Module 4: Consolidation subsequent to acquisition: Part 1:

advertisement

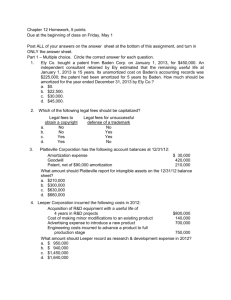

FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Module 4: Consolidation subsequent to acquisition: Part 1: Three methods an investor can use to REPORT its investment in an investee: • At each balance sheet date, the investor must decide how to present the investment on its financial statements, according to the level of influence that the parent has over the investee. • If the investor has no significant influence over its investment, this passive type of investment would be reported using the fair value method (or cost method if qualify for differential reporting or no fair value available for AFS). • If the investor had significant influence, the investment would be reported using the equity method (one line, ‘the investment account’, on the balance sheet (B/S) and one line, ‘investment income’, on the income statement (I/S). The impact on the investor’s net asset position is identical to consolidation. • If the investor controls the investee (creating a parent-subsidiary relationship), the investment would be reported using Consolidation (cost or equity method if qualify for differential reporting). Parent can use 2 methods to RECORD its investments in a subsidiary: 1. The Cost method: records the initial acquisition at the purchase cost in the investment account, and dividend payments are treated as revenue when they are declared by the investee. The investment account is only adjusted for subsequent changes in the parent’s ownership interest, permanent impairment or if the investee pays a liquidating dividend. 2. The equity method: records the initial purchase at the purchase cost in the investment account and adjusts it each subsequent year for the parent’s share of the investee’s net income, dividends and consolidation-type adjustments (purchase discrepancy amortization, goodwill impairments and unrealized profits on intercompany transactions). ‘One line’ consolidation – parent’s net income and retained earnings equal consolidated totals because of the adjustment in one line on the parent’s balance sheet (investment account) and one line on the income statement (investment revenue). • • • Parent company would use the cost method to record its investments because it is simple to use and simple for users to understand, the parent’s separate financial statements report only the results of its operation and financial users may require non consolidated statements. Parent company would use the equity method to record its investments because adjustments for consolidation are recorded in the parent’s books and provides retained earnings and income figures to be the same as consolidated income and retained earnings. Thus, it facilities the preparation of consolidated statements each year. The following parent’s financial statements account balances differ depending on which method is used: Investment in subsidiary, retained earnings, dividends income (used for cost method) and investment income (used for equity method). 1 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Purchase discrepancy amortization and goodwill impairment schedule: • Each year, the purchase discrepancy must be amortized to reflect the use of the subsidiary’s assets and liabilities, as if these assets and liabilities had been acquired directly by the parent.The investment revenue and account is reduced (or increased if NBV>FMV) by yearly amortization amounts of the purchase discrepancy as the subsidiary's amortization is based on NBV and thus the FMV is not reflected in subsidiary's books resulting in subsidiary's amortization expense too low (or too high if NBV>FMV).The investment revenue and investment account is also reduced by any goodwill impairment loss.To prepare a purchase discrepancy amortization and goodwill impairment schedule, all the fair value increments (FVIs) and goodwill at acquisition are listed in the first column and the total equals purchase discrepancy amount. • Second column all FVIs amortization and goodwill impairment loss up to the current year adjusted to opening consolidated retained earnings, third column all current year FVIs amortization and goodwill impairment loss adjusted on the consolidated income statement and fourth column, remaining balances of FVIs and