TIME VALUE OF MONEY

advertisement

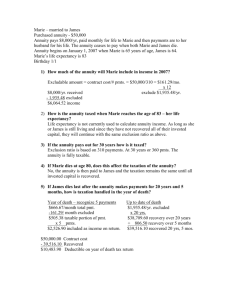

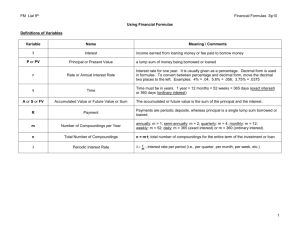

TIME VALUE OF MONEY In following we will introduce one of the most important and powerful concepts you will learn in your study of finance; the time value of money. It is generally acknowledged that money has a time value. One dollar today is worth more than one dollar tomorrow. TIME VALUE OF MONEY The reason why the value of money increases with time is because of the interest rate, which represents the cost of borrowing the money or the return obtainable by investing it. Because of the cost of money, interest must be considered by contractors when making decisions regarding their equipment. This requires a cash flow analysis, which recognizes that money has a different economic value depending on when it is received or paid. TIME VALUE OF MONEY In finance, we are often concerned with evaluating an investment (asset) that will pay out certain cash flows at given times in the future. In order to know what a reasonable price for such an investment (asset) is, we need to ask the question, „How much are the cash flows we will receive in the future worth today?" At other times, we might be trying to save for some future event, such as retirement or college. In cases like these we may ask, "How much will my savings be worth when I need to use them?" TIME VALUE OF MONEY The answers we get to these questions will allow us to do things like save for our retirement, purchase cars and homes, invest in rare collectibles, and buy a business. TIME VALUE OF MONEY Objective 1: Compute how much a sum deposited today will grow to in the future. This is also referred to as the future value of a lump sum. What if your wealthy uncle had deposited $1,000 into an account when you were born and the account earned a return of 8% per year. How much would that account be worth on your 20th birthday? This is the type of problem that future value of a lump sum techniques are designed to solve. TIME VALUE OF MONEY Objective 2: Compute the value today of a sum you will not receive until some future date. This is also referred to as the present value of a lump sum, since you are looking for the present value (the value today) of a sum of money that is promised to you at some point in the future. Say that as the beneficiary of a trust you were to receive a sum of $20,000 on your 25th birthday. However, when you graduated from high school at age 18 you could not afford to go to college. Rather than delay your education until you turn 25. You might be able to sell the payment you will receive from the trust. How much would it be worth? This question is easily answered using the concepts of present value of a lump sum. TIME VALUE OF MONEY Objective 3: Compute how much a series of equal payments will grow to over time. This is also referred to as the future value of an annuity. The most common application of this concept is in retirement planning. Let‘s say that you deposited $2,000 per year into an individual retirement account, also called an IRA, and were able to earn 12% per year on your investment. If you continue your annual investing from the age of 25 until you retire at age 65, how large would your retirement nest egg be? It is easy to see the important implications of this type of calculation, and using the future value of annuity techniques will make problems like this easy to solve. TIME VALUE OF MONEY Objective 4: Compute the value today of a series of equal payments. This final time value of money concept is also called finding the present value of an annuity. Say you won a million dollars in the lottery. However, like most lotteries; this one pays out the money in twenty equal installments of $50,000 each. While the total dollar value received over the twenty-year period equals one million dollars, it is obviously not the same as having a million dollars in your hands today. Many lotteries now have started giving winners the choice of the traditional installment payments or a lump sum, which is paid out immediately. In effect, you are trading twenty annual payments of $50,000 for some dollar value received today. How much should you get if you make the trade? This is a question you can answer using present value of an annuity techniques. TIME VALUE OF MONEY Objective 5: Apply the time value of money methods to answer a variety of questions. The beauty of the techniques you will learn is that they can be applied to such a wide variety of problems and answer such a large number of important questions. Whether you are concerned with how much money you will have at retirement. Or whether you can afford the payments on a new sport utility vehicle, the concepts encompassed in this chapter will allow you to answer the question. If you learn these concepts well, you will be amazed at how often you will use them throughout the rest of your