1 (Yet Another Hierarchical Officious Oracle) Yahoo. Presentation of

advertisement

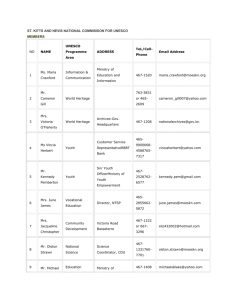

MGP 708XA: Strategy Implementation (Yet Another Hierarchical Officious Oracle) Prepared for Professor Dr. T. Koplyay Authors • Art Byrnes • Marilyn Fevrier • Sebastien Fontaine • Lori Woods Version 0.8 University of Ottawa EMBA Program ©2002 - Byrnes, Fevrier, Fontaine, Woods 11 March, 2002 1 Yahoo. Presentation of group members. 1 Presentation Roadmap Magazine article 21 May 2001 Strategy Analysis based on events since magazine article Yahoo life-cycle analysis based on article Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 2 Presentation of our methodological approach in the presentation •Information gathered from business week article, then analyzed •Yahoo life cycle analysis statement •Strategy analysis based on all information/events since may 2001 2 Objectives !Identify where is Yahoo! today in its life cycle? !What has been the past strategy for Yahoo!? (up to 1Q-01, CEO: Koogle) !What is the current strategy for Yahoo!? (2Q-01 to present, CEO: Semel) !Is Yahoo! Aligned for this strategy? Issues? Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 3 Presentation of the study objectives: •Identification of yahoo’s position in its life cycle (to understand strategic positions & orientations of the company) •Determine what was the strategy under the former CEO Koogle 3. Determine the current strategy since the appointment of Semel as CEO. 4. To assess the level of alignment for this strategy 3 Life Cycle Analysis Methods ! ! ! ! ! ! ! Version 0.8 Financial Profile Leadership Analysis SWOT Analysis SPACE Portfolio Analysis Growth Vector Analysis Life Cycle ©2002 - Byrnes, Fevrier, Fontaine, Woods 4 The following analysis techniques were used to determine the position of Yahoo on the organizational maturity life-cycle curve. Financial Profile – determines firm’s capacity to survive. Main focus is on historical information, particularly ratios. Useful to determine company’s financial position relative to competitors in industry and to project the company’s probable future financial position. Portfolio Analysis – examines the firm’s products and where they are in their life cycle, examining the contribution or drain they pose on the company’s assets and revenues. SWOT – examines the companies internal and external environment and identifies Strength and Opportunities that can be used to increase the company’s profitability. It helps to find best match between the environment trends and company’s internal capabilities. SPACE – Analysis will be conducted on the Yahoo organization. Leadership – examines the leadership styles of CEOs Koogle and Semel, and evaluates them against the requirements of Yahoo. Growth Vector Analysis - this is a technique that indicates the strategy of the organization in terms of market options and product alternatives. Plotting out the implementation of strategy will indicate where the organization is in the organizational life-cycle. This analysis can also be used to explore future market-product strategies. 4 What is Yahoo!? A Portal - Content as well as Internet Access " " " Portals are the first sites customers see when they go on-line (see backup slide) Goal of portal is to earn $ through: " advertising " taking % of sale of goods sold at the portal Start-up Strategy: " attract large numbers of users and keep them there (Casino strategy), by " gearing content to target market segment Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 5 Like AOL, Yahoo is a portal that provides both horizontal content and services (e.g. e-mail, community services) and access to a variety of vertical portals (including, finance, health, entertainment, etc.) and shopping. Since it’s founding in 1995, Yahoo’s strategy has been to establish close, long-term relationships with a large audience of Web users. During December 1999, the company’s global audience grew to more that 120 million unique users (100 million registered users), double the number during the same period in 1998. Embarking on an aggressive globalization strategy, Yahoo’s user base outside the United States exceeded 40 million at year-end 1999, and its non-US operations represented 13 percent of total consolidated revenues during fourth quarter. During 1999, the company also significantly expanded its media business, launching audio and video content services. 1. Definition of what Yahoo is, in terms of portal: characteristics •Portals are specific applications written to track specific information about users and their preferences (page layout, access to applications from application servers). •Portals are a special case of an application running inside any application server. •A portal provides frames for content layout. The content in each frame is referenced by URL and is unique to users. The URL in the frame can be content inside the portal or content from any other web site or any other portal. 2. Presentation of Yahoo start-up strategy 5 Current Situation – Yahoo! Magazine article, 21 May 2001 " Current shake-out in Internet Portal industry " " " Over-reliance on free services to users Declining revenues from Internet advertising " " " " " " " Yahoo! is #1 Global Internet Search site New revenues being pursued -premium transaction services Challenge - convince people to pay for services they have always gotten for free integration happening - vertical or horizontal? partnerships & acquisitions Vanishing profits (cost structure out of hand) Stock depreciation (-92%) - end of Koogle’s rein, 1Q-2001 Dysfunctional management (aloof CEO) " Internal leadership conflicts and mismatches Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 6 -Explain what shake-out in internet portal industry means: instability, too fast growing internet industry, high level of speculation in new economy … -Over-reliance on free services to users: to focus on free services (start-up patterns ) 3. Big issue: declining revenues from dot com advertising ; need for new revenues sources Involves big challenge : convince people … At 21 May 2001: integration, nature = vertical integration Vanishing profits: linked to 42 BU (dispersion) Stock depreciation: illustrates Dysfunctional management: too conservative top managers vs absolute need for change ‘Over reliance on free services users’ is related to ‘clicks’ on a site translating into a top line performance figure for Yahoo. The ‘vanishing profits’ is related to a shift in focus from the aforementioned top line performance to a bottom line focus. The lesson is that it is never too early to practise economy and efficiency. 6 1Q-2001 Portal Market Reach 70 217M users Shakeout 60 3 major players 50 40 No 4th Portal in sight! 30 20 (Yahoo- 10 9 content 0 acquistions) Yahoo! Vertical integration (2001) Version 0.8 MSN AOL (AOL-TW) % of World’s at home Internet population Average minutes per month per consumer Vertical integration (2000) ©2002 - Byrnes, Fevrier, Fontaine, Woods 7 Yahoo is an example that you don’t need robust technology to win. It is an example that if you are first in a field and you stake out a leadership position, then the advantage of being the first to move will win. Yahoo is now 7 years old as a corporation. In 2000, AOL merged with Time-Warner; AOL is a portal like Yahoo, and TW is a media giant that represents the content for AOL. Yahoo stayed the course as a portal/content assembler, and even so, remained the #1 Internet destination for the past 18 consecutive months. A shakeout is underway, per se, leaving but three major contenders as portals - Yahoo, MSN, and AOL. The intriguing thing is that the market reach between the #1 and #3 portals is about 10% market reach. Any of these portals are contenders to be the lead portal. Indeed, Yahoo was profitable in 1999 – a claim that few pure-play dot-com businesses could make. Revenues for 1999 were $589 million, and income from operations was $67 million, up from $245 million and a loss of $13 million, respectively, in 1998. 1999 operating expenses were $420 million (sales and marketing, $209 million; product development, $64 million; and general and administrative, $35 million). “We exited 1999 as one of the top three global branded networks,” said Yahoo chair and CEO, Tim Koogle. “Throughout the year, we leveraged the inherent scale in our business carefully managed our business model to deliver superior results to our users, clients, partners and stockholders. We are well-positioned to continue our leadership position in the year ahead, and will continue growing our business on all fronts.” Branding is an excellent strategy as the mass markets will eventually simplify their lives with just a single portal. It appears that the market space has reached the functionality stage, so Yahoo should be able to hold its lead if it does not stumble in its execution of strategy. 