goodwill adjusted on the consolidated balance sheet. • Assumptions are made as to the remaining life of the item, the period to maturity, or when the underlying item will be used by the subsidiary. • Review Exhibit 4.2-1. Current assets/liabilities = 1 year; Capital assets/Intangibles with finite life = useful life; Long-term debt = years to maturity; Goodwill/Intangibles with indefinite life = impairment loss. • Inventory is normally amortized within 1 year unless the subsidiary uses LIFO then the Purchase discrepancy FVI may remain for a longer period until the beginning inventory from acquisition date is used up and then it will be adjusted thru CGS on the consolidated income statement (see Question 3, December 2005 exam). • Unamortizable assets (i.e. land) are not subject to amortization and the original fair value increment (FVI) remains until the asset is sold to an outside party. • Each year, goodwill and other intangible assets with indefinite useful lives remaining must be tested for impairment. • Any resulting impairment loss is recorded in the consolidated income statement. • The yearly amortization or impairment loss for each item is calculated to determine the annual adjustment to investment income and the unamortized or unimpaired balance of each asset or liability at the end of the year. The unamortized or unimpaired balance of each asset or liability at the end of the year balances is reported on the consolidated balance sheet. • NCI is not affected by the purchase discrepancy amortization (NCI is not part of the purchase transaction so they do not participate in the FVIs of the subsidiary's assets and liabilities). 2 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Part 2: How to account for goodwill and other intangible assets:In July 2001, CICA handbook approved the replacement of Section 3060 with Section 3061 & Section 3062. Section 3062 must be applied by most organizations for fiscal year beginning on or after January 1, 2002. • Section 3062 distinguishes between intangible assets, other than goodwill, that have a defined (or limited) life and those whose useful life is considered to be indefinite. • The cost of intangible assets with a limited life, other than goodwill, is to be amortized in a systematic and rational manner similar to other amortizable assets (i.e. building) • Section 3062 requires that the estimated useful life and method of amortization be • Intangibles with indefinite lives and goodwill are subject to an annual impairment test (no longer amortized). • Section 3062 has introduced the concept of recording a loss when the fair value of these assets are less than their carrying value. Impairment test determines the lossIn December 2002, Section 3063 “Impairment of long-lived assets” was approved. It addresses measurement, recognition and disclosure issues for assets with finite limited lives (i.e. applies to tangible assets). The important features of the impairment test are: o It is either a one-part or two-part test (intangible assets are only subject to the first part whereas goodwill is subject to the second part if its carrying value>fair value). o The first part of the test compares the carrying value of the asset to its fair value. o The fair value of an intangible asset is determined by reference to its expected value in the market. o The test is to be conducted annually for each intangible asset (Exception: if qualify for differential reporting, under certain circumstances qualifying enterprises may elect to do so only when an event or circumstance occurs that indicates that the fair value of a reporting unit may be less than its carrying value).Process to determine if Goodwill is impaired: • Goodwill derives its value from all aspects of the firm. Thus, in order to determine its fair value, we have to determine the fair value of the firm.To determine if goodwill is impaired: o The fair value of goodwill is calculated in the same manner as goodwill is calculated in a business combination; purchase price minus fair market value. (Problem: determining the “purchase price” when there is no offer to purchase can be difficult but using share value or a business valuator may help). o Next, the fair market value of the goodwill is compared to its carrying value. o If fair value is less than carrying value, the difference is reported as a goodwill impairment loss on the consolidated income statement before extraordinary items and discontinued operations. 