life. TIME VALUE OF MONEY Simple versus Compound Interest Simple Interest is money earned on an investment, which is not reinvested. It is easy to understand simple interest if you think of the interest payments as cash that is placed in a safe after it is received. Since the interest earned is sitting in a safe gathering dust, it cannot be reinvested. Hence, it "simply" accumulates over time, but does not grow in value once it is earned. Compound Interest is money (or interest) earned on an investment that is immediately reinvested, typically in the same investment. In contrast to simple interest, compound interest allows the investor to earn interest on interest. Over long periods of time, and this interest on interest can generate large amounts of money, and is often referred to as the power of compounding. TIME VALUE OF MONEY Assume that you invested $100 for 3 years at an interest rate of 10%. If the money was earning simple interest, at the end of the three years you would have a total of $130. This is found in the following manner: Year Interest Earned 0 1 2 3 $100(.10)= $10.00 $110.00 $100(.10)= $10.00 $120.00 $100(.10)= $10.00 $130.00 Cumulative Value $100.00 TIME VALUE OF MONEY Now assume, however, that the investment was set up to automatically reinvest the earnings at the same rate of return. In this case, you would be earning interest on interest, or compound interest. The total value of the investment at the end of three years is then found as follows: Year Interest Earned 0 1 2 3 $100(.10)= $10.00 $110.00 $110(.10)= $11.00 $121.00 $121(.10)= $12.10 $132.00 Cumulative Value $100.00 Notice that the compound interest approach results in a final investment value that is $2.10 larger than the simple interest approach. This "extra" money earned represents what was earned on the reinvested interest. TIME VALUE OF MONEY The Future Value of a Lump Sum We can use the example above to develop a formula that will allow us to find the future value of any lump sum investment under a compound interest scenario. In order to general this formula, all we need to do is examine how we arrived at the cumulative values in the table above. We found that the value of a $100 investment at the end of one year was $110. This can also be written as: $100(1+0.10)=$100(1+0.10)1 = $110.00 TIME VALUE OF MONEY Similarly, the value at the end of the second year, $121.00, can be written as: $100(1+.10)(1+.10)=$100(1+.10)2= $121.00 Finally, the value at the end of the third year can be rewritten as: $100(1+.10)(1+.10)(1+.10)= $100(1+.10)3 = $132.10 TIME VALUE OF MONEY You can see the pattern. To find the future value of a lump sum, you only need to multiply the original investment times (1+i)n where i is the interest rate and n is the number of years for which the investment will be compounded. Now we can use this information to develop a generic equation that we can use for any lump sum amount and any number of periods. The formula is: FV = PVo(1+i)n Where FVn is the future value the lump sum will grow to n years from today, PVo is the present value of the investment at time zero (the lump sum you invested today), i is the interest rate and n is the number of years. TIME VALUE OF MONEY But what if your calculator doesn't have an exponent key? Without one, it can be impractical to find something like (1+.10)25. Fortunately, these values have already been computed for you and put into an easy to use table. To use the tables, we convert preliminary equation into time value of money format. FVn =PVo (FVIFi,n) We know (1+i)n = (FVIFi.n). The values of FVIF – Future Value Interest Factor you can find out in the tables or at http://finance.thinkanddone.com/fvif.htm TIME VALUE OF MONEY Example Assume we want to place $1,000 into an account today, could that the investment will earn an annual rate of return of 10% over the next five years. How much will we have at the end of the period? TIME VALUE OF MONEY NONANNUAL COMPOUNDING PERIODS In the previous examples, interest was paid once per year, which is also called annual compounding. Frequently, interest in accounts is paid more often than once per year. Many bank accounts, for example, pay interest monthly. Therefore, we must adjust our formula to allow for any interest payment schedule that may arise. TIME VALUE OF MONEY Equation shows how to adjust for any number of compounding periods per year: FVn = PV(1 + i/m)mn where FVn = PV = i = n = m = the future value of a deposit at the end of the nth period the initial deposit the annual interest rate the number of years the deposit is allowed to compound the number of times compouding occurs during the year TIME VALUE OF MONEY Similarly, we can adjust Equation to reflect nonannual compounding periods, with the result being: FVn =PVo (FVIFi/n,mxn) and where all the variables are the same as defined above. TIME VALUE OF MONEY Now we can apply either of these new formulas