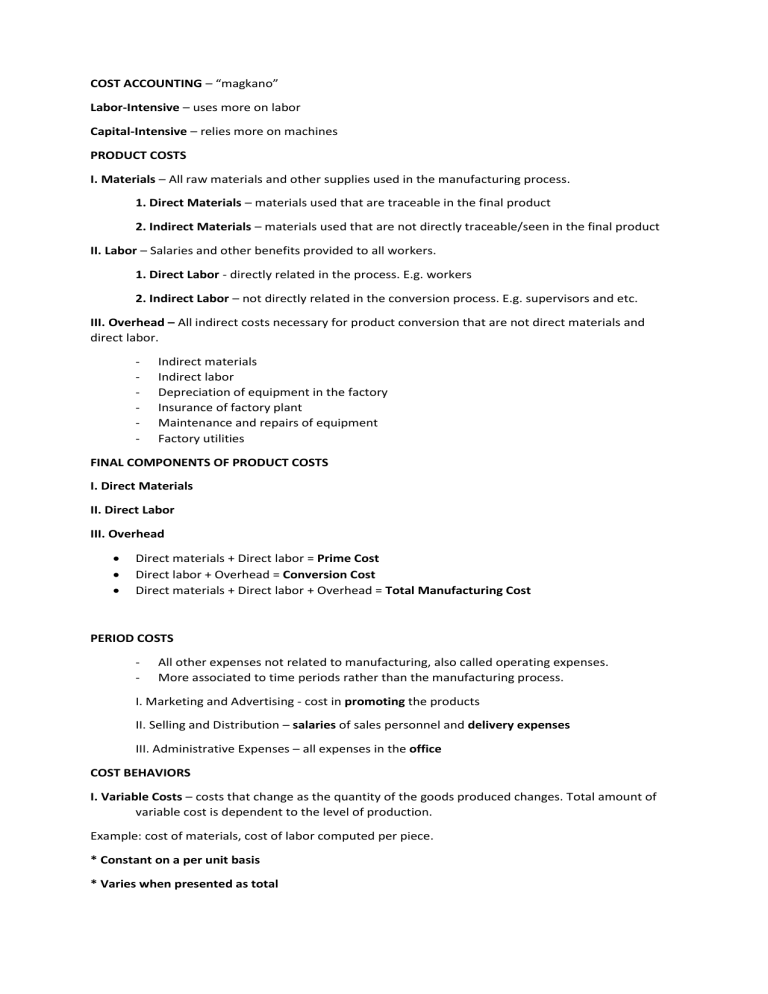

COST ACCOUNTING – “magkano” Labor-Intensive – uses more on labor Capital-Intensive – relies more on machines PRODUCT COSTS I. Materials – All raw materials and other supplies used in the manufacturing process. 1. Direct Materials – materials used that are traceable in the final product 2. Indirect Materials – materials used that are not directly traceable/seen in the final product II. Labor – Salaries and other benefits provided to all workers. 1. Direct Labor - directly related in the process. E.g. workers 2. Indirect Labor – not directly related in the conversion process. E.g. supervisors and etc. III. Overhead – All indirect costs necessary for product conversion that are not direct materials and direct labor. - Indirect materials Indirect labor Depreciation of equipment in the factory Insurance of factory plant Maintenance and repairs of equipment Factory utilities FINAL COMPONENTS OF PRODUCT COSTS I. Direct Materials II. Direct Labor III. Overhead Direct materials + Direct labor = Prime Cost Direct labor + Overhead = Conversion Cost Direct materials + Direct labor + Overhead = Total Manufacturing Cost PERIOD COSTS - All other expenses not related to manufacturing, also called operating expenses. More associated to time periods rather than the manufacturing process. I. Marketing and Advertising - cost in promoting the products II. Selling and Distribution – salaries of sales personnel and delivery expenses III. Administrative Expenses – all expenses in the office COST BEHAVIORS I. Variable Costs – costs that change as the quantity of the goods produced changes. Total amount of variable cost is dependent to the level of production. Example: cost of materials, cost of labor computed per piece. * Constant on a per unit basis * Varies when presented as total II. Fixed Costs – whatever the level of production is, the cost doesn’t change. It is independent from the level of production. Example: rent of facilities, depreciation of equipment * Constant when presented as a total * Varies on a per unit basis COST EQUATION y=a+bx y = total cost a = total fixed cost b = variable cost per unit x = volume of activity/how many units III. Mixed Cost – refers to costs that has both variable and fixed components. Example: Utilities like electricity, since these are charged with a base amount and goes higher with any usage over the base amount. In separating mixed costs, there can be two methods to be used: 1. High-Low Method 2. Least Squares Regression Method IV. Step Cost – costs that are constant on a certain level of activity but increases or decreases on another certain level of activity. Example: Airlines agent (people server) – salaries and commission goes up when they meet certain quote requirement of how many people they served. Other Cost Tems V. Opportunity Cost – benefits foregone in choosing one action over another. * used in decision making VI. Sunk Cost – Cost incurred that will not affect a future decision. VII. Committed Cost – Costs resulting from organizational structure or use of facilities. VIII. Discretionary Cost – Costs arising from managerial decisions. IX. Controllable Cost – Costs that are able to be influenced on how much shall be spent. X. Non-Controllable Cost – Costs that can’t be controlled or influenced. MANUFACTURING JOURNAL ENTRIES 3 Kinds of Inventory in Manufacturing Business 1. Raw Materials Inventory - the materials or supplies to be consumed in the production process. 2. Work-in-process Inventory – items that are currently in the process of production. 3. Finished Goods Inventory - items that are finished and are held for sale in the business.