AreYou Optimistic?

advertisement

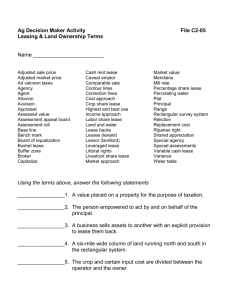

25357_C1_Cover 9/23/10 9:29 AM Page 1 SPECIAL FEATURE! Is Growth an Opportunity or Risk? October 2010 www.financialexecutivemag.com October 2010 Financial Executive Published by Financial Executives International AreYou Optimistic? n LEASE ACCOUNTING www.financialexecutives.org Proposed new rules would require more business knowledge and professional judgment n WORKING CAPITAL Obtaining business financing and customer payments continue to challenge SMEs n TREASURY New financial regulation is sure to increase the complexity of account analysis statements READ FOR CPE CREDIT PREPARING FOR THE NEW LEASE ACCOUNTING Is it a lease, or not a lease? This is just one of the considerations in the new lease accounting proposal, which could lead to major changes in how leases are negotiated and administered. Though implementation is in the future, the long-term nature of many leases means it’s not too early to start planning. liabilities: Operating leases. All leases will create a lease obligation liability and a corresponding right-of-use asset on the balance sheet, similar to the current accounting for capital leases. However, the proposed changes go beyond the current rules for recording leases as capital leases. The new rules would require con- By John Hepp and Rahul Gupta www.financialexecutives.org october 2010 | financial executive ACCOUNTING While the recent financial crisis has focused increased attention on offbalance sheet liabilities, proposed changes to lease accounting are the result of a project that dates back to an earlier round of accounting scandals and the subsequent passage of the Sarbanes-Oxley Act of 2002. The current proposal would eliminate a major category of off-balance sheet 49 sideration of additional items — such as contingent rental payments and optional renewal periods — that will add complexity to the initial valuation of a lease obligation. Leases with contingent rentals or option periods may need to be re-evaluated every reporting period. The scope of the new standard will also require evaluation of lease contracts to determine whether any of the payments are for distinct services. These services would not be included with the lease obligation. The additional complexity is likely to change how lease terms are negotiated and structured. The proposal will also affect how rent expense is reported on the income statement. Currently, rent expense is recognized as part of operating income and included in calculation of earnings before interest, taxes, depreciation and amortization (EBITDA). Under the new proposal, part of rent payments will be recognized as interest expense and the right-of-use asset will be depreciated, moving the expense out of the current definition of EBITDA. In addition, more interest expense will be attributed to the early years of a lease, accelerating the recognition of overall expense. The scope of the changes may require redesign and reevaluation of existing procedures for negotiating, administering, recording and reporting leases in the financial statements. Entities with significant leasing activities may also find it necessary to redesign and test their internal controls over leasing to ensure compliance with the proposed accounting rules and expanded disclosure requirements. Evaluating a New Lease The proposed standard defines a lease as “a contract in which the right to use a specified asset is conveyed, for a period of time, in exchange for consideration.” Similar to the existing standards, any agreement that transfers to the lessee more or less exclusive rights to use property, plant and equipment (or its output) would be classified as a lease. While it will no longer be necessary to evaluate a new lease to determine whether the lease is a capital lease or an operating lease, it will still be necessary to evaluate each new lease for the proper accounting treatment. That evaluation will cover eight distinct steps (and this list is not exhaustive): 1. Determining whether an arrangement contains a lease. 2. Determining whether a lease is to be accounted for as a sale or a lease. 3. Determining whether some elements of the lease should be account- SUMMARY OF KEY CHANGES FOR OPERATING LEASES Topic 50 Existing U.S. GAAP Proposed Model Expected Impact OVERALL RECOGNITION Operating leases are “off balance sheet.” Record an asset and liability for all leases based on the most likely future rent payments and lease term. Increased assets and liabilities on the balance sheet. PAYMENTS FOR SERVICES Also off balance sheet. Remains off balance sheet. Need to distinguish payments for rent from payments for services. LEASE TERM Include option periods with bargain renewals or periods prior to a bargain purchase option. Capitalize the most likely lease term, including option periods. Need to reassess most likely lease term each reporting period and adjust financial statements, if needed. CONTINGENT RENTS Generally recognize when incurred. Capitalize most likely estimated future payments and include in recorded asset and liability. Need to estimate and capitalize most likely future payments each reporting period and adjust through income. INCOME STATEMENT PRESENTATION Record rent expense on a straight-line basis in the income statement. Recognize interest expense on the obligation and depreciation expense on the asset. Increased EBITDA, depreciation expense and interest expense. financial executive | october 2010 www.financialexecutives.org ed for as distinct services. 