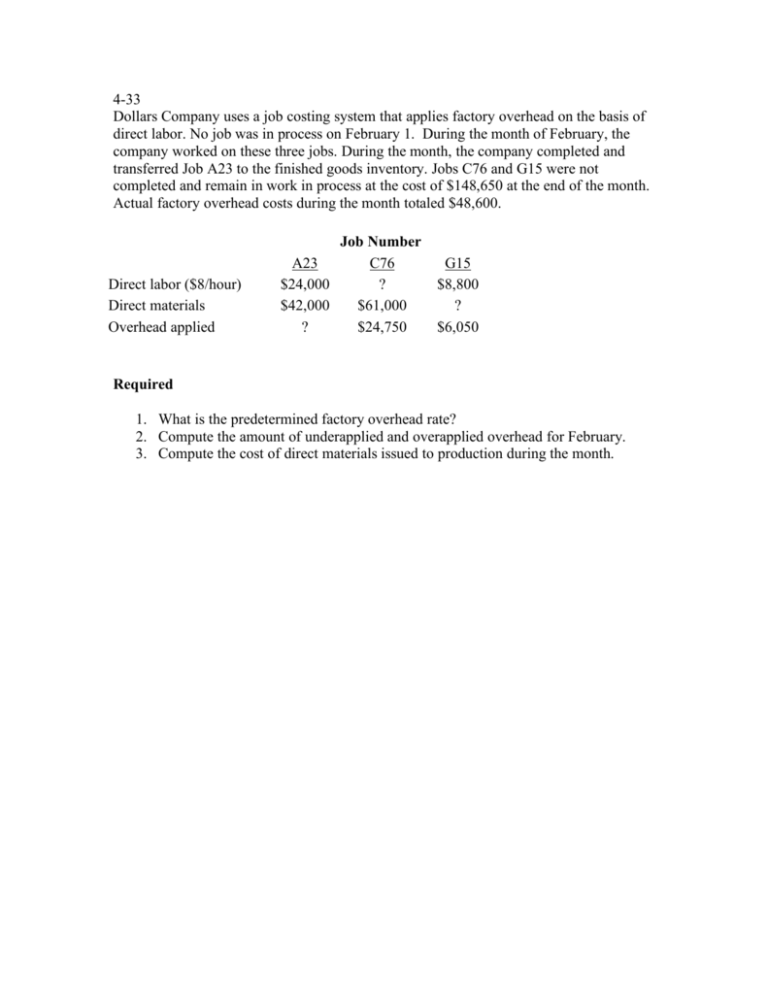

4-33 Dollars Company uses a job costing system that applies factory

advertisement

4-33 Dollars Company uses a job costing system that applies factory overhead on the basis of direct labor. No job was in process on February 1. During the month of February, the company worked on these three jobs. During the month, the company completed and transferred Job A23 to the finished goods inventory. Jobs C76 and G15 were not completed and remain in work in process at the cost of $148,650 at the end of the month. Actual factory overhead costs during the month totaled $48,600. Direct labor ($8/hour) Direct materials Overhead applied Job Number A23 C76 $24,000 ? $42,000 $61,000 ? $24,750 G15 $8,800 ? $6,050 Required 1. What is the predetermined factory overhead rate? 2. Compute the amount of underapplied and overapplied overhead for February. 3. Compute the cost of direct materials issued to production during the month. 4-35 Norton Associates is an advertising agency in Columbus, Ohio. The company's controller estimated that it would incur $325,000 in overhead costs for 2010. Because the overhead costs of each project change in direct proportion to the amount of direct professional hours incurred, the controller decided that overhead should be applied on the basis of professional hours. the controller estimated 25,000 professional hours for the year. During October, Norton incurred the following costs to make a 20-second TV commercial for Central Ohio Bank. Actual overhead costs to make the commercial totaled $14,700. The industry customarily bills customers at 150 percent of total cost. Direct Materials Direct professional hours Cost per professional hour Estimated overhead costs Estimated professional hours Actual overhead costs for commercial Billing rate on cost $32,000 1,200 $50 $325,000 25,000 $16,500 150% Required 1. Compute the predetermined overhead rate. 2. What is the total amount of the bill that Norton will send Central Texas Bank? 4-40 The following information is for Shiller Company for July 2010: Facts and Figures about Shiller Company March 2010 Jobs: Job 1467 Job 1469 Predetermined Labor Hour Rate 39.50 Labor Hours: 6,175 39.50 4,275 Status: Completed Ship Date: July Gross Margin: 24% In Process NA NA The company purchased the following direct materials and indirect materials: Material A Material B Indirect Materials TOTAL: $76,000 $57,000 $14,250 $147,250 Direct materials and indirect materials used are as follows: Material