GDP, The Price Level, and the Current Account

advertisement

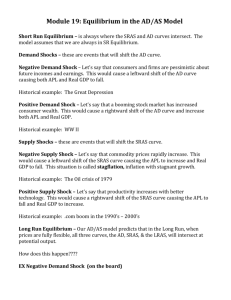

Dr. Mitchell/Eco 329/Fall 2000 Lecnot15 1 GDP, The Price Level, and the Current Account Review--AD/AS model Components of AD C, I, G, X - M Why does AD slope downward? Wealth effect A higher price level reduces the real value of assets, making households feel poorer and reducing their desire to purchase new goods & services. Interest rate effect Holding the nominal money supply constant, a higher price level reduces the real supply of money, increasing interest rates and reducing investment and interest-sensitive consumption. Terms of trade effect Holding the exchange rate and foreign price levels constant, a higher domestic price level makes foreign goods more attractive relative to domestic goods, reducing the quantity of domestic goods demanded. Shifting AD Change in C, I, G, X - M unrelated to changes in price level. Price Level AD Y (GDP) Aggregate Supply Determinants of SRAS Output prices, Input prices, Technology, Expected price level Dr. Mitchell/Eco 329/Fall 2000 Lecnot15 2 Why SRAS slopes upward Holding input prices constant, an increase in output prices (price level) makes production more profitable, producers expand output. Holding the expected price level constant, an increase in the price level results in higher nominal wages and "fools" workers into temporarily working more. LRAS In the LR, all prices and expectations adjust so that we have the natural rate of unemployment and full-employment output. LRAS shifts for changes in the size of the labor force, changes in the amounts of other resources, changes in technology. Why SRAS may be "asymmetric" Beyond full-employment output, it is difficult to increase labor hours worked without a substantial increase in the price level. However, when AD falls, prices and wages do not seem to adjust downward. Instead, we see reductions in output. LRAS Price Level SRAS Y (GDP) SR macro equilibrium Quantity demand in aggregate equals quantity supplied in aggregate LRAS Price Level SRAS P* AD Y* Y (GDP) Dr. Mitchell/Eco 329/Fall 2000 Lecnot15 3 The multiplier Recall: An autonomous increase in C, I, G, or X-M of $1 will shift AD by a multiple of the original change. The multiple depends on the marginal propensity to consume, the marginal propensity to import, the marginal tax rate, and the slope of the SRAS curve. LR macro equilibrium SR equilibrium, plus on LRAS. SRAS' LRAS Price Level SRAS P* P* AD Y* Y (GDP) Adjustment to LR equilibrium From an expansionary (inflationary) gap Expectations of the price level are revised upwards Input prices adjust upwards SRAS shifts left until unemployment rate returns to natural rate. From a contractionary (deflationary) gap Expectations of the price level are revised downwards Input prices (wages) adjust downwards SRAS shifts right until unemployment rate returns to natural rate. Typically expect that this takes longer than adjustment from inflationary gap. The length of time the adjustment takes will depend on the past history of monetary & fiscal policy. If policy was used to stimulate AD in the past, this may increase the population's willingness to wait for jobs at their old nominal wages. How trade affects the analysis Exports Determined by our price level, the foreign price level, the exchange rate, and foreign levels of income. Dr. Mitchell/Eco 329/Fall 2000 Lecnot15 4 Note: A recession abroad will reduce exports, reducing AD and possibly causing a recession at home. Depreciation of our currency will stimulate AD since X rises and M falls. A change in our price level moves us along AD. A reduction in the foreign price level decreases AD. Imports Determined by our price level, the foreign price level, the exchange rate, and domestic level of income. Our imports rise as our GDP rises. This is the marginal propensity to import. It reduces the slope of Aggregate Expenditure and reduces the size of the multiplier. The higher our mpi, the smaller our multiplier. Our trade balance thus falls as GDP rises. A trade deficit is more likely when economic times are good. A trade surplus may be associated with a recession. $ M X