4. Estimating the present value of future rentals during option periods that are more likely than not to be exercised. 5. Estimating the present value of the amount of any contingent lease payments. 6. Determining the amount of initial direct costs to allocate to a right-ofuse asset. 7. Determining the proper discount rate. 8. Determining the information to be accumulated for disclosure in the notes to the financial statements. Step 1: Is the Arrangement a Lease? The first step in some evaluations will be to determine whether an arrangement contains a lease. In addition to contracts that explicitly identify equipment under a lease, there may be other contracts that contain implicit leases that will fall within the scope of the standard. Current generally accepted accounting principles require similar evaluations. However, their impact is less significant because the accounting for an operating lease and the accounting for a service contract is essentially the same. This will change dramatically under the proposed revisions to lease accounting because a service contract will not create a liability, but a lease contract will. EXAMPLE: ABC Company contracts with a truck owner-operator for a three-year contract that includes exclusive rights to use the vehicle. The arrangement may contain a lease, as it conveys the right to use a specified asset for a period of time. As described below, it would be necessary to separately account for the lease elements and the non-lease elements of the contract. Step 2: Is the Lease Accounted for as a Sale or as a Lease? Under the new standard, the second step in accounting for a lease will be to determine whether the lease is a www.financialexecutives.org lease at all. In some cases a lease will be accounted for as a sale by the lessor and a purchase by the lessee. A lease contract that transfers control at the end of the contract — and all but a trivial amount of the risks and benefits associated with the underlying asset to the lessee — will be accounted for as a purchase. Thus, a lease will usually be classified as a purchase in the following situations: • Title of the underlying asset automatically transfers to the lessee at the end of the lease. • The lease contains a bargain purchase option. The determination of whether a lease is to be accounted for as a lease or a purchase will be made at the inception of the lease and will not be revisited. Regardless of whether the lease is accounted for as a purchase, it may still be necessary to determine if there are distinct service elements within the contract that will need to be segregated and accounted for separately. EXAMPLE: ABC Company leases production machinery from XYZ Company for a five-year term. At the end of the lease, ABC has the option of purchasing the machinery for a nominal amount. The lease would be accounted for as a purchase. Step 3: What is a Lease and What is A Service? The third step in evaluating a lease will be to look for distinct service elements in the lease contract. While technically, current U.S. GAAP requires separation of amounts for lease elements and service elements, it has been less of an issue because most leases are at present classified as operating leases. The accounting for an operating lease and the accounting for services are essentially the same. The proposed changes would create a new and significant difference between the accounting for a lease and the accounting for a service. A liability (and a corresponding asset) The scope of the changes may require redesign and reevaluation of existing procedures for negotiating, administering, recording and reporting leases in the financial statements. will be recognized for lease elements, but not for service elements. The Financial Accounting Standards Board has proposed that distinct service components should be accounted for separately. The proposed rules for determining whether a service is distinct come from the FASB Revenue Recognition Project. A service would be distinct if: • The lessor or another entity sells an identical or similar service separately; or • The lessor could sell the service separately, (i.e., the service has a distinct function and a distinct profit margin). The payments under the lease contract would be allocated between the service and the lease components. If the services are not distinct, or if it is not possible to allocate the payments between service and lease components, then all payments would be considered to be lease payments. The distinction between lease and service elements is made at the inception of the lease. If total payments change, the process is repeated, but with one important difference: If the amount attributable to the lease or service elements cannot be determined, the change in payments would be allocated to the previously identi- october 2010 | financial executive 51 While it will no longer be necessary to evaluate a new lease to determine whether it’s a capital lease or an operating lease, it will still be necessary to evaluate each new lease for the proper accounting treatment — which covers eight distinct steps. fied