7 2001 Revenue Distribution 50% Transactions & Business Services ~ 25% 50% •Advertising •Sponsorships 2004 Objective •Key Words Reduce exposure to declining advertising ~ 75% revenues - diversify portfolio. Transaction Services Advertising, Sponsorships, Key Words Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 8 Presentation of 2001 revenue distribution : - 75 % revenues generated through the sale of advertisements, promotions and through sponsorships. - 25 % through transaction services (fees on transactions) This distribution illustrates the level of reliance on advertising. As budgets for Internet advertising within the dot.com industry declined or dried up with disappearance of dot.com ad-placing customers (2001), it will be crucial that Yahoo develops others sources of revenues. If alternative sources of revenue are not secured, then Yahoo’s 75:25 revenue split represents a significant exposure for it. So: 2004 objective. Yahoo intends to reduce strong exposure to advertising revenues. Objective of a 50:50 ad:transaction revenue distribution will be pursued. Notwithstanding this initiative, Yahoo intends to increase its ad revenues beyond earlier levels realized prior to the dot.com bust in 2001. The means to achieve that : portfolio diversification will be necessary, ie will seek out more traditional businesses for advertising, and diversify its transaction services (see later portfolio analysis) 8 Sales & Assets Growth 2500 " $M 2000 Forecast: " 1500 1000 " 500 2000 1999 1998 1997 Net Revenues Gross Profit Total Assets Version 0.8 FY 2002 Market Growth " 1996 0 " " Earnings less than projections 1Q-02 Decline in online advertising Increase in commerce, enterprize services 85% of revenues US-based 9 ©2002 - Byrnes, Fevrier, Fontaine, Woods Assets are mainly technological know-how (brilliant engineers…). In internet industry (high tech industry), most assets that count are non physical : know-how, knowledge, skills & competencies (but still has huge global physical asset base). Over the period (1996-2000), Yahoo has increased its 1. Assets, 2. Gross profit, 3. Net revenues, enjoying of the boom of high tech industry and its first to market position. However, earnings are less than projections for first quarter 2002. 2002 market forecasted evolution : decline in online advertizing while increase in commerce and entreprize services (B2B, business solutions). Interesting point: 85% of Yahoo revenues are US-based. Suggests market potential from a worldwide point of view. Q: What compelling factor will drive consolidation in the portal business? The masses (of users) go for brand; they are switching to one portal instead of many to make their lives simpler. Only the market leader can brand, everyone else plays catchup. After a shakeout, it is key to retain customers; if can’t get new customers then have to buy them from the competition, ergo consolidation will happen. 9 Financial Ratio Profile Industry Norm Profitability -21% -1% (Net Profit Margin - TTM) Very Low Liquidity Average Very High 1.52 3.18 (Current Ratio) Very Tight Leverage 0.31 (LT Debt to Equity) Too Much Debt Activity (Sales 5 yr Growth Rate) (Sales (MRQ) vs. Qtr 1 yr ago) Too slow - 39% Too Low Version 0.8 About Right Too Much Slack 0.0 Balanced Too Much Equity 33% 279% About Right Too Fast 12% About Right ©2002 - Byrnes, Fevrier, Fontaine, Woods Too High 10 Profitability - This measures allocation of resources in relation to income generated - a measurement of management’s ability to control expenses, pay taxes and result in reasonable profit margin on sales. Poor cost controls have contributed to this poor profit showing. Customers are not willing to pay as much as they used to for advertising on the Internet and so Yahoo margins, ergo profitability, have had a dramatic drop. Advertising amounts to almost 75% of Yahoo revenues, a reliance that must be reduced. Yahoo must quickly establish itself in other value-add services with higher margins to re-establish profitability. Profitability is sacrificed for market share. Liquidity - This reflects the ability to pay bills. By rule of thumb,it should be 2 to 1 (higher is better). In the high tech sector, one requires lots of cash to sustain product development, or diversify, since there is usually a long period between product kick-off and initial revenues. Yahoo appears to be in a reasonable financial position compared to the industry norm (Cash reserves = $1.7B; Market capitalization = $8.4B) . Without prudent management of its P&L statement, i.e runs a tight ship, this positioning could quickly reverse itself. Leverage - Compares amount invested in business by creditors with that invested by owners. A higher ratio indicates more of a creditors claim. This reflects how operations are financed. Yahoo has little leveraging and high liquidity. Suggests owners are too conservative and are not letting business realize its potential. Growth Activity - Provides measure of business growth potential. Yahoo sales were far in advance of industry norms, clearly they were an industry leader. Of recent, sales fortunes have abruptly reversed with the burst bubble of the dot.com industry. The market has reversed, the market is shifting to more traditional bricks and mortar clients (with different needs) and Yahoo was slow to react, and/or Yahoo’s market share has dropped. Price/Earnings (P/E) ratio is 181, whereas industry segment P/E = 32, and S&P 500 has a P/E = 21. There is a high performance expectation in Yahoo; or put another way, it will take a long time to repay investors money. All in all, this analysis suggests a company that was clearly an upstart and is now transitioning up the growth curve and having to deal with a shake-out situation. It has deep pockets to under-right diversification and could survive a shakeout. 10 (Cash Use) High Low Industry Growth Rate The Future since May 2001. Cost centres change to revenue centres. MVA created here. Portfolio Analysis Secure Enterprize Portals, web-hosting - Health care program admin - Retirement program admin Broadcast svcs: Audio & video 2001 1-to-1 Database Marketing ? Business E-mail 1999 Consumer Transaction Services - Shopping, Auctions, Finance, Travel, Document Downloads On-line Market Research Mobile Services: B2B Pagers, PDAs, Phones, Trains, Taxis Personal E-mail - Free Transaction & Business Services Revenues 25% Media Services: News, Sports Games, music Movies 1995 Advertising Sponsorships Key Words Advertising Sponsorship Key Word Revenues 75% Web Navigational Guide - Free (search engine) Low Relative Market Share (Cash Generation) Version 0.8 EVA created on right side of table. High Flagship ‘www.yahoo.com’ Pays for the Future ©2002 - Byrnes, Fevrier, Fontaine, Woods 11 •Yahoo’s product portfolio includes products in 3 of 4 quadrants. Yahoo has pursued a limited acquisition strategy and has mostly home grown products/services. •Its flagship, www.Yahoo.com, is very much a “cow” and is paying for the future by providing horizontal services of email and community sites. The issue with the flagship is that its revenues are associated with dot.com advertising, a revenue source that turned south with the bursting of the dot.com bubble in 2001. Reactive measures are in order to prop up revenues in this domain (from other advertising sources) if the flagship is to prevent becoming a “dog”, i.e. low revenues. •Since 1999, Yahoo has leveraged its large installed base to be the “world’s largest enabler of transactions”. This is in part reflected by the products/services in the “stars” quadrant. During 1999, more that 9,000 merchants sold merchandise on Yahoo shopping, and during the 1999 X-mas holiday season, Yahoo was one of the leading shopping destinations, with a weekly average of more than three million shoppers. •Unlike AOL, which in recent years has extended its ownership of digital infrastructure and provision of digital infrastructure portal services, Yahoo favoured partnership arrangements with ISPs hardware and software providers, personal digital assistant (PDA) providers, and wireless infrastructure portals. Yahoo touts that its status as an independent distribution platform as a major focus of differentiation and a key to its success. •The current aggregation of products/services reflects a strategy of moving closer to the customer with services that are clearly transaction focused and which build on Yahoo’s foundation of being THE quality Internet destination, both in terms of technology and trusted content. The strategic focus of Yahoo today is on the high-growth areas: transaction services, outsourcing services, and replacing dot.com ad clients with traditional business clients. This strategy will reduce exposure to Yahoo’s dot.com ad revenue base, which is shrinking. •Yahoo owns a huge installed asset base of global portals (26 countries, 55 subsidiaries). Yahoo clearly wants to remain as the number one Internet destination as it has been for the past 18 months. The goal here is to attract users and to keep them on the site (the Casino strategy - keep gamblers in the building, whether eating or entertaining,and they will spend (gamble)). Yahoo has very capable technology to track user preferences and customizes the portal experience for EACH user, for EACH visit. They must learn to leverage this knowledge and turn it into revenues, such as through its 1-to-1 database partnerships with marketing agencies that use such information to prosecute on-line loyalty programs. •There has been a push into international markets, but it has been quite limited when one considers that 85% of revenues originate from the U.S.. There is much potential to exploit the global market. One area that is leverages the global market is the customization of local portal to reflect local issues, preferences and culture. •Yahoo has begun to offer Internet outsourcing services and access to its user database to corporate clients. In this fashion, Yahoo is turning what were formerly cost centres into revenue centres. 