On the Internet

advertisement

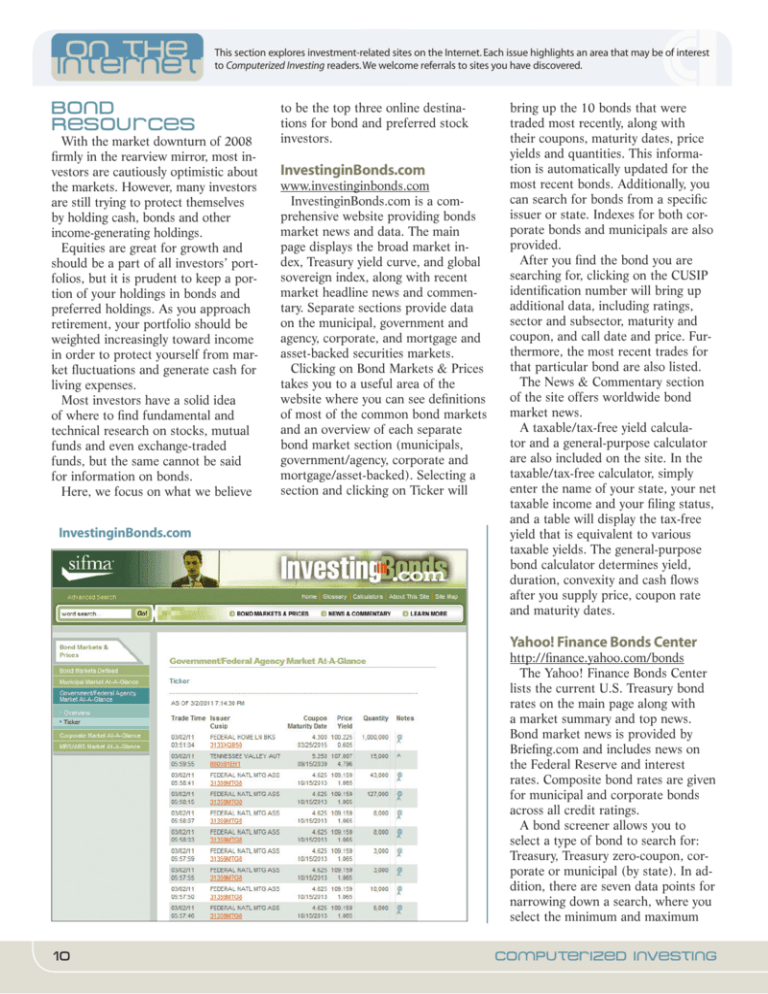

This section explores investment-related sites on the Internet. Each issue highlights an area that may be of interest to Computerized Investing readers. We welcome referrals to sites you have discovered. Bond Resources With the market downturn of 2008 firmly in the rearview mirror, most investors are cautiously optimistic about the markets. However, many investors are still trying to protect themselves by holding cash, bonds and other income-generating holdings. Equities are great for growth and should be a part of all investors’ portfolios, but it is prudent to keep a portion of your holdings in bonds and preferred holdings. As you approach retirement, your portfolio should be weighted increasingly toward income in order to protect yourself from market fluctuations and generate cash for living expenses. Most investors have a solid idea of where to find fundamental and technical research on stocks, mutual funds and even exchange-traded funds, but the same cannot be said for information on bonds. Here, we focus on what we believe InvestinginBonds.com to be the top three online destinations for bond and preferred stock investors. InvestinginBonds.com www.investinginbonds.com InvestinginBonds.com is a comprehensive website providing bonds market news and data. The main page displays the broad market index, Treasury yield curve, and global sovereign index, along with recent market headline news and commentary. Separate sections provide data on the municipal, government and agency, corporate, and mortgage and asset-backed securities markets. Clicking on Bond Markets & Prices takes you to a useful area of the website where you can see definitions of most of the common bond markets and an overview of each separate bond market section (municipals, government/agency, corporate and mortgage/asset-backed). Selecting a section and clicking on Ticker will bring up the 10 bonds that were traded most recently, along with their coupons, maturity dates, price yields and quantities. This information is automatically updated for the most recent bonds. Additionally, you can search for bonds from a specific issuer or state. Indexes for both corporate bonds and municipals are also provided. After you find the bond you are searching for, clicking on the CUSIP identification number will bring up additional data, including ratings, sector and subsector, maturity and coupon, and call date and price. Furthermore, the most recent trades for that particular bond are also listed. The News & Commentary section of the site offers worldwide bond market news. A taxable/tax-free yield calculator and a general-purpose calculator are also included on the site. In the taxable/tax-free calculator, simply enter the name of your state, your net taxable income and your filing status, and a table will display the tax-free yield that is equivalent to various taxable yields. The general-purpose bond calculator determines yield, duration, convexity and cash flows after you supply price, coupon rate and maturity dates. Yahoo! Finance Bonds Center http://finance.yahoo.com/bonds The Yahoo! Finance Bonds Center lists the current U.S. Treasury bond rates on the main page along with a market summary and top news. Bond market news is provided by Briefing.com and includes news on the Federal Reserve and interest rates. Composite bond rates are given for municipal and corporate bonds across all credit ratings. A bond screener allows you to select a type of bond to search for: Treasury, Treasury zero-coupon, corporate or municipal (by state). In addition, there are seven data points for narrowing down a search, where you select the minimum and maximum 10 Computerized Investing value. A few quick searches yielded a universe of approximately 30,000 bonds at any given time. The bond lookup tool allows you to search for a bond by its name. If you are unsure, typing in the issuer will provide bonds that are issued by that particular entity. Data on the bond is provided by ValuBond and includes price, coupon rate, maturity date, yield-to-maturity, current yield, Fitch rating and callability. Yahoo! Finance’s Education Center includes a section on bonds. Basic learning tools describe what bonds are, what you can expect from a change in interest rates, and the risk versus reward of investing in bonds. For investors looking for more advanced bond education, articles on bond laddering and global bonds are also available. Yahoo! Finance Bonds Center The Wall Street Journal Online online.wsj.com The Wall Street Journal Online’s bond section is very robust and covers bonds comprehensively. The main page lists the Treasury yields for each maturity length and provides recent price change. Charts show the Treasury yield curve, labor-swap curve and U.S. consumer rates. Consumer money rates such as the prime, 30year fixed mortgage, home-equity loan and 48-month new car loan rates, along with their 52-week highs and lows, are all presented on the main page. The most active corporate bonds are listed on the corporate bonds page. In addition, offerings of the major government agencies are listed with their yield. Coupons and yields for guaranteed investment contracts, mortgage-backed securities, taxexempt bonds, TIPS and Treasury Strips are all provided, as is a weekly snapshot of the key rates. A bond calendar reports upcoming offerings, including the total offering amount and ratings from Fitch, Moody’s and Standard & Poor’s. Second Quarter 2011 The Wall Street Journal Online 11