Mgmt strategies break-even analysis

advertisement

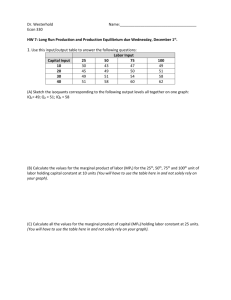

College of Agriculture MANAGEMENT STRATEGIES THROUGH BREAKEVEN ANALYSIS Washington State University Pullman, WA 99164 Marginal Income One approach to this improved understanding of break-even analysis utilizes a marginal incomemarginal investment chart. The typical, break-even chart is shown in Exhibit 1, where total revenue and total cost are plotted against sales volume. Fixed expenses, of course, are those incurred irrespective of sales volume, e.g., depreciation, plant maintenance, and related forms of overhead. Total cost is the summation of fixed expenses and variable costs, i.e., those which vary proportionately with sales volume. As shown, the break-even point as achieved at a sales volume of $4,000 and maximum profit is reached when the budgeted sales volume of $6,000 is achieved. Using this classical chart, we may now construct a marginal income chart by simply subtracting variable costs from sales volume. For analysis purposes, marginal income is depicted as a percentage or ratio of sales dollars, see Exhibit 2. In Exhibit 2, the marginal income ratio is 25%, i.e., 25 cents of every sales dollar Of all those methodological tools available to the modern manager, break-even analysis is by far the most used within the agribusiness industry for purposes of budgeting and long-range planning. Methodologically, break-even analysis is simple to apply, logically appealing, and readily applicable to agribusiness situations. Once constructed, the breakeven chart provides management with a convenient guide for judging operational performance, adjusting pricing levels, or controlling cost components. Where used for planning purposes, the cost-revenue relationships are extended into future periods, subject only to the constraints of competition or plant capacity. Traditionally, this capacity constraint is measured in physical units and expressed in relation to what the competitive market will absorb or what the plant is capable (in an engineering sense) of producing. It is when dealing with this capacity constraint that managerial conflicts might evolve. That management which is operationally oriented will base the breakeven analysis on the profit and loss data with a capacity constraint composed only of market absorption or physical plant limits. Those in management who are financially oriented, however, will look more closely on balance sheet items and consider the break-even chart in light of its impact on receivables, inventories, and available working capital. From this managerial philosophy, capacity must not be based on market or the plants' physical limits, but should rather be measured by the limits placed on working capital and related financial resources. In the past, the operational and financial arms of management may have operated nearly independent of one another. However, with the rising cost of debt capital and economic decisions resulting in possible capital shortages, the two management functions have become increasingly more interdependent. Moreover, the agribusiness industry can no longer afford this dichotomy of understandings as they relate to capacity. A new definition of capacity is needed -- one which will illustrate the interdependence between physical and financial capacity. Exhibit 1 Break-Even Chart $6,000 ue st en v Co Re al t l o T ta To $4,000 $3,000 (Loss) $2,000 $1,000 Budgeted Sales Costs, Revenues, Profits (Profit) $5,000 Break-Even Point Cooperative Extension Fixed Expense 0 0 1 2 3 4 Sales Volume ($000) WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING 1 5 6 1.0 Exhibit 2 Marginal Income Chart* Profit .5 Sales Volume ($000) 0 1 .5 1.0 n rgi Ma 2 o ati eR m o Inc 3 % 25 4 Fixed Expense 5 .5 Decrease S.V. 0 1 2 3 5% I. 2 M. 5% .5 I. 2 M. 5% Increase I. 2 M. 4 5 6 S. B. B.T.P. Increase F. Exp. 1.0 Exhibit 3 Marginal Income Chart (Fixed-Expense Variation) 1.5 1.0 Decrease 6 Sales Budget Fixed Expense Before-Tax Profit represents a contribution towards fixed expense and profit. As shown, every dollar of sales beyond the break-even point will yield a profit of 25 cents and every dollar of sales below this point reduces unpaid fixed expenses by 25 cents. Quite obviously, those factors having an impact on profit are fixed expenses, marginal income, and sales volume. Variations in any of these factors will have a direct impact on the level of profit generated. 1.5 1.5 1.5 Exhibit 4 Marginal Income Chart (Marginal Income Variation) 1.0 2.0 F. Exp. Exhibits 3, 4, and 5 are included to demonstrate the nature of this factor impact on profit. For example, as shown in Exhibit 3, variation in fixed expense does not affect the slope of the marginal income ratio line, but it does affect its point of origin. As shown, profit is directly affected by the absolute dollar adjustment, up or down, of fixed expense. I. M. S.V. 0 1 2 3 4 5 .5 % 25 Decrease 6 S. B. B.T.P. Increase .5 1.0 The impact of a variation in marginal income ratio while fixed expense and sales volume remain constant is shown in Exhibit 4. By increasing the ratio, the sales volume needed to break even is decreased and profit as the budgeted, sales volume level is increased. Increasing this ratio might be accomplished by changes in price, variable costs, and product mix. Improvement in any one of these categories increases the slope angle. 