Vancouver Island University Faculty of Management – Business

advertisement

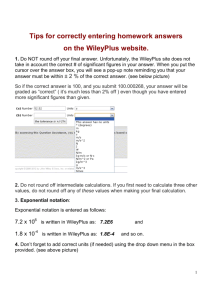

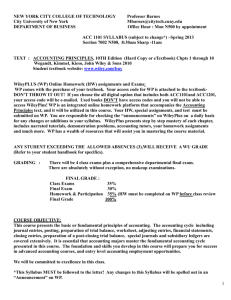

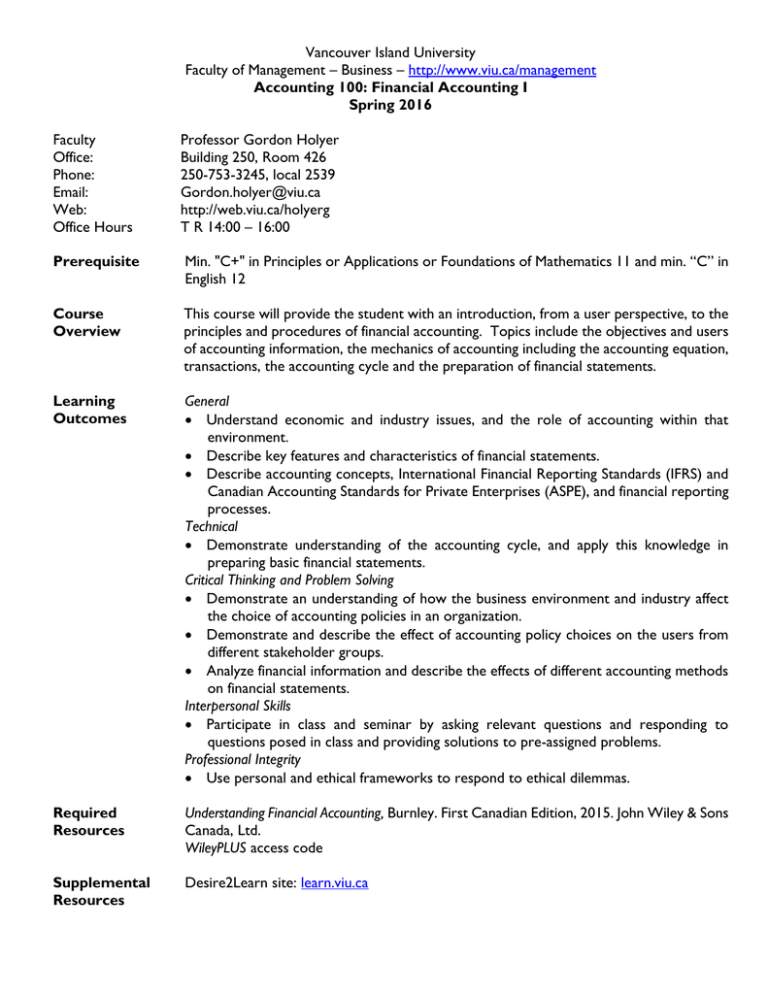

Vancouver Island University Faculty of Management – Business – http://www.viu.ca/management Accounting 100: Financial Accounting I Spring 2016 Faculty Office: Phone: Email: Web: Office Hours Professor Gordon Holyer Building 250, Room 426 250-753-3245, local 2539 Gordon.holyer@viu.ca http://web.viu.ca/holyerg T R 14:00 – 16:00 Prerequisite Min. "C+" in Principles or Applications or Foundations of Mathematics 11 and min. “C” in English 12 Course Overview This course will provide the student with an introduction, from a user perspective, to the principles and procedures of financial accounting. Topics include the objectives and users of accounting information, the mechanics of accounting including the accounting equation, transactions, the accounting cycle and the preparation of financial statements. Learning Outcomes General Understand economic and industry issues, and the role of accounting within that environment. Describe key features and characteristics of financial statements. Describe accounting concepts, International Financial Reporting Standards (IFRS) and Canadian Accounting Standards for Private Enterprises (ASPE), and financial reporting processes. Technical Demonstrate understanding of the accounting cycle, and apply this knowledge in preparing basic financial statements. Critical Thinking and Problem Solving Demonstrate an understanding of how the business environment and industry affect the choice of accounting policies in an organization. Demonstrate and describe the effect of accounting policy choices on the users from different stakeholder groups. Analyze financial information and describe the effects of different accounting methods on financial statements. Interpersonal Skills Participate in class and seminar by asking relevant questions and responding to questions posed in class and providing solutions to pre-assigned problems. Professional Integrity Use personal and ethical frameworks to respond to ethical dilemmas. Required Resources Understanding Financial Accounting, Burnley. First Canadian Edition, 2015. John Wiley & Sons Canada, Ltd. WileyPLUS access code Supplemental Resources Desire2Learn site: learn.viu.ca Evaluation Assessment 1. WileyPLUS Assignments (best 10 of 12) 2. Term Tests (2) 3. Comprehensive Final Exam Value 20% 40% 40% The term tests must be written as scheduled. The test date in this course outline is approximate. The student is responsible for knowing the correct date. Students must write the final exam on the date scheduled in the assigned examination room. POLICY WITH REGARD TO MISSED OR POORLY WRITTEN TESTS. If the scheduled term test is missed for any reason a mark of zero will be assigned. If the mark obtained in the term test is less than that received on the final, the mark received on the final will be assigned to the term test. Grading Scale Grades will be assigned according to the following scale. A+ 90 – 100% C+ 64 - 67 A 85 – 89 C 60 - 63 Last day to withdraw from this A80 – 84 C55 – 59 course without academic penalty B+ 76 – 79 D 50 – 54 is February 26, 2016 B 72 – 75 F < 50 B68 – 71 References Faculty of Management (Business) requires the APA style of referencing for academic papers. Resources for using APA are available from the VIU Writing Centre (Library, Room 474). You can find their hours of operation and access to online student resources (including tutorials and a printable Quick Guide) at: http://sites.viu.ca/writingcentre/. English Standards Assignments must be free of spelling, punctuation and grammatical errors. Assignments containing such errors will be penalized (i.e. mark deductions). Accommodation Students with documented disabilities requiring academic and/or exam accommodation should contact Disability Services in Building 200. Academic Misconduct Academic misconduct includes, but is not limited to, giving and receiving information during any test or exam, using unauthorized sources of information during any test; plagiarizing; fabrication, cheating, and, misrepresenting the work of another person as your own, facilitation of academic misconduct, and under certain conditions, non-attendance. Plagiarism will not be tolerated. You must reference your work and acknowledge sources with in-text citations and a complete list of references. This includes direct and indirect quotes, diagrams, charts, figures, pictures and written material. For group projects, the responsibility for academic integrity, which can result in academic misconduct and its resulting penalties, rests with each person in the group and sanctions would be borne by each member. No electronic dictionaries, cell phones or other electronic devices will be allowed in exams/tests/quizzes. Only the following approved calculators