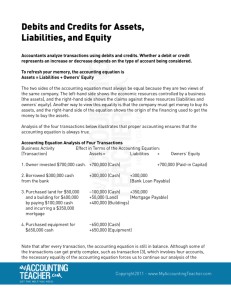

The Basics of Accounting

advertisement

Debits versus Credits By Michael Reimer Left Side is Right side the debit is the credit side side This is where all the daily transactions of a business are recorded. The general journal entries are posted here. The account balances are updated each day. Assets = Liabilities + Owner’s Equity Left side of the balance sheet equation Normal asset balance is a debit Assets go up with a debit Assets go down with a credit Assets Debit Credit Properties or economic resources Provision of future company benefits Cash Receivables Supplies Machinery Land Inventory held for sale Right side of the balance sheet equation Normal liability balance is a credit Liabilities go up with a credit Liabilities go down with a debit Liabilities Debit Credit Debts or payables owed by the business A reduction of future assets of the business Accounts Payable Notes Payable Bank Loan Payable Mortgage Payable Two Accounts: Capital: records the owner’s investment in the business Withdrawals: records the owner’s personal drawings from the business Capital goes up with a credit Capital goes down with a debit M. Reimer, Capital Debit Credit M. Reimer, Withdrawals goes Withdrawals up with a debit Debit Credit Withdrawals goes down with a credit Is linked with another account Has an opposite balance to its counterpart Reduces the value of its counterpart Revenues – Expenses = Profit or Loss Revenues go up with a credit Revenues go down with a debit Revenue Debit Credit Two different types: Service based: Work provided to customers (Chapters 3 to 5) Retail based: Sales of inventory to customers (Chapter 6) Sales Commissions Earned Professional Fees Earned Rent Revenue Interest Earned Expenses go up with a debit Expenses go down with a credit Expenses Debits Credits Incur costs while doing daily business Show a consumption of assets to generate revenues Advertising Expense Supplies Expense Telephone Expense Utilities Expense Wages Expense Rent Expense Insurance Expense Left side is the debit side Right side is the credit side Assets Withdrawals Expenses Liabilities Capital Revenues