11 Life Cycle Development Introduction Growth (Early Growth) (Accelerated Development) Fee-Based User Services Maturity Decline Free User Services Growth Consumer TransactionServices - Shopping, Auctions, Finance, Travel, Document Downloads Post 1Q-01 On-line Market Research 1-to1 Database Marketing Media Services: News, Sports Games, music Movies B2B Secure Enterprize Portals Broadcast svcs: svcs: Audio & video Personal E-mail - Free Web Navigational Guide Free (search engine) Business E-mail Mobile Services: Pagers, PDAs, Phones, Trains, Taxis Advertising Sponsorships Key Words Maturity Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 12 Yahoo’s product portfolio suggests that Yahoo is in the growth domain, just before the industry shakeout, and that its next move should be towards diversification. The Yahoo product portfolio spans the entire life cycle - products are all over the map. As expected, those products which launched Yahoo as an ad-dominated portal are clearly at the mature end of the life cycle spectrum, while the transaction and outsourcing products are in the introduction and growth sectors of the life-cycle. With its full spectrum of products and services, Yahoo is able to offer integrated solutions to its customers. It can combine products and services into a seamless offering to address a pressing customer need in the areas from information management to Internet services to communications. This full spectrum offering, and emphasis on end-to-end solutions is indicative of later stage lifecycle behaviour. The product has been commoditized and one-stop-shopping is the result. The threat of such a broad-based portfolio offering is that the book-end products, ie introduction and mature products, are at risk of being relatively ignored, or being eliminated out of hand. By structuring the company into fewer SBUs, some of which are focused on growth and others managing a mature product portfolio, the product scope is narrowed, each group’s centre of gravity becomes consistent with each group’s respective product portfolio, which makes it easier to protect the book-end products of each group. Are Yahoo’s borders defensible? No, so diversify from niche strategy. It will be important for Yahoo to stabilize its technology as it moves along the life cycle. Such a move would stabilize its cost structure, and simplicity is best for a ‘one-stop-shopping’ strategy, which Yahoo is adopting (see later strategy slides). 12 Growth Vector Analysis Non-Reversible, High Risk Late life cycle behaviour Change own Centre of Gravity 1Q-01 Post 1Q-01 Product Alternatives Present Products Market Options Reversible, Low Risk Early life-cycle behaviouir Shift of Centre of Gravity Market penetration Public portal: Existing Market •Fast, reliable, trusted search & directory service •Basic free communications •customer behaviour research Aggressive promotion Expanding Market US, Japan, UK, Germany, France Asia, etc Market development New Market Improved Products Product variants; Limitations Public portal: •Media services •Mobile services •Consumer transaction services: shopping, auctions, store, etc. Market segmentation, product differentiation •B2B portal •Enterprise portal •B2E portal Market extension •Multiple language services •Local on-line properties New Products Product line extension •Non-PC access services •Off-line print media •Buyer protection program •1-to-1 marketing database Vertical diversification •9 Content acquisitions (upstream) •Partnerships (downstream Distribution channels) • ISPs, Wireless networks, Hispeed cable - SBC •Broadcast services •video conferencing •on-line training Conglomerate diversification Global presence 55 Subsidiaries, 26 Countries Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 13 Our growth vector analysis of Yahoo’s product and market opportunities reflects the strategy routes that Yahoo has taken since its incorporation in 1995. This analysis also highlights the course of action that the company recently selected as its objective. Beginning in the market penetration sector, Yahoo started off with a bit of a shot-gun strategy moving quickly into aggressive promotion. That was followed by transitioning into product variants (personal to business customers) and pushing harder into the global market of market development and market extension. and product line extension, market development, and market extension almost simultaneously. Implementation of strategy to this point reflects the core competency of Yahoo, that being a global Internet portal. Outsourcing services began with a move into product differentiation, specifically B2B opportunities. This was followed by other outsourcing initiatives in the realm of Entreprize portal and B2E portal. Yahoo had been focused on PC-centric services, it is now moving into product line extension by looking to non-PC services like PDAs, providing buyer protection programs and partnering in offline print media. It is also leveraging its user tracking database and engaging in a 1-to-1 database partnerships with marketers. The Buyer Protection service, a financial service, is one of the initial indicators of corporation maturation. Of note, the products in the quadrants Product Line Extension and Market Segmentation, Product Differentiation, are products that have been converted from cost centres to revenue centres. As Yahoo develops content, or acquires or partners with content owners, it positions itself to advance into vertical diversification. Yahoo is leveraging the breadth and depth of its core competency, its global portal, to help global corporations take advantage of the growing opportunities in data and Internet communications. Building out its portal reach globally represents Yahoo’s core competency, which would be early stage behaviour on the organizational maturity life-cycle. The moves along the product alternatives axis represents Yahoo’s core capabilities a late stage behaviour mode. The conclusion to be drawn from Yahoo’s recent move into market segmentation, vertical diversification, and product line extension is that Yahoo is diversifying and is moving up towards the mature position on the organization life cycle curve. 13 SPACE Analysis Financial Strength (FS) Conservative 6.0 Competitive Advantage (CA) 2.3 3.9 4.1 6.0 -6.0 ‘Narrow’ the Company, 1Q1Q-01 -6.0 Defensive - 3.6 Industry Strength (IS) NOW, ‘Narrow’ the Market Mergers Competitive Turnaround Environmental Stability (ES) See Back-Up Slides for Details Version 0.8 Aggressive ©2002 - Byrnes, Fevrier, Fontaine, Woods 14 The indicator arrow is very short and near the centre of the SPACE grid. This indicates a point of indecision. As the market converges, one does not know who holds the high ground and so SPACE could potentially point different directions on different days - a very fickle market situation to be in. This scenario indicates that the market is at its shakeout point. With that in mind, with slight changes in the industry or with Yahoo’s competitive advantage, Yahoo could easily swing between a Defensive position to a Competitive position, ergo Yahoo must get its strategy right and execute that strategy with finesse. Which company is Yahoo? Defensive: The defensive posture alludes to an unattractive industry in which the company lacks a competitive product and financial strength. The critical factor is competitiveness. Firms in this situation should prepare to retreat from the market, discontinue marginally profitable products (which it has done dropped unprofitable, unpromising LOBs and restructured from 42 SBUs to 6 SBUs), reduce costs aggressively, cut capacity, and defer or minimize investments. Competitive: The industry is attractive (see AOL-TW). The company enjoys a competitive advantage in a relatively unstable environment. The critical factor is financial strength. Yahoo should acquire financial resources to increase market thrust (it has deep pockets - $1.7B in cash reserves and $8.4B in market capitalization), add to sales force (which it is doing - replacing less experienced with more experienced sales/marketing personnel), extend or improve the product line (which it is doing - own its content), invest in productivity, reduce costs (yes - it is happening), protect competitive advantage in a declining market, and attempt to merge with a cash-rich company (AOL did this with TW). Summary: Yahoo has pursued both Defensive and Competitive behaviours. Suggest that at end 1Q-01 that Yahoo was in a Defensive position. In response to the shakeout, the new CEO, Semel, first narrowed the company (internal looking, cost control), and then focused externally to narrow the market, to focus the company with a view to a turnaround. Semel acted to realize a more Competitive position for Yahoo. Yahoo is at the shakeout point of the life cylce. 14 SWOT: Yahoo! Strengths Opportunities - 1st worldwide internet portal - Existing business solutions (B2B …) - Incredible technology strength in its people - Up selling to existing customer base - Attract new customers - Develop services for non-PC Internet access devices - Develop compelling products - Adaptable Threats Weaknesses - Dependency on ad revenues - Turnover and staffing - Network architecture limits (not designed for today’s load) - CRM and poor competitive intelligence - Lack of direct-billing relationship with user, as does AOL and MSN. Version 0.8 - Financial sensitivity - Stockholders pressure - Endangered management of change - Loss of market - Market KSF identification - Customers and market expectations - Dependence upon communications companies for all Internet access (telecom shakeout today) ©2002 - Byrnes, Fevrier, Fontaine, Woods 15 2001 Strengths - opportunity: yahoo! has to benefit from its huge audience (54 millions of visitors each month). This large visibility has to be well managed to generate new sources of revenues throughout value-added packages of services for customers. Potential customers are very numerous and yahoo have to exploit its core competencies (technological know-how, value-creative ideas - delivery info) by focusing on them (B2C value chain). Also, Yahoo has to exploit its presence on the B2B segment by developing and supplying business portal, corporate solutions, integrated solutions. Indeed, companies’ future strategic management (internal and external, stakeholders management …) will have obligatory a virtual side (for example ”web public image” of a company …). It is a huge potential market. Cf 2004 objective Weaknesses – threats: yahoo’ revenue structures is very representative of its current strategic position, that is to say too dependant on ad market and not enough focus on its existing customers- and new