may be used in exams/ tests/quizzes. No other materials will be allowed on the desktop apart from a pen/pencil unless specifically approved by the faculty member. Texas Instrument BAII Plus, BAII, BA35 / Sharp EL-733A / Hewlett Packard 10B Pre-class Preparation In advance of each class, you should read, watch and attempt the pre-assigned material. These readings, videos and problems will give you an initial exposure to the material that will be discussed in class. This will position you to be able to clarify and deepen your understanding of the material during classroom discussions. While working through the pre-assigned material, be sure to note any questions you may have that remain unanswered and ensure that these are addressed in class or in discussions with your professor. Assessments WILEYPLUS ASSIGNMENTS There are twelve assignments set up within WileyPLUS. Your assignment mark will be determined after dropping your lowest two results (i.e. your grade is based on the best ten out of twelve assignments). All of the assignment due dates are specified within WileyPLUS. Your ability to complete these assigned problems will be critical to success on the tests and examination. You must be able to complete these problems independently. Solutions are available through WileyPLUS once you have submitted the assignment and should be reviewed. ADDITIONAL PRACTICE PROBLEMS – For each chapter, there are demonstration problems and additional practice questions set up within WileyPLUS. These problems are optional and can be used to help reinforce your understanding of the material. TERM TESTS Term tests have been scheduled to take place at the completion of a given set of chapters. If a scheduled term test is missed for any reason, it will be assigned a grade of zero. You will be able to replace the mark obtained on one of the term tests if the mark received on your final examination is higher than that received on the term test. COMPREHENSIVE FINAL The comprehensive final will be three hours in length and will be held during the regularly scheduled exam period (April 14 – 25, 2016). The final will consist of multiple choice, short essay answer questions, and problems. The final examination is not optional and must be written as scheduled. NO TRAVEL PLANS SHOULD BE MADE DURING THE EXAM PERIOD. ASSESSMENT DEADLINES/DATES All dates in the outline are approximate and may change as a result of circumstances including the pace of course progress, weather cancellations or illness. Any changes to deadline/dates will be announced in class and students are responsible for knowing the correct dates. Assignments, assignment dates, and test dates will be announced in class. This information is also available on the “Course Update” section on D2L and the Professor’s website. Course Outline: Chapter 1: Overview of Corporate Financial Reporting Forms of Business Organization Activities of a Business Financial Reporting Chapter 2: Analyzing Transactions and Their Effects on Financial Statements Accounting Standards Qualitative Characteristics of Financial Information Transaction Analysis and the Accounting Equation Chapter 3: Double-Entry Accounting and the Accounting Cycle Understanding the Accounting Cycle The Chart of Accounts Transaction Analysis and Recording Adjusting Entries Closing Entries Preparing Financial Statements Chapter 4: Revenue Recognition and the Statement of Income Revenue Recognition Measurement Statement of Income Statement of Comprehensive Income Test # 1: Expected Date February 2 & 3, 2016 Chapter 5: The Statement of Cash Flows Understanding the Statement of Cash Flows Preparing the Statement of Cash Flows Interpreting Cash Flow Information Chapter 6: Cash and Accounts Receivable Cash Internal Control Bank Reconciliation Accounts Receivable Bad Debts Chapter 7: Inventory Types of Inventory Inventory Systems Cost Formulas and Inventory Valuation Gross Margin Internal Controls and Inventory Chapter 8: Long-Term Assets Valuation of Property, Plant, and Equipment Depreciation Depreciation Methods Changes in Depreciation Methods Impairment Disposal of Property, Plant, and Equipment Depreciation and Income Taxes Intangible Assets Goodwill Test # 2: Expected Date March 15 & 16, 2016 Chapter 9: Current Liabilities Transactions with Lenders Transactions with Suppliers Transactions with Customers Transactions with Employees Transactions with the Government Transactions with Shareholders Chapter 10: Long-Term Liabilities Transactions with Lenders Transactions with other Creditors Transactions with Employees Income Tax Issues Commitments and Contingencies Chapter 11: Shareholders’ Equity Types of Shares Dividends Stock Splits Chapter 12: Financial Statement Analysis Context for Financial Statement Analysis Financial Statement Analysis Perspectives Financial Statement Analysis Techniques Ratio Analysis Final Examination: Examination Period April 14 – 25, 2016