3 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Part 3: Class example 1:Pa Co. purchased 75% of the outstanding common shares of Son Co. on January 1, 2002 for $630,000. Son’s common shares were $500,000 and retained earnings were $300,000 at this time. Son’s assets and liabilities had fair values equal to book values. On January 1, 2004, Son Co. was valued at $800,000. At this time Son’s Retained earnings were $290,000. All Son’s assets and liabilities were equal to their fair value. No new shares have been issued since the acquisition date. No goodwill impairments have been recorded to date. Required: Determine the amount of goodwill impairment to be recognized by Pa Co. on its 2004 consolidated income statement. January 1, 2002 – acquisition date: Calculation and allocation of purchase discrepancy: Cost of 75% of Son $ Book value of Son: Common shares $ 500,000 Retained earnings 300,000 800,000 Pa’s ownership 75% Purchase discrepancy = goodwill January 1, 2004 Calculation and allocation of purchase discrepancy: FMV of Son FMV of Pa’s 75% Book value of Son: Common shares Retained earnings Pa’s ownership Purchase discrepancy = goodwill $ 630,000 600,000 30,000 800,000 600,000 $ 500,000 290,000 790,000 75% 592,500 7,500 Impairment loss = carrying value less fair market value = $30,000 – $7,500 = $22,500 Goodwill impairment loss of $22,500 should be reported on Pa’s 2004 consolidated income statement. Working paper JE: Impairment loss 22,500 Goodwill 22,500 If parent used equity method for recording: DR Investment income (loss) 22,500 CR Investment in Son 22,500 4 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Part 4: Consolidated financial statements for the first and subsequent year ends after acquisition when a parent uses the equity method of recording: • Consolidated net income will be equal to reported net income on the parent’s separate entity income statement prepared under the equity method. • Consolidated retained earnings will be equal to retained earnings on the parent’s own separate entity balance sheet prepared under the equity method. • When preparing consolidated financial statements, first determine what the final account balances should be on the consolidated financial statement. • Consolidated financial statements should be a straight add of the financial statements of the parent and subsidiary plus or minus the consolidation adjustments. Approach for preparing consolidated financial statements: • Prepare schedules in the following order to determine the consolidation adjustments: • Calculation and allocation of purchase discrepancy • Purchase discrepancy amortization and goodwill impairment schedule • Intercompany sales, receivables and payables • Intercompany profits, gains and losses • Calculation of the noncontrolling interest • Prepare consolidated financial statements using the schedules previously prepared. • Intercompany payables or receivables are not reported, as they do not represent an obligation outside the economic entity (seen by the consolidated entity as inter-branch transfers). Also offsetting accounts need to be removed to avoid double counting and distorting the financial ratios. Since there is no economic effect (net assets are not changed), the eliminations of these items have no impact on retained earnings, NCI or shareholders’ equity. Working paper approach when a parent uses the equity method of recording: • The working paper approach when the equity method has been used requires that you make the following entries: 1. Remove the subsidiary’s current-year equity-based net income and dividends, reducing the investment account to its balance at the beginning of the year. 2. Eliminate the subsidiary’s beginning of the year retained earnings and common shares, set up the opening balance of the NCI, and reverse the balance of the investment account. At the same time, record the total purchase discrepancy amortization and impairment losses for the current year (including write-offs to cost of goods sold and interest expense) and set up the unamortized and unimpaired balances of the FVIs and unimpaired goodwill at the end of the year according to the purchase discrepancy amortization and impairment schedule.3. Allocate to the NCI its share of the subsidiary’s separate entity current-year net income. Reduce the NCI by its percentage of the subsidiary’s current-year dividends. 