to the following example Example: Assume we wanted to place $125 into a bank account earning 12% interest, compounded quarterly. If we left the investment in place for five years, what would be its value at the end of the period? TIME VALUE OF MONEY Effective Interest Rates If the bank increases the number of compounding periods, the amount earned on a deposit increases. This implies that a higher effective interest rate is being earned. The effective interest rate is the amount you would need to earn annually to be as well off as you are with multiple compounding periods per year. To determine the exact effective interest rate, we use the following equation: Effective Rate = (1+ i/m)m Where m is the number of compounding periods per year. TIME VALUE OF MONEY Accumulating a Future Balance Another application of future value is computing the initial deposit required to some future amount of money. Example: Suppose you are saving for your child's education, and want to have $10,000 available 10 years from now. If you can earn 8% annually on your investment, how much will you need to deposit today? TIME VALUE OF MONEY In other words, if you put $4,631.93 into an account earning 8% interest, it would grow to exactly $10,000 in ten years. This problem can also be solved in a similar manner using either the tables or a financial calculator. TIME VALUE OF MONEY Solving for Number of Periods and Interest Rates Up until now we have used the future value equation to find out either how much a deposit will grow to in the future, or how much we need to deposit today to have a given amount at some future time. But what if we want to determine the rate of return on an investment we have already made, or want to find out how long it will take for an investment to grow to a certain value? Solving for these different variables is not difficult; we just need to identity the future and present value amounts and at least one other variable and plug them into the previous equations. TIME VALUE OF MONEY Example: 1. Finding the interest rate i: Assume your uncle invested $1,000 m a trust fund for you 20years ago. Since then, the fund has grown in value to $6,727. What is the average annual compound rate of return earned on the account? TIME VALUE OF MONEY This problem can be solved easily using either financial factor tables or a financial calculator. The table solution starts by plugging the known variables into the future value equation. FVn = PV (FVIFi,n) FV20 = PV0(FVIFi,20 yrs.) $6,727 = $1,000(FVIFi,20 yrs.) 6.727 = FVIF i,20 yrs. ) TIME VALUE OF MONEY Now go to the FVIF table and on the row corresponding to 20 periods, find the value closest to 6.727 and look at the top of that column to find the interest rate. In this case, the interest rate is 10%. If we wanted to use a financial calculator to solve the problem, we would enter the following inputs: FV = $6,727 PV = -$1,000 N = 20 PMT = 0 TIME VALUE OF MONEY Then compute the interest rate using the calculator key marked I. As with the tables, the answer you receive should be 10%. Note that the sign on the $1,000 initial deposit is negative. Some calculators require this because the PV is assumed to be an investment, and hence is really a cash outflow or negative cash flow. Some calculators do not follow this convention, however, and you will need to experiment to see which method gives you the correct answer. TIME VALUE OF MONEY 2. Finding the Number of Periods n: Now suppose you have $5,000 to invest and your investment advisor tells you to expect a 12% rate of return. How long will it take you to double your money? Using the tables, and the FV formula, we have: TIME VALUE OF MONEY FV = PV (FVIF i,n) FVn= PVo (FVIF12%,n) $10,000 = $5,000(FVIFi 12%,n ) 2.000 =FVIF12%,n The next step is to consult the FVIF table. Run down the 12% interest rate column until you come as close as possible to the value 2.000. The closest value you will find is 1.974, which corresponds to 6 years. In other words, it will take slightly more than 6 years to double your money if you can earn a 12% rate of return. TIME VALUE OF MONEY Future Value of an Annuity An annuity is a stream of equal cash flows. The two basic types of annuities are the ordinary annuity and the annuity due. With an ordinary annuity, payments occur at the end of each period. In contrast, an annuity due's payments occur at the beginning of each period. The future value of an annuity can be found by summing the future values of each year's cash flows. It is important to remember that with an ordinary annuity, payment is made at the end of the period, so in the last period no interest will be received. TIME VALUE OF MONEY To simplify the future value of an ordinary annuity calculation, a precalculated future value interest factor for an annuity is provided. When interest is compounded annually at "i" percent for "n" periods, this factor is multiplied