Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Top Stories

Weekly Market Review

Pioneers Holding (PIOH.CA)

unveiled its FY11 financial statements showing a net profit of

LE114.7 million versus LE19.8 million in the FY10.

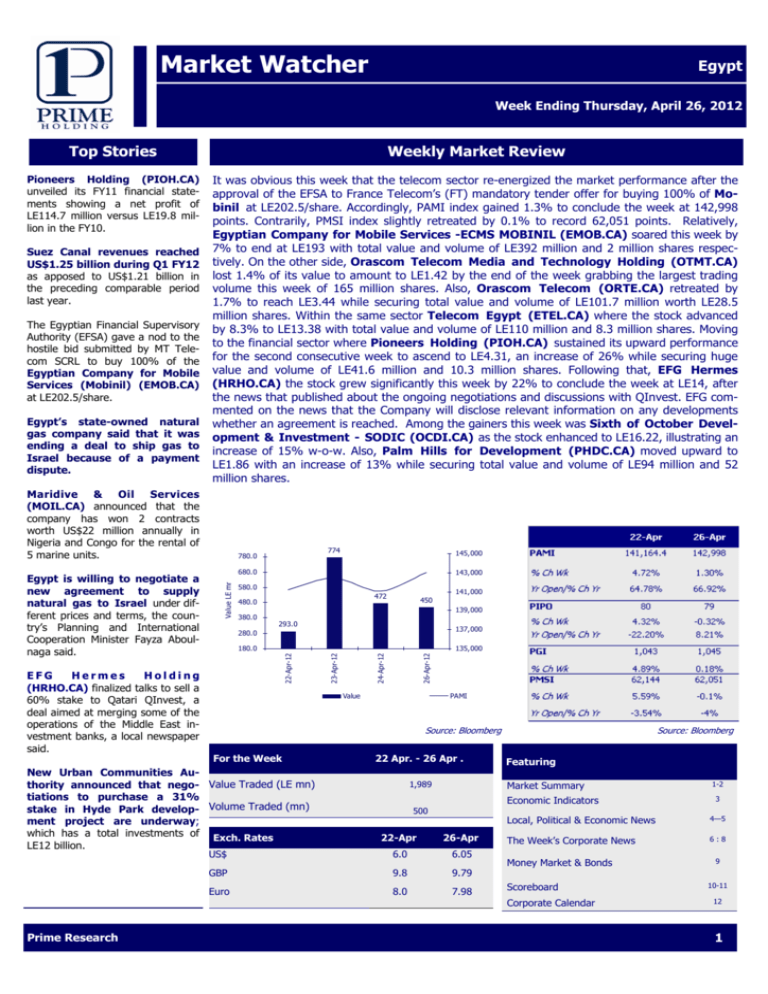

It was obvious this week that the telecom sector re-energized the market performance after the

approval of the EFSA to France Telecom’s (FT) mandatory tender offer for buying 100% of Mobinil at LE202.5/share. Accordingly, PAMI index gained 1.3% to conclude the week at 142,998

points. Contrarily, PMSI index slightly retreated by 0.1% to record 62,051 points. Relatively,

Egyptian Company for Mobile Services -ECMS MOBINIL (EMOB.CA) soared this week by

7% to end at LE193 with total value and volume of LE392 million and 2 million shares respectively. On the other side, Orascom Telecom Media and Technology Holding (OTMT.CA)

lost 1.4% of its value to amount to LE1.42 by the end of the week grabbing the largest trading

volume this week of 165 million shares. Also, Orascom Telecom (ORTE.CA) retreated by

1.7% to reach LE3.44 while securing total value and volume of LE101.7 million worth LE28.5

million shares. Within the same sector Telecom Egypt (ETEL.CA) where the stock advanced

by 8.3% to LE13.38 with total value and volume of LE110 million and 8.3 million shares. Moving

to the financial sector where Pioneers Holding (PIOH.CA) sustained its upward performance

for the second consecutive week to ascend to LE4.31, an increase of 26% while securing huge

value and volume of LE41.6 million and 10.3 million shares. Following that, EFG Hermes

(HRHO.CA) the stock grew significantly this week by 22% to conclude the week at LE14, after

the news that published about the ongoing negotiations and discussions with QInvest. EFG commented on the news that the Company will disclose relevant information on any developments

whether an agreement is reached. Among the gainers this week was Sixth of October Development & Investment - SODIC (OCDI.CA) as the stock enhanced to LE16.22, illustrating an

increase of 15% w-o-w. Also, Palm Hills for Development (PHDC.CA) moved upward to

LE1.86 with an increase of 13% while securing total value and volume of LE94 million and 52

million shares.

Maridive & Oil Services

(MOIL.CA) announced that the

company has won 2 contracts

worth US$22 million annually in

Nigeria and Congo for the rental of

5 marine units.

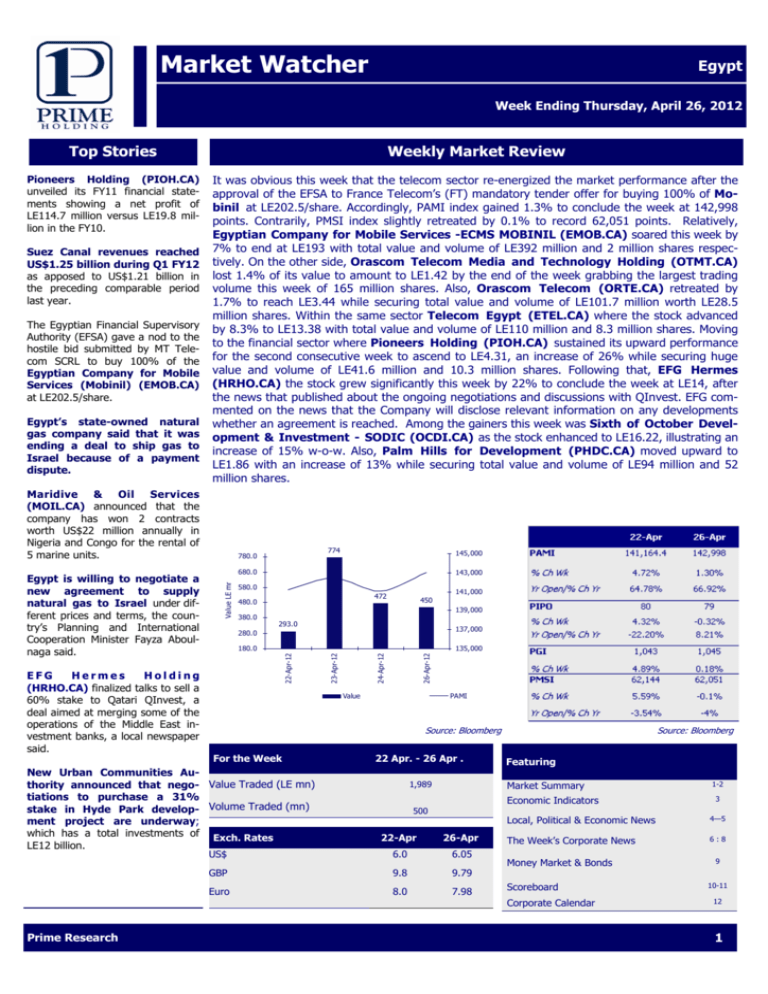

143,000

580.0

380.0

141,000

472

480.0

450

139,000

293.0

137,000

280.0

135,000

180.0

22-Apr-12

EFG

Hermes

Holding

(HRHO.CA) finalized talks to sell a

60% stake to Qatari QInvest, a

deal aimed at merging some of the

operations of the Middle East investment banks, a local newspaper

said.

145,000

680.0

Value LE mn

Egypt is willing to negotiate a

new agreement to supply

natural gas to Israel under different prices and terms, the country’s Planning and International

Cooperation Minister Fayza Aboulnaga said.

774

780.0

26-Apr-12

Egypt’s state-owned natural

gas company said that it was

ending a deal to ship gas to

Israel because of a payment

dispute.

24-Apr-12

The Egyptian Financial Supervisory

Authority (EFSA) gave a nod to the

hostile bid submitted by MT Telecom SCRL to buy 100% of the

Egyptian Company for Mobile

Services (Mobinil) (EMOB.CA)

at LE202.5/share.

23-Apr-12

Suez Canal revenues reached

US$1.25 billion during Q1 FY12

as apposed to US$1.21 billion in

the preceding comparable period

last year.

Value

PAMI

Source: Bloomberg

For the Week

New Urban Communities Authority announced that nego- Value Traded (LE mn)

tiations to purchase a 31%

stake in Hyde Park develop- Volume Traded (mn)

ment project are underway;

which has a total investments of Exch. Rates

LE12 billion.

22 Apr. - 26 Apr .

1,989

Source: Bloomberg

Featuring

Market Summary

Economic Indicators

500

22-Apr

26-Apr

US$

6.0

6.05

GBP

9.8

9.79

Euro

8.0

7.98

3

Local, Political & Economic News

4—5

The Week’s Corporate News

6:8

Money Market & Bonds

Scoreboard

Corporate Calendar

Prime Research

1-2

9

10-11

12

1

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Market Summary

Top 10 Gainers Between

Top 10 Losers Between

% Gain

22 Apr. - 26 Apr .

% Loss

Pioneers Holding

Financial Group Hermas Holding Co.

