UTI Mutual Fund Performance Evaluation: Equity Schemes

advertisement

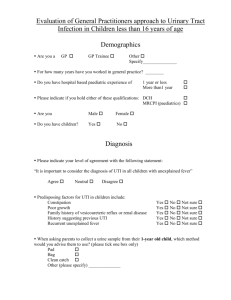

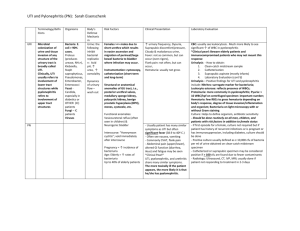

Performance Evaluation of UTI Mutual Funds (On Selected Diversified Equity Schemes) Mahabub Basha S, Accounting Analyst, Neovia Logistics Services India Pvt Ltd., Bangalore, India Abstract— Indian investors prefer to invest in safe securities. Among the various avenues Mutual funds will have less risk and more returns to the investors. According to the Mutual fund industry is having safest image, Investors are increasing day-by-day in this industry. In this paper, an attempt has been made to study performance of selected equity diversified schemes of mutual funds based on risk – return relationship models and various measures. The analysis has been made on the basis of Rate of Return, Standard Deviation, Beta, and Sharpe Ratio. Keywords- Risk, Return, Investors, Mutual Funds. 1. Introduction A Mutual fund is a professionally managed firm of collective investments that pools money from many investors and invest in stocks, bonds, and short –term securities. Mutual fund is an investment vehicle preferred by small investors as it offers an opportunity to invest in in a diversified, professionally managed portfolio at a relative low cost. These investors buy units of a particular mutual funds scheme that has an own objective and strategy. The money thus collected is then invested by the fund manager in different type of securities. The value of mutual fund is depicted by NAV (Net asset value). Mutual funds have started in India in 1964. The first scheme was Unit scheme 1964. UTI has the monopoly over the mutual fund industry up to 1987. In 1987 government institutes were allowed to start mutual funds operations. In 1993 it has opened for private sector. The regulations on mutual funds came in the year 1996. Mutual funds offers open ended and closed ended schemes. Closed ended schemes have some stipulated time period that is normally between 3 to 15 years. Open ended schemes are available for subscription during all the time period. So this paper is an attempt to study the performance of mutual funds in the frame work of risk and return during the period 1st January 2010 to 31 December 2014. 2. Review of Literature A large number of studies have been done on the growth and performance evaluation of mutual funds. Sharpe (1966) explains in a modern portfolio theory context that the expected return on an efficient portfolio and its associated risk and linearly related. By incorporating various concepts he developed a Sharpe index. In this paper he attempted to rate the performance on the basis of optimal portfolio with the risky portfolio and a risk – free asset is one of the greatest reward to variability. Shome (1994) based on growth schemes examined the performance of the mutual fund industry between April 1993 to March 1994 with BSE Sensex as market surrogate. The study revealed that, In the case of 10 schemes, the average rate of return on mutual funds was marginally lower than market return. Raghunathan and Verma (1991) evaluate the performance of master share during the period 1987 to 1991 using Sharpe, Jensen and Treynor measures. They conclude that the fund performed better than the market, but not so well as compared to the Capital Market Line. Kothari and Smythe (2004) analysed the Finnish mutual fund industry from 1993 to 2000, and focused on market segmentation and mutual fund expenses. As per their industry, Finnish mutual funds have performed neutrally with the exception of equity funds under performing. Acharya and Sidana (2007) attempted to classify hundred mutual funds employing cluster analysis and using a host of criteria like the 1 year total return, 2 year annualized return, 3 year annualized return, 5 year annualized return, alpha, beta, R-squared, Sharpe’s ratio, mean and Stand deviation etc. The data is obtained from value research online. They do find evidences of inconsistences between the investment style/objective classification and the return obtained by the fund. 3. Objectives of the Study • • • To examine performance of selected equity diversified mutual funds. To measure the risk – return relationship and market volatility of the selected UTI mutual funds. To examine the fund performance with regard to risk – adjustment model by Sharpe Ratio. 