Dividends vs. Retained Earnings

advertisement

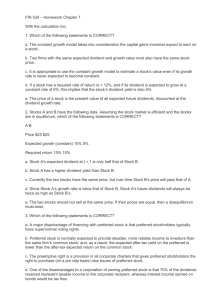

Chapter

Dividend Policy and

Retained Earnings

PPT 18-2

Chapter 18 - Outline

Dividends vs. Retained Earnings

Factors Influencing Dividend Policy

Life Cycle Growth and Dividends

Cash and Stock Dividends

Stock Splits

Repurchase of Stock

Summary and Conclusions

PPT 18-3

Dividends vs. Retained Earnings

A

company has a choice or decision regarding what

to do with its profits:

Pay them out to shareholders as dividends

OR

Retain the earnings in the business

There

is disagreement as to whether investors prefer

dividends or reinvestment

PPT 18-7

Factors Influencing Dividend Policy

Investment

opportunities and growth prospects

within company

Company’s stage in corporate life cycle

Cash position of the firm

Access to capital markets

Desire for control

Legal and lender restrictions

Tax position of shareholders

Pressure to maintain stability in dividends

Improve company’s image by increasing dividends

PPT 18-10

Figure 18-3

Life cycle growth and dividend policy

Sales ($)

Maturity

Expansion

Decline

Growth

Development

Time

Development

Development

StageII

Stage

Growth

Growth

StageIIII

Stage

Expansion

Expansion

StageIII

III

Stage

Maturity

Maturity

StageIV

IV

Stage

No cash dividends

Stock dividends

Low cash dividends

Stock dividends

Low to moderate

cash dividends

Stock splits

Moderate to high

cash dividends

PPT 18-9

Life Cycle Growth and Dividend Policy

Dividend policy is reflected in 4 stages:

Stage I - Development

no cash dividends

Stage II - Growth

stock dividends, low cash dividends

Stage III - Expansion

stock dividends, moderate cash dividends, stock splits

Stage IV - Maturity

moderate to high cash dividends

Residual theory of dividends

A.

According to the passive residual theory of dividends,

earnings should be retained as long as the rate earned is

expected to exceed a shareholder’s rate of return on the

distributed dividend.

B. The residual dividend theory assumes a lack of preference

for dividends by investors.

1, Much disagreement exists as to investors’ preference

for dividends or retention of earnings.

2, The homemade dividend argument suggests dividend

policy is irrelevant to firm valuation

Figure 18-1

Homemade dividends

PPT 18-4

Relevance of dividends arguments

1.

Resolves uncertainty ( Bird in hand theory )

2.

Information content

( signaling theory )

3. Payout ratios suggest firms view dividends as relevant

PPT 18-5

Table 18-1

Earnings and dividends of selected

Canadian corporations

Bank of Montreal

Earnings

Dividends

Payout ratio

Canadian Tire

Earnings

Dividends

Payout ratio

Dofasco

Earnings

Dividends

Payout ratio

Inco

Earnings

Dividends

Payout ratio

Noranda

Earnings

Dividends

Payout ratio

BCE Inc

Earnings

Dividends

Payout ratio

Cognos

Earnings

Dividends

Payout ratio

Ten Year

Average

2001

2000

1999

1998

1997

1996

1995

1994

1993

1992

$20.45

$7.85

38%

$2.66

$1.12

42%

$3.25

$1.00

31%

$2.34

$0.94

40%

$2.29

$0.88

38%

$2.28

$0.82

36%

$2.06

$0.74

36%

$1.62

$0.66

41%

$1.49

0.60

40%

$1.28

$0.56

44%

$1.18

$0.53

45%

$16.17

$4.00

25%

$2.25

$0.40

18%

$1.89

$0.40

21%

$1.89

$0.40

21%

$2.09

$0.40

19%

$1.79

$0.40

22%

$1.51

$0.40

26%

$1.38

$0.40

29%

$1.30

$0.40

31%

$1.11

$0.40

36%

$0.96

$0.40

42%

$14.99

$5.67

38%

$0.35

$1.06

303%

$2.46

$1.06

43%

$3.16

$1.00

32%

$2.02

$1.00

50%

$2.12

$0.80

38%

$2.12

$0.30

14%

$1.98

$0.00

0%

$2.33

$0.30

13%

$1.41

$0.00

0%.

