Vol. 1, Chapter 2 - Accounting for Business Transactions

advertisement

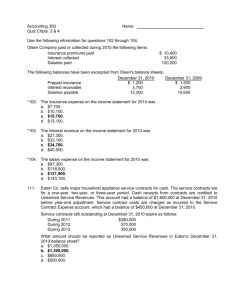

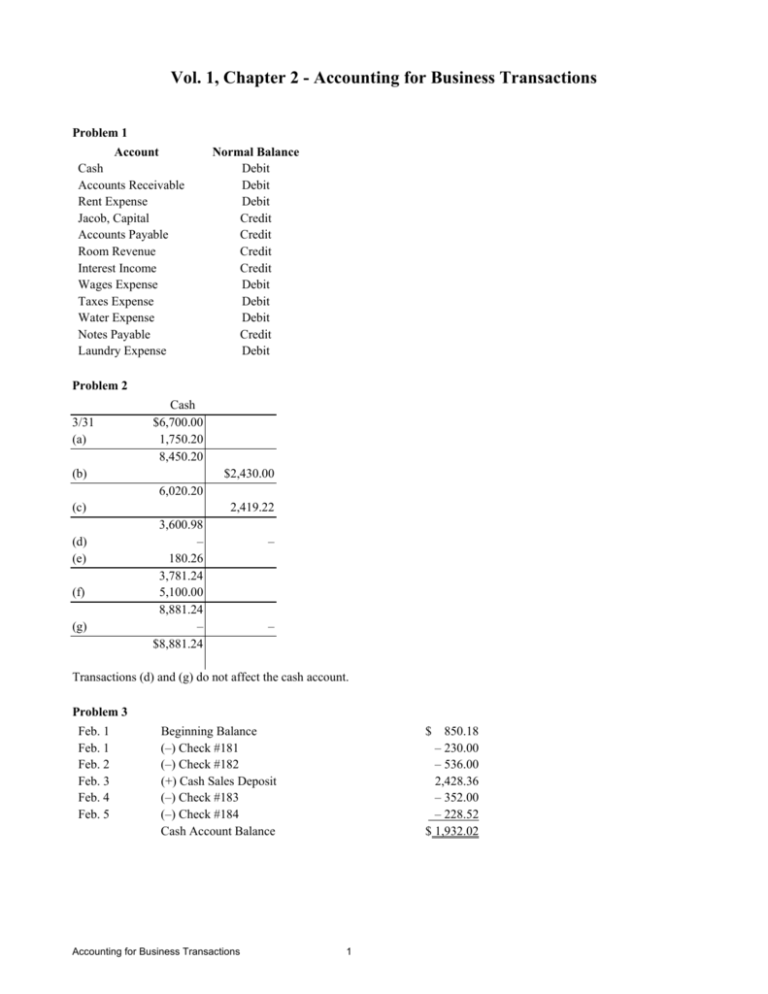

Vol. 1, Chapter 2 - Accounting for Business Transactions Problem 1 Account Cash Accounts Receivable Rent Expense Jacob, Capital Accounts Payable Room Revenue Interest Income Wages Expense Taxes Expense Water Expense Notes Payable Laundry Expense Normal Balance Debit Debit Debit Credit Credit Credit Credit Debit Debit Debit Credit Debit Problem 2 3/31 (a) Cash $6,700.00 1,750.20 8,450.20 (b) $2,430.00 6,020.20 (c) (d) (e) (f) (g) 2,419.22 3,600.98 – 180.26 3,781.24 5,100.00 8,881.24 – $8,881.24 – – Transactions (d) and (g) do not affect the cash account. Problem 3 Feb. 1 Feb. 1 Feb. 2 Feb. 3 Feb. 4 Feb. 5 Beginning Balance (–) Check #181 (–) Check #182 (+) Cash Sales Deposit (–) Check #183 (–) Check #184 Cash Account Balance Accounting for Business Transactions $ 850.18 – 230.00 – 536.00 2,428.36 – 352.00 – 228.52 $ 1,932.02 1 Problem 4 Accounts Affected Equipment Cash Notes Payable Normal Balance Debit Debit Credit Debit or Credit Debit Credit Credit (b) Salary Expense Cash Debit Debit Debit Credit (c) Kati Litchfield, Capital Cash Credit Debit Debit Credit (d) Supplies Expense Accounts Payable Debit Credit Debit Credit (e) Accounts Receivable Sales Debit Credit Debit Credit (f) Marketable Securities Cash Debit Debit Debit Credit (g) Accounts Payable Cash Credit Debit Debit Credit (h) Prepaid Rent Cash Debit Debit Debit Credit (a) Problem 5 $ Wage Expense 2,000 Food Sales $ $ 5,500 Rent Expense 700 Beverage Sales $ 400 Cost of Food Sales (Expense) $ 1,700 Cost of Beverage Sales (Expense) $ 100 Accounting for Business Transactions 2 Problem 6 Transactions a) b) c) d) e) f) g) Debit Food Expense Cash To record food purchases for cash Equipment Accounts Payable, Circus Supply To record the purchase of equipment from Circus Supply Cash Food Sales To record food sales Wages Expense Cash To record wages paid Cash Beverage Sales To record beverage sales Beverage Expense Cash To record the purchase of beverages for cash Accounts Payable, Circus Supply Cash To record payment to Circus Supply on account Problem 7 Turner Café Trial Balance December 31, 20XX Cash J. Turner, Capital Food Inventory Prepaid Expenses Accounts Payable Equipment Notes Payable Sales Cost of Food Sold Rent Expense Wages Expense Other Expenses Accounting for Business Transactions Debit $ 3,500 Credit $ 10,500 4,500 700 2,100 14,400 7,400 42,000 14,000 2,000 16,000 6,900 – $ 62,000 $ 62,000 3 Credit $ 75 $ 75 $150 $150 $300 $300 $110 $110 $100 $100 $ 12 $ 12 $ 10 $ 10 Problem 8 Tyler Motel Trial Balance Cash Accounts Receivable Inventory Prepaid Insurance Land Buildings Acc. Dep.