26%

22 Apr. - 26 Apr .

Alexandria Cement Company

-20.75%

22%

Sidi Krier

-10.52%

Sixth of October for Investment & Development

15%

Sinai Cement

-9.66%

Egyptian for Touristic Resorts

13%

Central & West Delta Mills

-8.60%

Palm Hills

13%

Medical Union Pharmaceutical

-7.79%

Ramco for construction of Touristic Villages

12%

Arab Ceramics (ARACEMCO)

-7.66%

Egyptians Company for Housing Development & Reconstruction

10%

Delta Sugar

-7.64%

Talaat Mostafa Group Holding

10%

Misr Hotels (HILTON)

-5.78%

Bisco Misr

9%

Golden Tex Wool Company

-5.63%

United Housing & Development

9%

Pyramisa Hotels & Cruises Company

-5.27%

Top 10 Traded By Volume

Top Sectors by Market Value

Volume

(000's)

22 Apr. - 26 Apr .

Orascom Telecom Media And Technology Holding

165,101

Palm Hills

Arabia Investments, Development, Fin. Inv. Holding Comp.Cash

Amer Group

Egyptian for Touristic Resorts

Orascom Telecom

52,126

Talaat Mostafa Group Holding

28,264

Financial Group Hermas Holding Co.

Pioneers Holding

Arab Real Estate Investments (ALECO)

14,443

10,329

9,448

41,037

35,452

29,625

28,524

%

22 Apr. - 26 Apr .

Holding Companies

19.43%

Housing &Real Estate & Tourism

11.07%

Cement & Building Material

8.26%

Telecom & Media

6.65%

Banking

5.24%

GDR Performance

26-Apr-12

5.13

25-Apr-12

5.13

24-Apr-12

5.20

23-Apr-12

5.10

20-Apr-12

5.11

19-Apr-12

5.10

18-Apr-12

5.06

CIB

COMIq.L

Orascom Telecom

ORTEq.L

4.68

4.66

4.58

4.84

4.95

4.93

4.98

Orascom Construction Industries

OCICq.L

48.15

48.00

48.40

48.55

48.60

48.20

48.55

Suez Cement

SUCEq.L

7.55

7.55

7.55

7.55

7.55

7.55

7.55

Telecom Egypt

ETELq.L

16.50

16.50

16.65

16.30

16.50

15.50

15.50

EFG-Hermes

HRHOq.L

7.76

7.76

7.76

7.80

7.60

7.60

7.84

Prime Research

2

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Egypt Economic Indicators

(LE Billion)

Balance of Payments

(US$ Mn)

*GDP by Expenditures (Current Prices)

FY08/09

FY09/10

FY10/11

-25,173

-25,120

-23,784

Real Growth Rate

Budget Deficit

Trade Balance

Services (net)

12,502

10,339

7,878

FY08

FY09

FY10

FY11

896

7.2%

(66,7)

1,042

4.7%

(69,1)

1,207

5.1%

(97,9)

1,372

1.8%

(132,5)

% of GDP

7.4

6.6

8.1

658

755.3

888.7

Domestic Debt/GDP %

73.4

72.5

73.6

76.2

Govt. Debt/GDP %

53%

54%

55%

59%

Domestic

Total Domestic Debt

9.7

1,044.8

Current Acc.

-4,424

-4,318

-2,769

Capital & Fin. Acc.

1,381

8,325

-4,824

External

External Debt (US$ bln)

33.9

31.5

33.7

34.9

FDIs

8,113

6,758

2,189

External Debt/GDP %

3.8%

3.0%

2.8%

2.5%

Fiscal Year Ending June*

Source: CBE & Ministry of Finance

Long-term Credit Ratings

S&P

B- Negative (non-inv. Grade)

Moodys (FCY Bonds)

Fitch IBCA

B1 Negative (non-inv. Grade)

B- (non-inv. grade)

Foreign Reserves - US$ Bln

A: Actual; E: Estimate; F: Forecast; N/A: Not Available

*Ending June

Feb., 2012

Mar., 2012

15.7

15.1

Source: CBE

Macro & privatization News

Saudi Arabia will provide Egypt with an aid package that may

include a three-year deposit or the purchase of treasury bills and

bonds, according to Egyptian Prime Minister Kamal el-Ganzouri. Planning and International Cooperation Minister Fayza Aboulnaga said in

an interview that the package will include a US$1 billion deposit and

US$750 million to buy treasury bonds. A Saudi delegation will visit

Egypt to discuss details, she said. Announcements came after Aboulnaga met Saudi Finance Minister Ibrahim Al-Assaf at a conference this

week in Morocco. The kingdom has so far given Egypt US$500 million

out of almost US$4 billion of aid pledged after last year’s popular

revolt that ousted Hosni Mubarak.

Suez Canal revenues reached US$1.25 billion during Q1 FY12

as apposed to US$1.21 billion in the preceding comparable period last

year.

Egypt's request for a US$3.2 billion IMF loan will not be enough

to meet the country's financial needs and will require additional

resources from donor countries, the head of the International Monetary Fund said on Wednesday. "It will not be sufficient, and everybody knows that, so it will require other donors, other participants to

also come to the table to help Egypt," IMF Managing Director Christine Lagarde told a news conference before the start of the IMF and

World Bank meetings in Washington. On a related note, The IMF said

on Friday Egypt's government and political partners have

made good progress in agreeing on the content of an IMF

funding program for the country. "We feel there is some progress

in terms of getting a commitment and broad buy-in to the objectives

and the measures" of a program, including among those who are

likely to be involved in implementing after the elections, said IMF

Director for the Middle East Masood Ahmed. Relatively, IMF expects

that inflation rate in Egypt will increase to 10.8% during the coming period, due to the applied policy of retreating subsidy, hence,

resulting in increasing prices for consumers. Moreover, IMF expects

that the Egyptian economy will register a real growth rate of 1.5%

during FY11/12 in comparison to 1.8% in FY10/11.

Prime Research

CBE monthly bulletin revealed that banknote issue increased on a

monthly basis by 1.78% in January FY12 reaching LE193.51 billion.

Meanwhile, non governmental deposits in foreign currency escalated

by 2% m-o-m, standing at LE188.35 million in January FY12. The

report revealed also that loan loss provisions in banks reached

LE54.89 billion in January FY12 versus LE52.92 billion in the previous

month.

Released data from the Ministry of Trade and Industry revealed a

14% y-o-y decline in the Egyptian exports in March FY12

reaching LE10.4 billion in comparison to the same period in the previous year.

Plastic and rubber department in the Chemical Industries

Chamber will hold a meeting tomorrow to discuss renewing the penalty fee on plastic residues which is estimated at LE1,500/ton.

The Ministry of Water Resources and Irrigation will execute a

package of development projects in South Sudan regarding the water

resources field with investment cost of US$11.5 million.

Alexandria Cotton Exporters' Association (Alcotexa) committed to sell 951 tons of cotton in the week that ended on April 14,

an Alcotexa official said. The sales comprised 569 tonnes of Giza 88

grade cotton and 382 tones of Giza 86, the official said. The deals

bring Alcotexa's export commitments for the 2011/12 season, which

began in September 2011, to 67,940 tones, worth US$213.7 million.

By this time last year, Alcotexa had sold 110,213 tones of cotton

worth US$452.98 million.

Egypt's Nasr Petroleum Company is in the midst of restarting

its 146.3k barrels-per-day refinery in Suez after a fire, an official source from the company said. "The refinery remains shut. We

are in the process of preparing to restart it," he said but declined to

be named. "We hope that we will be able to restart the refinery within

the next 24 hours."

3

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Macro & privatization News

The government will ask parliament to allocate LE108.9 billion or more in subsidies for petroleum products in the budget

for the new fiscal year 2012-2013, Minister of Petroleum Abdallah

Ghorab has said. The allocation is intended to cater for the annual

increase in consumption and the rise in the prices of petroleum

product imports. It is predicted that the subsidy will be increased to

LE113.2 billion by the end of June, and that the price of petroleum

will increase.

Saad El-Katatni, speaker of parliament, denied rumors on Thursday

that proposals for a draft law setting standards for the constituent

assembly composition have been submitted to Egypt's People's

Assembly. Instead Katatni asked Mahmoud El-Khodeiry, head of the

Legislative and Constitutional Affairs Committee, to conduct sessions

with representatives from all sections of Egyptian society to reach a

consensus on the method chosen to elect members of the constitutional-building body.

The Egyptian Tourist Authority announced that there is a

noticeable increase in number of tourists pouring into Egypt,

where rates increased by 32% during the first quarter of 2012 compared with the first quarter of 2011. The number of tourists reached

2.5 million between January and March as opposed to 1.89 million

tourists during the same period last year.

Egypt’s state-owned natural gas company said that it was

ending a deal to ship gas to Israel because of a payment dispute. Israeli officials responded by warning that the termination cast a

new shadow over the bilateral peace treaty. In reaction to Egypt's decision to cancel the gas agreement, Energy Minister Uzi Landau said that

his ministry has been preparing for such a possibility for one year. The

minister added that regular gas supplies have not been coming from

Egypt for over a year and that in any case Israel is taking steps to

strengthen its independence in energy and to provide for the speedy

development of Israeli sources of supply. Sources in the energy sector

in Egypt claim that the agreement with Israel was cancelled because

Israel did not meet its commitments. The Egyptian sources noted that

this is not a political issue, but a purely commercial agreement, our

correspondent Gal Berger reports.

