Students caught cheating on a homework will be reported to the Academic Integrity Hearing Board. If you have any doubts, please read the Code of Academic Integrity for more information about what constitutes a violation: http://www.cuinfo.cornell.edu/Academic/AIC.html Homepage Information about the course including assignments can be found at http://www.blackboard.cornell.edu/ Please enroll in this site. For further information see http://www.cit.cornell.edu/atc/cst/howto selfenroll.shtml Tentative syllabus The course provides an introduction to continuous-time models of financial engineering and the mathematical tools behind them. Starting with Brownian motion as a fundamental building stone in the theory of stochastic processes, the course develops a practical knowledge of stochastic calculus, covering topics including Itô integrals, the Itô-Doeblin formula, the Girsanov transform, and the Feynman-Kac formula. These methods are applied to the pricing and hedging of derivative securities in complete financial markets. In addition, we discuss absence of arbitrage, incomplete markets and the fundamental theorems of asset pricing theory. 1. Information and conditioning: information and σ-algebras, independence, general conditional expectations 2. Brownian motion (BM): scaled random walks, definition of BM, distribution of BM, filtration for BM, martingale property of BM, quadratic variation 3. Stochastic calculus: Itô’s integral, Itô-Doeblin formula, Black-Scholes-Merton equation, multivariable stochastic calculus 4. Risk-neutral pricing: Girsanov’s theorem, risk-neutral measure, martingale representation, fundamental theorems of asset pricing 5. Connections with partial differential equations (if time permits): stochastic differential equations, Markov property, PDEs, interest rate models, multidimensional Feynman-Kac theorems 2