Chapter 12 Homework, 5 points

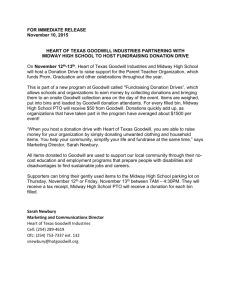

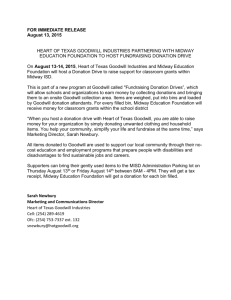

advertisement

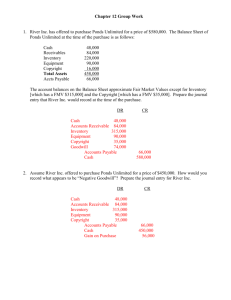

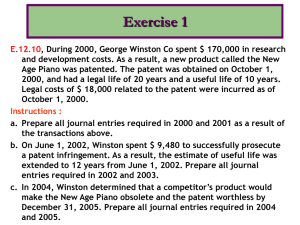

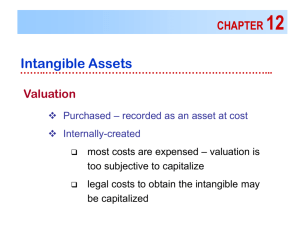

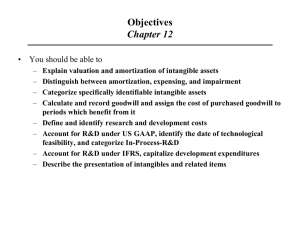

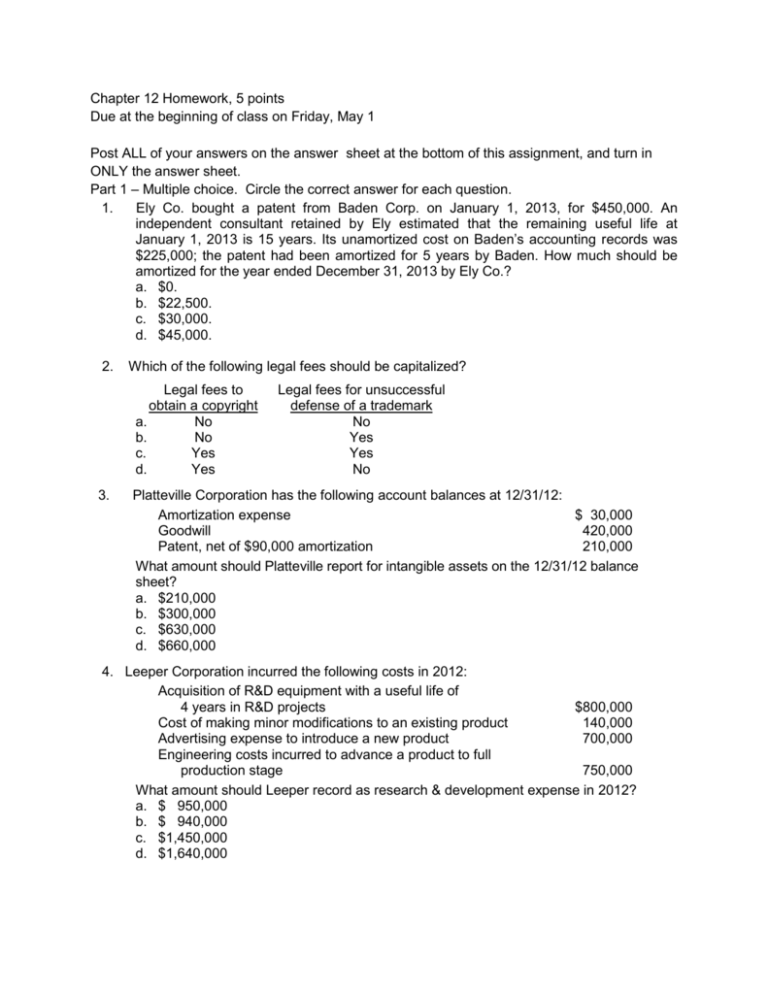

Chapter 12 Homework, 5 points Due at the beginning of class on Friday, May 1 Post ALL of your answers on the answer sheet at the bottom of this assignment, and turn in ONLY the answer sheet. Part 1 – Multiple choice. Circle the correct answer for each question. 1. Ely Co. bought a patent from Baden Corp. on January 1, 2013, for $450,000. An independent consultant retained by Ely estimated that the remaining useful life at January 1, 2013 is 15 years. Its unamortized cost on Baden’s accounting records was $225,000; the patent had been amortized for 5 years by Baden. How much should be amortized for the year ended December 31, 2013 by Ely Co.? a. $0. b. $22,500. c. $30,000. d. $45,000. 2. Which of the following legal fees should be capitalized? Legal fees to obtain a copyright a. No b. No c. Yes d. Yes 3. Legal fees for unsuccessful defense of a trademark No Yes Yes No Platteville Corporation has the following account balances at 12/31/12: Amortization expense $ 30,000 Goodwill 420,000 Patent, net of $90,000 amortization 210,000 What amount should Platteville report for intangible assets on the 12/31/12 balance sheet? a. $210,000 b. $300,000 c. $630,000 d. $660,000 4. Leeper Corporation incurred the following costs in 2012: Acquisition of R&D equipment with a useful life of 4 years in R&D projects $800,000 Cost of making minor modifications to an existing product 140,000 Advertising expense to introduce a new product 700,000 Engineering costs incurred to advance a product to full production stage 750,000 What amount should Leeper record as research & development expense in 2012? a. $ 950,000 b. $ 940,000 c. $1,450,000 d. $1,640,000 5. Which of the following would not be considered an R & D activity? a. Adaptation of an existing capability to a particular requirement or customer's need. b. Searching for applications of new research findings. c. Laboratory research aimed at discovery of new knowledge. d. Conceptual formulation and design of possible product or process alternatives. 6. Malrom Manufacturing Company acquired a patent on a manufacturing process on January 1, 2012 for $6,250,000. It was expected to have a 10 year life and no residual value. Malrom uses straight-line amortization for patents. On December 31, 2013, the expected (undiscounted) future cash flows expected from the patent were expected to be $500,000 per year for the next eight years. The present value of these cash flows, discounted at Malrom’s market interest rate, is $3,000,000. At what amount should the patent be carried on the December 31, 2013 balance sheet? a. $6,250,000 b. $5,000,000 c. $4,000,000 d. $3,000,000 7. Which of the following costs should be capitalized in the year incurred? a. Research and development costs. b. Costs to internally generate goodwill. c. Organizational costs. d. Costs to successfully defend a patent. 8. Goodwill may be recorded when: a. it is identified within a company. b. one company acquires another in a business combination. c. the fair value of a company’s assets exceeds their cost. d. a company has exceptional customer relations. 