BAC 212 B01- Intermediate Financial Accounting

advertisement

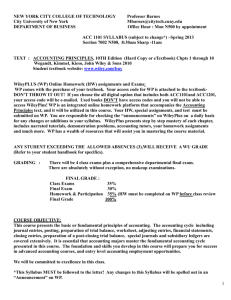

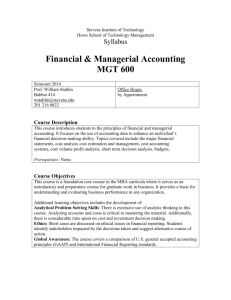

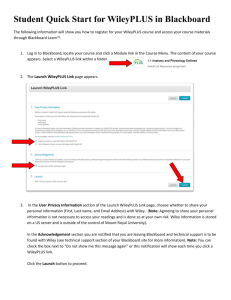

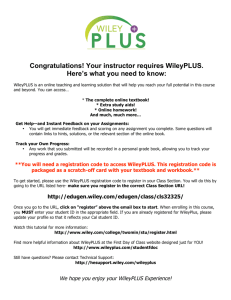

_________________________________________________________________________ Course: BAC 212 B01- Intermediate Financial Accounting II / Winter 2012 Professor: Nathalie Hivert, MSc, CA Office: HAM-217 (extension 2479) Email: Nathalie.Hivert@ubishops.ca Office hours: Tuesday and Thursday, 14h00 to 15h30 ________________________________________________________________________ COURSE OBJECTIVES: This course is a continuation of BAC211 Intermediate Accounting I, and together are key courses for accounting students. The topics covered by this course are: Liabilities, Shareholder’s Equity, Financial Instruments, Earnings per Share, Income Taxes, Employee Future Benefits, Leases, Accounting Changes and Statement of Cash Flows. Emphasis will be placed on developing the students’ professional judgement and building strong ethical skills and professionalism. COURSE PRE-REQUISITE BAC211: Intermediate Financial Accounting I TARGET AUDIENCE This is a key course for students planning a career in the accounting profession. This course is a prerequisite for the advanced accounting course. COURSE MATERIALS Intermediate Accounting, Ninth Canadian Edition, (volume two) Kieso, Weygandt, Warfield, Young, and Wiecek, John Wiley & Sons, 2010 All online material available for student on WileyPLUS CICA Handbook All or most of your course material will be available on Moodle. Students are expected to check the course Web site on Moodle regularly. CLASS WORK AND ASSIGNMENTS Intermediate accounting is an important course for students planning a career in the accounting profession. Practice, through completion of assignments (which may be lengthy) plays an important role in obtaining a functional understanding of the material to be covered. You should plan to have the Kieso’s text readings completed for a topic by the date we begin class meetings about it. It is highly recommended to redo the problems we resolve in class. Chapter material may or may not be summarized in class, nor will entire problem solutions be presented in class. WEB ASSIGNMENTS USING WILEYPLUS WileyPlus is the e-learning tool that will help you with this course. In addition to the Web assignments and the extra study aids, the complete textbook is available online within WileyPlus. If you bought the new printed text at our campus bookstore, a WileyPLUS access code is already included. Otherwise, you have to purchase it online. Once you purchase your WileyPLUS registration code, you will need to register for WileyPLUS at your class section. GRADING SCHEME: Assignments (Best 2 of 3) Case assignment in team Midterm Final examination 20 % 15 % 25 % 40 % 100 % Tests and examinations will cover all work completed to date; Assignments are due at the start of the class indicated. Late assignments will not be accepted; You need at least 50 % in total in the final examination to pass the course; No supplemental (test or examination). CONTENTS Introduction Chapter 13: Non-Financial and Current Liabilities Chapter 14: Long-Term Financial Liabilities Assignment #1 (Jan 31st) Chapter 15: Shareholder's Equity Chapter 16: Complex Financial Instruments Assignment #2 (Feb 16th) Chapter 17: Earnings Per Share Chapter 18: Income Taxes Midterm (March 1st) Reading week Chapter 19: Pensions and other Employee Future Benefits Chapter 20: Leases Assignment #3 (April 3rd) Chapter 21: Accounting Changes and Error Analysis Chapter 22: Statement of Cash Flows Final Exam (3 hrs) (1 class) (2 classes) (2 classes) (2 classes) (3 classes) (2 classes) (3 classes) (2 classes) (3 classes) (1 classes) (2 classes) Readings and Self-Study practice exercises are listed on Moodle site.