by the amount to be deposited annually at the end of each year, resulting in the future value of an annuity. FV annuity = PMT (FVIFAi,n) Where: PMT FVIFA i,n = the equal payment made at equal intervals, and = the future value interest factor of an annuity from table TIME VALUE OF MONEY The payments for an annuity due are received at the beginning of each period. Because of this, the equation for finding the future value of an annuity must be converted to work for the future value of an annuity due. Previous equation can be converted for use with an annuity due simply by multiplying the right-hand side of the equation by 1+i. This results in the following: FVannuity due = PMT (FVIFAi,n)(1 + i) This new equation recognizes the fact that the payments of an annuity due are received one period sooner, and they therefore are compounded for one additional period as well TIME VALUE OF MONEY Suppose you planned to invest $2,000 per year into an Individual Retirement Account (IRA) for the next 20 years. What would be the value of your account if you could receive a 12% annual rate of return on your investment? Assume first that you are dealing with an ordinary annuity, and then solve assuming you have an annuity due. TIME VALUE OF MONEY To solve the problem as an ordinary annuity, we apply following: FV annuity = PMT (FVIFAi,n) FV annuity = $2,000(FVIFA12%,20yrs.) FV annuity = $2,000(72.052) FV annuity = $144,104 TIME VALUE OF MONEY To solve the problem as an annuity due, we simply apply the annuity due formula. FVannuity due = PMT (FVIFAi,n)(1 + i) FVannuity due = $2,000(FVIFA i,n12%,20yrs.)(1 + 0.12) FVannuity due = $2,000(72.052)(1.12) FVannuity due = $161,396 Note that depositing the annual payment at the beginning of the year instead of the end of the year results in more man $17,000 in additional retirement funds at the end of 20 years. This provides a good illustration of the power of compounding. TIME VALUE OF MONEY Present Value of a Lump Sum We previously derived equation, which establishes the future value of a deposit. Take another look at this equation: FVn = PV0 (1 + i)n To convert this equation to a present value equation, all that we need is a little algebra. Rearrange the terms in the equation so that PV is all by itself on the right-hand side, and we have the following: PV0 = FVn / (1 + i)n And when the PV interest factors from the tables in the book are used, the equation becomes: PV0 = FV(PVIFi,n) TIME VALUE OF MONEY The present value of a single amount is found by discounting the cash flow back to time zero. The process of discounting is simply the inverse of compounding interest. The application of discounting is concerned with answering the question: "If l am earning i percent on my money, what will I be willing to pay today (at time zero) for the opportunity to receive the designated cash flow n periods from now?" TIME VALUE OF MONEY To illustrate, let‘s work through the following example. Assume you have the chance to buy a rare baseball card as on investment. You believe that you could sell this card in 8 years for $12,000 to help pay part of your daughter's college expenses as a freshman at an exclusive private school. If you require a 10% rate of return on your investments, how much should you be willing to pay for the card today? TIME VALUE OF MONEY PV = FVn / (1 + i)n PV = $12,000 / (1 + 0.10)8 PV = $12,000 / 2.144 PV = $5,597.01 In other words, if you paid $5,597.01 for the card today, and sold it 8 years later for $12,000, you would have earned a 10% annual rate of return on your investment. If you paid more than $5,597.01, you would not be able to earn the required 10%. Of course, if you paid less than $5,597.01, you would earn more than 10%. TIME VALUE OF MONEY The Present Value of Mixed Streams Say you want to find the present value of an investment that pays a series of unequal cash flows over a period of years. To solve problems like this the technique is simply to find the individual PV of each cash flow and sum the PV's together. TIME VALUE OF MONEY Example: Assume you were considering buying part ownership in a hot dog stand. You expect business to grow over time, and you have estimated the following annual cash flows from / your portion of the stand‘s ownership. Assuming an 8% required rate of return, how much should you pay for your ownership share? TIME VALUE OF MONEY TIME VALUE OF MONEY PV = $500(PVIF8%,1) + $600(PVIF8%,2) + $800(PVIF8%,3) + $950(PVIF8%,4) PV = $500(0.926) + $600(0.857) + $800(0.794) + $950(0.735) PV=$463.00+$514.20+$635.20+$698.25 PV= $2,310.65 The calculator solution is $2,310.71, which is slightly larger due to rounding. TIME VALUE OF MONEY Increasing the Compounding Period As with future value, non-annual compounding periods require a bit of adjustment before the PV can be found. The PV equation for multiple compounding periods is: PV=-FVn / (1 + i/m)mn where m = number of