4. Research Methodology This study is based on secondary data which is collected from various sources like published journals books, magazines, newspapers and online material. It covers the information on selected schemes of UTI mutual funds. This study examines 17 diversified equity schemes launched by UTI. These schemes have been selected on the basis of regular data availability during the period of January 2010 to December 2014. Daily NAV (net asset value) has been used for data analysis. For this study, BSE national index has been used a proxy for market index. Risk free rate of return refers to that minimum return on investment that has no risk of losing the investment over which it is earned. It has been marked as 8%. Different statistical tools are used evaluate the performance of these mutual fund schemes under present study. These tools include average return, standard deviation, beta and Sharpe ratio. 5. Limitation of the Study Secondary data is used for this study. Sector wise classification of mutual fund analysis is not possible. The scope of this study is limited to the selected schemes. 6. Statistical Tools Rate of Return: The rate of return on an investment, expressed as a percentage of total amounts invested. R = (P1-P0)/P0 Whereas P1 is the present year and P0 is the previous year. Standard Deviation (SD): Measures likely deviation from the expected return. In other words the standard deviation tells us how much the return on a fund is deviating from expected returns based on historical performance. A higher SD indicates that NAV of the mutual fund is more volatile. Beta: Beta measures the volatility of a particular fund in comparison to the market as a whole. It is measures volatility of a particular stock in relation to the market. Beta higher than 1 indicates risky stock and lower than 1 indicates a stock safer as compare to the market. Sharpe Ratio (SR): SR is the best known risk – adjusted performance. It’s evaluates the return that a fund has generated relative to the risk taken. Risk here measured by SD. A mutual fund with a higher SR is better because it is implies that it has generated higher returns for every unit of risk that was taken. SR: (Rp-Rf)/σ Rp is the return from the scheme, Rf is the risk free return and SD measures the total risk. 7. Data Analysis & Interpretation Table: 1Showing rate of return of UTI Mutual fund schemes Schemes UTI Equity Fund UTI Master Share Unit Scheme UTI Top 100 Fund UTI Dividend Yield Fund UTI India Life Style Fund UTI Infrastructure Fund UTI Leadership Equity Fund UTI Midcap Fund UTI MNC Fund UTI Opportunities Fund UTI Banking Sector Fund UTI Energy Fund UTI Pharma & Healthcare Fund UTI Transportation & Logistics Fund UTI Equity Tax Savings Plan UTI Master Equity Plan Unit Scheme UTI Nifty Index Fund Average Return (%) 17 14 13 16 16 11 13 27 25 16 22 3 24 34 13 13 12 The above table exhibits the NAV returns of over 5 years. UTI Transportation & Logistics Fund growth has yielded highest returns (34%) of all selected mutual funds and UTI MNC equity diversified fund growth rate has earned next highest returns, followed by UTI Pharma & Healthcare fund. UTI Energy fund delivered lowest returns (3%) among the all funds Table: 2 Showing Standard Deviation of UTI Mutual fund schemes Schemes UTI Equity Fund UTI Master Share Unit Scheme UTI Top 100 Fund UTI Dividend Yield Fund UTI India Life Style Fund UTI Infrastructure Fund UTI Leadership Equity Fund UTI Midcap Fund UTI MNC Fund UTI Opportunities Fund UTI Banking Sector Fund UTI Energy Fund UTI Pharma & Healthcare Fund UTI Transportation & Logistics Fund UTI Equity Tax Savings Plan UTI Master Equity Plan Unit Scheme UTI Nifty Index Fund Standard Deviation 13.98 14.31 14.36 13.73 13.94 18.6 15.48 14.76 11.01 14.04 23.77 16.47 12.47 15.91 14.09 15.11 16.78 Higher Standard deviation means higher volatility. UTI MNC fund has less standard deviation (11.01) which means it is comparatively less risky than the other funds. It is the fund best one to choose. Similarly UTI Pharma & Healthcare fund (12.47) next lowest standard deviation fund in the above table and followed by UTI Dividend Yield fund (13.73). Table: 3 Showing Beta of UTI Mutual fund schemes Schemes UTI Equity Fund UTI Master Share Unit Scheme UTI Top 100 Fund UTI Dividend Yield Fund UTI India Life Style Fund UTI Infrastructure Fund UTI Leadership Equity Fund UTI Midcap Fund UTI MNC Fund UTI Opportunities Fund Beta 0.55 0.49 0.41 0.45 0.43 0.82 -0.94 0.58 0.38 0.54 UTI Banking Sector Fund UTI Energy Fund UTI Pharma & Healthcare Fund UTI Transportation & Logistics Fund UTI Equity Tax Savings Plan