Job Costing: Actual vs. Normal Costing Exercises

advertisement

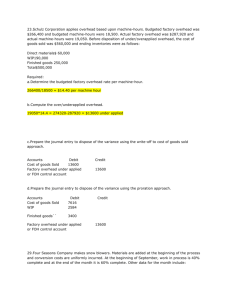

CHAPTER 4 JOB COSTING 4-17 1. (20 min.) Actual costing, normal costing, accounting for manufacturing overhead. Budgeted manufacturing overhead rate Actual manufacturing overhead rate = Budgeted manufacturing overhead costs Budgeted direct manufacturing labor costs = $2, 700, 000 = 1.80 or 185% $1, 500, 000 = Actual manufacturing overhead costs Actual direct manufacturing labor costs $2, 755, 000 = 1.9 or 190% $1, 450, 000 Costs of Job 626 under actual and normal costing follow: = 2. Direct materials Direct manufacturing labor costs Manufacturing overhead costs $30,000 × 1.90; $30,000 × 1.80 Total manufacturing costs of Job 626 4-1 Actual Costing Normal Costing $ 40,000 30,000 $ 40,000 30,000 57,000 $127,000 54,000 $124,000 3. Total manufacturing overhead = allocated under normal costing Actual manufacturing × Budgeted labor costs overhead rate = $1,450,000 × 1.80 = $2,610,000 Underallocated manufacturing = overhead Actual manufacturing – Manufacturing overhead costs overhead allocated = $2,755,000 − $2,610,000 = $145,000 There is no under- or overallocated overhead under actual costing because overhead is allocated under actual costing by multiplying actual manufacturing labor costs and the actual manufacturing overhead rate. This, of course equals the actual manufacturing overhead costs. All actual overhead costs are allocated to products. Hence, there is no under- or overallocatead overhead. 4-2 4-18 1. (20 -30 min.) Job costing, normal and actual costing. Budgeted indirectcost rate = Budgeted indirect costs $8,000,000 = Budgeted direct labor-hours 160,000 hours = $50 per direct labor-hour Actual indirectcost rate = $6,888,000 Actual indirect costs = Actual direct labor-hours 164,000 hours = $42 per direct labor-hour These rates differ because both the numerator and the denominator in the two calculations are different—one based on budgeted numbers and the other based on actual numbers. 2a. Normal costing Direct costs Direct materials Direct labor 2b. Indirect costs Assembly support ($50 × 900; $50 × 1,010) Total costs Actual costing Direct costs Direct materials Direct labor Indirect costs Assembly support ($42 × 900; $42 × 1,010) Total costs Laguna Model Mission Model $106,450 36,276 142,726 $127,604 41,410 169,014 45,000 $187,726 50,500 $219,514 $106,450 36,276 142,726 $127,604 41,410 169,014 37,800 $180,526 42,420 $211,434 3. Normal costing enables Anderson to report a job cost as soon as the job is completed, assuming that both the direct materials and direct labor costs are known at the time of use. Once the 900 direct labor-hours are known for the Laguna Model (June 2007), Anderson can compute the $187,726 cost figure using normal costing. Anderson can use this information to manage the costs of the Laguna Model job as well as to bid on similar jobs later in the year. In contrast, Anderson has to wait until the December 2007 year-end to compute the $180,526 cost of the Laguna Model using actual costing. Although not required, the following overview diagram summarizes Anderson Construction’s job-costing system. 4-3 INDIRECT COST POOL } Assembly Support COST ALLOCATION BASE } Direct Labor-Hours COST OBJECT: RESIDENTIAL HOME } Indirect Costs DIRECT COSTS } Direct Costs Direct Materials 4-4 Direct Manufacturing Labor 4-19 (10 min.) Budgeted manufacturing overhead rate, allocated manufacturing overhead. 