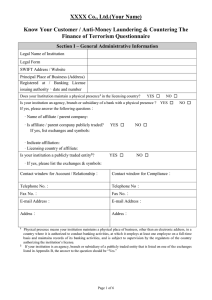

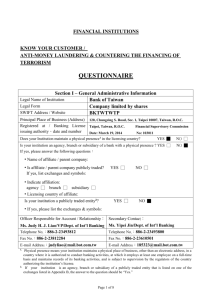

Key questions for assessing relevant aspects of the regulatory

advertisement

This tool was originally developed by USAID and NetHope; however neither party has endorsed or participated in this application of use. Detailed Questions on e-Payments Regulatory Policy This document is intended to help organizations understand the local regulatory environment when evaluating the suitability of e-payments. Standards set by international bodies require implementation into local laws in order for the standards to be enforceable domestically. These standards, when adopted and enforced, mitigate some of the risks associated with payment transactions. Key overarching questions to consider when examining regulatory policies around inclusive financial services and electronic money are as follows: 1. What is the local regulation governing Know Your Customer Requirements (KYC) on bank accounts? 2. What types of identification are required for customers to open bank accounts, and what is the level of official identification penetration? 3. What types of entities (i.e. bank branches, banking agents) are allowed to process KYC requirements and open accounts for customers? 4. What Anti-Money Laundering (AML) or Counter Terrorism Financing (CTF) regulations are in place that dictate transaction volume and amount limits on accounts? The following are questions that will help your organization establish a stronger understanding of country specific regulations around electronic payments. Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) regulations/standards What recommendations, if any, is the central bank implementing from the Financial Action Task Force standards (FATF)1? 1 Financial Action Task Force (FATF): Multinational body endorsed by the International Monetary Fund, World Bank, and United Nations, as the international standard-setting body for anti-money laundering (AML) and combating the financing of terrorism (CFT) safeguards. Specific FATF recommendations include preventative measures such as customer identification and transaction recordkeeping requirements. Can be accessed here. Note: This Toolkit is made possible by the generous support of the American people through the United States Agency for International Development (USAID). The contents are the responsibility of NetHope and do not necessarily reflect the views of USAID or the United States Government. This tool was originally developed by USAID and NetHope; however neither party has endorsed or participated in this application of use. With respect to mobile money, does the mobile network operator providing the service comply with FATF, or at least the standards set by GSMA which include things like limits on accounts and transactions, monitoring transaction frequency, and implementing automated tracking of transaction flows on a system level. GSMA standards can be accessed here. Supervisory system What is the status of the central bank's ability to monitor and examine the condition of banks and their compliance with laws and regulations? Is there an annual report? Does the central bank regulate the minimum amounts of capital held by banks and other financial institutions? Consumer Protection Does the central bank enforce consumer protection standards? Are there regulations and clear rules on deposit insurance? Is there transparent pricing for products? What redress measures exist for consumers to report and/or dispute claims of fraud? E-Money Regulation Is there a clear and separate regulation on electronic money? How mature is this regulation? Are there circulars that are still in the legislative process, or are they part of law? Are there specific regulations for both prepaid cards and mobile money?