UTI Master Equity Plan Unit Scheme 0.91 0.65 -0.57 UTI Nifty Index Fund 0.52 0.62 0.43 0.51 Beta measures the volatility of a particular fund in comparison to the market as a whole. The above table explains the UTI Pharma & Healthcare fund has lowest Beta (-0.57). This fund is less risky to compare with other funds. Since Beta value is less than 1 means the funds reacts less than the market reaction. Table: 4 Showing Sharpe Ratio of UTI Mutual fund schemes Schemes UTI Equity Fund UTI Master Share Unit Scheme UTI Top 100 Fund UTI Dividend Yield Fund UTI India Life Style Fund UTI Infrastructure Fund UTI Leadership Equity Fund UTI Midcap Fund UTI MNC Fund UTI Opportunities Fund UTI Banking Sector Fund UTI Energy Fund UTI Pharma & Healthcare Fund UTI Transportation & Logistics Fund UTI Equity Tax Savings Plan UTI Master Equity Plan Unit Scheme UTI Nifty Index Fund Sharpe Ratio 6.65 4.99 4.52 4.96 6.33 0.57 3.72 0.05 15.43 6.34 4.45 -0.65 13.19 15.17 4.43 4.06 3.03 The Sharpe ratio is the best known for risk – adjusted statistic. In above table UTI MNC fund has the highest Sharpe ratio (15.43). This scheme provides the highest return for a given unit of risk taken and similarly, UTI Transportation & Logistics fund has registered with (15.17) next highest Share ratio. Findings • • • • The UTI Transportation & Logistics Fund growth has yielded highest average returns (34%) for the past 5 years when compared with selected mutual funds The UTI MNC fund has less standard deviation (11.01) which means it is comparatively less risky than the other funds. All the selected funds shows beat value is less than 1. Which means all equity diversified funds are less volatile than the market The UTI MNC fund has the highest Sharpe ratio (15.43). This scheme provides the highest return for a given unit of risk taken. Suggestions Based on the observation made during the study of the paper below suggestions are submitted for the betterment of mutual funds. • • • • • • The AMC’s should adopt more investor friendly programmes for semi and urban areas. Lack of information/ financial sophistication of the investors about mutual funds. It is very difficult to finding a quality of agents/ distributors. Female segment is not fully tapped in mutual investment and even there is low target on higher income group of people. Hence, Fund managers should take some steps to tap female segment to enhance more investment in MF. Commission charges for offering the services by mutual fund companies should be reduced. Most of the investors not aware various schemes, so initiative should be taken to spread awareness about mutual funds. References [1] Mishra, Banikanta & Mahmud, Rahman (2000), “Measuring mutual fund performance using lower partial moment”, Global business trends, Contemporary Readings, 2001 edition. [2] Sharpe W., (1966), “Mutual fund performance”, The journal of business, Vol.39, Issue sl, pp 119-138. [3] S.Vasantha, Uma Maheshwari and K.Subashini, “Evaluating the performance of some selected open ended equity diversified mutual fund in Indian mutual fund industry”, in International journal of innovation research in science, engineering and technology, Vol 2, Issue 9, September 2013. [4] Tom Jacob, Anila Shelvi and Athira A.R, “A Comparative study of mutual fund schemes of SBI and UTI”, in Journal of business management, commerce & research, Vol 2, Issue 6, December 2013. [5] M. Jaydev, (1996) “Mutual fund performance: An analysis of monthly returns, in Finance India, 10(1) March, pp 73-84. [6] R. Narayanasamy, & V. Rathanamani, “Performance evaluation of equity mutual funds” in International journal of business and management invention, Vol 2, Issue 4, April 2013. [7] Russell J Fuller & James L Farrell (1987), “Modern investment and security analysis”, Tata McGraw – Hill Publishing, New Delhi, pp 560 – 574. Author’s Profile Conclusion Investors can opt any mutual funds based on their objectives. Risk is important factor playing very key role in selection of mutual funds. From the analysis it is clear, The UTI MNC fund has the highest Sharpe ratio (15.43) and SD registered with low (11.01) similarly this fund less (0.38) volatile than the market. This scheme provides the highest return for a given unit of risk taken. The investor who needs regular income can invest in UTI MNC fund. My self, Mahabub Basha S, I am working as an Accounting Analyst at Neovia Logistics Services India Pvt Ltd, Bangalore. I have 5 years of Industry Experience. I have Completed MBA & MCOM.