Ezz Eddin Ashraf, Egyptian envoy to the United States, said that the

volume of trade between Egypt and the US in January 2012

decreased by 34.2% to US$545.3 million, compared to US$829.8

million in January 2011. Egypt's exports decreased to US$152.3 million from US$171 million. He said the decrease was due to Egypt’s

failure to export any petroleum products last January, compared to

US$26.9 million worth of oil exports in January 2011. He added that

Egypt previously exported metal fuel, liquefied natural gas and crude

oil to the US. Ezz Eddin said non-oil exports rose in January 2012 to

reach US$152.3 million, a 5.6% increase from US$144.1 million in

January 2011. Products listed in the Qualified Industrial Zones

agreement witnessed the greatest export increase, rising by 29.4%

to reach US$106.3 million in January 2012 from US$82.1 million in

January 2011. Ezz Eddin noted that the most important Egyptian

exports were textiles, carpets and cotton, in addition to urea fertilizer and decorative pieces, vegetables, medicinal herbs and aluminum.

China suspended a loan of US$300 million, was intended to

create a new building for the exhibition and a 5 star hotel

Authority Nasr City Conference. The China Development Bank

canceled the loan and agreed to the submission of Egypt in 2009,

and adopted by the council of parliament in 2010, due to the delay

of the Ministry of Industry and Commerce in the implementation of

the project agreed upon, and the failure of the parties Egyptian and

Chinese to reach a compromise on the technical issues related to the

project.

The Muslim Brotherhood’s political arm criticized a visit to

Jerusalem by a top Egyptian cleric, Grand Mufti Ali Gomaa.

“It is not acceptable for such a visit to take place after the revolution, when both official and popular positions reject having any relations with the Israeli entity as long as occupation, settlements and

the siege of Gaza continue,” the Freedom and Justice Party said in a

statement.

The Egyptian Higher Presidential Elections Commission

(HPEC) on Saturday set rules for the presidential election

propaganda, which will kick off on April 30, state media reported.

According to the rules, presidential candidates can hold meetings,

rallies and symposiums to explain their electoral platforms but cannot expose other candidates' private lives or their families in any

form, the official MENA news agency quoted an HPEC official as saying.

Prime Research

Dr. Mohamed Salem, Minister of Telecommunications and Technology

has met representatives from the World Bank, during the meeting the

Egyptian government asked the WB to speed up the procedures of borrowing US$1.2 million to support the economy and

provide job opportunities. Meanwhile, Dr. Momtaz El Said, Minister

of Finance declared that Egypt will receive first tranch of US$1.5

billion from the IMF's loan by the mid of May with an interest

rate of 1.2%

Fayza Abu El Naga, Minister of International cooperation announced

that the government has finally settled the problems of all the

Arab investors in Egypt, especially from UAE and Qatar. The

minister pointed out that the settlement committee searched during its

meeting yesterday with the prime minister the settlement of the current established investments.

Ministry of Petroleum is currently searching for methods to

provide US$140 million to finance the importing of four shipments of solar to satisfy the needs of the local market until the end

of this month.

Egyptian Businessmen committee signed a protocol yesterday with an

Egyptian Italian Committee to increase the cooperation between two

countries and increase the commercial trade between Egypt and Italy.

Relatively, Dr. Mahmoud Eissa, Minister of Trade and Industry

announced that the Italian investments in Egypt amounted to

US$1.5 billion by the end if FY11 distributed over 808 projects in

different fields.

Economic affairs Committee in the Parliament decided yesterday to

postpone the final approval of the draft law of amending the law to

protect competition and prevent monopolistic practices.

4

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Macro & privatization News

Egypt is willing to negotiate a new agreement to supply natural gas to Israel under different prices and terms, the country’s Planning and International Cooperation Minister Fayza Aboulnaga said. The

Egyptian parties to the 2005 accord notified East Mediterranean Gas

Co., which transports the gas to Israel, five times about past-due

amounts before deciding to end the agreement, Aboulnaga said. The

last notification was issued on March 31, she added.

Egypt's cabinet has ordered that LE8.8 billion of so-called special funds be redirected into the country's central bank, Finance

Minister Momtaz El-Saeed announced. Special funds are monies raised

by state institutions through means other than customs or taxes, such

as hospital fees or parking tickets.

Egypt's Minister of Communications and Information Technology, Mohamed Salem, discussed with World Bank Vice President for the Middle East, Inger Andersen, ways of accelerating

measures to receive a loan worth US$200 million Egypt has

sought from the Bank. The loan aims to minimize unemployment

and develop job opportunities in labor-intensive industrial sectors including irrigation, housing, health, and education.

Energy-poor Jordan warned that cut-offs in unstable Egyptian

gas supplies could cost the kingdom more than US$2 billion

this year. "We are worried about the energy situation. Egypt's gas

supplies have become an unstable source," Minister of Trade and Industry Sami Gammoh said. "We are doing our best and in all directions.

We have received promises from Iraq and Gulf states to help cover our

needs", he added.

Minister of Planning and International Cooperation Fayza

Abouelnaga expects foreign reserves to rise next month with

the stabilization of political and economic conditions. Speaking

to the Shura Council’s Finance and Economic Affairs Committee,

Abouelnaga said foreign reserves were depleted by US$3 billion every

month at the beginning of the revolution, started to decline to US$2.5

billion, until it dropped to US$600 million in the past months. The government has wisely allowed foreign investors to transfer US$10 billion

out of the country two months after the revolution,” she said. “This

made them trust the government and would encourage them to reinvest in the local market.” Moreover, she said that local wheat production increased by three million tons this year, which eases the burden

of importing from abroad and saves foreign currency. She also added

said that intense negotiations are underway with international financial

institutions for a US$1 billion credit to buy petroleum products, particularly butane gas.

The President of the International Fund for Agricultural Development (IFAD), Kanayo F. Nwanze, will meet the Minister of

Agriculture and Land Reclamation of the Arab Republic of

Egypt, Mohammed Reda Ismail, this week in Cairo to discuss

the country's agriculture development, which is critical for employment generation, food security and reduction of poverty.

Egypt's Ministry of Finance will offer LE3 billion (US$494.7

million) in reopened bonds at an auction on 30 April, the central bank said. It will offer LE2 billion in reopened three-year bonds

maturing on 3 April, 2015 with a coupon of 16.15%, and LE1 billion in

seven-year bonds maturing on April 3, 2019 with a coupon of 16.85%,

the bank said. Settlement for the bonds, which the central bank is selling on behalf of the ministry, is on 1 May.

Prime Research

Jordanian Minister of Energy and Mineral Resources Qutaibah

Abu Qura met in Cairo with Egyptian Minister of Oil and Minerals Mohammad Ghurab, where the two ministers discussed

energy cooperation between the two countries. They also highlighted the strong and strategic ties between the two countries.

Federation of Egyptian Industries (FEI) Plastics Division has rejected

the request of both Oriental Petrochemicals Company (OPC) and The

Egyptian Propylene & Polypropylene Company (EPPC) as regards to

imposing dumping fees on Egypt’s Polypropylene imports

from Saudi Basic Industries Corporation (SABIC). The two companies

indicated in a memo submitted to the Ministry of Trade and Industry

that Saudi Polypropylene imports weighed on their local sales. Khalid

Abu Makarem, Head of Plastics Division at FEI, noted that most of the

plastics factories objected to imposing restrictions on Polypropylene

imports, taking into consideration that the domestic production did

not meet the consumption needs.

The Egyptian/ Italian friendship and cooperation organization announced that Italian companies intend to invest US$4 billion in

the Egyptian economy within the tourism and industrial sectors during

the coming period.

CAPMAS reported an increase in of food prices during March

2012 compared to February as prices of fish Chicken and rice rose by

13.5%, 10.5% and 3% respectively.

Egypt's ruling army has approved a law barring top officials

from Hosni Mubarak's era running for president, a newspaper

website said on Monday, but it may not stop the candidacy of his last

prime minister. It was unclear if the law passed by the Islamist-led

parliament would take effect in time to block the presidential bid of

Ahmed Shafiq, who was appointed prime minister in the last days of

Mubarak's rule and served for a short time after his ouster.

New Urban Communities Authority announced that negotiations to purchase a 31% stake in Hyde Park development

project are underway; which has a total investments of LE12 billion. Furthermore, the stake that NUCA intends to purchase would be

from the total stake of Damac Properties in the project of 18.2% as

well as 13% from other investors.

Prime Minsiter Kamal Al Ganzoury approved a decree for real

estate developers; entailing that no lands would be reclaimed by

the government on projects that have begun development operations.

Furthermore, the decree increases the grace period for project development from 3 years to 5 years starting from the date that facilities

were connected to the land plot.