9. Which of the following does not describe intangible assets? a. They lack physical existence. b. They are financial instruments. c. They provide long-term benefits. d. They are classified as long-term assets. 10. The general ledger of Vance Corporation as of December 31, 2012, includes the following accounts: Copyrights $ 30,000 Deposits with advertising agency (will be used to promote goodwill) 27,000 Discount on bonds payable 70,000 Excess of cost over fair value of identifiable net assets of Acquired subsidiary 440,000 Trademarks 90,000 In the preparation of Vance's balance sheet as of December 31, 2012, what should be reported as total intangible assets? a. $530,000. b. $557,000. c. $560,000. d. $587,000. Part II. Classification (See Exercise 12-1 for examples) Given the following classifications: A. Patent B. Trademark C. Goodwill D. Research and Development Expense E. None of the above How would each of the following activities be classified in the financials: 1. Cost of developing a product internally. 2. Goodwill generated internally through superior customer relations. 3. Legal costs associated with successfully defending a patent. 4. Cost of testing in search for product alternatives. 5. Goodwill recognized by the acquiring company in the acquisition of a subsidiary. Part III. On May 31, 2013, Armstrong Company paid $3,300,000 to acquire all of the assets and liabilities of Hall Corporation. Hall reported the following balance sheet at the time of the acquisition: Inventory $ 900,000 Accounts Payable $ 600,000 Equipment 2,700,000 Notes Payable 500,000 Stockholders’ equity 2,500,000 Total liabilities and Total assets $3,600,000 stockholders’ equity $3,600,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Hall was $2,800,000, because the fair value of the equipment was 3,000,000. Prepare the journal entry on the books of Armstrong to record the purchase of Hall Company (record each asset and liability account in your entry (not totals). Show the entry on your answer sheet. Part IV. At December 31, 2013, Harrison Company reports the following balance sheet information related to its acquired division, Archer Company: Inventory Equipment Goodwill Current liabilities Long-term liabilities Net assets $ 800,000 1,100,000 1,300,000 (700,000) (500,000) $2,000,000 It is determined that the fair value of the Archer division is $1,800,000. The recorded amount for Archer’s net assets (excluding goodwill) is the same as fair value, except for equipment, which has a fair value of $200,000 above the carrying value. On the answer sheet provided: 1. Perform the test for impairment of goodwill: 2. Calculate the amount for the impairment loss on goodwill: 3. Prepare the journal entry to record the impairment. Chapter 12 Homework Answer Sheet Due at beginning of class May 1 Name____________________________ Sec.: 11am____ Noon____ Keep your question booklet and turn in ONLY this sheet. For the next two sections, circle the correct answer/ Part I. Multiple Choice Part II. Classification 1. a b c d e 1. a b c d e 2. a b c d e 2. a b c d e 3. a b c d e 3. a b c d e 4. a b c d e 4. a b c d e 5. a b c d e 5. a b c d e 6. a b c d e 7. a b c d e 8. a b c d e 9. a b c d e 10.a b c d e III. Journal Entry for merger and recognition of goodwill: IV. Impairment 1. Perform the test for impairment of goodwill: 2. Calculate the amount for the impairment loss on goodwill: 3. Prepare the journal entry to record the impairment.