Powerpoint

advertisement

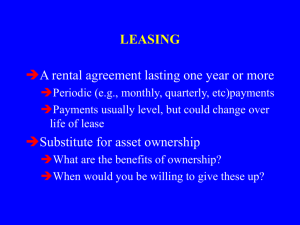

Financing for Clean Energy Entrepreneurs To succeed in this fast-paced industry, entrepreneurs and project developers need access to financing. This panel will focus on creative financing models that can create win-win solutions within the current regulatory landscape. Moderator: Alec Guettel, Co-founder, Sungevity Panelists Doug Beebe, VP of Energy Finance, Key Equipment Finance Eric Cohen, Senior Commercial Relationship Manager, Fifth Third Bank Melissa Malkin-Weber, Green Initiatives Manager, Self-Help Credit Union David Scoglio, Chief Financial Officer, Strata Solar UNC Friday Center Redbud Auditorium Alec Guettel Co-founder Sungevity Key Equipment Finance Energy Finance Overview NC Clean Tech Summit Doug Beebe Vice President, Energy Finance Clean Energy Finance Trends • Clean energy is financed in many creative ways • Traditional companies are doing it – no longer a fringe business • Renewables are more economical than ever • Shift from environmentalists to business people • Clean energy is growing rapidly and needs your help! • Get involved! • We need more people like you working in clean energy! Key Bank • Traditional bank succeeding in a non-traditional space • Started in 1858 in Cleveland/ Publicly traded on NYSE: KEY • Top 20 Bank: Among nation’s largest, well-capitalized • $92.9 Billion in Assets • Expertise in customized energy lease transactions • Key Equipment Finance (KEF) is a subsidiary of Key Bank, based in Superior, CO (near Boulder, CO) Key Energy Practice • $1 Billion + energy portfolio • 80 + wind and solar finance transactions • Financing energy assets since the 1990’s • Leasing and Project Finance • KEF markets the energy lease product Key Equipment Finance profile • • • • • Key Bank’s Leasing Business $9.1 billion in assets $4.3 billion of originations 540 employees globally Market specialization: Products and services – Energy – – – – – – Key Government Finance Information Technology Healthcare Specialty Vehicles Corporate Aviation Other verticals coming soon! • www.keyequipmentfinance.com Classification - 8 Community Bank Corporate Bank Local Market Knowledge* Investments Private Banking Retail Banking Loans* Leases* Treasury Management Deposits Industry Expertise* Financial Advisory Capital Markets* Investment Banking *Creates Synergies with Key Equipment Finance • • • • KEF leasing capabilities Alternative to PPA financing Incentives belong to the lessee/ end user 100% Financing Direct, full-recourse leases and loans – Capital lease / Non-tax lease – Operating lease / Tax lease • Tax structure expertise • Can offer caps for FMV purchase options – Synthetic Lease • Hybrid of Capital and Operating Leases – Loans • • • • 7 – 10-year terms Transaction size: $250,000+, no maximum Construction financing Syndication to broaden tax and risk appetite Classification - 9 PPA and Lease Comparison PPA/ ESA Operating Lease Capital Lease / Loan Low-cost funding Quick and efficient underwriting process Customer takes tax benefits Investor takes tax benefits PBI / SREC / FIT direct to customer PBI / SREC / FIT direct to investor Bundled approach/ undisclosed costs System ownership with customer Permitted / Feasible in all 50 U.S. States Reduced/ Streamlined documentation Classification - 10 Doug Beebe VP of Energy Finance Key Equipment Finance Eric Cohen Senior Commercial Relationship Manager Fifth Third Bank Melissa Malkin-Weber Green Initiatives Manager Self-Help Credit Union David Scoglio Chief Financial Officer Strata Solar