4. Eliminate any intercompany sales, payables, receivables, profits, gains and losses. 5 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Part 5: Prepare consolidated financial statements for the first and subsequent year after acquisition when a parent uses the cost method of recording: • Final balances on the consolidated statements will be exactly the same regardless of whether the cost method or equity method was used in preparing the parent’s separate entity statements. • Since the starting position is different, the consolidation adjustments must be different between the cost method and equity method in order to end at the same consolidated statements. Working paper approach under cost method: • Initial adjusting entries on the working paper are: 1. Adjust the parent’s investment account and retained earnings at the beginning of the year to the balances they would have been if parent used the equity method. 2. Replace dividends revenue from the subsidiary for the current year with the equity method income. Difference is reflected in an entry to the investment account. Steps to prepare consolidated financial statements when the cost method was used in the parent’s general ledger: • • • • • Prepare schedules to convert the parent’s records from the cost method to the equity method. In addition to those prepared when the equity method is used, calculate the consolidated net income and consolidated opening retained earnings. Perform the same procedures as when the equity method of recording has been used, with some differences. Note: Three (3) main differences between cost and equity method: When the parent uses the cost method for recording, you need to calculate consolidated net income, calculate consolidated retained earnings and prepare adjusting entries before eliminating entries. Under the cost method, consolidation-type adjustments are recorded on a consolidated worksheet and are NEVER recorded in the parent’s separate entity books. Net income represents results for one reporting period. When calculating consolidated net income, only make adjustments applicable to the reporting period.When calculating consolidated retained earnings, include the cumulative effect of all consolidation adjustments made from the acquisition date to the end of the reporting period. NCI on the income statement represents the NCI’s share of the subsidiary’s net income for one reporting period. When calculating NCI on the income statement, only include adjustments applicable to the reporting period. 6 FA4 Class notes • Barbara Wyntjes, B.Sc., CGA. NCI on the balance sheet represents NCI’s share of the subsidiary’s shareholders’ equity at the reporting date. When calculating NCI, include the cumulative effect of all adjustments made to the end of the reporting period. Direct approach:The direct approach requires the following: o Replace the investment income account with 100% of the subsidiary’s revenue and expenses adjusted for the current year’s purchase discrepancy amortizations and impairment losses. o Eliminate any intercompany payables or receivables. o The investment account is replaced with goodwill and the subsidiary’s assets and liabilities, adjusted for purchase discrepancy amortization and impairment loss. • Add NBV of parent and subsidiary plus or minus FVIs and consolidation adjustments • The NCI’s portion of the subsidiary’s separate entity net income and net assets will have to be deducted on the income statement and included on the balance sheet between liabilities and shareholders’ equity. NOTE the starting point when adding line by line the separate legal financial statements of the parent and subsidiary. Both are at book value and since legally they are outsiders to each other, they must report gains, losses, profits, revenues, expenses, payables, receivables, sales and purchases between them. This is why we have to adjust: 1: FVIs as if legal title transferred at acquisition and thus the assets and liabilities of the subsidiary would have been recorded in the books at FMV. Then amortization would have been based on FMV, goodwill would have been recorded and the balances would show up on the subsidiary’s balance sheet. 