Qatar is providing US$400 million to support Egypt’s

Mostorod refinery project, which has been stalled since former

President Hosni Mubarak’s ouster in February last year, MEED reported. State-run Qatar Petroleum is providing US$300 million in equity, and Qatar National Bank, which counts the emirate’s government

as its biggest shareholder, is providing US$100 million in loans, MEED

reported, citing unnamed people involved in the effort. The Qatari

funding ensures that the project will reach its financial close in May,

according to the report.

5

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Macro & privatization News

Egypt will offer LE17 billion (US$2.8 billion) of seven-day repurchase agreements, after accepting bids for LE19.2 billion last week.

The contracts, known as repos, allow government securities holders

to sell them back to the North African country’s central bank to access funds for a week at 9.75%, according to the regulator’s data on

Bloomberg. The facility was started in March 2011 to ease funding

pressure at local banks as they increased holdings of government

debt amid political unrest. The Finance Ministry sold five-year notes

yesterday at an average yield of 16.54%, the lowest level in more

than three months.

Ahmed Refaat head of the Egyptian tax authority announced that the

total income tax revenues for individuals during 2011 rose to reach

LE2.2 billion compared to LE1.4 billion. Moreover, Mr. Refaat announced that total tax revenues till March 2012 reached LE115.5

billion compared to LE88.5 billion during the comparable period in the

preceding year.

Egypt's military is pumping LE400 million of its funds into

North Sinai development projects to coincide with the 30th anniversary of Israel's return of the territory, Al-Ahram newspaper reported. The North Sinai projects detailed in the Al-Ahram report are

worth LE400 million (US$66.6 million) and involve developing residential and industrial sectors, as well as infrastructure, in the border

governorate.

Vice Chairman of the Holding Company for Spinning and

Weaving announced that the current form of the company’s subsidiaries threatens of a total shut down; adding that Al Mahala company,

the largest and most equipped subsidiary, is operating at 30% capacity.

transportation minister has called a large step in increasing

maritime trade between countries in the greater region. The

agreement establishes direct shipping lines between the two countries, allowing Egyptian shipments to travel to Europe via Turkey, and

Turkish shipments to cross the Arab gulf and Africa via Egypt, Transportation Minister Galal al-Saeed said.

Cement companies have set their selling prices for the month

of May to range between LE500-LE566 per ton. Moreover, Ahmed Al Zainy, Vice Chairman of the building materials society in the

Cairo chamber of commerce, announced that the total cost of cement

stands at LE300 per ton.

Prime Research

Egypt has signed a shipping protocol with Turkey that the

Total paid in capital for newly established copmpanies during the

first 4 month of 2012 reach LE10.53 billion; of which egyptioans contributed LE8.8 billion.

The decision to halt Egyptian natural gas exports to Israel

was not due simply to commercial differences, international

shareholders in the consortium involved said on Wednesday,

dismissing claims they were behind in payments. "Any attempts to characterize this dispute as a mere commercial one is misleading," shareholders in East Mediterranean Gas Co (EMG) said.

The Cabinet has decided to postpone its coupon-for-canisters

project for three weeks to further examine how the project

will be implemented. The project has been developed to alleviate

the current fuel shortage, and could help the government save nearly

LE4 billion in annual expenses.

Egypt's election commission has reinstated former premier,

Ahmed Shafiq as a contender in the country's upcoming

presidential election. Shafiq was earlier disqualified after the Egyptian authorities approved a law that bans senior officials from the

Mubarak's regime from running for office. On Wednesday, the commission, however, upheld Shafiq's appeal. "The decision to accept my

client's appeal proves that the electoral committee functions as an

independent body according to the rule of law," the report quoted

Shafiq's lawyer, Shawqi Sayyid, as saying. Shafiq was the last prime

minister to serve under Mubarak, who was ousted by an uprising

against his rule in February last year. The law under which Shafiq was

originally disqualified bars from the presidency anyone who served in

senior positions in President Hosni Mubarak-led government. According to the report, Shafiq, in his appeal, challenged the measure's constitutionality and the commission has now referred the law to Egypt's

Supreme Constitutional Court.

Egypt has gained political backing for an IMF loan, opening

the way for the first tranche to flow from next month, the

country's minister of finance has said. Wrangling between parties has beset negotiations over the US$3.2 billion funds, required to

avert a fiscal crunch. The IMF has insisted it will not release the cash

without broad political support for the loan and the linked economic

plan.

6

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Corporate News

Waseela Microfinance Bank is likely to commence its nationwide banking operations in the upcoming weeks subsequently the central bank

has granted it permission for the launch of its commercial services.

Waseela Microfinance Bank is a subsidiary of Orascom Telecom

Holding- OTH (ORTE.CA), which is parent company of Mobilink. It

was granted license of microfinance bank earlier in November 2011.

The OTH had bought license of bank against Rs0.25 million and fulfilled all mandatory to declare its worth Rs1 billion infrastructure and

asset for bank as per requirement. The group total investment has

reached US$3.9 billion so far in Pakistan particularly through Mobilink

and Bank.

Egyptian Company for Mobile Services (MobiNil) (EMOB.CA)

sent a release stating that the company will send its un-audited financial results for the financial period ending March 31, 2012 on Monday

April 30, 2012 at 6 PM.

Al Youm7 reported Egypt Aluminum (EGAL.CA) CFO said that the

company has additional expenses of LE90 million during the last three

months attributed to the increase in the electricity bill. He added that

EGAL have sent a complaint to Prime minister Dr. Kamal El Ganzoury

asking the ministry of electricity to adhere aluminum prices to electricity prices hence avoiding a loss of LE360 million. Meanwhile, an official source said that the company obtained a loan with a total amount

of LE3 million with an interest rate of 2.5%, to be utilized in buying

new equipments to reduce energy consumption.

Pioneers Holding (PIOH.CA) unveiled its FY11 financial statements

showing a net profit of LE114.7 million versus LE19.8 million in the

FY10.

Faisal Islamic Bank (FAIT.CA) disclosed its KPIs for Q1 FY12 with

total equity balance amounting to LE36.6 billion, implying an increase

of 14.1% y-o-y. Meanwhile, total assets grew 14.3% during the same

period to reach LE36.4 billion.

BoD of Cairo Poultry (POUL.CA) approved its Q1 FY12 financial

results with a net profit reached LE29 million versus LE47.8 million.

BoD of Al Ahram for Prinitng and Packaging (EPPK.CA) approved the Q1 FY12 unaudited financials results reporting a net income of LE1.7 million from LE1.15 million in Q1 FY11.

Arab Polivara Spinning & Weaving (APSW.CA) released its financial results of FY11 ending December with net losses of LE63.5 million

in comparison to net profits of LE29.96 million in FY10.

The BoD of Delta for Printing & Packaging (DTPP.CA) approved

the financial statements of Q1 FY12 with a net income LE3.6 million,

showing 16.2% growth y-o-y.

Helwan Cement (HCCO.CA) approved a cash dividend of LE1.85/

share. Record and distribution dates will be April 24 and April 30, 2012

respectively.

Ahmed Heikal, Chairman of Citadel Capital (CCAP.CA), rebutted

published news about forming a commercial partnership with Rami

Makhlouf, the cousin of Syria's President Bashar Al-Assad, according to

Youm 7 newspaper. Heikal also indicated that Citadel does not undertake any investments in Syria, except for a cement plant worth approx.

US$3 million. The top official added that Citadel does not have any

projects in Iraq at present, but may undertake investments there in

the future.

Prime Research

The Egyptian Financial Supervisory Authority (EFSA) gave a nod to

the hostile bid submitted by MT Telecom SCRL to buy 100% of the

Egyptian Company for Mobile Services (Mobinil) (EMOB.CA)

at LE202.5/share. Accordingly, Mobinil will resume trading, as of April

23, 2012. Meanwhile, all offers and orders submitted before this announcement will be suspended. Relatively, Khaled Bichara, Managing

Director of OTMT revealed that the amended terms between OTMT

and France Telecom includes a financial appeasement for ceding

managing MOBINIL. The financial appeasement value amount to

EUR110 million which was set in the first settlement deal, Almal newspaper reported. Separately, Bichara pointed out that France Telecom

showed interest to continue partnership with Egyptian investor in

Mobinil in case of OTMT full exit.

El Sewedy Electric (SWDY.CA) approved in its GA meeting held

yesterday the FY11 financials and the cash dividend distribution of

LE223.4 million, representing LE1/share. Record and distribution

dates are yet to be announced.

Onsi Youssef, Vice Chairman and Investor Relations Manager at

Remco For Construction of Touristic Villages (RTVC.CA), said

that his company received bids for two hotels in Sharm El Sheikh and

Hurghada to boost liquidity. He added that Remco received purchase

offers for Sharm El Sheikh Hotel at a total value of LE500 million. The

offers are being evaluated, Youssef stated. The sale proceeds will be

used in completing Stella Heights project, in Sidi Abd El Rahman, at a

total value of LE1.2 billion.

Shareholders of Mansourah Poultry (MPCO.CA) gave the green

light to the board's proposal for paying cash dividends at 5% of paidup capital, implying LE0.50/share. Record and distribution dates are

yet to be announced.