—Buildings Equipment Acc. Dep.—Equipment Accounts Payable Notes Payable Tyler, Wray, Capital Room Revenue Wages Expense Laundry Expense Advertising Expense Utilities Expense Insurance Expense Property Taxes Expense Interest Expense Depreciation Expense Supplies Expense Maintenance Expense $ Debit 12,400 40,500 18,300 2,100 150,000 2,400,000 $1,250,000 900,000 235,000 35,000 846,000 32,800 2,350,000 751,000 50,000 36,000 52,000 22,000 20,000 82,000 115,000 33,000 64,500 $ 4,748,800 Problem 9 Debit Accounts Payable Accounts Receivable Building Cash Chuck Franko, Capital Delivery Equipment Interest Expense Interest Payable Land Merchandise Inventory Mortgage Payable Notes Payable Notes Receivable Office Equipment Office Supplies Prepaid Insurance Prepaid Interest Revenue Store Equipment Accounting for Business Transactions Credit Credit $ 2,400 $ 4,500 25,500 2,000 18,300 2,500 200 150 8,200 9,500 6,500 1,200 300 1,600 85 160 15 35,950 5,450 4 $ 4,748,800 Store Supplies Taxes Payable Telephone Expense Truck Repairs Wages Expense Wages Payable 155 250 110 130 4,420 – 75 $ 64,825 $ 64,825 Problem 10 1. Transactions October 2 October 3 October 3 October 4 October 4 October 5 To record the investment of cash and equipment by the owner To pay the rent for November in advance To record the purchase of food and beverages (to be sold this period) on account To record the sale of food and beverages for cash and on account To record the wage expense incurred but not yet paid Payment of cash from an account receivable 2. Cash $ 12,000 $ 1,000 500 100 $ 11,600 Prepaid Rent $ 1,000 $ 1,000 Food Sales $ $ Equipment $ 10,000 $ 10,000 Accts. Pay., Bixbie Food $ 2,500 $ 2,500 600 600 Beverage Expense $ 500 $ 500 Beverage Sales $ 100 $ 100 Wages Expense $ 195 $ 195 Mary Ramaker, Capital $ 22,000 $ 22,000 Accounts Receivable $ 200 $ 100 $ 100 Food Expense $ 2,000 $ 2,000 Wages Payable $ 195 $ 195 Problem 11 June 1 June 6 June 6 June 8 June 12 June 15 Beginning Balance (+) 3 Meals Total Cost (+) Tip from 3 Meals (15%) (–) Pay Down Account (+) Breakfast (+) 2 Lunches Accounting for Business Transactions $ 480.00 34.00 5.10 – 300.00 12.42 24.15 5 (1) June 15 June 21 June 28 