compounding periods per year n = number of years i = annual interest rate We can also write this in TVM notation as follows: PV=FVn (PVIPi/m,mn) TIME VALUE OF MONEY Example: Find the present value of $1,500 to be received 5 years from now, if the appropriate rate of return is 12% compounded quarterly. TIME VALUE OF MONEY PV= $1,500 PVIF12%/4,4(5)) PV=$1,500(PVIF3%,20periods) PV=$1,500(0.554) PV=$831.00 The calculator solution for this problem is $830.51. TIME VALUE OF MONEY Present Value of an Annuity If we want to find the PV of a stream of equal cash flows, we use a concept called the present value of an annuity. The formula is: PVannuity = PMT (PVIFAi,n) where PMT = the $ amount of the equal payments. TIME VALUE OF MONEY Example: Assume you just won the Illinois lottery, and the prize was $50,000 per year for the next 20 years. Lottery officials claim you won a "one million dollar" prize because the payments sum to $1,000,000. However, what if you decided you needed all the cash today, and wanted to sell your stream of payments? If the going rate of interest in the market was 10%, how much would your lottery winnings really be worth? TIME VALUE OF MONEY Using the annuity formula: PVannuity PVannuity PVannuity PVannuity = PJMT (PVIFAi,n) = 50,000 (PVIFA10%,20) = 50,000 (8.514) = 50,000 ($425,700.00) The calculator solution is $425,678. So winning the "one million dollar" lottery is worth only $425,700 in today's dollars, or less than half what tottery officials claimed it was worth. TIME VALUE OF MONEY Perpetuities Annuities whose payments go on for infinity are called perpetuities. On the surface, it would seem impossible to value such an asset, since the payments we need to value never end. Fortunately, valuing perpetuities is actually very simple. The formula for the value of perpetuity is: PV0 = PMT / i TIME VALUE OF MONEY Examples: Suppose you were able to buy on investment that makes $500 annual payments that never end. If you require a 12% rate of return on your investment, how much would you be willing to pay for the perpetuity? TIME VALUE OF MONEY PV0 = PMT / i PV0 = $500 / 0.12 PV0 = $4,166.67 TIME VALUE OF MONEY Another way to look at this problem is to ask yourself the following question: "If I could place $4,166.67 into a bank account earning 12% interest, and if l wanted to spend only the interest each year, how large would my annual payments be?" By simply multiplying $4,166.67 by the interest rate (0.12), you come up with the annual interest earned on your investment, or $500. If you leave the money in the account forever, you have just created a perpetuity that pays $500 each year. The cost to create such perpetuity is $4,166.67, which therefore also must be its present value. TIME VALUE OF MONEY Uneven Streams When an annuity is mixed with other irregular payments we have what is called an imbedded annuity. To solve for the present value of mixed-cash flow streams we find the present value of the annuity, and then add the present value of any other cash flows. TIME VALUE OF MONEY Assume you are evaluating cm investment that pays $50 at the end of year 1, $75 at the end of year 2, $90 at the end of year 3, and $100 at the end of years 4 through 6. If you require a 10% rate of return on your investments, what is the most you should be willing to pay for this investment? In order to solve this problem, first draw a timeline like the one below. The irregular payments in years 1 through 3 require us to find their associated present values individually and then add them up. The embedded annuity in years 4 through 6 allows us to use the annuity formula. However, the present value of an annuity formula is designed to find the PV of an annuity where the payments begin at the end of the first year. In this case, the annuity payments begin at the end of the fourth year. Therefore, the formula has to be modified somewhat. TIME VALUE OF MONEY TIME VALUE OF MONEY The solution is: PV = $50(PVIF10%,1 )+ $75(PVIF10%,2)+ $90(PVIF10%,3)+ $100(PVIFA10%,3)(PVIF10%,3) PV=$50(0.909)+$75(0.826)+$90(.751)+$100(2.487)(0.751) PV=$45.45+$61.95+$67.59+$186.77 PV=$361.76 TIME VALUE OF MONEY Note that the annuity formula finds the value of the annuity one period before the first payment is made. This is because the formula is designed to find the present value of an ordinary annuity (where the first payment is received at the end of year 1). Hence, multiplying the $100 payment by FVIFA 10%,3 yields a value of $248.70, but that is really the value of the annuity at the end of year 3, one period before the 1st $100 payment is made. In order to obtain the proper result, we must discount $248.70 back to time zero. This was accomplished using PVIF 10%,3 in the solution above. The timeline shows how each of the original cash flows is discounted back to time zero and then added to the others. The final result is that the investment would be worth $361.76.