Adel El-Mouzy, CEO of Egyptian Chemical Industries KIMA

(EGCH.CA) will meet within a few days with Chairmen of National

Bank of Egypt (NBE), Commercial International Bank (CIB) and National Societe Generale Bank (NSGB) to look into financing the projects of Egyptian Chemical Industries (KIMA) and Delta Fertilizers. An

official source in KIMA said that the lenders shelved approximately

LE6.4 billion facility, for fear of people's objection to the two projects

due to potential environment pollution. The source added that some

banks asked KIMA and Delta to raise the ratio of self-financing from

40% to 50%, and increase the required interest rates on both loans.

Al Baraka Bank Egypt (SAUD.CA)'s GA meeting gave the goahead for the board's proposal for paying FY11 cash dividends at a

total value of LE92.287 million. This dividend will be used in lifting

paid in capital by 15%. Record and distribution dates are yet to be

announced

Oriental Weavers (ORWE.CA) posted a 14% increase in FY11

sales to LE4.609 billion spurred by a 14% leap in exports. ORWE also

increased its market share in the US and EU to 25% and 21% respectively and forayed into new African and Asian markets. ORWE said in

a statement, that it doubled dividends from LE0.75/share to LE1.50/

share and added that its cash dividends totaled LE800 million and

bonus share distribution reached 50% over the past five years. This

high dividend reflects the company's commitment to paying strong

yields to shareholders. FY11 cash dividends are expected to reach

LE135 million.

7

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Corporate News

Shareholders of B-Tech Trade and Distribution Co. (OSTD.CA)

approved postponing the increase of issued capital from LE67.43 million to LE90 million, until a new industrial business activity is included

in the company's operations, Chairman Mahmoud Khattab said. The

meeting also approved the board's recommendation on paying cash

dividend at LE0.19/share. Moreover, the company will inject more than

LE25 million in enhancing productivity and competitive ability. B-Tech

targets a 25% leap in FY12 sales to LE1.25 billion, Khattab concluded.

Methanex Corp. has entered a long-term off-take agreement with

Orascom Construction Industries (OCIC.CA) for a significant

portion of the production from its methanol plant in Beaumont, Tex.,

which is expected to commence commercial production in June, 2012.

Vanessa James, Methanex's vice-president, marketing and logistics,

North America, commented, "We are pleased to be entering into this

agreement with Orascom, which will complement our supply capability to our customers in North America."

Beltone Financial (BTFH.CA) aims to increase the value of its assets under management by 45% within a year, the company's chairman said.

Maridive & Oil Services (MOIL.CA) announced that the company

has won 2 contracts worth US$22 million annually in Nigeria and

Congo for the rental of 5 marine units. According to Mr. Eissa Elish,

chairman of the company, the Nigerian contract would be renewed on

an annual basis, while the contract with the Congo is for a 3 year

period. Moreover, Mr. Elish announced that the company had received

approval from the emirate of Abu Dhabi for the establishment petroleum platforms and facilities on a 168k sqm plot of land. Important to

note, the company is expected to pay US$30 million for equipments

and construction for the new line of business during the coming 2-3

years.

The board of Heliopolis Housing & Development (HELI.CA) approved unaudited financial results for 9M FY11/12 reflecting net earnings of LE77.964 million compared with LE116.59 million in year-earlier

period. FY12/13 estimated budget revealed distributable surplus before

tax of LE173.4 million and LE130.1 million after tax. Moreover, Mr.

Shabaan Ibrahim, IR manager of the company said that the company

expects proceeds from the sale of four land plots amount to LE55 million. Relatively, HELI had to cancel the auction which was scheduled to

take place yesterday due to the absence of buyers.

Oascom Development Holding (ODHN.CA) released FY11 consolidated financial statements recording net losses of CHF131.69 million compared to net losses of CHF24.65 million in FY10.

Egyptians for Investment & Urban Development (EIUD.CA)

reported its Q1 FY12 financial results posting net profits of LE377k as

apposed to LE167k in the same comparable period.

Misr Duty Free Shops (MFSC.CA) reported its 9M FY11/12 financial

results recording net profits of LE45.6 million versus LE47.5 million in

the same comparable period.

Gezirah Hotels & Tourism (GIZF.CA) declared cash dividends of

US$0.84/share. Record and distribution dates are as of May 2, 2012

and May 5, 2012 respectively.

Egyptian Transport (EGYTRANS) (ETRS.CA) declared cash dividends of LE0.40/share. Record and distribution dates are as of May 2,

2012 and May 7, 2012 respectively.

BoD of Misr Cement Quena (MCQE.CA) approved its Q1 FY12 financial results with a net profit of LE74 million, implying a decline of

28% y-o-y.

Heliopolis Housing & Development (HELI.CA) announced offering 97 residential units for sale in a public auction on Sunday, April

29th. The units, whose spaces range between 124 and 217 sqm, are

located in Eighth District, El Obour City. The developer will also offer

12 villas, whose areas range between 214 and 242 sqm for sale in the

same action. Moreover, the company cancelled yesterday's auction to

sell four pieces of land at a total value of LE55 million after only one

bidder attended the auction. The pieces of land are located behind

Sheraton Heliopolis, Fairmont.

Housing & Development Bank (HDBK.CA) reported FY11 consolidated results posting net profits of LE156.2 million in comparison to

LE191.5 million in the same comparable period.

The board of Amer Group Holding (AMER.CA) agreed to sell 14

million treasury shares that were bought back between the period April

18, 2011 and April 21, 2011.

Prime Research

EFG Hermes Holding (HRHO.CA) finalized talks to sell a 60%

stake to Qatari QInvest, a deal aimed at merging some of the operations of the Middle East investment banks, a local newspaper said.

The merge between the two is intended to create an investment bank

covering the Arab world, Africa, Turkey and Southeast Asia, the paper

said. "The negotiations began months ago and the deal will be announced in the next 10 days," a source with knowledge of the deal

told the paper without giving details of the value of the deal. Moreover, the venture would include securities brokerage, asset management and investment banking operations, but not EFG Hermes Private

Equity, the paper added.

Awad Ibrahim, Libya’s Electricity Minister, revealed that Libyan Government awarded El Sewedy Electric (SWDY.CA) and Misr Mechanical Projects (KAHROMICA) the project of electricity network in

Libya with an investment cost of US$1 billion, Alborsa newspaper

reported. He pointed out that Sewedy is executing many projects with

the Libyan Government in generating renewable energy; adding that

the company is expected to complete construction and operation of

the electricity generating plant by end of FY12.

Commercial International Bank (CIB) (COMI.CA) announced

that the Chairman converted 280k local shares to global depository

receipts (GDRs). The lender operates with issued and paid-up capital

of LE5.9 billion, divided into 597.2 million shares at LE10 par value

each.

Egyptian Financial Supervisory Authority announced that Amer

Group Holding (AMER.CA) can not sell its 14 million treasury

shares as a period of 1 year has passed since the shares' purchase.

The board of Orascom Telecom Holding (OTH) (ORTE.CA) recommended withholding dividend for FY11, due to the negative impact

of Algeria operations as well as the inability to post earnings.

Housing & Development Bank (HDBK.CA) declares cash dividends of LE1.25/share. Record and distribution dates are as of May 6,

2012 and May 9, 2012 respectively.

The board of Development & Engineering Consultants

(DAPH.CA) gave a nod to Q1 FY12 financial statements, which reflected net earnings of LE8.743 million compared with LE5.831 million

in year-earlier period.

8

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Money Market

Ending

Inflation CPI

Mar. 11

Feb. 12

Mar. 12

11.48%

9.9%

9.5%

Dec., 11

Jan., 11

255,581

258,977

Latest

Previous

9.740%

9.750%

9.5%

9.6%

91-Day T-Bill

13.905%

14.856%

182-Day T-Bill

14.824%

14.791%

Inter-bank

CAIBOR

M1 (LE Million)

M2 (LE Million)

783,290

784,900

Source: CBE

Source: Bloomberg

Bonds

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Treasury

Apr 2012

Aug 2012

Sep 2012

Jan 2013

Jul 2013

Feb 2014

Feb 2014

Apr 2014

Nov 2014

May 2015

Nov 2015

Jun 2016

Jun 2016

Feb 2018

Jan 2025

Bid Price

Ask Price

Market

Price

Coupon

Amount

Coupon

Type

Next Coupon

Date

Current

Yield %

YTM %

99.98

98.81

99.04

97.49

94.29

93.83

94.24

90.96

97.23

94.23

89.22

83.87

92.88

83.20

86.81

100.00

99.99

99.43

98.32

97.77

101.86

97.88

100.08

101.89

102.99

100.44

99.01

103.63

99.98

108.04

99.99

99.40

99.24

97.90

96.03

97.84

96.06

95.52

99.56

98.61

94.83

91.44

98.25

91.59

97.42

10.35

10.45

9.1

8.85

10.8

12

9.2

10.55

11.625

10.65

9.3

11

10.95

9.15

11.4

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

FIXED

28-04-2012

11-08-2012

20-09-2012

24-07-2012

28-07-2012

10-08-2012

19-08-2012

14-10-2012

16-05-2012

27-05-2012

15-05-2012

09-06-2012

10-06-2012

12-08-2012

18-07-2012

10.35

10.51

9.17

9.04

11.25

12.26

9.58

11.04

11.68

10.80

9.81

12.03

11.14

9.99

11.70

11.32

12.34

11.03

11.86

14.34

13.37

11.66

13.21

11.82

11.19

11.10

13.79

11.49

11.15

11.79

Source: Bloomberg

Prime Research

9

Market Watcher

Egypt

Scoreboard

Based on PGI constituents on (a minimum 160 days traded annually and LE 100 mn market capitalization)