($2.96)

$0.15

n.a.

$6.43

$2.95

46%

$1.52

$0.00

0%

$2.06

$0.00

0%

$0.08

$0.00

0%

($0.63)

$0.10

n.a.

$0.25

$0.40

160%

$1.17

$0.40

34%

$1.82

$0.40

22%

$0.15

$0.40

267%

$0.22

$0.40

182%

($0.21)

$0.85

n.a.

$9.47

$9.40

99%

($0.47)

$0.80

n.a.

$1.14

$0.80

70%

$0.70

$0.80

114%

$2.68

$1.00

37%

$1.00

$1.00

100%

$1.02

$1.00

98%

$2.26

$1.00

44%

$1.45

$1.00

69%

($0.41)

$1.00

-244%

$0.10

$1.00

1000%

$28.06

$13.21

47%

$0.56

$1.20

214%

$7.43

$1.24

17%

$8.35

$1.36

16%

$2.50

1.36

54%

2.00

$1.36

68%

$1.54

$1.36

88%

$1.12

$1.36

121%

$1.43

$1.34

94%

$1.03

$1.33

129%

$2.10

$1.30

62%

$3.17

$0.00

0%

$0.70

$0.00

0%

$0.67

$0.00

0%

$0.66

$0.00

0%

$0.36

$0.00

0%

$0.40

$0.00

0%

$0.20

$0.00

0%

$0.10

$0.00

0%

$0.04

$0.00

0%

($0.08)

$0.00

0%

$0.04

$0.00

0%

Figure 18-2

Corporate earnings and dividends (all

industries)

PPT 18-6

Dividend yields on selected common

shares, April 1995

Edper Group A ……………………7.1%

TransAlta Utilities………………….6.7%

Hees International Bankcorp……...6.6%

Trilon Financial A………………….6.1%

Cdn Utilities A………………………5.8%

BCE………………………………….5.6%

Comparison of dividend policy

Year

1

EPS

$1.5

Reinvest of EPS

0.40

Dividend per share

1) Pure residual

dividend policy 1.10

2) Smoothed residual

dividend policy 0.90

3) Stable payout

ratio policy

0.75

2

$2.1

0.80

3

$1.2

1.30

4

$2.8

1.35

5

$2.4

1.15

Total

$10.00

5.00

1.25

5.00

1.30

-0.10

1.45

0.90

1.00

1.10

1.05

0.60

1.40

1.10

1.20

5.00

5.00

Other factors influencing dividend policy

Legal rules:

Laws have been enacted protecting corporate

creditors by forbidding distribution of the firm’s

capital in the form of dividends. Dividends are also

prohibited if the firm will become insolvent as a

result.

Other factors influencing dividend policy

( cont’ )

Cash position:

The firm must have cash available regardless of

the level of past or current earnings in order to pay

dividends.

Other factors influencing dividend policy

( cont’ )

Access to capital markets

The easier the access to capital markets, the

more able the firm is to pay dividends rather than

retain earnings. Some large firms have borrowed to

maintain dividend payments.

Other factors influencing dividend policy

( cont’ )

Desire for control:

1.

Small, closely-held firms may limit dividends

to avoid restrictive borrowing provisions or the need

to sell new stock.

2.

Established firms may feel pressure to pay

dividends to avoid shareholders’ demand for

change of management.

Other factors influencing dividend policy

( cont’ )

Tax position of shareholders ( clientele effect )

1. High tax-bracket shareholders may prefer retention of

earnings.

2. Lower tax-bracket individuals, institutional investors,

and corporations receiving dividends prefer higher dividend

payouts.

3. Shareholder preferences for dividends or capital gains

fosters investor behavior called the clientele effect. High tax

bracket investors often invest in growth-oriented firms that

pay no or lowdividends. Low tax bracket investors often

purchase stocks withhigh dividend payouts.

4. The dividend tax credit lowers the effective tax rate on

dividend income.

PPT 18-8

Sample calculation of tax* on individual

dividend receipt

Dividend received . . . . . . . . . . . . . . . . . . . . .