customers (B2B and B2C) expectations. As a result, financial sensitivity, potential difficulty to raise money on financial market (stockholders) to finance investment in strategic acquisitions or alliances. Yahoo has to prove its ability to turnaround its revenues, what involves to define new strategies based on the integration of core competencies in new and diversified business formula. Appropriate incentives policy has to be implemented. Yahoo faces necessary strategic changes, so an appropriate management of change is required. So top management has to create a new confident atmosphere within the company to succeed crucial strategic change. Medium and long term view. Yahoo has absolutely to avoid arrogance to success in the future.It means a better understanding and taking into account of customers and market expectations throughout pro active competitive intelligence. Internet is a field where change occurs very fast. To be in phase with existing market and market trends. Need for vertical integration (threats if not occurred) 15 SWOT Summary – Yahoo! Threats Organizational evolution Not mature Not start-up Confront Customer Relations Management Staffing External Factors Opportunities Dependency on ad revenues Avoid Staff turnover Corporate Upstart leadership Core -management competencies services Revenues Exploit Search diversification Strategic Better competitive and B2B alliances marketing intelligence Weaknesses Strengths Smaller architecture adjustments required to fix issues Version 0.8 Internal Factors ©2002 - Byrnes, Fevrier, Fontaine, Woods Bigger tasks required to fix issues 16 SWOT analysis indicates yahoo is not mature, but it is not a start up any more. Main issues : Be closer to customers, appropriate HRM, leverage is core competencies (technological know-how), organizational evolution is required to match market and customers evolution, branding, revenues diversification. 16 Life Cycle: Leadership 70% of strategy is? Marketing Product Effectiveness Production Efficiency •Management by persuasion •Lack of control •Snail-paced decision-making •Analytical •Impatient •Product focused •Engineer Semel Mallett •Strategist •Marketer •Patient but decisive •Organization performance focus •Brass tacks management style - controller Koogle Transformational Transactional (revolutionary) (evolutionary) Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 17 Semel is attractive to Yahoo board of directors because he has the following experience: - he is a marketer; selects appropriate strategies for success - global business - a Yahoo strategy is to deploy more properties in international markets - good at managing people - Yahoo has been suffering from dysfunctional leadership - has created brands - Yahoo is a brand, and that brand must continue to be leveraged - developed multiple revenue streams - Yahoo has been principally dependent upon ad revenues, which represents a huge exposure for the company. Diversity in revenue streams is the strategy. - has an appreciation for creativity - Yahoo is more than technology. It a medium that must support online communities if it is to grow its market share and revenues - is directive in his management style; prefers tight control, but is patient for turnaround results (recognizes need for culture shift) - focus is continued growth of previous phase of organization - increase customer base (even if different customer base) - establish sustainable competitive edge Yahoo is focused on quality of their product. Such a culture should ideally be lead by someone with logical leadership traits - more Semel than Koogle or Semel. Koogle is too distant from the organization, didn’t keep track of Mallett when Mallett was CEO, manages by persuasion and exercises snail-paced decision-making, which is not fast enough for a growth company. He is a risk avoider which is more in tune with a mature organization, which Yahoo is not. Koogle is a clear misfit for Yahoo. Q: Why can misfits such as Koogle survive as long as he did? Because outsiders tend to look at the top line, not the bottom line, during market growth periods - the market is rushing to Yahoo. So early market conditions forgive non-performing CEOs. Mallet is an engineer; very product focused; suitable for start-up. 17 Analysis Summary #Financial #Leadership #SWOT #SPACE #Portfolio #GVA Indicates indecisiveness Development Mallett Semel Koogle MVA ↑ EVA ↓ $GVA SWOT Fee-Based Services Introduction Growth Free Services Maturity Differentiation Focus Niche Cost Focus Cost leadership Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods Decline 18 Yahoo is in the Growth stage of the organizational life cycle (not a start-up anymore, nor is it mature): Marketing: Heavy emphasis on branding of Yahoo properties; works only when products are climbing the quality curve. If clients did not take advertising offer, Yahoo moved on; ad revenues plummeted. Marketing and sales are major expenditures (36% of net revenues). Focus is on competitors, i.e. AOL-TW and MSN. Production: Always focused on users (from R&D perspective, have a quality product). Have array of standards for their technology and its performance from view of user. Offering an increasingly wide array of products and services (some through acquisition process). Finance: Lots of cash. EVA is poor (loss). MVA is rising as market has high expectations later in life cycle; didn’t anticipate the market shift. Post introduction phase, in growth phase, not yet mature. Personnel: Have strategy to retain key tech and business personnel through initial stock option offerings; expect to retain best folks for stock vesting period of 4 years, the length of the turnaround strategy. R&D:Products are differentiators - many free communications services. Few companies can sell technology to Yahoo, although Yahoo acquired a dozen or so companies (see back up slides). Is a trusted site, with high quality technology and similarly high quality content. Strategy Focus: Still a fast mover; can shift with the market forces (if it anticipates them and takes appropriate strategic action - Semel has proven to be correct in his thinking but too slow to act). Competition. Shifted to increasing instability with merger of AOL-TW. High competitive pressure since did not pursue a parallel merger strategy. Leadership. Koogle - risk avoider (late cycle), Semel - marketer (mid-cycle), Mallet - product focused (engineer - early cycle). Koogle and Mallet are poor CEO fits for growth activity. GVA. Has already pushed into global markets with its core competencies. Is exercising core capabilities working external to Yahoo to provide and distribute content. Exhibiting later cycle behaviour. Products. Its flagship product ‘www.yahoo.com’ is currently a cash cow (75% of revenues from ads). With declining ad revenues could evolve to be a dog. Focus is on establishing other revenue channels. 18 Strategy - May 2000 under CEO - Koogle - Singular Strategy " Strategic Alternative Status Quo " " " " " " " " " Concentration Horizontal Integration Vertical Integration Diversification Joint Venture Retrenchment Divestiture or Liquidation Innovation Restructuring Version 0.8 Focus " " " Internal Stability Continue in present products/markets •Yahoo response to AOL-Time Warner merger: Remain an independent assembler of news and entertainment provided by others. ©2002 - Byrnes, Fevrier, Fontaine, Woods 19 In mid-2000, AOL and Time-Warner merged. AOL is a portal, like Yahoo, and TW is a media giant that represent content for AOL. In response to this merger, Yahoo decided to stay the course, to remain an independent assembler of news and entertainment provided by others, and not follow the AOL-TW model. 19 Pre-May 2001 Strategies (SEC ‘K-10’ Filing) " " " " " " Provide a marketplace for commerce on the web Content aggregation with best of breed third parties Extend Yahoo brand and create demand for online properties through offline media Increase visibility and awareness for Yahoo through sponsorship positions for high-profile promotions Strategic relationships to provide content and distribute content Distribute Yahoo services through non-PC means, eg wireless providers " " " " Generate advertising revenues through sponsored services and placements by third parties in Yahoo online media properties in addition to banner advertising Continue to provide new communications applications which are compelling to users Develop Yahoo-branded online properties in international markets Acquisition for content and technology Problem? - Execution, Execution, Execution Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 20 The SEC ‘K-10’ filing of Yahoo includes these many strategies. Of note, some of these strategies are those that have been accepted by the new CEO, Semel. It would appear that Yahoo had the right idea for itself (in part), but lacked in its ability to execute on those strategies. This is reflective of the softer side of the organization, its organization, its leadership and its culture. Since arrival of new CEO, Semel, the subordinate strategies have included: - Stabilize key metrics - measurement - SBC partnership to share risk - Experience in functional areas is enhanced through changing the guard, particularly in sales and marketing - Vertical integration through partnerships and acquisitions is occurring, eg pharmaceuticals, computers, 9 content acquisitions, SBC - Trusted info site - Wholesale change in culture is being pursued as company learns to sell content rather than process incoming orders. 