Reuters

Market

Weight to

Closing

Week

YTD

52-Wk

52-Wk

Revenue Growth

Code

Cap. (LEmn)

PGI

Price

Change

Change

High

Low

2010a

2011e

2012f

Food & Tobacco

Eastern Tobacco

Delta Sugar

International Agricultural Products

Juhayna Food Industries

Cairo Poultry

Starch & Glucose

National Company For Maize Products

EAST.CA

SUGR.CA

IFAP.CA

JUFO.CA

POUL.CA

ESGI.CA

NCMP.CA

12,203

4,897

2,252

201

3,102

1,134

197

420

3.6%

1.4%

0.7%

0.1%

0.9%

0.3%

0.1%

0.1%

97.94

15.84

2.70

4.27

7.81

6.40

14.22

1.6%

-4.0%

-7.6%

7.6%

6.75%

-2.7%

1.6%

1.6%

5.5%

5.5%

-19.0%

8.9%

9.5%

-18.7%

5.3%

8.7%

110.00

18.80

3.45

5.10

11.44

8.35

15.59

89.00

15.60

2.40

3.70

7.81

5.94

12.90

18.0%

7.7%

37.3%

142.0%

18.0%

1.4%

18.5%

7.5%

5.0%

2.4%

0.6%

5.0%

20.5%

-3.9%

10.0%

30.9%

19.0%

15.7%

23.1%

5.0%

22.2%

5.5%

n/a

27.4%

15.17

2.22

0.11

0.28

1.25

0.17

2.24

Housing & Development

TMG

Palm Hills

Amer Group

Nasr City

Heliopolis

SODIC

Cairo Housing

El Shams Housing

Mena for Touristic Investments

United Housing

TMGH.CA

PHDC.CA

AMER.CA

MNHD.CA

HELI.CA

OCDI.CA

ELKA.CA

ELSH.CA

MENA.CA

UNIT.CA

19,316

8,667

1,950

2,107

1,805

1,791

1,471

448

320

128

629

5.7%

2.5%

0.6%

0.6%

0.5%

0.5%

0.4%

0.1%

0.1%

0.0%

0.2%

4.20

1.86

0.69

17.19

16.10

16.22

4.78

3.20

1.71

7.23

7.5%

9.9%

12.7%

4.5%

6.3%

6.2%

14.8%

3.5%

7.4%

7.5%

9.0%

47.7%

43.8%

72.2%

25.5%

60.8%

47.3%

103.5%

25.5%

48.1%

17.1%

93.3%

5.16

2.43

0.91

21.43

18.52

19.79

5.36

3.64

2.30

7.50

2.75

1.06

0.52

10.70

10.60

7.25

3.83

2.13

1.45

3.70

45.1%

10.7%

59.8%

3.8%

22.5%

124.5%

62970.1%

n/a

n/a

44.7%

45.5%

-13.3%

-4.5%

-69.4%

-32.3%

-17.5%

-9.0%

15.8%

n/a

-2.3%

n/a

-25.0%

17.3%

20.9%

60.0%

3.3%

31.1%

13.7%

54.8%

n/a

3.2%

n/a

10.0%

Spinning & Weaving

Oriental Weavers

Arab Ginning

Arab Polavara

Nile Ginning

Kabo

Spinalex

Arafa Holding

ORWE.CA

ACGC.CA

APSW.CA

NCGC.CA

KABO.CA

SPIN.CA

AIVC.CA

4,013

1,634

747

171

347

217

280

616

1.2%

0.5%

0.2%

0.1%

0.1%

0.1%

0.1%

0.2%

18.16

2.76

1.83

6.55

0.64

0.94

0.33

4.9%

0.9%

5.7%

5.8%

0.0%

4.9%

5.6%

0.0%

6.8%

-39.5%

31.4%

25.3%

0.0%

14.3%

6.8%

-15.4%

31.24

3.46

2.55

0.00

0.88

1.25

0.44

17.92

2.09

1.45

0.00

0.56

0.83

0.33

10.4%

14.3%

n/a

n/a

n/a

6.4%

30.0%

4.5%

9.8%

13.5%

n/a

n/a

n/a

6.1%

53.8%

-38.9%

Pharmaceuticals

EIPICO

PHAR.CA

2,690

2,690

0.8%

0.8%

33.90

-0.3%

-0.3%

5.2%

5.2%

34.99

32.01

10.8%

10.8%

Industrial

Ezz Dekhila

Ezz Steel

Ghabbour

Lecico Egypt

El Sewedy Electric

Olympic Group Investment

IRAX.CA

ESRS.CA

AUTO.CA

LCSW.CA

SWDY.CA

OLGR.CA

21,266

7,045

4,031

2,477

402

4,873

2,439

5.5%

2.1%

1.2%

0.7%

0.1%

1.4%

0.7%

527.13

7.42

19.20

5.02

21.81

40.60

1.1%

1.8%

7.5%

-4.2%

0.4%

8.5%

0.0%

4.1%

29.1%

103.8%

-9.1%

-12.1%

6.1%

2.1%

525.00

8.37

25.50

7.30

28.00

0.00

392.00

3.59

18.50

4.85

19.67

0.00

Telecommunications & IT

Orascom Telecom

The Egyptian Mobile

Telecom Egypt

Raya

ORTE.CA

EMOB.CA

ETEL.CA

RAYA.CA

60,509

18,045

19,277

22,841

346

17.6%

5.3%

5.6%

6.7%

0.1%

3.44

192.77

13.38

5.57

7.7%

98.8%

7.1%

8.3%

-3.8%

79.9%

98.8%

154.8%

2.8%

61.0%

4.79

194.01

18.50

6.29

Tourism, Entertainment & Services

Egyptian Resorts

EGTS.CA

Remco

RTVC.CA

Orascom Dev. Holding

ODHN.CA

43,840

1,187

503

42,150

0.5%

0.3%

0.1%

12.3%

1.13

2.03

14.94

11.5%

13.0%

11.5%

0.0%

30.1%

36.1%

30.1%

0.0%

Oil, Gas & Derivatives

Sidi Krir

AMOC

Maridive

16,560

6,568

7,351

2,641

4.8%

1.9%

2.2%

0.8%

12.51

85.38

1.24

1.3%

-11%

1%

5%

6.5%

6%

31%

-11%

Company

Prime Research

SKPC.CA

AMOC.CA

MOIL.CA

EPS

2010a

2011e

Dividend Yield

PE

2012f

2010a

2011e

2012f

2010a

2011e

2012f

10.74

2.44

0.16

0.26

1.08

0.19

1.69

12.56

2.74

0.17

0.32

0.69

n/a

1.41

7.1x

6.5x

7.1x

24.6x

15.3x

6.2x

37.4x

6.3x

9.1x

9.1x

6.5x

16.4x

16.7x

7.2x

34.0x

8.4x

10.7x

7.8x

5.8x

15.6x

13.2x

11.3x

n/a

10.1x

11.1%

5.1%

7.9%

11.1%

n/a

16.0%

n/a

14.7%

6.1%

6.1%

12.6%

3.7%

3.5%

9.6%

2.4%

11.2%

9.4%

7.1%

11.0%

n/a

5.4%

9.6%

n/a

9.4%

20.60

5.16

23.10

112.33

20.53

n/a

5.64

11.28

n/a

22.59

0.46

0.50

0.18

1.25

1.36

1.48

0.43

0.12

-0.35

0.31

0.28

-0.32

0.08

0.44

1.28

-2.08

0.32

0.10

-0.21

0.32

0.37

0.25

0.08

0.99

1.15

-0.98

0.37

0.12

-0.40

0.28

11.1x

9.2x

3.7x

3.8x

13.8x

11.8x

10.9x

11.1x

26.2x

n/a

23.1x

15.0x

15.0x

n/a

8.5x

39.0x

12.6x

n/a

14.8x

30.6x

n/a

22.8x

13.4x

11.4x

7.4x

8.5x

17.3x

14.0x

n/a

12.8x

27.5x

n/a

26.2x

9%

n/a

n/a

n/a

5.8%

9.3%

9.9%

8.4%

3.8%

90.6%

n/a

5%

n/a

n/a

n/a

n/a

6.2%

n/a

6.2%

1.1%

n/a

3.5%

4%

2.6%

n/a

n/a

4.8%

4.7%

n/a

7.2%

1.3%

n/a

4.1%

5.88

1.59

1.07

23.00

17.00

18.29

-

6.60

2.00

1.47

21.55

20.30

15.17

n/a

n/a

n/a

n/a

7.6%

13.2%

n/a

n/a

n/a

n/a

n/a

2.1%

3.80

0.08

0.22

0.03

-0.03

0.11

0.06

2.70

n/a

n/a

n/a

n/a

0.16

0.07

2.69

n/a

n/a

n/a

n/a

n/a

0.03

8.7x

4.8x

35.8x

8.4x

200.7x

n/a

8.9x

5.8x

6.0x

6.7x

n/a

n/a

n/a

n/a

6.0x

4.5x

8.5x

6.8x

n/a

n/a

n/a

n/a

n/a

10.3x

10.2%

11.0%

34.4%

n/a

n/a

n/a

8.2%

9.4%

6.1%

4.1%

n/a

n/a

n/a

n/a

13.3%

6.1%

9.8%

16.5%

n/a

n/a

n/a

n/a

n/a

3.0%

-

32.98

n/a

n/a

n/a

n/a

n/a

0.08

5.0%

5.0%

10.1%

10.1%

401.6%

4.02

378.8%

3.79

379.4%

3.79

8.4x

8.4x

8.9x

8.9x

8.9x

8.9x

7.4%

7.4%

8.1%

8.1%

7.7%

7.7%

40.86

41.15

35.4%

40.3%

32.0%

61.4%

-3.3%

38.9%

12.8%

9.4%

10.9%

12.0%

7.9%

-5.1%

17.6%

-15.4%

11.7%

6.3%

8.9%

21.8%

12.5%

10.9%

20.4%

188.3%

49.35

0.46

1.83

1.19

3.56

1.93

135.2%

46.29

0.37

1.36

0.29

2.28

1.35

209.4%

46.69

0.41

1.74

0.76

2.60

2.45

10.6x

10.7x

16.0x

10.5x

4.2x

6.1x

21.0x

15.8x

11.4x

19.9x

14.2x

17.5x

9.6x

30.1x

11.2x

11.3x

18.3x

11.0x

6.6x

8.4x

16.6x

4.9%

6.6%

3.4%

5.2%

14.9%

4.6%

2.5%

4.6%

7.6%

3.4%

5.2%

n/a

4.6%

3.7%

6.0%

6.6%

5.5%

6.4%

14.9%

4.8%

4.9%

938.00

11.80

25.00

26.00

-

n/a

12.47

32.39

11.44

28.57

35.90

1.80

72.99

11.61

3.41

3.2%

3.7%

-2.1%

2.6%

36.6%

-1.4%

10.7%

-3.7%

-3.2%

0.4%

4.7%

13.6%

2.2%

0.1%

7.3%

116.9%

-0.26

12.93

1.64

0.70

78.7%

0.93

-2.53

1.49

0.64

107.0%

0.19

2.84

1.37

0.77

8.2x

n/a

14.9x

8.2x

7.9x

8.7x

3.7x

n/a

9.0x

8.7x

14.2x

18.6x

67.9x

9.8x

7.2x

8.1%

n/a

6.4%

9.7%

n/a

10.5%

n/a

n/a

10.5%

n/a

6.8%

n/a

n/a

10.8%

2.7%

5.52

95.00

17.70

-

4.92

99.57

17.57

10.00

1.48

2.84

0.00

0.83

1.55

0.00

37.8%

55.9%

0.0%

37.8%

8.3%

16.7%

0.0%

n/a

160.6%

160.6%

n/a

n/a

2.5%

0.00

0.57

0.02

-0.7%

-0.01

1.15

-0.01

75.0%

0.02

1.48

n/a

594.1x

594.1x

3.6x

598.0x

1.8x

n/a

1.8x

n/a

25.4x

49.4x

1.4x

n/a

10.6%

10.6%

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

1.21

-

0.98

n/a

28.07

15.51

94.50

1.94

11.74

66.73

1.17

0.0%

0.0%

0.0%

0.0%

26.0%

26.0%

42.6%

21.4%

15.1%

21.1%

15.1%

-13.0%

156.5%

1.57

6.47

0.14

151.9%

1.52

12.19

0.08

192.5%

1.92

14.63

0.12

9.2x

8.0x

13.2x

9.2x

8.2x

8.2x

7.0x

15.5x

6.5x

6.5x

5.8x

10.7x

6.4%

11.2%

6.4%

4.8%

11.5%

12.4%

10.5%

n/a

12.2%

14.4%

12.2%

3.7%

15.76

81.44

1.99

15.06

82.91

1.81

10

Market Watcher

Egypt

Scoreboard

Based on PGI constituents on (a minimum 160 days traded annually and LE 100 mn market capitalization)

Sector

Reuters

Market

Weight to

Closing

Week

YTD

52-Wk

52-Wk

Company

Code

Cap. (LEmn)