1.5 Marginal Investment Above, it has been shown that under break-even analysis the concept of marginal income can be developed as a ratio of dollars of contribution to profit and overhead per dollar of sales. Using a similar procedure, working capital requirements can be developed as a ratio of dollars of investment required per dollars of sales. A With a constant, marginal-income ratio and fixed expense, Exhibit 5 illustrates how a firm's profit potential can he enhanced by increasing budgeted sales volume. Quite obviously it would be desirable to expand the budgeted sales volume as long as the increased profit of 25 cents per dollar of sales exists. Unfortunately, even if cash flow permits continuous expansion of budgeted sales volume, physical plant capacity places some limits on this possibility. *See "Plant Capacity: Physical or Financial," E. J. Renner, Management Review, February 1976, pp. 6, 8, 10, 12. WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING 2 the concept of marginal income, an increment of investment (working capital) is required for every increase in dollar sales. Exhibit 5 Marginal Income Chart (Volume Variation) 1.5 The marginal investment ratio is equally simple to arrive at, i.e., we are searching for the working capital increment required to support each dollar's sales. At the budgeted sales volume in our exhibit of $6,000, the working capital requirement of $1,800 would suggest a ratio of .30. The slope of this ratio line, of course, is dependent on management's control over the current assets and liabilities, such as, inventory, receivables, payables, accruals, etc. Decrease S.V. 2 3 5% I. 2 M. .5 4 5 6 S. B. 1 Increase 0 1.0 Physical Plant Capacity Increase .5 Decrease 7 Favorable adjustments in working capital requirements lowers the line slope and unfavorable changes increase it. As shown in Exhibit 7, reducing the working capital requirement per dollar sales could result in a marginal investment ratio of .25. Referring to earlier exhibits, wherein budgeted sales were set at $6,000 and the plant's productive capacity was $7,000, the working capital required to support the 1.5 Exhibit 6 Marginal Investment Chart 1.5 % 30 nt e stm ve n I l na rgi Ma 1.0 05 2.0 Sales Budget Working Capital. Working Capital Required Exhibit 7 Marginal Investment Chart (Working Capital Variation) % % 33 v. . 30 n I Inv . . M M 1.5 5% I. 2 M. 1.0 0. 1 2 3 4 Sales Volume 5 6 W.C. Fixed Assets Total Investment 2.0 0.5 F. A. marginal investment chart such as that shown in Exhibit 6 can be constructed to show those variables of the balance sheet in much the same manner that the marginal income chart demonstrated variables on the profit and loss statement. Sales volume, for example, is again plotted on the horizontal plane. Corporate investment, comprised of fixed assets and working capital, is plotted on the vertical axis on much the same basis as we had previously plotted total costs, comprised of variable and fixed expenses. 05 S. B. F. Exp. B.T.P. 1.0 S.V. 0. 1 2 3 4 5 6 0.5 physical capacity (extending M. Inv. ratio line until it intersects the vertical line) arising from a sales volume of $7,000 would be $2,100, see Exhibit 8. Now let's assume this particular agribusiness firm has a limit of $1,500 on its available working capital. This working capital ceiling can be illustrated as shown in Exhibit 9. Confronted with this limit and a marginal investment ratio of 30%, the firm's sales volume potential has been reduced to $5,000. In other words, the budgeted sales volume and the plant's physical capacity are no longer relevant. Despite the fact that our marginal income analysis suggests a desired sales volume of $6,000 or $7.000, the constraint on working capital available has tied "capacity" to but Fixed assets, of course, are comprised of physical facilities and remain fixed unless decisions are made to substantially increase or decrease productive capacity. Much like the fixed expenses, these assets do not generally vary with volume nor over a day-byday basis. Working capital, however, does vary with volume and (like variable expenses) will adjust directly to increases or decreases in sales. Similar to WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING 3 Exhibit 8 Marginal Investment Chart (Sales Volume Variation) relationship of each and the impact this association has on the planning process. As shown in Exhibit 10, the conflict between a physical vs. financial concept of capacity is readily apparent. Management which relates capacity (i.e. follow the marginal investment ratio line to a desired sales volume of $5,000 and a before-tax profit of $250. In this case, the financial constraint is most limiting and would take precedence. In another situation, however, plant capacity might provide the major limit. As shown in Exhibit 10, plant capacity and a before-tax profit of $750 could only be reached if the marginal investment ratio line were reduced to .214. Given this knowledge, management can now begin to search for means by which current assets and liabilities could be effectively reduced. 2.0 1.5 % 30 v. n I M. 05 S.B. S.V. 0. F.A. 1 2 3 4 5 6 7 0.5 (To be continued in next issue) $5,000. In fact, if this firm were to secure its budgeted sales volume, the marginal investment ratio would have to be reduced to .25, and if it were to utilize its plant at full production capacity, a further reduction in ratio to .214 would be necessary. Sincerely, Ken D. Duft Ken D. Duft Extension Economist By combining our analysis of marginal income and marginal investment on a single chart, management can now readily perceive the interdependent Exhibit 9 Marginal Investment Chart (Working Capital Ceiling) Exhibit 10 Marginal Income-Investment Chart (Physical vs. Financial Capacity) 2.0 2.0 0.5 1 2 3 4 5 6 7 Before-Tax Profit Working Capital. 1.5 1.0 05 0. Fixed Assets F.A. 0. Sales Volume Fixed Expenses 05 . Inv M. % 1.4 v. 2 n I M. 30% M.I. v. In M. % 30 Capacity at W.C. 1.0 Plant Financial % 25 Budgeted Sales 1.5 Plant Physical Capacity Working Capital Limitation 0.5 -1.0 Working Capital Limitation % 1.4 I. 2 . M Before-Tax Profit % 30 v. Before-Tax Profit In . M Sales Volume 1 5% I. 2 M. 2 3 4 Fixed Expenses -1.5 WASHINGTON STATE UNIVERSITY & U.S. DEPARTMENT OF AGRICULTURE COOPERATING 4 Physical Plant Capacity W. C. 1.0 5 6 7