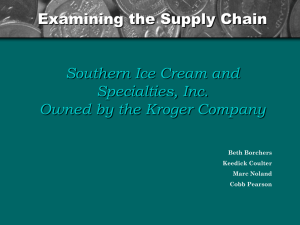

An Equity Valuation and Analysis of Kroger Co.

advertisement