Homework 4

advertisement

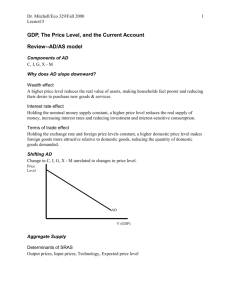

Homework 4 Economics 503 Foundations of Economic Analysis Assigned: Week 4 Due: Week 5 1. Using aggregate demand, short-run aggregate supply and long-run aggregate supply curves, explain the process by which each of the following economic events will move the economy from one long-run macroeconomic equilibrium to another. Illustrate with diagrams. In each case, what are the short-run and long-run effects on the aggregate price level and aggregate output? a. There is a decrease in households’ wealth due to a decline in the stock market. The model starts at point 1. Household consumption drops as wealth declines. This decreases spending at any given price level (the AD curve shifts in) and reduces the prices they are willing to pay for goods. The falling price level along with given wages raises the costs of hiring workers and output declines in equilibrium. Equilibrium price and output drop to point 2. The falling price level combined with fixed wages will raise the relative or real wage as the economy goes into a recession. The relatively low demand for labor in the recession will put downward pressure on the nominal wage rate. The falling cost of production reduces the prices that firms demand for their production (i.e the SRAS curve shifts down). Wages will fall until the labor market equilibrium return relative wages to their long-term levels. The new long run equilibrium will be at point 3. SRAS LRAS P SRAS´ 1 2 3 AD AD´ Y YP b. The government lowers taxes, leaving households with more disposable income, with no corresponding reduction in government purchases. The economy begins at point 1. When households have more disposable income, they increase spending. This shifts out demand for goods and increases the prices they are willing to pay for goods. The higher prices of goods reduce the cost of labor. Falling real wages induce firms to increase production. The new equilibrium is at point 2. When firms are producing a lot of output, labor demand is high. Wages feel upward pressure, raising costs. The costs of production are passed along to customers which in turn reduces equilibrium demand. Eventually, wages rise far enough that the excess demand for labor is in equilibrium and real wages return to their equilibrium level and the economy returns to potential output at point 3. LRAS P SRAS 3 2 SRAS´ 1 AD´ AD Y YP 2. Consider again the case (b) from the above problem, when the government lowers taxes. Focus on how event (b) will change money market interest rates and the forex rate. a. Draw a graph of the money market and show what would happen to money market interest rates after event (1b) if the central bank left the money supply unchanged. (Hint: After event (1b), GDP will change. How will this change affect money demand?). Money Market: In the short-run, prices and output increase which increases the money value of transactions which means people will have to hold more liquidity. Liquidity tightens and the interest rates that banks must offer to raise liquidity rises. Money Supply i Y↑ 2 1 Money Demand´ Money Demand M b. Demonstrate the impact of the changes in the interest rate (described in 2.a.) caused by monetary policy on the foreign exchange market. Would the spot exchange rate appreciate or depreciate? Foreign Exchange Rate: The higher interest rate in domestic markets encourages domestic investors to keep their money at home. The domestic demand for foreign exchange drops. At the same time, the domestic market attracts funds from overseas increasing the supply of foreign currency. The excess supply conditions of forex reduces the price of domestic currency and the domestic currency appreciates. S Supply Supply′ 1 Demand 2 Demand′ Forex 3. In 2005, a hurricane hit New Orleans, Louisiana, an important transportation and oil refining center in the USA, one of Hong Kong’s key for the petrochemical industry in that country. Consider the impact of the recent hurricanes that devastated that city as a temporary supply shock for the USA. a. Discuss briefly, using one graph, the outcomes that we would have been likely to see in terms of goods markets in the USA as a result of this negative business cycle shock. With the refineries knocked out, the price of oil would rise. With firms energy costs rising, the price level charged by firms at every level of production would rise. The rising price levels would dampen consumption and hurt export competiveness and the equilibrium quantity would fall and prices rise. SRAS P 2 SRAS´ 1 AD Y b. Analysts are also worried that the natural disaster might have had a negative impact on consumer confidence. Discuss briefly, using one graph, the differences in outcomes that we would observe if this demand side effect were stronger from the outcomes that we would observe if the supply side effects were dominant. c. YP P SRAS 1 P** 2 AD ´ AD Y A decline in consumer confidence would reduce the demand for consumer goods at any level of prices. This would shrink demand at any price level. If this effect were dominant the price level would fall.