20 Post 1Q-2001 Strategies Actions - Behaviours " " " " " New, more experienced management team Sales/marketing Restructuring - 40 to 6 “SBUs” Up-down vertical integration Acquisitions & partnerships Culture change being actively pursued - learn to sell content versus be assembler of Internet content only Strategies " Diversification Joint Venture Restructuring " By 2004: " " " " Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 50:50 Ad:Transaction revenue split Increase ad revenues 21 Clearly there is a shift in focus for Yahoo. Still a high quality technology portal powerhouse, it is now shifting to an emphasis on sales and marketing, with a view to making money from its core competency and managing its customer relationships. Evidence the initiative to replace/bolster its sales/marketing team with folks with more experience than the incumbents and who have the contacts to grow the market for Yahoo. Growth of both ad revenues and transaction revenues is a mainstay of this strategy - building on the customer base of the previous strategy. Brand development is a continuing action. They will also be building (through partnership) channels to customers, and will build, partner, or acquire products, or content, to fill those channels. Diversification makes sense as the dot.com ad market has contracted significantly since its melt-down in 2001. Yahoo must find other revenue streams. Yahoo can afford to diversify given its deep pockets. Cost control is wrapped up in the strategies of re-structuring and joint ventures. Re-structuring is a means to reduce Yahoo’s cost structure, witness the lay off of almost 10% of the workforce in Nov 2001 (300 positions). Also, the number of SBUs was reduced from 42 to 6 SBUs. Synergies (cost savings) resulted as well as focusing on those products/services that have high future revenue potential. Intrinsic to this collection of strategies is turning cost centres into revenue centres. The out-sourcing strategy for B2B, B2E, video-conferencing, 1-to-1 database, and on-line training are all examples of such a strategy. Bottom line is that the strategies must realize an increase in ad revenues (relates to core competency of Yahoo, and the ratio of ad revenues to transaction revenues must shift to 50:50 from today’s 75:25 ratio, with a view to reduce Yahoo’s exposure. It is difficult to differentiate on strategy (as everyone eventually does the same thing). So the real differentiator will be on execution of the strategy, which has been a past failing during Koogle’s tenure. 21 Strategy - May 2001 under new CEO - Semel- Trifurcation " " " " " Diversification " " " " " Retrenchment Divestiture or Liquidation Innovation Restructuring Version 0.8 " " Joint Venture " " " " " External or Internal Broadening of product line Reduce competitive pressure; gain greater profitability; spread risk External Complementary benefits Spread risk; create synergy Internal Cost reduction, Growth potential Concentrate on products & divisions with high potential ©2002 - Byrnes, Fevrier, Fontaine, Woods Cost Control " Status Quo Concentration Horizontal Integration Vertical Integration Focus " Diversification Strategic Alternative 22 The Strategy which Semel embarked on in May 2001 was one of Diversification, Joint Ventures and Restructuring. To this end he has been actively seeking to expand the product offerings of Yahoo through Diversification and Joint Venture activities. Examples of these are the Enterprise Portal Market and the Top 10 Hits Joint Venture. The B2B, B2E and B2C pressures coupled with Yahoo’s proven track record in classification systems make them a natural for hosting outsourced Enterprise Portals. With the court action with respect to MP3s in March 2001, the additional of a subscription based music listening service coupled with a licensed download fills a market niche. Finally, massive restructuring has taken place as we will see when Marilyn discusses the new Yahoo management team. The choice for a trifurcated strategy is a bit of a surprise; the SPACE analysis indicates that a status quo strategy would be a best option, since little is known about where the industry is going. Yahoo has gone against the SPACE indicator and has chosen a tri-furcated strategy . 22 Post-May 2001Strategy (Semel interview) Revenue buckets are: " Brand advertising & awareness " Promotions " Research " Outsourcing of Internet function " One-to-one database marketing " Version 0.8 aid marketers to deploy online loyalty programs ©2002 - Byrnes, Fevrier, Fontaine, Woods 23 Strategy implementation for Yahoo divides up the revenues into 5 buckets; three of which were carried over from Koogle’s tenure, and two of which are new. This is a reasonable approach for Yahoo since it is still in the growth sector of the life cycle: - branding is a strong emphasis. It works in Low to High quality product vector - is still a fast mover in responding to the market; early cycle - EVA (poor,loss), MVA is declining due to burst bubble, suggests early cycle (later in cycle, the future is behind you as indicated by a declining MVA) - focus has shifted from market pull (dot.com frenzy) to market push (having to adapt to traditional client needs and advertisers will not pay high prices - focus is on competitors (AOL-TW) and customers (both users and paying customers) - in the focus zone since are spending lots on sales and marketing (approx 36% of gross revenues) - competition is shifting to increasing stable with mergers of AOL-TW; high competitive pressure Growth is a mainstay of this strategy - building on the customer base of the previous strategy. The strategy focus will be on sales, production capacity and production technologies; increase sales, manage delivery of products without growing organization (cost management), and evolving technology so can pick up outsourcing Internet business (need predictability in technology). They will also be building (through partnership with distribution agents like SBC) channels to customers, and will build (or acquire) products, or content, to fill those channels (9 acquisitions since May 2001). The one-to-one database marketing is an excellent strategy; it plays into the need for customer retention later in the cycle (must either buy customers from competition or attract a customer who has not yet entered the market space, and there are few of them later in the cycle). 23 The Strategy Question " Do: culture/leadership " information/decision making " incentives " structure " follow the strategy of diversification and cost control? (diversification, JV, & restructuring) Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 24 24 Information/Decision making follows Strategy Reactive Inductive Informal External focus Spontaneous Sporadic Widely shared Cost leadership Yahoo Cost focus Niche Focus Product differentiation Proactive Deductive Structured process System based Internal focus Deliberate Continuous Compartmentalized Organizational Life Cycle Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 25 Yahoo is still demonstrating some of the information/decision making style of a startup - most particularly, reactive, external focus, sporadic. However, some of the attributes of a more mature company are emerging wrt decisions. They are making some delegated decisions (compartmentalized) and are increasingly deliberate in their approach to decision making, however, they have a long way to go. Major influences of the decision making style are inherent in the leadership style and the culture which currently exists. The great variance in the three past leaders have hampered the evolution of the decision making process. As well, the market is still evolving with market share to be had in a growing market so while some product offerings in certain areas may warrant a more mature approach to decision making, others are still playing catch up in their particular areas. All this to say that there are no standardized decision making mechanisms in evidence but it is clear that the responses (marketplace) to certain decisions are being monitored as a first step in developing some metrics on which to base decisions. Semel: Experience/success in media industry as co-CEO of TW-AOL’s TW. Increased several fold the value of TW during his tenure there. Indicated would take 60 days to set out a strategy, a way forward for Yahoo. Moved quickly into new markets, clearly an external focus. Moved quickly to deal with profit and loss statement (layoffs) and abandoning LOBs with poor profit potential; an internal focus. Koogle: Snail-paced decision-making. Principally used concensus style decion-making which is more appropriate with a mature organization. Lost touch with market space, was too internal and futures focused; too much visioning and not enough business action. Q: Why is it that deductive reasoning does not work early in the life cycle? Because there is no early cycle experience on which to base analysis - every day is a different experience. 25 Strategy Performance Dashboard " " " " " " Sales volume (by ad/transaction and total) compared to baseline data Growth $ (by ad/transaction) New Customers Customer Retention Revenue per employee ROI,ROA,ROE – Incr Mgmt Effectiveness (managing margins) Version 0.8 Are we increasing Ad revenues? Are we moving towards 50-50 ad/transaction revenue split? ©2002 - Byrnes, Fevrier, Fontaine, Woods 26 Yahoo has a variety of products that are mature with established customer – both computer users and business advertisers. They are seeking to make these offerings more efficient and to retain the customers that they have. This is reflected in the key performance indicators which monitor this type of activity such as (refer to slide above). They are also developing new sources of revenue which would require a different key indicators such as the take up of product offerings by new customers and relative market share in new areas. The monitoring of the product mix will be important since they have an opportunity to cross sell their products within their market space. It would be interesting to monitor this activity in order to fine tune their strategy. Some metrics are applicable to both categories of products such as sales volumes, growth and margins. These can be used to examine the overall health of the company in comparison with the market. In the end, the performance dashboard must provide indicators that the strategies being followed are resulting in: 1. An increase in ad revenues (these were falling with the dot.com decline, and Yahoo wants to backfill lost dot.com ad accounts with accounts from more traditional businesses) 2. The ratio of ad revenues to transaction revenues must shift from its current 75:25 ratio to 50:50 ratio with a view to reducing exposure. 