Journal Entries for Manufacturers

advertisement

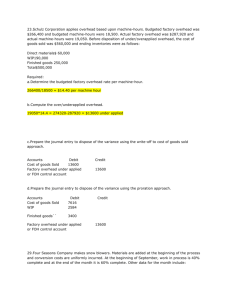

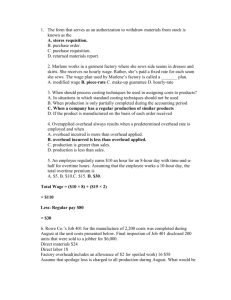

Principles of Accounting II Chapter 19 - Common Transactions and Journal Entries for Manufacturers Transactions relating to manufactured goods: • Purchase Raw Materials • Apply Raw Materials to Goods in Process • Pay wages for Direct Labor • Apply Direct Labor to Goods in Process • Apply Overhead to Goods in Process • Transfer completed goods from Goods in Process to Finished Goods • Sell Finished Goods Common Journal Entries Relating to Product Costs for Manufacturing Companies • Purchase Raw Materials When raw materials are purchased, you recognize an increase in an asset account by debiting Raw Materials Inventory. Credit Accounts Payable (if purchased on account) or Cash (if purchased for cash). The source document for this transaction is the purchase invoice. Raw Materials Inventory Accounts Payable • Apply Raw Materials Raw materials are applied to goods in process. As raw materials are applied, the raw materials inventory decreases and the goods in process inventory increases by the amount of raw materials applied. The source document for this transaction is the Materials Requisition. Goods in Process Inventory Raw Materials Inventory • Incur Labor Costs Factory labor costs are generally recorded when the paychecks are written. An exception would be when an adjusting entry is required at the end of an accounting period. Factory labor, whether direct or indirect, is a product cost and not a period cost. The cost of all factory labor is accrued in a temporary account called Factory Payroll (as opposed to using the Wages Expense account which would indicate a period cost). The source document for this transaction is the employee time card. Factory Payroll Cash • Apply Factory Payroll – Direct Labor The Factory Payroll account includes costs for both direct labor and indirect labor. Direct Labor is applied to Goods in Process. The source document for this transaction is the time ticket. Goods in Process Inventory Factory Payroll • Apply Factory Payroll –Indirect Labor Indirect Labor is absorbed into Factory Overhead since the indirect labor cannot be easily traced to a specific product. The source document for this transaction is the time ticket. Factory Overhead Factory Payroll • Incur Various Indirect Product Costs Any indirect product cost (such as utilities, machinery depreciation, factory supplies and indirect materials) are absorbed into Factory Overhead. (Note: indirect labor was closed to Factory Overhead in a separate entry). To journalize these costs, Factory Overhead is debited for the total of indirect expenses and the appropriate account is credited based on the expense being incurred. (NOTE: if an item is being paid for as part of this transaction, Cash would be credited). Factory Overhead Utilities Payable Accumulated Depreciation Supplies Raw Materials • Apply Overhead to Goods in Process In the previous entries involving overhead, the overhead cost was accumulated by not assigned to any goods in process. Overhead is applied to goods in process using the predetermined overhead application rate. Debit Goods in Process and credit Factory Overhead for the amount of applicable overhead. Goods in Process Factory Overhead • Transfer Completed Goods in Process to Finished Goods As goods in process are completed, their cost should be transferred out of Goods in Process and into Finished Goods inventory. Since the asset Finished Goods is increasing, this account is debited. The inventory asset Goods in Process is decreasing, therefore this account should be credited. Finished Goods Goods in Process • Sell Finished Goods Recall from Chapter 5 that when goods are sold in a perpetual inventory system, two journal entries are required. The first entry shown below records the sale of the goods at the negotiated sales price (Cash would be debited if cash were received for the sale). Secondly, when finished goods are sold, the Cost of Goods Sold account is debited and the inventory asset Finished Goods is credited. The cost of finished goods sold is deducted from Sales on the income statement to determine gross profit. Any unsold finished goods remain as an asset on the balance sheet. Accounts Receivable Sales Cost of Goods Sold Finished Goods • Apply Over- or Under-Applied Overhead Since overhead is based on an estimate, the overhead account will almost always have a balance at the end of the accounting period. If the overhead account has a debit balance, overhead has been underapplied. If the overhead account has a credit balance, overhead has been overapplied. Assuming the balance is immaterial, close the balance in the overhead account to Cost of Goods Sold. Underapplied: Cost of Goods Sold Factory Overhead Overapplied: Factory Overhead Cost of Goods Sold