2: For all intercompany transactions. Part 6: Class example 2: On January 1, 2001, Pal Ltd. purchased 80% of the outstanding shares of Son Company for $1,000,000 in cash. On the date of the purchase, Son’s balance sheet and fair values were as follows: SON COMPANY Balance Sheet At January 1, 2001 Book value Fair value Assets Cash $ 40,000 $ 40,000 Accounts receivable 100,000 95,000 Inventory 180,000 200,000 Equipment — net 500,000 450,000 Land 300,000 450,000 $ 1,120,000 7 FA4 Class notes Liabilities Accounts payable Bonds payable Shareholders’ equity Common shares Retained earnings Barbara Wyntjes, B.Sc., CGA. $ 110,000 360,000 594,000 115,000 360,000 450,000 200,000 650,000 $ 1,120,000 Son has a new patent that is not recorded in its books but has a fair value of $250,000. The patent rights extend for another 20 years. The equipment in Son’s books has an expected remaining useful life of 10 years. Due to economic changes the annual goodwill impairment tests resulted in a $9,600 loss in 2001 and 2002. At December 31, 2002, Son owed Pal $80,000 in a non-interest bearing current note. During 2002, Pal paid $200,000 in dividends and Son paid $100,000 in dividends. The income statements and balance sheets for both companies for the year ended 2002 are as follows: Balance Sheets At December 31, 2002 Pal Ltd. Son Company Assets Cash $ 50,000 $ 35,000 Accounts receivable 200,000 40,000 Notes receivable 120,000 Inventory 900,000 150,000 Land 1,000,000 900,000 Equipment 3,500,000 490,000 Investment in Son (cost basis) 1,000,000 — $ 6,770,000 $ 1,615,000 Liabilities Accounts payable $ 70,000 $ 150,000 Notes payable 80,000 Bonds payable 200,000 360,000 270,000 590,000 Shareholders’ equity Common shares Retained earnings 2,000,000 4,500,000 6,500,000 $ 6,770,000 450,000 575,000 1,025,000 $ 1,615,000 8 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Income Statements For the year ended December 31, 2002 Sales Cost of goods sold Amortization expense Administration expense Other expenses Investment income (100,000 x 80%) Net income before taxes Income tax Net income Pal Ltd. $ 8,000,000 5,500,000 2,500,000 Son Company $ 5,000,000 2,900,000 2,100,000 300,000 400,000 600,000 1,300,000 110,000 400,000 910,000 1,420,000 80,000 — 1,280,000 576,000 $ 704,000 680,000 306,000 374,000 $ Required: a. Calculate the purchase discrepancy amortization schedule for 2001 and 2002. b. Calculate the consolidated net income for 2002, and indicate the non-controlling interest claim on Son’s 2002 income. c. Calculate the consolidated retained earnings at January 1, 2002. d. Prepare the consolidated financial statements (balance sheet and statement of income and retained earnings) for Pal at December 31, 2002, using the direct method. e. Prepare the adjusting and eliminating journal entries for 2002. Class example 2 Solution: a) Calculation and allocation of purchase discrepancy: Cost of 80% of Son $ Book value of Son: Common shares $ 450,000 Retained earnings 200,000 650,000 80% Purchase discrepancy Allocated: (FV – BV) × % Accounts receivable – 5,000 × 80% – 4,000 Inventory 20,000 × 80% 16,000 Equipment –50,000 × 80% –40,000 Land 150,000 x 80% 120,000 Patent rights 250,000 × 80% 200,000 Accounts payable -5,000 × 80% –4,000 Balance — goodwill 1,000,000 520,000 480,000 288,000 $ 192,000 9 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Calculation of noncontrolling interest Shareholders’ equity, Son Noncontrolling interest’s ownership Noncontrolling interest $ 650,000 20% $ 130,000 Purchase discrepancy amortization and impairment schedule: Balance at Amortization/ Amortization/ Acquisition Impairment Impairment Jan. 1, 2001 2001 2002 Accounts receivable –4,000 –4,000 — Inventory 16,000 16,000 — Equipment (10 years) –40,000 –4,000 –4,000 Land 120,000 — — Patent rights (20 years) 200,000 10,000 10,000 Accounts payable –4,000 –4,000 — Goodwill 192,000 9,600 9,600 480,000 23,600 15,600 * $32,000: CV in excess over FV (Online lecture – said opposite) Remaining at Dec. 31, 2002 — — –32,000* 120,000 180,000 — 172,800 440,800 b) Calculation of consolidated net income — 2002 Pal’s net income — cost method Less: Dividend income from Son ($100,000 × 80%) Pal’s net income, own operations Son net income $ 374,000 Pal’s ownership 80% 299,200 Less: Purchase discrepancy amortization/impairment 15,600 Pal’s net income — equity method $ 