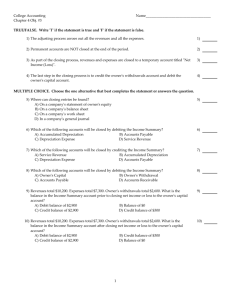

Illustrating Permanent Accounts

advertisement

Chapter 5 Transactions That Affect Revenue, Expenses, and Withdrawals Ch 5 Section 1 Vocabulary OLD Revenue Expenses Withdrawals NEW Temporary Capital Accounts Permanent Accounts Ch 5 Section 1 Relationship of Revenue, Expenses, and Withdrawals to Owner’s Equity Owner’s Capital account shows the amount of the owner’s investment, or equity (what the business is worth $$ if sold). Expenses and owner’s withdrawals decrease owner’s equity Ch 5 Section 1 Temporary Capital Accounts Accounting is measured in periods of time or accounting periods Revenue, expense, and withdrawals accounts are used to collect information for a single accounting period. Temporary capital accounts start new each period with zero balances. - The balance does NOT carry forward At the end of that period, the balances in the temporary capital accounts are transferred to the owner’s capital account. Ch 5 Section 1 Illustrating Temporary accounts During the accounting period, transactions related to utilities such as electric and phone are recorded in Utilities Expense account The individual transaction amounts accumulate during the period At the end of the period, the total is transferred to owner’s capital and subtracted Ch 5 Section 1 The Relationship of Temporary Capital Accounts to the Owner’s Capital Account Utilities Expense Accumulated telephone costs for accounting period Accumulated electricity costs for accounting period Total for accounting period $2,857 5,141 $7,998 Utilities Expense balance transferred to Owner’s Capital at end of accounting period. Expenses decrease owner’s capital. Owner’s Capital Balance of Utilities Expense $7,998 Balance at Beginning of Accounting Period $90,000 Balance at End of Accounting Period $82,002 Ch 5 Section 1 Permanent Accounts Owner’s capital account Asset and liability accounts Permanent accounts are continuous from one accounting period to the next. Dollar balances at the end of one accounting period becomes the beginning dollar balances for the next accounting period Ch 5 Section 1 Illustrating Permanent Accounts If a business has supplies totaling $875 at the end of one accounting period, the business will start with $875 in supplies at the beginning of the next accounting period. Permanent accounts show balances on hand or amounts owned at any time. Show day to day changes in assets, liabilities, and owner’s capital. 5 Section 1 Rules of D and Cr forChTemp Capital Accounts The rules of debit and credit for accounts classified as revenue, expense, and withdrawals accounts are related to the rules for the owner’s equity account. Ch 5 Section 1 Rules for Revenue Accounts Revenue earned from selling goods or services will increase owner’s capital Revenue Accounts Debit Debit -– (2) (2)Decrease DecreaseSide Side Credit + (1) Increase Side (3) Normal Balance Ch 5 Section 1 Rules for Expense Accounts Expenses decrease Owner’s Capital Expense Accounts Debit + (1) Increase Side (3) Normal Balance Credit – (2) Decrease Side Ch 5 Section 1 Rules for Expense Accounts - Withdrawals are money that that owner takes out of the business - Withdrawals decrease Owner’s Capital Withdrawals Accounts Debit + (1) Increase Side (3) Normal Balance Credit – (2) Decrease Side Review 1. Changes to revenue accounts eventually affect another account. What other account is affected? Explain 2. What type of transaction affects the debit side of the owner’s capital account? Explain