elements on a pro rata basis. EXAMPLE: ABC Company rents equipment from XYZ Company. The contract includes service elements for routine and emergency maintenance and repairs. XYZ provides similar services to customers who purchase equipment. The service element would be distinct, and the payments under the contract would be allocated between payments for use of the equipment and payments for services. The present value of the payments for use of the equipment would be recognized as a lease obligation liability and a related right-ofuse asset (see chart on page 50). Step 4: What is the Lease Term? Lease contracts that include optional renewal periods will require a fourth evaluation step to determine the length of the lease term. Under current GAAP, the lease includes option periods only when the rent is such a bargain (or there are penalties for nonrenewal) that it is reasonably certain that the lessee will extend the lease. Under the proposal, it only needs to be more likely than not that the lessee will extend the lease by exercising an option, including options at market value. The lease term would be the longest possible period including all likely option periods (those 52 financial executive | october 2010 where exercise is more likely than not). The present value of the rental payments, including those potentially due during likely option periods, would then be discounted to determine the lease obligation. Because the likelihood of exercising an option can change, the lease term would be reassessed at each reporting date, but a detailed examination of every lease would not be required unless there is a change in facts or circumstances. The effects of any change in the lease term would be recorded as an adjustment to the right-of-use asset and lease obligation using the same discount rate originally used at inception of the lease. EXAMPLE: ABC Company enters into a 10-year non-cancellable lease with three renewal options of five years each. The renewal options are at market value. ABC will need to determine whether any of the three options are more likely than not to be exercised based on all relevant facts and circumstances. If it is likely that one renewal option will be exercised, the present value of the estimated market rents during the renewal period would be included in the lease obligation and the right-ofuse asset. If in the fifth year of the lease the customer company determines it is likely that all three option periods would be exercised, the obligation and asset would be re-measured using the present value of estimated future market rentals measured at the same discount rate used to measure the original obligation. Step 5: Are There Any Contingent Rental Payments? Contingent rental payments are payments whose timing or amount is not determined at the beginning of the lease. The amounts paid in future periods may be contingent on future changes in inflation, the amount of use of the underlying asset (for example, miles driven in a car lease) or future sales. Under the current standard, contingent rent payments are recognized as rent expense when incurred. The proposed accounting model would change this by requiring the lessee to estimate the most likely amount that will be paid using an expected outcome technique. The estimate would cover the longest possible lease term that is more likely than not to occur. Lessees will measure contingent rentals based on an index or rate, using either forward rates, if readily available, or the rates current at the inception of the lease. Estimated future contingent rentals would be reevaluated each reporting period if any new facts or circumstances indicate that there is a material change in the obligation. Changes in estimated future contingent rentals would be discounted using the same discount rate used to measure the original obligation. On re-measurement, changes in estimated contingent rentals incurred in the current period or prior periods would be recognized immediately in earnings. Changes relating to future periods would be recognized as adjustments to the lease obligation and the right-of-use asset. EXAMPLE: ABC Company rents a vehicle with a five-year lease term. Rent payments include a fixed component plus a mileage charge for miles in excess of an annual allowance. At inception, ABC would estimate the amount of miles that will be driven each year using an expected outcome technique. It would recognize the present value of total estimated payments as a lease obligation and right-of-use asset. Over the lease term, it would recognize differences attributable to the current period in ear nings. Any changes in the estimated amount to be incurred in future years would be recognized as an adjustment of the lease obligation and right-of-use asset. Step 6: Have Initial Direct Costs Been Correctly Capitalized? One feature carried over from current GAAP is the ability of the lessee to capitalize certain direct costs of www.financialexecutives.org obtaining a lease (e.g., commissions, legal fees, negotiating costs, etc). General overhead costs and costs relating to unsuccessful negotiations may not be capitalized. These costs would be combined with the right-of-use asset and amortized over the lease term. Step 7: Have the Payments Been Discounted Correctly? The next step is to discount all of the