June 28 June 28 (+) Tip from 2 Lunches (20%) (–) Pay Down Account (+) Anniversary Dinner (+) Service Charge (15%) (+) Sales Tax (6%) Ending Account Balance (1) (2) (3) (4) 4.83 – 100.00 480.00 72.00 33.12 $ 745.62 (2) (3) (4) 34.00 × .15 = 5.10 24.15 × .20 = 4.83 480.00 × .15 = 72.00 480.00 – 72.00 = 552.00 × .06 = 33.12 Problem 12 1. and 2. Cash $ a Marketable Securities 1,500 $ 5,000 10 $ 5,000 $ 200 b Accts. Rec., Erica Lee $ 20 $ – 10 $ 10 a 100 d 5 e 20 f h 310 $ $ b 1,495 Accts. Rec., Monica Ray 15 5 $ 20 $ $ Office Supplies 2,250 2,250 $ $ Furniture 1,000 1,000 Equipment 2,000 2,000 $ $ Notes Pay., Mineral State Bank $ 1,500 $ 1,500 $ $ Cleaning Supplies 500 500 Accts. Pay., Stacie Supply, Inc. $ 400 250 $ 650 Stephanie Smith, Capital $ 2,085 $ 2,085 Food Sales $ $ Beverage Sales $ Accounting for Business Transactions 7,000 Food Expense 10,000 $ 6 $ Beverage Expense 2,000 25,000 4 250 25,254 1g 60 h 7,061 $ $ Wages Expense 8,000 20 8,020 $ $ Insurance Expense 500 500 $ f c 250 10,250 $ $ Utilities Expense 1,000 100 $ 1,100 $ d Office Supplies Expense $ 100 $ 100 $ b $ $ e $ 3. Stephanie's Steakhouse Trial Balance July 1, 20X1 Cash Marketable Securities Accounts Receivable, Erica Lee Accounts Receivable, Monica Ray Office Supplies Cleaning Supplies Furniture Equipment Accounts Payable, Stacie Supply Inc. Notes Payable, Mineral State Bank Stephanie Smith, Capital Food Sales Beverage Sales Food Expense Beverage Expense Wages Expense Utilities Expense Rent Expense Insurance Expense Office Supplies Expense Advertising Expense Accounting for Business Transactions Debit $ 1,495 5,000 10 20 2,250 500 1,000 2,000 Credit $ 650 1,500 2,085 25,254 7,061 10,250 2,000 8,020 1,100 2,200 500 100 105 – $ 36,550 $ 36,550 7 2,000 Rent Expense 2,000 200 2,200 Advertising Expense 100 5 105 Problem 13 Cash 5,000 (a) Food and Beverage Inventory 1,200 (f) 400 (f) 1,600 800 ( c) 150 (d) 450 (e) 80 (g) Furniture 5,000 (a) 5,000 2,400 (h) 5,920 Equipment 50,000 (a) 800 ( c) 50,800 Land 100,000 (a) 100,000 Accounts Payable Building 450,000 (a) 450,000 400 (b) 1,200 (f) 400 (f) 2,000 B. Wilson, Capital 5,000 (a) 5,000 (a) 50,000 (a) 100,000 (a) 450,000 (a) 610,000 Food and Beverage Sales 2,400 (h) 2,400 Operating Supplies Expenses 400 (b) 400 Advertising Expenses 150 (d) 150 Utilities Expenses 80 (g) 80 Wages Expenses 450 (e) 450 Problem 14 1. and 2. Cash a Furniture $ 2,000 a $ 200 c 30 50 250 10 100 i Equipment $ 2,000 a $ 2,000 c d e f g h $ 