PGI

Price

Change

Change

High

Low

PGI

1

Banking & Finance

CIB

Credit Agricole

Export Development

Societe Generale

Housing & Dev. Bank

.PIGI

1

83.7%

3

10.7%

4.5%

0.7%

0.2%

3.3%

0.5%

1,045.3

4

16.27%

6

9%

37.1%

10.7%

12.8%

37.8%

26.9%

895.2

8

25.59

8.67

4.85

27.87

13.96

3.31%

5

3%

5.0%

-1.6%

0.4%

2.8%

5.7%

7

COMI.CA

CIEB.CA

EXPA.CA

NSGB.CA

HDBK.CA

341,726

2

36,539

15,283

2,488

698

11,238

1,605

26.88

10.00

5.49

30.00

16.90

NBD

EGB $

Al Baraka Egypt

Suez Canal Bank

Faisal Islamic Bank

DEVE.CA

EGBE.CA

SAUD.CA

CANA.CA

FAIT.CA

714

1,656

792

822

1,242

0.2%

0.5%

0.2%

0.2%

0.4%

3.57

1.39

9.01

4.11

20.93

4.7%

0.0%

2.6%

1.5%

8.8%

2.9%

-4.8%

7.4%

-3.3%

7.2%

Financial Institutions

EFG-HRMS

Citadel Capital

Egyptian Kuwaiti Holding

HRHO.CA

CCAP.CA

EKHO.CA

10,413

6,701

2,780

932

3.0%

2.0%

0.8%

0.3%

14.01

3.19

1.11

5.6%

21.8%

5.6%

1.8%

Cement & Construction

OCI

Torrah Cement

Misr Benisuef

Sinai Cement

Suez

Quena Cement

South Valley Cement

ASEK for Mining

OCIC.CA

TORA.CA

MBSC.CA

SCEM.CA

SUCE.CA

MCQE.CA

SVCE.CA

ASCM.CA

69,003

54,255

2,107

2,526

1,891

3,804

2,599

1,547

273

20.2%

15.9%

0.6%

0.7%

0.6%

1.1%

0.8%

0.5%

0.1%

259.67

29.46

50.51

27.02

20.92

87.00

3.14

7.79

Chemical

Abu Kier Fertilizers

EFIC

ABUK.CA

EFIC.CA

11,470

10,760

710

3.4%

3.1%

0.2%

Milling

North. Mil s

West Mil s

Upper Mil s

East Delta Mil s

Central Egypt Mil s

MILS.CA

WCDF.CA

UEFM.CA

EDFM.CA

CEFM.CA

1,010

169

225

317

191

108

0.3%

0.0%

0.1%

0.1%

0.1%

0.0%

Prime Research

EPS

Revenue Growth

PE

Dividend Yield

2010a

2011e

2012f

2010a

2011e

2012f

2010a

2011e

2012f

2010a

2011e

2012f

18.71

7.70

4.06

20.25

10.51

9

14%

15.3%

15.1%

1.9%

12.0%

10.0%

10

13%

-4.0%

8.5%

-13.5%

6.4%

-13.3%

11

20%

16.1%

16.7%

3.5%

14.9%

28.1%

12

141%

3.00

1.41

1.19

3.12

1.45

13

95%

2.38

0.97

0.53

3.35

1.19

14

148%

3.20

1.14

0.43

4.04

1.48

8.7x

15

7.3x

8.5x

6.2x

4.1x

8.9x

9.7x

8.9x

16

9.0x

10.7x

9.0x

9.1x

8.3x

11.7x

8.9x

17

7.6x

8.0x

7.6x

11.4x

6.9x

9.4x

10.2%

18

8.2%

3.9%

13.8%

20.6%

4.5%

7.2%

8.1%

19

7.4%

3.9%

7.4%

11.8%

4.5%

9.0%

7.7%

20

6.4%

4.9%

9.5%

6.5%

6.3%

6.2%

4.49

1.77

11.65

4.99

23.48

3.25

1.32

8.30

4.00

19.02

391.3%

97.4%

0.9%

43.7%

9.1%

78.4%

24.7%

49.4%

17.8%

24.5%

25.9%

n/a

37.3%

n/a

23.5%

-2.44

0.76

1.07

n/a

5.66

-2.95

0.53

0.94

-0.25

2.91

-2.84

n/a

2.36

-0.01

3.17

n/a

1.8x

8.4x

n/a

3.7x

n/a

2.6x

9.6x

n/a

7.2x

n/a

n/a

3.8x

n/a

6.6x

n/a

8.2%

n/a

n/a

9.7%

n/a

5.4%

n/a

n/a

10.1%

25.6%

40.2%

25.6%

14.4%

16.79

4.05

1.25

9.71

2.35

0.93

42.4%

78.3%

-57.9%

42.4%

-31.5%

-31.5%

-65.9%

8.9%

12.1%

22.6%

1.6%

n/a

17.3%

1.46

-0.34

0.17

17.8%

0.43

-0.63

0.18

18.7%

0.75

-0.37

0.19

8.0x

9.6x

n/a

6.4x

19.4x

32.5x

n/a

6.2x

12.3x

18.7x

n/a

5.9x

11.9%

17.1%

n/a

6.8%

0.57%

4.0%

0.3%

0.8%

-9.7%

-0.4%

3.6%

0.3%

6.9%

-3.21%

29.9%

-5.0%

-16.5%

-4.9%

-9.1%

-1.5%

6.1%

0.8%

279.95

34.70

151.65

83.73

25.49

70.26

4.35

11.48

200.00

28.10

97.92

48.27

20.99

88.00

2.87

6.99

5.19%

29.3%

n/a

-6.9%

7.6%

-3.6%

5.2%

0.8%

99.1%

-2.34%

15.2%

n/a

20.3%

-26.3%

-16.8%

-11.0%

-2.3%

50.8%

2.27%

23.6%

n/a

-0.7%

11.8%

-3.9%

2.3%

n/a

n/a

8.8x

16.8x

10.5x

8.8x

2.1x

3.1x

6.1x

30.4x

10.2x

7.0x

12.9x

n/a

9.3x

5.8x

5.8x

8.2x

27.6x

0.8x

8.3x

8.8x

n/a

10.3x

6.4x

4.1x

8.3x

25.1x

n/a

127.91

10.24

3%

1.1%

4.5%

8%

1.0%

14.8%

137.00

13.90

124.00

8.70

7%

0.3%

13.0%

19%

19.5%

18.6%

16%

3.0%

28.1%

689%

13.89

-0.12

839%

16.00

0.77

861%

15.95

1.27

9.2x

9.2x

n/a

10.6x

8.0x

13.2x

15.75

29.98

45.26

31.90

7.34

-1%

-0.3%

-8.6%

-0.5%

0.0%

-0.8%

-6%

5.5%

-12.6%

-5.6%

-0.7%

-6.0%

17.25

37.00

51.00

35.90

9.68

14.80

30.00

43.75

29.01

6.85

-3%

-13.3%

13.7%

-0.3%

-7.1%

-3.0%

-6%

-1.9%

-19.3%

-29.7%

-0.4%

-6.1%

3%

3.1%

3.0%

3.0%

3.2%

1.8%

425%

1.70

7.06

12.81

4.25

0.57

408%

2.43

4.08

8.06

4.33

0.58

416%

2.46

4.16

8.23

4.60

0.53

7.5x

9.3x

4.2x

3.5x

7.5x

12.8x

7.3x

6.5x

7.3x

5.6x

7.4x

12.7x

1,287

625.50% 542.86% 502.53%

15.46

20.10

29.59

2.81

n/a

n/a

5.71

5.43

4.92

12.94

4.69

4.24

6.80

3.60

5.13

14.34

10.57

10.52

0.10

0.11

0.13

0.76

9.39

n/a

Prime

Cons.

DCF Target

21

22

21.80

8.70

3.50

24.69

11.55

29.11

10.49

3.50

30.07

14.71

n/a

n/a

n/a

n/a

7.9%

1.65

3.53

7.03

30.05

1.65

1.67

10.92

6.67

30.05

n/a

n/a

n/a

4.5%

n/a

n/a

n/a

n/a

-

16.67

3.87

1.50

14.6%

4.3%