26 New Experienced Team No ‘20-something’ Yahoos here, BUT… …”Hesitation increases in relation to risk in equal proportion to age.” - Ernest Hemingway Chairman-CEO Semel 58 Accountable for strategy & corporate performance President-COO Mallett 37 Accountable for strategy implementation 6 SBUs R&D Exec-VP NA Operations 47 Chief Advertising Sales Officer 47 VP - Sales Western Region 37 VP - Sales Eastern Region 48 Version 0.8 VP - Sales Central Region Chief Global Marketing Officer 54 43 VP-Brand Marketing 59 Chief Solutions Officer Customer acquisition Sales strategies Partner relations 40 ©2002 - Byrnes, Fevrier, Fontaine, Woods 27 The fact there is a Chief Solutions Officer is indicative of an organization that it is moving towards maturity through a period of diversity. “Solutions” suggests that Yahoo is integrating its many products. Each member of this team has at least 10 years experience, much more so than the previous incumbents who had 3-5 years experience. They have plenty of contacts in the market place and have been very successful in their past careers. CRM is a major focus with this team - they are focused on keeping their market share, to leverage their branding initiative. Key success factors for strategy implementation. ADDITIONAL NOTES FOR CULTURE SLIDE: Leverage current quality culture as an opportunity (refer to SWOT) - is a site trusted by users for its integrity of content. The new team, which is much more experienced and older than its predecessors, could impact the culture of Yahoo. This more risk averse group will drag the Yahoo culture up the life cycle curve. This new team of veterans has breadth and experience in the industries of hi-tech, media, but mostly with traditional markets (not dot.com industry). This fits with the bifurcated revenue strategy of splitting the ad:transaction revenues 50:50 (from 75:25), and to increase ad revenues above current levels. 27 Staffing follows Strategy Generalists Risk takers Reactive Improvisers Results motivated Change accepting Undisciplined HR Cost leadership Yahoo Cost focus Niche Focus Specialists Risk avoiders Anticipative Process motivated Predictable Change resistant Disciplined Product differentiation Organizational Life Cycle Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 28 Focus on market after products are established. Requires highly qualified technical and management personnel; quality culture. Generalist vs specialist: Employed young personnel in its earlier 7 years as a start-up. Now it replacing the management team with folks with much more corporate experience, particularly in marketing and sales - definitely a seasoned team in terms of experience. Expertise comes with experience. Fit Semel’s strategy. Risk taker vs risk avoider: Yahoo! does have the right for doing mistake in its current life-cycle position, especially Semel (stakeholder pressure). So staffs do slowly what they have to do but in the good way. It corresponds to a move to more maturity: positive and controlled risk taking (better rationality). Experts. See partnerships, joint ventures … (spread risk, complementary staffs benefits) Reactive vs anticipative: more and more anticipative. After years of reactive style due to start up phase, the company is closer to the market, customers, stakeholders … So, staff’s closer look on those key elements means logically anticipations about what they have to deal with. Improvisers vs process motivated: better rationality of actions and behaviors means process motivated patterns. By reducing the number of SBU, Semel wants to have closer control so there is a need to control processes. Maybe experienced executives and mid-management will fasten and improve the transition from may 2001. Results motivated vs predictable: perfect mid-cycle position (growth phase), that is to say staffing focused on the future (see incentives) but also on short term results (for the success of diversification, restructuring and joint venture). Short term results are favored, but linked with medium or long term view (ex: 2004 objectives of revenue repartition). Ex: Mallet has to outline a succession plan before he leaves (testify the new approach of more control and prediction). Change accepting vs change resistant: after difficult beginning, Semel succeeded to inspire a dynamic for change. Staffing is very important for change. Staffs are well aware of the need to change, evolve …Change seems to be well accepted internally. Mallet’s quit supports this idea : he was a emblematic character of the company. So with its departure, strong signal. Required to make strategic change (cultural issue also). Still start up phase. No feedbacks about employees’ unhappiness. Undisciplined vs disciplined: more and more disciplined. With the arrival of new and experienced executives, greater discipline and control. More reflexion about the way to recruit the good people regarding strategic issues (expert in alliances, up-down integration...). Fit the strategy. Allows better control, strategy implementation. Yahoo is reinforcing its mid-management team with experts or high qualified people since strategy implementation requires closer and stronger follow-up (mistakes not possible). New start for the company. The risk in bringing on more specialists into the organization is that it may encumber issue resolution as each specialist brings their own perspective to the decision making table, which drags down the speed of decision making - CEO needs to actively manage this 28 issue. Incentives Follows Strategy Rewards tied to corporate performance •Will influence decision making •Could promote short term strategies •Turnarounds take time •Information management may follow •New, mature experienced team; measured risk taking. Yahoo Long term Output oriented Team based Uniform Subjective Risk promoting Informal Cost Focus Niche Focus Executives: ≈ $300k salary + stock options; 25% vesting in first Cost Leadership year, incremental Short term vesting up to 4 years Process oriented Individual based Differentiated Objective Risk Avoiding Formalized Product Differentiation Organization Life Cycle Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods Staff: Salary + limited stock options. Same vesting profile as execs. 29 Heavy equity package for Semel (and other executive staff); focus on long term company performance. Semel and Executives receive about $300k per year in remuneration plus stock options. Stock options fully vest to individual only after four years on the job. This incentive package has both long and short term components, which is a good fit with the strategy needs of Yahoo. Yahoo has short term turnaround needs - get cost structure under control, and focus its product/service offerings to generate revenues. It also has long term objectives of increasing ad revenues while concurrently reducing dependence on these revenues, I.e. 50:50 revenue split between ads and transaction revenues by 2004. This is a mid life-cycle incentive strategy with its salary (near term) and stock option (long term component). Yahoo is at the mid life-cycle point, so this incentive package works for it. The remuneration package is a mix of short term and long term incentives. Stock options reinforce positive risk taking behaviour. Executive rewards tied to corporate performance - has new, mature experienced team; more risk averse - will influence decision making - Could promote short term strategies (turnarounds take time) - information management may follow 29 Structure - then & now " " " " " " THEN - Functional Restricted view of goals - note ‘stay the course’ response to AOL-TW merger Slow response time Centralized decisionmaking - delayed Technical quality emphasis Sales growth Conflict between leaders Version 0.8 " " " " " " NOW - Divisional Goals: CSAT & effectiveness Profit-based planning Cross product coordination difficult Fast change in unstable environment High CSAT Decentralized decision-making ©2002 - Byrnes, Fevrier, Fontaine, Woods 30 GVA shifted from horizontal to vertical: acquisitions & partnerships - content - distribution channels ⇒ Divisional strategy Market rejuvenation ⇒ delayer 42 ‘SBUs’ to 6 ‘SBUs’ Need effectiveness to realize turnaround ⇒ shallow structure 30 Structure Divisional/Product Firm Compress # Divisions CEO COO Corporate Staff Manager Division A " " " " Manager Division B Manager Division C Context: 6 SBUs (reduced from 42 SBUs) Technology: Non-routine, high interdependence Size: Large - 3500 employees Goals: External effectiveness, adaptation, client satisfaction Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 31 Yahoo structure has changed from a strong functional organization to a divisional strucuture. The functional structure over which Koogle presided included 42 R&D ‘SBU’s; Yahoo was becoming unwieldy. Decision-making was slow, and there were missed market./merger opportunities, such as eBay. Semel cut back the number of R&D SBUs from 42 to 6 SBUs to engender a modicum of control over operations, to focus the organization on winning value propositions. This action to reduce the number of SBUs was intended to align it with the market opportunities. He also shifted the corporate structure more towards a true divisional structure. The SBU (divisional or product group structure) facilitates external effectiveness, adaptation and client satisfaction. Changing the corporate structure too much beyond a divisional structure would have destabilized the company and would have put at risk any needed efficiencies, effectiveness and timely delivery of new “product” needed for the market space. 