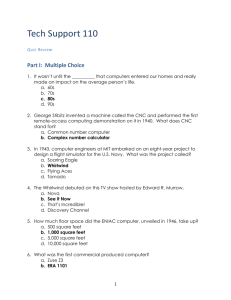

APPLE HOSPITALITY REIT, INC.

advertisement