A Material B Subtotal: Indirect Materials TOTAL: Job 1467 $28,500 $9,500 $38,000 Job 1469 $71,250 $33,250 $104,500 TOTAL $99,750 $42,750 $142,500 $199,500 $342,000 Factory labor incurred for the two jobs and indirect labor is as follows: Job 1467 $76,000 Job 1469 $57,000 Indirect Labor $133,000 TOTAL: $266,000 The company closed the overapplied or underapplied overhead to the Cost of Goods Sold account at the end of July. Required 1. Calculate the amount of overapplied and underapplied overhead and state whether the cost of goods sold account will be increased or decreased by the adjustment. 2. Calculate the total manufacturing cost for Job 1467 and Job 1469 for July 2010. Chapter 4 4-33 Working with Unknowns 1. From Job G15: $6,050/$8,800 = 0.6875 overhead rate 2. Job A23: $24,000 x 0.6875 = $16,500 applied overhead Total applied overhead: A23 $16,500 C76 24,750 G15 6,050 $47,300 $48,600 - $47,300 = $1,300 underapplied overhead 3. For Job C76: $24,750 / .6875 = $36,000 direct labor Therefore, $148,650 - ($36,000 + $61,000 + $24,750) – ($8,800 + $6,050) = $12,050 direct materials for Job G15 $42,000 + $61,000 + $12,050 = $115,050 cost of direct materials issued 4-35 Service Industry; Overhead Rate, Pricing 1. Predetermined Overhead Rate = $325,000 / 25,000 hours = $13 per professional hour 2. Total Cost = $32,000 + ($50 x 1,200) + ($13 x 1,200) = $32,000 + $60,000 + $15,600 = $107,600 Total Revenue = $107,600 x 150% = $161,400 1 Chapter 4 4-40 Job Costing 1. Underapplied OH = $31,350 2. Total Mfg cost for Job 1467= $357,913; for Job 1469 = $330,363 Dire ct Ma te ria ls Data Section Job 1467 Material A $ Material B Dire ct La bor La bor Hours $ 76,000 6,175 $ 57,000 4,275 28,500 9,500 Job 1469 Material A $ Material B 71,250 33,250 10,450 Fa ctory Ove rhe a d Applie d $39.50 per machine hr Solution Fa ctory Ove rhe a d Ana lysis Actual Factory OH Indirect Materials Indirect Labor $199,500 133,000 Utilities 14,250 Depreciation 85,500 Insurance Tota l Actua l Fa ctory OH Less: Applied Factory OH 11,875 $444,125 412,775 (10,450 x $39.50) Unde r/ove ra pplie d Fa ctory OH $31,350 UNDERAPPLIED Adjust Diffe re nce to COGS 31,350 Incre a se in Cost of Goods Sold Breakdown of Job Costs Job 1467 Tota l Dire ct Ma te ria ls Cost Tota l Dire ct La bor Cost !"#$% Job 1469 $38,000 $104,500 76,000 57,000 Applie d Ove rhe a d Ma chine Hours 6,175 4,275 Applica tion ra te $39.50 $39.50 Tota l Applie d Ove rhe a d Cost 243,913 168,863 Tota l Ma nufa cturing Costs $357,913 $330,363 2 !"#$%&&'