31 Centre of Gravity Customer Content Development • • Content Assembly Transaction Distribution Services Channels Divisional structure lends itself to an ‘omellette’ style centre of gravity (blue) Yahoo has shifted from a single Portal business of content assembly to a “one stop shopping” business, expanding its business up and down the value chain. Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 32 Centre of Gravity (CoG) of Yahoo has shifted from focus on just ‘content assembly’, to expanding to include content development (upstream - home built, partnerships and acquisitions), developing its transaction servicers portfolio, and entering into partnerships with distribution channels like SBC (downstream). In essence the CoG has spread up and down the value chain. Each point on the value chain must be managed according to the requirements of that part of thevalue chain, ergo a divisional organization structure would seem to make sense. 32 Structure - follows Strategy Yahoo has deep pockets so it can diversify outside its traditional market during shakeout. Can fund emergent SBUs. Lack of Market Flexibility (control) Yahoo Previous Structure? Expected Structure Lack of Market Match (invent) Entrepreneur Lack of Market Research (adapt) Lack of Market Fit (align) Functional Divisional SBU Matrix Matrix Version 0.8 Outside Market (portfolio) ©2002 - Byrnes, Fevrier, Fontaine, Woods 33 Koogle left a legacy of a stable but complex organization with 42 SBUs (R&D). Notwithstanding the reference to SBUs, the organizational structure was a functional organization. Semel prefers close control, and he has achieved that by reducing the number of SBUs to 6, resulting in a much more simple organization - easier to control and focus on corporate objectives. The result of Semel’s restructuring strategy is: - concentrate on products & divisions with high potential. Probably aligned with the five revenue streams. - enabled cost reduction and facilitated control over a previously extremely diversified operation - forces lots of coordination with central office regarding plans, $, technology, personnel, I.e. efficiency and effectiveness increases. Caps pers growth (lay offs in Nov 2001). - In short, high degree of central control and decentralized decision-making. This is needed to meet short term goal of controlling the cost structure and the longer term 2004 objective of a 50:50 revenue split between ads and transactions. The structure appears to be a reasonable fit with his strategy. 33 Culture/Leadership follows strategy Leadership style ORGANIZATIONAL CULTURE Directive PRODUCTION Yahoo Effectiveness Efficiency Supportive SUPPORTIVE Logical QUALITY Inspirational (leadership style) CREATIVE (organizational culture) Version 0.8 Transformational Transactional (revolutionary) (evolutionary) ©2002 - Byrnes, Fevrier, Fontaine, Woods 34 Yahoo is acting like a grown-up. They have purposefully sought out sales and marketing veterans to bring in revenue and to compete against bigger and more diversified media companies. Since Semel’s arrival Yahoo has recruited industry veterans who have a breath of experience in consumer, media and interactive ventures and have access to industry decisions-makers and influencers. New recruits to the senior executive positions include: Terry Semel Greg Coleman (Reader’s Digest Association/ Executive VP NA Operations). Responsible for overseeing sales and marketing and all business units. Wenda Harris Millard (DoubleClick/Chief Advertising Sales Officer). Directs account management, client services and advertising sales. Her position is crucial in Yahoos efforts to court traditional advertisers. Her background fits the job she has executive positions at Internet ventures such as DoubleClick Inc. and Ziff Davis Media and at Traditional media operations such as Working Women Ventures Inc. and New York Magazine. John Costello (Sears/Chief Global Marketing Officer (newly created position)). Directs the brand marketing organization. Costello is credited for helping to revitalize the Sears brand. He over saw Sears’ marketing, public affairs, corporate communications, customer information, catalog, research and direct-response operations. He also helped Sears launch their Internet and e-commerce initiatives. He was named on e the 50 most influential People in Marketing by Advertising Age and elected to the Retail Marketing Hall of Fame in 1997, Costello has been recognized by his contemporaries as a leading marketing professional. Tim Sanders (Victoria Secret. Chief Solutions Officer (newly created position) Oversees customer acquisition, sales strategies and partner relationsThe average age of Yahoos senior executives is 47. Culture of Yahoo is currently one of logical-quality (pg 474). Technical focus - value individual performance; quality culture. Flexible in its approaches; accepts change as indicated by effective planning and problem solving. Where to go next? Wholesale change in culture is being pursued as company learns to sell content rather than process incoming orders (technical focus). 34 Business Stages Stage Business Dynamics Transitional Crisis Stage 2 - •Centralized analytical decision making and directive leadership •Decision to diversify into a multi-business operations represents a major shift in strategy requiring new management behaviour Professional Single Business (Content assembler) (Growth Stage) Stage 3 Professional Multi Business (Maturity) Version 0.8 •Formalized, functional organization structure •Emphasis on increased efficiency in operations •Decentralized analytical decision making •Divisional or strategic business unit (SBU) structure •Emphasis on portfolio management, especially where businesses are unrelated ©2002 - Byrnes, Fevrier, Fontaine, Woods 35 Yahoo is evolving as a business as one would expect. Under the leadership of Koogle and Mallett, Yahoo had hit the wall with regards to business development (not a negative connotation, just a reality). It has been a single business, per se, and should it wish to expand, survive, it must diversify. Under the leadership of Semel, the potential is there to transition Yahoo to stage 3, that of a multi-business. To do so, Yahoo must diversify, control its cost structure and retain, if not increase, its market share. 35 Summary " Are these factors a good fit with the selected Strategies?: " Issues with the factors: $Culture-Leadership $Staffing $Information- " OK " OK " OK $Incentives $Structure " OK " OK Decision making Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 36 Yahoo is on a reasonable track to recovery. The above-noted factors seem well aligned to the strategies that have been embraced. Yahoo may not have carried out this analysis; nonetheless, it appears that the leadership team has instinctively reached out to the correct combination of factors each supporting the strategies. It seems they know how to fix themselves. 36 Q&A Thank You Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 37 37 Back Up Slides #Corporate Overview #What is a Portal? #SPACE Analysis #Growth Strategy - Acquisition #Thoughts on Strategy #Internet Opportunities #The Value of On-Line Communities #Virtual Value Chain 38 38 Corporate Overview " Under the Yahoo brand, Yahoo provides broadcast media, communications, business, enterprize and commerce services. In Dec 2000, Yahoo’s global audience grew to 180 million unique users who viewed an average of approximately 900 million Wed pages per day on Yahoo-branded online properties. Yahoo makes its properties available without charge to users, and generates revenues primarily through the sale of advertisements, promotions, sponsorships, merchandising and direct marketing. The majority of advertising on Yahoo properties is sold through Yahoo internal sales force. Approximately 3,700 customers advertised on Yahoo Network during 4Q-2000, including 55 of the Fortune 100. Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 39 39 What is a Portal? " Portals are specific applications written to track specific information about users and their preferences (page layout, access to applications from application servers). Portals are a special case of an application running inside any application server. A portal provides frames for content layout. The content in each frame is referenced by URL and is unique to users. The URL in the frame can be content inside the portal or content from any other web site or any other portal. Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 40 40 SPACE - Competitive Advantage Factors determining competitive advantage: Market Share Product Quality Product Life cycle Product replacement cycle Customer loyalty Competitons capacity utilization Technological knowhow Vertical integration Speed of new prod. Intro Average - 6 Version 0.8 0 1 2 Small Inferior Late 3 3 4 5 6 Large Superior Early 4 3 Variable Low 2 Fixed High 4 Low 5 High Low Low 5 5 High High Slow 33 -3.7 0 2 4 Fast 6 8 15 0 ©2002 - Byrnes, Fevrier, Fontaine, Woods 41 Market Share: has largest market reach of top 3 Internet portals. Yahoo is 4% ahead of #2 MSN, and 12% ahead of #3 AOL-TW. Really not a large delta between market reach of top-3 Internet portals. Product Quality: Are customer focused. Insist on min. page times (no ‘flash’, designed for quick down-load). Recognize that users will not tolerate long download waits. If users have to make more than two clicks to get what they want, they move to another sight. Users use more than one search site to get work done some like academic and business intelligence researchers use 10. Product life cycle: Market perception - there are lots of users and the product is “old” now. Product life cycle is rather short. Product replacement cycle: Driven by rate of technology implementation. Line of sight for life cycle is probably less than 1-1.5 yrs. Customer loyalty: Not likely to be more than first “too long a wait” or “can’t find what I want” experience. Nonetheless, loyalty can be built by personalizing interactions with customers through exploiting Internet technologies and use of user Internet behaviours - tailoring information and options customers see at a site to just what they want. Can use its user-tracking technology/database to tailor portal experience for each user. Cheap way to provide high service level - displaces traditional costs for sales, marketing and service. Competitions capacity utilization: Unknown. Needs more detailed research. Technological know-how: Company is full of brilliant people. Few companies are able to sell technology to Yahoo. Either Yahoo is very good or they are self indulgent. Vertical integration: Is beginning to follow lead to AOL-TW who have merged an Internet portal (AOL) with a major media company (TW). Speed of new product intro: New products are coming on line relatively quickly. 41 SPACE - Financial Strength Factors determining financial strength: Return on Investment Leverage Liquidity Cap. Req. vs Cap Available Cash flow Ease of exit Risk involved in Business Inventory turnover Economies of scale and experience Average Version 0.8 Low Imbalanced Imbalanced 0 0 1 2 3 4 5 6 High Balanced Solid 1 4 High Low Difficult Much Slow 2 Low High Easy Little Fast 5 1 1 Low 18 2.3 0 3 2 0 4 8 High 5 0 ©2002 - Byrnes, Fevrier, Fontaine, Woods 42 ROI: ROI is currently negative, -4.5% TTM, and -8.9% 5 yr average. Leverage: “= 0”. This low ratio indicates owner is too conservative and is not letting business realize its potential. Liquidity: Rule of thumb, should be ≅ 2:1. Is at 3.18, implying deep pockets to weather bad times and/or to pursue M&A strategy. Cap. Req. vs Cap available: Very high 5 yr cap spending rate: 245%, compared to industry 5 yr cap spending rate of -37%. Cap is not as freely available as just a year ago. This is key as cap will be required for M&A strategy re: vertical integration. Cashflow: ??????? Ease of exit: Lots invested in Portal sites, and support infrastructure for soft assets, globally. Risk involved in business: Relatively high. Inventory turnover: N/A Economies of scale and experience: One of industries first Internet Portals - good experience base. 42 SPACE - Environmental Stability Factors determining environmental stability: Technological changes Rate of inflation Demand variability Price range of competing products Barrier to entry into market Competitive pressure/rivalry 0 Version 0.8 2 2 3 4 5 6 5 Few 6 Low Small Wide 5 Narrow Few 5 Many High 0 Price elasticity of demand Elastic Pressure from substitute products High Average - 6 1 Many High Large Low 5 Inelastic 1 29 -3.6 1 Low 2 0 0 20 6 ©2002 - Byrnes, Fevrier, Fontaine, Woods 43 Technological changes: Constant - search engines are always improving, as example Rate of inflation: low Demand variability:Don’t think it is too variable (what indicator do we use?). Price range of competing products: (need to check this out with AOL and MSN) Assume is similar amongst top three. There is likely a price war to erupt as companies vy for volume leadership to avoid having to lay off personnel in response to lower market demands. Eventually, shakeout ensues followed by consolidation, after which capacities are brought back in line with market demand. Barrier to entry into market: Likely is high cost - need to better understand this.High asset costs (high tech) and high cost knowledge workers to keep it evolving. Competitive pressure: There is a fair bit of competitive pressure. There is only a 4% delta in market reach between the number 1 and the number 2 portal, and 12% for the number 3 portal. Price elasticity of demand: demand of users has clearly risen, but demand by advertisers has declined. Will be hard to convince users to pay for what they have always gotten for free. Price elasticity with advertisers declining. Pressure from substitute products: I am not aware of substitutes other than non-online research services. 43 SPACE - Industry Strength Factors determining industry strength: Growth potential Profit potential Financial Stability Technological Knowhow Resource Utilization Capital Intensity Ease of entry into market Productivity, capacity utilization Manufacturers bargain power 0 2 3 4 4 4 5 6 High High High 2 Simple Inefficient Low 5 5 5 Complex Efficient High Easy 5 Difficult Low 5 High Low 37 4.1 Average Version 0.8 1 Low Low Low 0 2 4 High 0 8 25 0 ©2002 - Byrnes, Fevrier, Fontaine, Woods 44 Growth potential: Has 52% of global market reach. Could theoretically double in size. Profit potential: If is able to untrain its user base to pay for what it used to get for free, or up-sell users to purchase content, profit potential could be enormous. Since 9-11, online transactions has skyrocketed. Financial stability: Industry appears strong. Internet use is not going away, but means to generate revenues is evolving. Internet is way to do business, and industry is getting better at that. Industry is nearing shakeout (instability) which will then lead to stability. Technological know-how: This is a core competency of Yahoo. Resource utilization: Unknown Capital intensity: Business is capital intensive. Ease of entry into market: Not particularly easy. High capital costs. Productivity, capacity utilization: Yahoo is less productive than industry norms would suggest it could be. Indicators include: (1) Asset Turnover: 0.3 vs industry 0.63, S&P 500 0.96; (2) Revenue per employee: $220k vs Industry - $298k. S&P 500 - $534K. Manufacturers bargain power: Don’t think there is much bargaining power, as users and clients can easily go to competition such as MSN and AOL-TW. 44 SPACE Analysis - Yahoo! 2.3 Status Quo FS Conglomerate Diversification Concentric Diversification Concentration Overall Cost Leadership Focus Vertical Integration Diversification - 3.9 Conservative Aggressive CA Divestment Defensive Gamesmanship 4.1 IS Concentric Differentiation Merger Competitive Liquidation Conglomerate Merger ES Retrenchment - 3.6 Version 0.8 Turnaround ©2002 - Byrnes, Fevrier, Fontaine, Woods 45 45 Growth Strategy - Acquisitions 1997 " Four11 1998 " WebCal Corp " Yoyodyne Entertainment,Inc " Viaweb, Inc " HyperParallel, Inc 1999 " Encompass, Inc " GeoCities " Online Anywhere Broadcast.com Inc " Log-Me-On.com " LLC " Yahoo!Canada Version 0.8 1999 (continued) Innovative Systems " Services Group, Inc " Broadcast.com 2000 " Arthas.com " eGroups, Inc 2001 " VivaSmart,Inc " SOLD.com.au " Launch Media, Inc. " HotJobs 2002 " Cadê " ©2002 - Byrnes, Fevrier, Fontaine, Woods 46 46 Structure Evolution " GVA shifted from horizontal to vertical: acquisitions & partnerships • content • distribution channels ⇒ Divisional strategy " Market rejuvenation ⇒ delayer " " 42 ‘SBUs’ to 6 ‘SBUs’ Need effectiveness to realize turnaround ⇒ shallow structure Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 47 47 Thoughts on Strategy " See next slides Internet opportunites The value of on-line communities " The virtual value chain Semel is slashing the number of business units from 42 to 6, replacing key executives, and trying to change the company’s relationship with many corporate clients and its customer base - can Yahoo! Be successful on so many fronts? The management changes will require a wholesale change to the entire corporate culture, as the company learns to sell content rather than process incoming orders. " " " " *after Can Yahoo! Change its stripes, D. Sterman, 2001-12-11 Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 48 48 Internet Opportunities " " " " Links companies directly to customers Lets companies bypass other players in an industry’s value chain It is a tool for developing and delivering new products and services to new customers Enables certain companies to dominate the electronic channel of an entire industry or segment, control access to customers, and set business rules * after Making Business Sense of the Internet, S. Ghosh, 1998 Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 49 49 The Value of On-Line Communities " " Real value of on-line communities will come from providing people with the ability to interact with one another - from satisfying their multiple social needs as well as their commercial needs. Create strong on-line communities to create customer loyalty. Types of communities. Communities of: " " " " " Incorporate as many as possible in on-line community Ways to generate economic value (returns ): " " " " * transaction interest fantasy relationship usage fees content fees transactions and advertising synergies with other parts of its business after The Real Value of On-Line Communities, A. Armstrong, J. Hagel III, 1996 Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 50 50 Virtual Value Chain " " The value chain in the physical world is a model that describes a series of value-adding activities connecting a company’s supply side with its demand side. This value chain treats information as a supporting element of the value-adding process, not as a source of value itself. The value adding processes that companies must employ to turn raw information into new market-space services and products are unique to the information world. The valueadding steps are virtual in that they are performed through and with information. Creating value in any stage of a virtual value chain involves a sequence of five activities: gathering, organizing, selecting, synthesizing, and distributing information. * after Exploiting the Virtual Value Chain, J. Rayport, J. Sviokla, 1995 Version 0.8 ©2002 - Byrnes, Fevrier, Fontaine, Woods 51 51