Gross-up . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable amount. . . . . . . . . . . . . . . . . . . . . . .

$1,000

250

1,250

Federal tax (at 29%) . . . . . . . . . . . . . . . . . . .

363

Federal tax credit (13 1/3% of $1,250) . . . .

167

Federal tax payable . . . . . . . . . . . . . . . . . . . .

196

Provincial tax payable (10% of $1,250) . . . .

125

Provincial tax credit (32% of $250) . . . . .

80

Provincial tax payable . . . . . . . . . . . .

45

Total taxes payable . . . . . . . . . . . . . . . . . . . .

241

Net dividend ($1,000 - $241) . . . . . . . . . . . . .

$759

*based upon an Alberta resident in the top tax bracket for 2001

Dividend payment procedures

Three key dividend dates:

1. Dividend record date : the date the corporation

examines its books to determine who is entitled to a cash

dividend.

2. Ex-dividend date : two business days prior to the

holder of record date. If an investor buys a share of stock

after the second day prior to the holder of record date, the

investor’ name would not appear on the firm’s books.

3. Payment date : approximate date of mailing of

dividend checks.

PPT 18-11

Cash and Stock Dividends

Cash

dividends are usually paid quarterly

Dividend

Yield (%):=

annual dividend per share / current stock price

A

stock dividend is a distribution of additional

shares of stock

There

is no benefit from a stock dividend unless

total cash dividends increase

PPT 18-12

Table 18-4

XYZ Corporation’s financial position

before stock dividend

Capital

accounts

{

Common stock (1 million shares issued) $15,000,000

Retained earnings . . . . . . . . . . . 15,000,000

Net worth. . . . . . . . . . . . . . . $30,000,000

PPT 18-13

Table 18-5

XYZ Corporation’s financial position after

stock dividend

Capital

accounts

{

Common stock (1.1 million shares issued)

. $16,500,000

Retained earnings . . . . . . . . . . . . 13,500,000

Net worth. . . . . . . . . . . . . . . . $30,000,000

PPT 18-14

Stock Splits

Similar

to a stock dividend: increases the total

shares of stock outstanding

Market value of stock is unchanged initially

ex, a 2-for-1 split will double the number of shares

outstanding (with each share worth half as much as

before)

Primary

purpose of a stock split is to lower the price

into a more popular trading range

Stock splits are used if the stock price gets too high

PPT 18-15

Table 18-6

XYZ Corporation before and after stock

split

Before

Common stock (1 million shares issued)

Retained earnings

After

Common stock (2 million shares issued)

Retained earnings

$15,000,000

15,000,000

$30,000,000

$15,000,000

15,000,000

$30,000,000

PPT 18-16

Repurchase of Stock

May

be used as an alternative to paying a cash

dividend

Often utilized when a firm has excess cash

Benefits to the shareholder are the same (in theory)

Other reasons for repurchase:

belief that the stock is selling at a low price

may be used for employee stock options

reduces the possibility of being taken over by another

firm

PPT 18-8

Table 18-8

Stock repurchases announced in 1997

Shares

Shares

Company

Originally Bid

Inco

Bought

11.5 million

nil

Toronto Dominion Bank

Nova

million

24 million

nil

25

22.5 million

Seagram

24 million

19.2 million

Source: Merrill Lynch & Co.

Dividend reinvestment plans

A.

Begun during the 1970s, plans provide investors with an

opportunity to buy additional shares of stock with the cash

dividend paid by the company.

B. Types of plans

1. The company sells authorized but unissued shares.

The stock is often sold at a discount since no investment or

underwriting fees have to be paid. This plan provides a cash

flow to the company.

2. The company’s transfer agent buys shares of stock in

the market for the shareholder. This plan does not provide a

cash flow to the firm but is the service to the shareholder.

PPT 18-17

Summary and Conclusions

LET’S

REVIEW . . .

A

profitable company must decide

whether to retain (reinvest) the

earnings in the business, or pay a

dividend

Factors influencing dividend

policy include the cash position of

the company, its growth prospects,

its access to capital markets, legal

and lender restrictions, and

considerations of corporate image.

Stock dividends and stock splits

lower the stock price into a more

acceptable trading range

A share repurchase may reflect

management’s opinion that the

shares are trading too low.