3,000 200 $ 3,200 900 $ 2,260 Building Accounting for Business Transactions Accts. Pay., Edgar's Food Supply, Inc. 8 Paul Olivia, Capital a $ 8,000 $ 8,000 h $ Food Sales $ 50 $ 50 $ 500 $ 500 $ 15,000 a – $ 15,000 $ 500 100 Beverage Sales Advertising Expense 750 i $ 150 i d $ 30 $ 750 $ 150 $ 30 Wages Expense f $ 250 $ 250 Food Expense b 600 b $ Utilities Expense e $ Cooking Supplies Expense g $ 10 $ 10 Beverage Expense b $ 100 $ 100 3. Trial Balance Cash Furniture Equipment Building Accounts Payable Paul Olivia, Capital Food Sales Beverage Sales Advertising Expense Utilities Expense Wages Expense Cooking Supplies Expense Food Expense Beverage Expense Debit $ 2,260 2,000 3,200 8,000 Credit $ 500 15,000 750 150 30 50 250 10 500 100 – $16,400 $16,400 Problem 15 1. Transactions a) Prepaid Rent Cash To record prepayment of September rent b) Cash Room Sales To record cash sales for August c) Accounts Receivable Room Sales To record room sales on account d) Cleaning Supplies Cash To record purchase of cleaning supplies for cash Accounting for Business Transactions 9 Debit $ 1,000 Credit $ 1,000 $15,000 $15,000 $ $ 250 $ 250 $ 290 290 e) Office Supplies Accounts Payable (Bing’s Office Supplies) To record the purchase of office supplies on account Cash Jack Wicks, Capital To record new investment by the owner Accounts Payable (Bing’s) Cash To record payment to Bing’s Office Supply Hut on account Cash Rental Income To record additional revenue from vending machines Wages Expense Cash To record the payment of wages with cash f) g) h) i) $ 150 $ 150 $ 1,000 $ 1,000 $ $ 50 $ 50 $ 75 75 $ 5,700 $ 5,700 2. and 3. $ b Cash 3,120 $ 15,000 1,000 a b Accounts Receivable $ 200 250 $ 450 Prepaid Rent 1,000 1,000 a$ $ 290 d f 1,000 h 75 – $ 12,155 50 g $ d $ 5,700 i Cleaning Supplies 30 290 320 e Office Supplies $ 100 150 $ 250 Accts. Pay. (Bing’s) $ g $ 50 $ Notes Pay. (Mineral State Bank) $ 400 $ 400 Rental Income (Revenue) $ 75 h i $ 75 Accounting for Business Transactions Jack Wicks, Capital $ 3,000 1,000 f $ 4,000 Wages Expense $ 5,700 $ 5,700 10 Room Sales $ $ 50 150 e – 150 15,000 b 250 c 15,250 4. Rodeside Motel Trial Balance August 31, 20X3 Debit $ 12,155 450 1,000 320 250 Cash Accounts Receivable Prepaid Rent Cleaning Supplies Office Supplies Accounts Payable (Bing's) Notes Payable Jack Wicks, Capital Room Sales Rental Income Wages Expense Accounting for Business Transactions Credit $ 11 5,700 150 400 4,000 15,250 75 – $ 19,875 $ 19,875