exams

advertisement

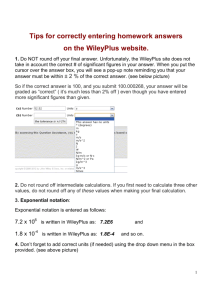

Stevens Institute of Technology Howe School of Technology Management Syllabus Financial & Managerial Accounting MGT 600 Semester:2014 Prof. William Stahlin Babbio 414 wstahlin@stevens.edu 201 216 8022 Office Hours: by Appointment Course Description This course introduces students to the principles of financial and managerial accounting. It focuses on the use of accounting data to enhance an individual’s financial decision-making ability. Topics covered include the major financial statements, cost analysis cost estimation and management, cost accounting systems, cost volume profit analysis, short term decision analysis, budgets, Prerequisites: None. Course Objectives This course is a foundation core course in the MBA curricula where it serves as an introductory and preparatory course for graduate work in business. It provides a basis for understanding and evaluating business performance in any organization. Additional learning objectives includes the development of: Analytical Problem Solving Skills: There is extensive use of analytic thinking in this course. Analyzing accounts and costs is critical to mastering the material. Additionally, there is considerable time spent on cost and investment decision making. Ethics: Short cases are discussed on ethical issues in financial reporting. Students identify stakeholders impacted by the decisions taken and suggest alternative course of action. Global Awareness: The course covers a comparison of U.S. general accepted accounting principles (GAAP) and International Financial Reporting standards. Learning Goals After successfully completing this course, the student will be able to: 1. 2. 3. 4. 5. 6. 7. 8. Analyze balance sheets, income statements and cash flow statements Identify adjustments necessary for accrual financial statements Account for liabilities, stock transactions and retained earnings Compute the ratios widely used in financial statement analysis and explain their significance Identify the three elements of manufacturing cost, compute overhead rates and allocate overhead Determine the sales volume to earn a desired level of operating income Prepare operating and cash budgets and supporting schedules Use incremental analysis in making such as special orders or outsourcing Pedagogy This course will consist of reading assignments, powerpoint slides (posted on Moodle) to clarify and emphasize key points in the readings, lectures and discussions, and solution of problems. Each week we will complete a chapter. You will submit selected homework assignments using WileyPlus online software. Required Text We will use an e-text in this course. It is available when you register on Wiley Plus. WileyPlus is a supplemental resource for students. Weekly homework assignments are submitted through WileyPlus. It is web-based tutorial software. The software makes submitting homework easy. You get immediate feedback and assistance in completing the assignments as well. Kimmel,Weygandt, Kieso, Accounting 4th Edition, Wiley 2012 Merrill Lynch, How to Read a Financial Statement (on Moodle Home Page) When you register for WileyPlus you will have immediate access to the e-text. You should register for the text as soon as possible. WileyPLUS Registration To gain access to WileyPLUS, go to: http://edugen.wileyplus.com/edugen/class/cls358340/ to sign up for this course section.You will need to pay a fee to gain access to the text book and Wiley Plus homework software. 2 Homework Submissions Due dates for assignments are indicated on WileyPlus. These assignments will be graded automatically. Five retries are allowed per problem. Timely submission is important to reinforce what is learned in the readings and in class. Assignments will generally be due on Sunday evening. Early submission of homework assignments is encouraged. Late solutions will be subject to a 25% deduction. The lowest homework grade will be dropped. Approximate Grade Allocations Assignment Homework assignments & on line participation Exam 1 Exam 2 Total Grade % 30% 35% 35% 100% EXAMS There will be two on line, open book exams. These will be assigned to be completed at a specific time on a Sunday evening. You will have a limited time to complete the exam and may attempt the exam only once. These are individual exams and you may not obtain assistance from nor provide assistance to anyone else. 3 Ethical Conduct The following statement is printed in the Stevens Graduate Catalog and applies to all students taking Stevens courses, on and off campus. “Cheating during in-class tests or take-home examinations or homework is, of course, illegal and immoral. A Graduate Academic Evaluation Board exists to investigate academic improprieties, conduct hearings, and determine any necessary actions. The term ‘academic impropriety’ is meant to include, but is not limited to, cheating on homework, during in-class or take home examinations and plagiarism.“ Consequences of academic impropriety are severe, ranging from receiving an “F” in a course, to a warning from the Dean of the Graduate School, which becomes a part of the permanent student record, to expulsion. Reference: The Graduate Student Handbook, Academic Year 2003-2004 Stevens Institute of Technology, page 10. Consistent with the above statements, all homework exercises, tests and exams that are designated as individual assignments MUST contain the following signed statement before they can be accepted for grading. ____________________________________________________________________ I pledge on my honor that I have not given or received any unauthorized assistance on this assignment/examination. I further pledge that I have not copied any material from a book, article, the Internet or any other source except where I have expressly cited the source. Signature ________________ Date: _____________ 4 MGT 600 Class Assignments Go to WileyPlus for the online homework assignments and their due dates. Week Class Date Chapter 1 1-Sep 1 Introduction to Financial Statements 2 8-Sep 2 A Further Look at Financial Statements 3 15-Sep 4 Accruals 4 22-Sep 5 The Multiple-Step Income Statement 5 29-Sep 6 6-Oct 7 13-Oct 8 20-Oct Exam Review 9 27-Oct Exam 1 9 27-Oct 7 Internal Control 10 Liabilities 11 Stockholders' Equity 13 Financial Statement Analysis 14 Managerial Accounting 10 Nov 3 15 Job Order Costing 11 Nov 10 18 Cost-Volume-Profit 12 Nov 17 20 Budgetary Planning 13 Nov 24 23 Incremental Analysis 14 1-Dec Exam Review 8-Dec Exam 2 5