1. Budgeted manufacturing overhead rate = = 2. Budgeted manufacturing overhead Budgeted machine hours $4, 000, 000 = $20 per machine-hour 200, 000 machine-hours Manufacturing overhead allocated = Actual machine-hours × Budgeted manufacturing overhead rate = 195,000 × $20 = $3,900,000 3. Since manufacturing overhead allocated is greater than the actual manufacturing overhead costs, Waheed overallocated manufacturing overhead: Manufacturing overhead allocated Actual manufacturing overhead costs Overallocated manufacturing overhead 4-5 $3,900,000 3,860,000 $ 40,000 4-20 (20-30 min.) Job costing, accounting for manufacturing overhead, budgeted rates. 1. An overview of the product costing system is } INDIRECT COST POOL COST ALLOCATION BASE } Machining Department Manufacturing Overhead Assembly Department Manufacturing Overhead Machine-Hours } Indirect Costs COST OBJECT: PRODUCT } DIRECT COST Direct Manuf. Labor Cost Direct Costs Direct Materials Direct Manufacturing Labor Budgeted manufacturing overhead divided by allocation base: Machining overhead Assembly overhead: 2. $1,800,000 = $36 per machine-hour 50,000 $3,600,000 = 180% of direct manuf. labor costs $2,000,000 Machining department, 2,000 hours × $36 Assembly department, 180% × $15,000 Total manufacturing overhead allocated to Job 494 3. Actual manufacturing overhead Manufacturing overhead allocated, 55,000 × $36 180% × $2,200,000 Underallocated (Overallocated) 4-6 $72,000 27,000 $99,000 Machining $2,100,000 Assembly $ 3,700,000 1,980,000 — $ 120,000 — 3,960,000 $ (260,000) 4-23 1. (10–15 min.) Accounting for manufacturing overhead. Budgeted manufacturing overhead rate = $7,500, 000 250,000 = $30 per machine-hour 2. Work-in-Process Control 7,350,000 Manufacturing Overhead Allocated 7,350,000 (245,000 machine-hours × $30 per machine-hour = $7,350,000) 3. $7,350,000– $7,300,000 = $50,000 overallocated, an insignificant amount of actual manufacturing overhead costs $50,000 ÷ $7,300,000 = 0.66%. Manufacturing Overhead Allocated 7,350,000 Manufacturing Department Overhead Control Cost of Goods Sold 4-7 7,300,000 50,000 4-27 (15 min.) Job costing, unit cost, ending work in progress. 1. Direct manufacturing labor rate per hour Manufacturing overhead cost allocated per manufacturing labor-hour $25 $20 Job M1 $275,000 Job M2 $200,000 Direct manufacturing labor costs Direct manufacturing labor hours ($275,000 ÷ $25; $200,000 ÷ $25) Manufacturing overhead cost allocated (11,000 × $20; 8,000 × $20) 11,000 8,000 $220,000 $160,000 Job Costs May 2009 Direct materials Direct manufacturing labor Manufacturing overhead allocated Total costs Job M1 $ 75,000 275,000 220,000 $570,000 Job M2 $ 50,000 200,000 160,000 $410,000 2. Number of pipes produced for Job M1 Cost per pipe ($570,000 ÷ 1,500) 1,500 $380 3. Finished Goods Control Work-in-Process Control 570,000 570,000 4. Raymond Company began May 2009 with no work-in-process inventory. During May, it started and finished M1. It also started M2, which is still in work-in-process inventory at the end of May. M2’s manufacturing costs up to this point, $410,000, remain as a debit balance in the Work-in-Process Inventory account at the end of May 2009. 4-8 4-28 1. (20−30 min.) Job costing; actual, normal, and variation from normal costing. Actual direct cost rate for professional labor = $58 per professional labor-hour $744,000 15,500 hours = $48 per professional labor-hour = $960,000 16,000 hours = $60 per professional labor-hour Budgeted indirect cost rate = $720,000 16,000 hours = $45 per professional labor-hour Actual indirect cost rate = Budgeted direct cost rate for professional labor Direct-Cost Rate Indirect-Cost Rate 2. Direct Costs Indirect Costs Total Job Costs (a) (b) Actual Normal Costing Costing $58 $58 (Actual rate) (Actual rate) $48 $45 (Actual rate) (Budgeted rate) (c) Variation