Assume that the City of Amber maintains its books and records in a

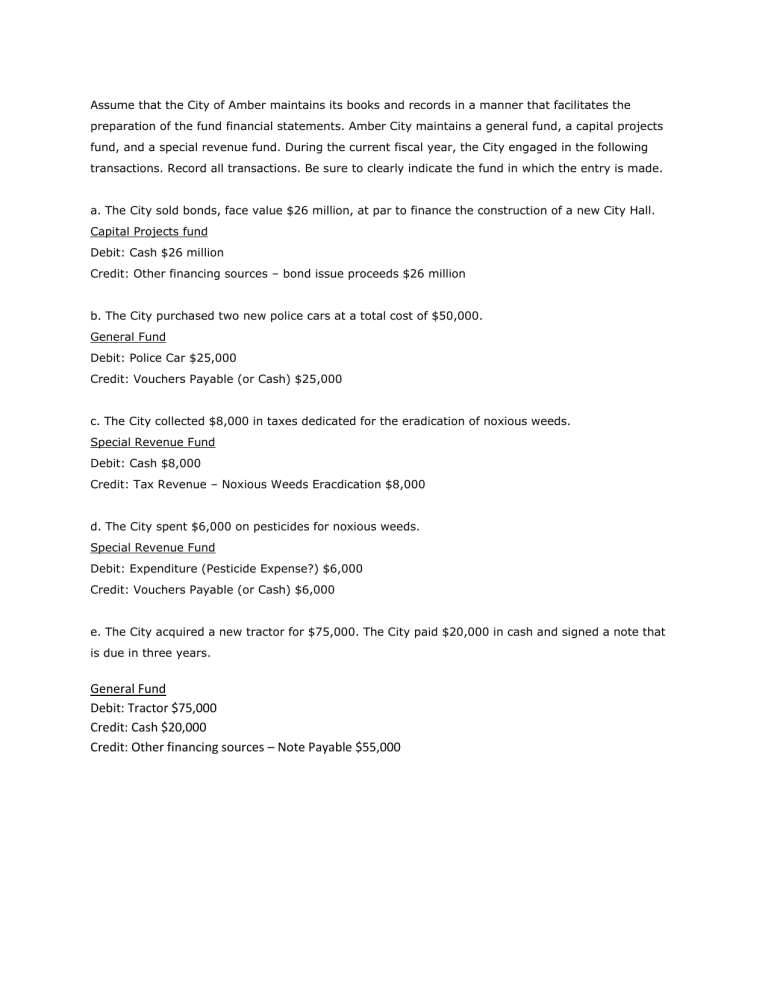

Assume that the City of Amber maintains its books and records in a manner that facilitates the preparation of the fund financial statements. Amber City maintains a general fund, a capital projects fund, and a special revenue fund. During the current fiscal year, the City engaged in the following transactions. Record all transactions. Be sure to clearly indicate the fund in which the entry is made. a. The City sold bonds, face value $26 million, at par to finance the construction of a new City Hall.

Capital Projects fund

Debit: Cash $26 million

Credit: Other financing sources – bond issue proceeds $26 million b. The City purchased two new police cars at a total cost of $50,000.

General Fund

Debit: Police Car $25,000

Credit: Vouchers Payable (or Cash) $25,000 c. The City collected $8,000 in taxes dedicated for the eradication of noxious weeds.

Special Revenue Fund

Debit: Cash $8,000

Credit: Tax Revenue – Noxious Weeds Eracdication $8,000 d. The City spent $6,000 on pesticides for noxious weeds.

Special Revenue Fund

Debit: Expenditure (Pesticide Expense?) $6,000

Credit: Vouchers Payable (or Cash) $6,000 e. The City acquired a new tractor for $75,000. The City paid $20,000 in cash and signed a note that is due in three years.

General Fund

Debit: Tractor $75,000

Credit: Cash $20,000

Credit: Other financing sources – Note Payable $55,000

Assume that the County of Katerah maintains its books and records in a manner that facilitates preparation of the fund financial statements. The County formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At the beginning of the fiscal year, the County had the following balances in its accounts. All amounts are in thousands. REQUIRED: Prepare the necessary entries for the current fiscal year. Cash $200 Fund

Balance-Unreserved 50 Reserve for Encumbrances 150 a. The County made the appropriate entry to restore the prior year purchase commitments.

Debit: Encumberances $150

Credit: Reserved for Encumberances $150 b. The County Board approved a budget with revenues estimated to be $800 and expenditures of

$750.

Debit: Estimated Revenues $800

Credit: Appropriations for Expenditures $750

Credit: Unreserved Fund Balance $50 c. The County received the items that had been ordered in the prior year at an actual cost of $135.

Debit: Reserved for Encumberances $135

Debit: Expenditures $135

Credit: Encumberances $135

Credit: Vouchers Payable $135 d. The County ordered supplies at an estimated cost of $50 and equipment at an estimated cost of

$70.

Debit: Encumberances $120

Credit: Reserved for Encumberances$120 e. The County incurred salaries and other operating expenses during the year totaling $600. The

County paid these items in cash.

Debit: Expenditures $600

Credit: Cash $600 f. The County received the equipment at an actual cost of $75.

Debit: Reserved for Encumberances $70

Credit: Encumberances $70

Debit: Expenditures $75

Credit: Vouchers Payable $75

g. The County earned and collected, in cash, revenues of $810.