Accounting Competency Quiz: Test Your Knowledge

advertisement

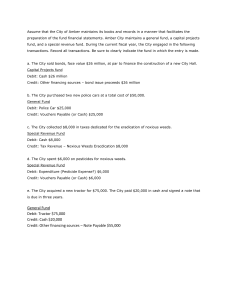

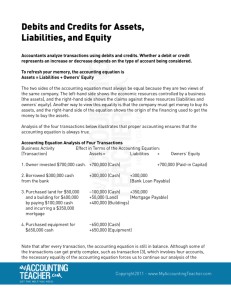

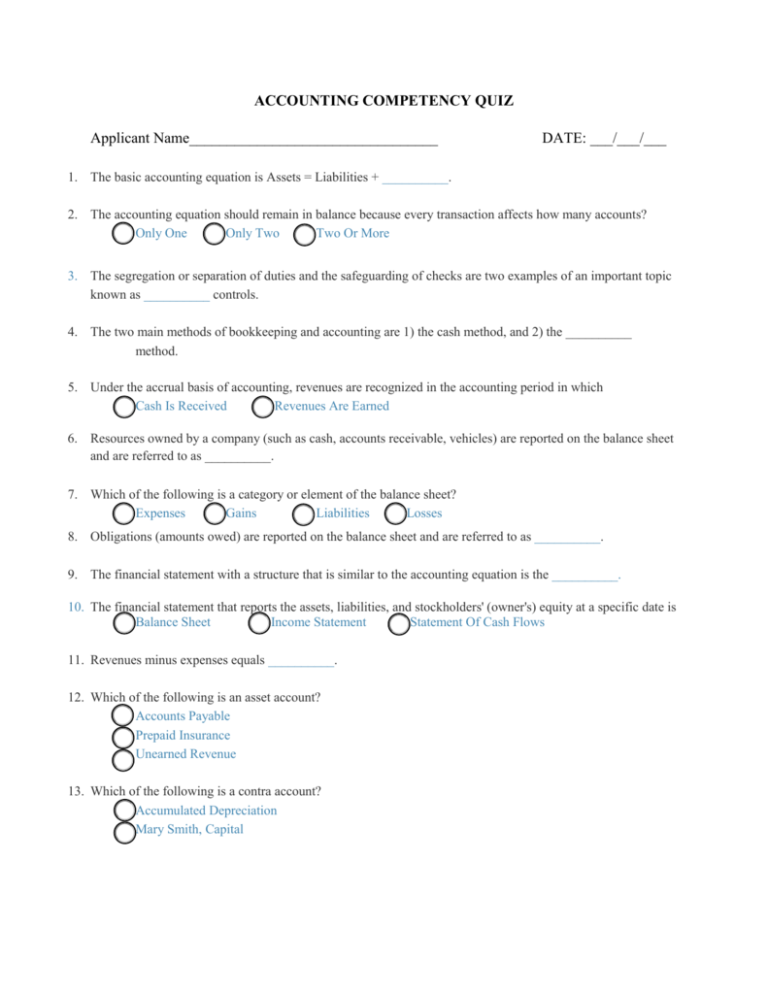

ACCOUNTING COMPETENCY QUIZ Applicant Name_________________________________ DATE: ___/___/___ 1. The basic accounting equation is Assets = Liabilities + __________. 2. The accounting equation should remain in balance because every transaction affects how many accounts? Only One Only Two Two Or More 3. The segregation or separation of duties and the safeguarding of checks are two examples of an important topic known as __________ controls. 4. The two main methods of bookkeeping and accounting are 1) the cash method, and 2) the __________ method. 5. Under the accrual basis of accounting, revenues are recognized in the accounting period in which Cash Is Received Revenues Are Earned 6. Resources owned by a company (such as cash, accounts receivable, vehicles) are reported on the balance sheet and are referred to as __________. 7. Which of the following is a category or element of the balance sheet? Expenses Gains Liabilities Losses 8. Obligations (amounts owed) are reported on the balance sheet and are referred to as __________. 9. The financial statement with a structure that is similar to the accounting equation is the __________. 10. The financial statement that reports the assets, liabilities, and stockholders' (owner's) equity at a specific date is Balance Sheet Income Statement Statement Of Cash Flows 11. Revenues minus expenses equals __________. 12. Which of the following is an asset account? Accounts Payable Prepaid Insurance Unearned Revenue 13. Which of the following is a contra account? Accumulated Depreciation Mary Smith, Capital 14. Expenses can be found in the: Statement of Owner’s Equity Income Statement Balance Sheet 15. Net Sales minus the Cost of Goods Sold equals Gross Profit Income From Operations Net Income 16. Which term is associated with "left" or "left-side"? Debit Credit 17. Which term is associated with "right" or "right-side"? Debit Credit 18. What is the normal balance for an asset account? Debit Credit 19. What is the normal balance for liability accounts? Debit Credit 20. What is the normal balance for stockholders' equity and owner's equity accounts? Debit Credit 21. When cash is received, the account Cash will be Debited Credited 22. When a company pays a bill, the account Cash will be Debited Credited 23. What will usually cause an asset account to increase? Debit Credit 24. What will usually cause the liability account Accounts Payable to increase? Debit Credit 25. Entries to expenses such as Rent Expense are usually Debits Credits 26. Entries to revenues accounts such as Service Revenues are usually Debits Credits 27. A __________ balance is typical for Accounts Payable. Debit Credit 28. The balance in Accounts Payable is decreased with a __________ entry. Debit Credit 29. The owner invests personal cash in the business. Assets………………………………… Liabilities……………………………. Owner's (or Stockholders') Equity… Increase Increase Increase Decrease Decrease Decrease No Effect No Effect No Effect 30. Which of the following will cause owner's equity to decrease? Net Income Net Loss Revenue 31. Paying the insurance premium on December 20 for the six-month period beginning 12 days later should result in a debit balance in the asset account __________ Insurance. 32. Sorting a company's accounts receivable into classifications such as current, 1-30 days past due, and 31-60 days past due is known as the __________ of accounts receivables. 33. A $1,000 invoice from a supplier has terms of 2/10, n/30. The amount that should be remitted to the supplier if the amount is paid within the discount period is $__________. 34. The Philip Company received a bill for natural gas. The bill is for $550 and is payable in 30 days. The accounting entry is: Debit accounts receivable $550; Credit service revenue $550 Debit accounts payable $550; Credit cash $550 Debit natural gas expense $550; Credit accounts payable $550 Debit natural gas expense $550; Credit cash $550 35. A company wrote a check for $76 and it cleared the bank for $76. However, the company recorded the check in its Cash account as $67. What is this most common type of accounting error that is divisible by 9 called? __________ error. 