14.6%

9.9%

46.3%

23.4%

18.4%

3.2%

n/a

9.5%

5.2%

9.5%

9.4%

11.1%

7.9%

16.1%

n/a

n/a

9.6%

5.9%

n/a

8.5%

12.6%

9.6%

9.7%

n/a

n/a

286.00 300.92

n/a

44.00 46.37

28.10 27.27

22.00 21.50

77.00 69.20

n/a

n/a

8.0x

8.0x

8.0x

10.2%

10.2%

n/a

10.3%

10.3%

n/a

7.2%

10.0%

4.4%

155.00 155.00

19.08 16.89

6.9x

6.4x

7.2x

5.5x

6.9x

13.9x

11.8%

9.5%

13.0%

13.3%

10.5%

n/a

9.4%

10.5%

9.4%

8.4%

10.7%

5.4%

9.6%

13.8%

9.6%

8.5%

10.5%

5.0%

-

17.50

46.90

83.10

40.10

8.30

11

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

Corporate Calendar

April 2012

Sun

Mon

Tue

Wed

Thu

Fri

1

2

Distribution Date of Misr

Cement - Quena Cash

dividend of 7

3

Record Date of Al

Ahram Company for

Printing and Packaging

Cash Dividend of 1

4

Distribution Date of

Cairo Poultry Co. Cash

dividend of 0.75

5

Distribution Date of

Commercial International

Bank

Cash

dividend of 1

6

Egyptian for Developing Building Materials

GA To approve the

resignation

offered

from members of

BOD

8

9

Distribution Date of Al

Ahram Company for

Printing and Packaging

Cash dividend of 1

10

Canal Shipping Agencies GA To approve the

estimated budget of

FY12/13

11

Distribution Date of

National Societe General

Bank Cash Dividend of

1.25

12

13

Distribution Date of

Development & Engineering

Consultants

(DAPH.CA)

Cash

Dividend of 1.4

Heliopolis Housing &

Development GA To

approve the estimated

budget of FY12/13

16

17

Ezz Aldekhela Steel

(IRAX.CA) GA To approve the financial

statement

of FY11

ending December 2011

7

14

Distribution Date of

Nozha

International

Hospital

(NINH.CA)

Cash Dividend of 1.3

United Arab for Unloading

&

Shipping

(UASG.CA)

GA

To

approve the estimated

budget of FY12/13

15

Sat

Distribution Date of

National Investment &

Reconstruction-Nirco

(NIRE.CA)

Cash

Dividend of 0.75

18

19

Distribution Date of

Arab

In v e s t m e n t

U r b a n i z a t i o n

(AIUR.CA)

Cash

Dividend of 17.39

20

21

Mansourah

Poultry

GA To approve the

financial statements

of FY11 in addition to

a proposed dividend

of LE0.50/share

27

28

Misr Beni Suef Cement

Company

(MBSC.CA) GA To

approve the financial

statement of FY11

ending

December

2011

Distribution Date of El

Arabia

Engineering

Industries (EEII.CA)

Cash Dividend of 1.7

23

22

Distribution Date of Housing & Development Bank

Juhayna Cash Dividend of GA & EGA

n/a

0.15

Ismailia Misr Poultry GA To

Distribution Date of Faisal

approve the estimated budget

Islamic BankCash Divi- of FY12/13

dend of 2.11

Distribution

Date

of

24

*Distribution Date of

Nasr Company For Civil

Works - NCCW Cash

Dividend of 0.5

25

26

Suez

Distribution Date of Faisal Cement Cash Dividend of 0.65

Islamic BankCash Dividend of US$ 0.35

Distribution Date of Suez Bags

Cash Dividend of 15.35

Distribution Date of Torah

Cement Cash Dividend of 2.8

Distribution Date of Egypt Gas

Cash Dividend of 6.5

Distribution Date of Semiramis

Hotels Cash Dividend of 3

29

Egyptian International

Pharmaceutical Industrial

Co. - EIPICO (PHAR.CA)

GA To approve the financial statement of FY11

ending December 2011

30

Egyptian for Tourism

Resorts (EGTS.CA) GA To

approve the financial

statement of FY11 ending

December 2011

Prime Research

12

Market Watcher

Egypt

Week Ending Thursday, April 26, 2012

PRIME SALES TEAM

Group Head – Global Securities Brokerage

+202 3300 5688

snabih@egy.primegroup.org

Mohamed Ezzat

Head of Branches

+202 3300 5784

mezzat@egy.primegroup.org

Amr Alaa, CFTe

Supervisor, Local Institutional Desk

+202 3300 5609

aalaa@egy.primegroup.org

Mohamed Magdy

SRM, Gulf & MENA Desk

+202 3300 5653

mmagdy@egy.primegroup.org

Osama Mahmoud

SRM, Institutional Sales

+202 3300 5623

omahmoud@egy.primegroup.org

RM, International

+202 3300 5614

mkhaled@egy.primegroup.org

Manager, High Networth

+202 3300 5672

asebaee@egy.primegroup.org

Sherif Nabih

Mohamed Khaled Hafez

Amr El Sebaee

PRIME INVESTMENT RESEARCH

Mohamed Seddiek

Head of Research/Strategist

+202 3300 5720

mseddiek@egy.primegroup.org

Rehab Taha, CFA

Acting Head of Research

+202 3300 5724

rtaha@egy.primegroup.org

Manager

+202 3300 5726

mdoss@egy.primegroup.org

Ahmed Hindawy

Senior Analyst

+202 3300 5719

aelhindawy@egy.primegroup.org

Radwa Abulnaga

Senior Analyst

+202 3300 5718

rabulnaga@egy.primegroup.org

Heba Sherif

Analyst

+202 3300 5717

hsherif@egy.primegroup.org

Ahmed Hazem

Analyst

+202 3300 5723

ahazem@egy.primegroup.org

Junior Analyst

+202 3300 5722

hmonir@egy.primegroup.org

Senior Technical Analyst

+202 3300 5721

lahmed@egy.primegroup.org

Monette Doss

Heba Monir

Lara Ahmed, CFTe

HEAD OFFICE

PRIME SECURITIES S.A.E.