Chapter 7 Case Study

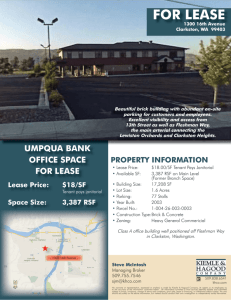

advertisement

Chapter 7 Case Study ISQS 5345: Business Statistics Team 4: Kyle Lock Amanda Mock Jeff Morris Derrick Plunk Brian Wilder 9/29/2009 Table of Contents Chapter 7 Case Study .................................................................................................................................... 3 Question 1 ................................................................................................................................................. 3 Question 2 ................................................................................................................................................. 3 Question 3 ................................................................................................................................................. 3 Question 4 ................................................................................................................................................. 3 Question 5 ................................................................................................................................................. 4 Question 6 ................................................................................................................................................. 4 Chapter 7 Case Study September 29, 2009 Chapter 7 Case Study Question 1 How much money would you make if there were no costs of extraction? Would this be enough to retire? At the current price of $18.36 per barrel multiplied by the estimated 1,500,000 barrels of oil underground, which would give you $27,540,000. Subtract out the $1 million dollar lease and you still net $26.54 million. Yes, that amount would be sufficient to retire on. Question 2 Would you indeed lose money if you leased and extracted immediately, considering the cost of extraction? How much money? Yes, you would lose money. $27,540,000 - $1,000,000 (lease) - $30,000,000 (extraction expense) = ($3.46 mil) Question 3 Continue the scenario analysis by computing the future net payoff implied by each of the future prices of oil. To do this, multiply the price of oil by the number of barrels, then subtract the cost of extraction. If this is negative, you simply won’t develop the field, so change negative values to zero. (At this point, do not subtract the lease cost, because we are assuming that it has already been paid.) $ $ $ $ $ Oil Price 10.00 15.00 20.00 25.00 30.00 $ $ $ $ $ Quantity of Oil 1,500,000.00 1,500,000.00 1,500,000.00 1,500,000.00 1,500,000.00 $ $ $ $ $ Profit 15,000,000.00 22,500,000.00 30,000,000.00 37,500,000.00 45,000,000.00 Cost $ (30,000,000.00) $ (30,000,000.00) $ (30,000,000.00) $ (30,000,000.00) $ (30,000,000.00) Net $ $ $ $ 7,500,000.00 $ 15,000,000.00 Question 4 Find the average future net payoff, less the cost of the lease. How much, on average, would you gain (or lose) by leasing this oil field? (You may ignore the time value of money.) The average future net payoff is $20/barrel. This gets you to the break-even point. No profit or loss unless you include the lease, then you would have a $1mil loss. Page 3 Chapter 7 Case Study September 29, 2009 Question 5 How risky is this proposition? With the fixed future prices that are given to us, you only have a 30% of making a profit. The standard deviation is $5.48 million. This shows that there is considerable risk involved. Profits could reasonably be $5.48 mil above or below its mean value of $20/barrel, which only brings us to the break-even point. Question 6 Should you lease or not? This investment does seem to be fairly risky, but with high risk can come high reward. I would need to know more information before proceeding with this investment, such as the following items: a) Current oil reserve levels b) Current state of the economy c) President d) Price trends e) Historical oil prices Page 4