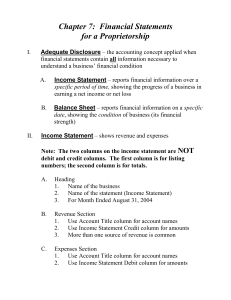

Accounting Chapter 8 • Accounting Concept #9: Adequate

advertisement

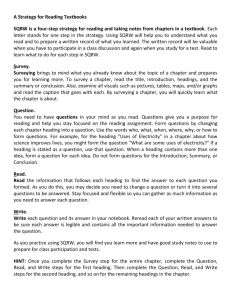

Accounting Chapter 8 • Accounting Concept #9: Adequate Disclosure o Financial statements contain all information necessary to understand a business’s financial condition Lesson 8-1 • • • • • • • • • • Income Statement reports information for a specific period of time Get the info from the work sheet IS – 4 parts – heading, revenue, expenses, net income/loss Heading: Name of business, Income Statement, For month ended _______ Revenue section info comes from work sheet IS credit column Expense section info comes from work sheet IS debit column To make decisions have to analyze the relationship between total expenses and net income Component Percentage = each component/sales Can prepare and IS with 2 sources of Revenue See pages 178 and 179 for IS examples Lesson 8-2 • • • • • • • • • • A balance sheet reports financial info on a specific date, showing the financial condition of a business Financial condition refers to its financial strength Balance sheet has 4 parts: heading, assets, liabilities, O.E. A = L + O.E. Assets on left side of BS Liabilities and O.E. on right side of BS Find info from BS columns on the work sheet Report current capital on BS o capital account balance + net income – drawing account = current capital o capital account balance – net loss – drawing account= current capital Sometimes want to report out all the info on how calculated current capital See page 184 for examples Owner’s Equity Capital, August 1, 20— Net Income Less Drawing Capital, August 31, 20—