36. On December 1 a company borrowed $100,000 at 12% per year. The interest will be paid quarterly, with the first payment due on March 1. What should the company report on its income statement for December? Nothing Interest Expense of $1,000 37. On December 31, if net income equals $15,000 and the ending owner’s equity is $20,000, and Forbes invested an additional $2,600 in his business, while withdrawing $6,000 during the year, the beginning owner’s equity for this year was: $7,100 $7,400 $8,400 $7,430 38. A truck was purchased on July 1 for $20,000. The estimated salvage value is $2,000. The estimated useful life is 3 years. Using straight-line method of depreciation, the amount of depreciation in the adjusting entry at fiscal year-end on December 31 is: Depreciation Expense-Truck $555.56 Accumulated Depreciation-Truck $555.56 Accumulated Depreciation- Truck $1,500 Depreciation Expense- Truck $1,500 Depreciation Expense- Truck $500 Accumulated Depreciation- Truck $500 Depreciation Expense- Truck $3,000 Accumulated Depreciation- Truck 3,000 39. A company paid in advance $4,800 for two years of prepaid insurance, which started on May 1. The adjusting entry on fiscal year ending December 31 of that year is: Debit Insurance Expense; Credit Prepaid Insurance, $1,200 Debit Insurance Expense; Credit Prepaid Insurance, $800 Debit Prepaid Insurance; Credit Insurance Expense , $1,600 Debit Insurance Expense; Credit Prepaid Insurance, $1,600 40. Rowe Inc. has a contract to construct a building for a price of $100. So far it has spent $60 of costs and it estimates an additional $20 will be needed to finish the building. How much profit can be recognized using the percentage of completion method? $ 0 $ 15 $ 20 $ 40 41. From merchandiser’s income statement you know that Sales revenue is $ 650,000 and the gross margin is 20%. What is the cost of Goods Sold? $ 650,000 $ 130,000 $ 520,000 $ 26,000 42. The Internal Revenue Service form to be issued for amounts paid to independent contractors (that are not corporations) for services provided is Form 1099-MISC Form W-2 Form W-3 43. The Internal Revenue Service form used to request a taxpayer identification number from a vendor is Form 1099-MISC Form W-9 Form W-3 44. The federal form on which an employee indicates the number of exemptions/dependents to be used in calculating the amount of federal income tax withholding for the employee is the __________form. 45. An example of a court-ordered employee withholding is __________. 46. A cost paid by the employer to cover an employee’s work-related injury is __________ insurance. 47. An employee is hired at a pay rate of $10 per hour. During the past week, the employee worked 50 hours. The employee’s gross wages for the past week are: $400 $450 $500 $550 48. The combination of the Social Security tax and the Medicare tax is referred to by the acronym __________. 49. The 2014 rate for the Social Security tax (excluding the Medicare tax) that is withheld from employees' salaries and wages up to a specified annual amount is __________%. 50. The combined rate for the Social Security tax and the Medicare tax to be withheld from each employee's gross wages up to $117,000 in 2014 is __________%. 51. What is the total amount of FICA that needs to be remitted by an employer in 2014 for an employee earning $50,000? $1,450 $3,825 $6,200 $7,650 Use the following information for the next two Questions: An employer has computed the following amounts for its employee Mary during a week in January: gross wages $500.00; FICA tax withheld $38.25; federal income tax withholding $67.25; State income tax withholding $20.00; unemployment taxes $24.00; worker compensation insurance $5.00. The company does not provide health insurance, paid vacations, or any other benefits. 52. The amount of Mary’s net pay is $352.75 $357.75 $374.50 53. The employer’s total expense for Mary’s employment during the week is $505.00 $529.00 $567.25 $605.50