estimated future payments determined so far plus the residual value guaranteed by the lessee and its related parties. All amounts (and any future changes to those amounts) will be discounted using the lessee’s incremental borrowing rate at the date of the lease or the rate the lessor charges the lessee if reliably determinable. The result is then booked as the initial lease obligation. The rightof-use asset is the amount of the obligation plus any initial direct costs. EXAMPLE: ABC Company enters into a lease contract to lease a property for 10 years. The incremental borrowing rate for ABC (after considering its credit standing, term of the lease and quality of underlying asset) is 10 percent. The rate charged by the lessor — which is determined using the yield on the property — is eight percent. ABC Company should use the eight percent rate to discount the estimated future payments. However, if the rate charged by the lessor cannot be reliably determined then incremental borrowing rate of 10 percent should be used. Step 8: Are Systems in Place to Provide Information for Required Disclosures? The final step required to record a lease will be to ensure that the information needed for required disclosures is captured and made available for audit and financial reporting purposes. The proposed standard requires quantitative and qualitative information that identifies and explains the amounts recognized in the financial statements and describes how leases may affect the www.financialexecutives.org amount, timing and uncertainty of the entity’s future cash flows. The expanded disclosure requirements include a reconciliation of the opening and closing balances of right-of-use assets and lease liabilities separately by class of underlying asset, including total cash paid during the period. The standard also requires a maturity analysis of payments due, among other disclosures. Needed: New Skills, Procedures and Controls As the above discussion indicates, successful evaluation of leases under the proposed standard may require a very different set of skills than those necessary for evaluating leases under the present standard. The process will require more business knowledge and professional judgment because each element of the lease contract needs to be evaluated separately. It also may be necessary to estimate future costs or prices, involving consideration of future market conditions and the strategic direction of the entity. It is not too soon to start considering changes in the procedures and controls used to capture and report information about leases in the financial statements. The impact on the balance sheet and income statement may require additional oversight from senior management and reconsideration of the internal controls over the leasing process and related financial reporting. Interaction with provisions in other contracts and debt covenants will also need to be monitored to ensure compliance. The controls will need to operate not only when a lease is initially signed or modified as is currently the case, but potentially every reporting period if the lease contract includes contingent rentals or optional renewal periods. It is recommended that entities review their existing leases (there are no grandfathering provisions) to estimate the impact of the proposed changes on the financial statements. It would also be advisable to carefully consider the proposed changes when negotiating new contracts of Successful evaluation of leases under the proposed standard may require a very different set of skills than those necessary for evaluating leases under the present standard. The process will require more business knowledge and professional judgment. more than a few years’ duration. Overall, any entity that makes use of lease accounting should be following events closely over the next several months. There is still time to submit comments to FASB and International Accounting Standards Board so that your views can be considered when preparing the final standard. J OHN H EPP, CPA (John.Hepp@gt.com), is a partner with the National Professional Standards Group of Grant Thornton LLP in Chicago. Rahul Gupta, CPA (Rahul.Gupta@gt.com), is a manager with the National Professional Standards Group of Grant Thornton LLP in Houston. To receive CPE for this article visit www.financial executives.org/magazineCPE to complete your review, test and evaluation. Instructional method: Self-Study Recommended CPE Credits: 1.0 Experience Level: Basic Field of Study: Accounting Prerequisites/advance preparation: None Advanced Prep: Reading article Financial Executives International (FEI) is registered with the National Association of State Boards of Accountancy (NASBA), as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN 37219-2417. Web site: www.nasba.org For FEI CPE credits, one credit hour equals 50 minutes according to NASBA guidelines. Some states boards may differ on how many minutes constitute a credit hour. Contact your state board for more information. Available in all States except those that do not accept Web-based self-study credits (Florida, Louisiana, Minnesota, North Carolina, Oklahoma, Oregon, Tennessee). For more information regarding administrative policies such as complaints, please contact our offices at 973.765.1029. october 2010 | financial executive 53