of Normal Costing $60 (Budgeted rate) $45 (Budgeted rate) (a) (b) (c) Actual Normal Variation of Costing Costing Normal Costing $58 × 120 = $ 6,960 $58 × 120 = $ 6,960 $60 × 120 = $ 7,200 48 × 120 = 5,760 45 × 120 = 5,400 45 × 120 = 5,400 $12,720 $12,360 $12,600 All three costing systems use the actual professional labor time of 120 hours. The budgeted 110 hours for the Pierre Enterprises audit job is not used in job costing. However, Chirac may have used the 110 hour number in bidding for the audit. The actual costing figure of $12,720 exceeds the normal costing figure of $12,360 because the actual indirect-cost rate ($48) exceeds the budgeted indirect-cost rate ($45). The normal costing figure of $12,360 is less than the variation of normal costing (based on budgeted rates for direct costs) figure of $12,600, because the actual direct-cost rate ($58) is less than the budgeted direct-cost rate ($60). 4-9 Although not required, the following overview diagram summarizes Chirac’s job-costing system. INDIRECT COST POOL COST ALLOCATION BASE Audit Support Professional Labor-Hours COST OBJECT: JOB FOR AUDITING PIERRE & CO. Indirect Costs Direct Costs DIRECT COST Professional Labor 4-10 4-31 (20−30 min) 1. Job costing, accounting for manufacturing overhead, budgeted rates. An overview of the job-costing system is: INDIRECT COST POOL } COST ALLOCATION BASE } Machining Department Manufacturing Overhead Finishing Department Manufacturing Overhead Machine-Hours in Machining Dept. Direct Manufacturing Labor Costs in Finishing Dept. } Indirect Costs COST COSTOBJECT: OBJECT: PRODUCT JOB } DIRECT COST 2. Direct Costs Direct Materials Direct Manufacturing Labor Budgeted manufacturing overhead divided by allocation base: a. Machining Department: $10,000,000 = $50 per machine-hour 200,000 b. Finishing Department: $8,000,000 $4,000,000 = 200% of direct manufacturing labor costs 4-11 3. Machining Department overhead, $50 × 130 hours Finishing Department overhead, 200% of $1,250 Total manufacturing overhead allocated 4. Total costs of Job 431: Direct costs: Direct materials––Machining Department ––Finishing Department Direct manufacturing labor —Machining Department —Finishing Department Indirect costs: Machining Department overhead, $50 × 130 Finishing Department overhead, 200% of $1,250 Total costs $6,500 2,500 $9,000 $14,000 3,000 600 1,250 $6,500 2,500 $18,850 9,000 $27,850 The per-unit product cost of Job 431 is $27,850 ÷ 200 units = $139.25 per unit The point of this part is (a) to get the definitions straight and (b) to underscore that overhead is allocated by multiplying the actual amount of the allocation base by the budgeted rate. 5. Machining Manufacturing overhead incurred (actual) $11,200,000 Manufacturing overhead allocated 220,000 hours × $50 11,000,000 200% of $4,100,000 Underallocated manufacturing overhead $ 200,000 Overallocated manufacturing overhead Total overallocated overhead = $300,000 – $200,000 = $100,000 Finishing $7,900,000 8,200,000 $ 300,000 6. A homogeneous cost pool is one where all costs have the same or a similar cause-andeffect or benefits-received relationship with the cost-allocation base. Solomon likely assumes that all its manufacturing overhead cost items are not homogeneous. Specifically, those in the Machining Department have a cause-and-effect relationship with machine-hours, while those in the Finishing Department have a cause-and-effect relationship with direct manufacturing labor costs. Solomon believes that the benefits of using two cost pools (more accurate product costs and better ability to manage costs) exceeds the costs of implementing a more complex system. 4-12