704,000 80,000 624,000 Noncontrolling interest ($374,000 × 20%) $ 74,800b 283,600g $ 907,600a c) Calculation of consolidated retained earnings at January 1, 2002 Pal’s R/E at January 1, 2002 (4,500,000 – 704,000 + 200,000) Son’s R/E at December 31, 2001 (575,000 – 374,000 + 100,000) Son’s R/E at January 1, 2001 Increase since acquisition Pal’s ownership Less: Purchase discrepancy amortization/impairment to the end of 2001 Consolidated R/E at January 1, 2002 $3,996,000 $ 301,000h (200,000) 101,000 80% 80,800 23,600 57,200f $4,053,200c 10 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Part 7: Calculation of NCI at December 31, 2002 Son’s common shares at December 31, 2002 Son’s retained earnings at December 31, 2002 $ 450,000 575,000 NCI $1,025,000 20% $ 205,000e d) PAL CORPORATION Consolidated Balance Sheet At December 31, 2002 Cash (50,000 + 35,000) Accounts receivable (200,000 + 40,000) Note receivable (120,000 + 0 – 80,000) Inventory (900,000 + 150,000) Land (1,000,000 + 900,000 +120,000) Equipment (3,500,000 + 490,000 –32,000) Patent rights Goodwill $ 85,000 240,000 40,000 1,050,000 2,020,000 3,958,000 180,000 172,800 $7,745,800 Accounts payable (70,000 + 150,000) Note payable (0 + 80,000 – 80 000) Bond payable (200,000 + 360,000) Noncontrolling interest Common shares Retained earnings (4,053,200c + 907,600a – 200,000) $ 220,000 — 560,000 205,000e 2,000,000 4,760,800d $7,745,800 11 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Consolidated Statement of Income and Retained Earnings For the year ended December 31, 2002 Sales (8,000,000 + 5,000,000) COGS (5,500,000 + 2,900,000) $13,000,000 8,400,000 4,600,000 406,000 800,000 10,000 1,510,000 2,726,000 9,600 Amortization (300,000 + 110,000 – 4,000) Administration (400,000 + 400,000) Patent amortization Other expenses (600,000 + 910,000) Loss due to goodwill impairment Net income before tax Less: Income tax (576,000 + 306,000) Net income — entity Less: Noncontrolling interest (374,000 x 20%) Net income 1,864,400 882,000 982,400 74,800b 907,600a Consolidated retained earnings at January 1 Less: Dividends declared 4,053,200c 200,000 Consolidated retained earnings at December 31, 2002 $4,760,800d e) Adjusting entries 2002: a. Investment in Son Retained earnings, Jan. 1’02 57,200f 57,200 To adjust the investment account and opening retained earnings of Pal to the equity basis at Dec. 31, 2001 (See calculations of cons. opening retained earnings for amounts). Recall not recorded in book so must make this adjustment. b. Dividend income Investment in Son Investment income 80,000 203,600 283,600g To reverse dividends income from Son recorded by Pal, and record equity basis net investment income (see calculations of cons. NI for amounts). 12 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. Eliminating entries for 2002: 1. Investment income 283,600 Investment in Son 203,600 Dividend income 80,000 To eliminate investment income and Pal’s percentage of Son’s dividends against the investment account. (Note: reverse of b. adjusting JE) 2. Common shares – Son’s 450,000 Retained earnings, Jan. 1’02 – Son’s 301,000h Purchase discrepancy (480,000-23,600) 456,400 Investment in Son (1,000,000 + 57,200) 1,057,200 Noncontrolling interest – B/S[(450,000 + 301,000)20%] 150,200 To eliminate Son’s beginning of the year common shares and retained earnings against the start of the year investment account, and set up purchase discrepancy and noncontrolling at the beginning of the year. 3. Patent 180,000 Goodwill 172,800 Land 120,000 Patent amortization Goodwill impairment 10,000 9,600 Equipment 32,000 Amortization exp (equip) 4,000 Purchase discrepancy 456,400 To allocate purchase discrepancy at the beginning of the year, record current year amortization expense and impairment loss, and set up unamortized purchase discrepancy and unimpairment balances at the end of 2002. 4. Noncontrolling interest – I/S 74,800b Noncontrolling interest – B/S 74,800b To allocate noncontrolling share of Son’s 2002 net income. 13 FA4 Class notes Barbara Wyntjes, B.Sc., CGA. 5. Noncontrolling interest - B/S 20,000 Dividends – Son. 20,000 To reverse noncontrolling percentage of dividends declared by Son (100,000 x 20%). 6. Note payable 80,000 Note receivable 80,000 To eliminate intercompany receivable/payable. Note: NCI – BS = 150,200 + 74,800 – 20,000 = 205,000 THE END 14