Macro_online_chapter_10_14e

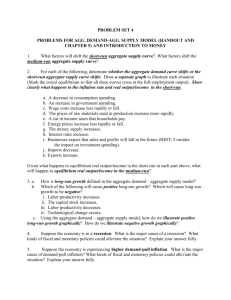

advertisement

Macro Chapter 10 Dynamic Change, Economic Fluctuations, and the AD-AS Model 4 Learning Goals 1) Examine the factors that shift aggregate demand 2) Examine the factors that shift short-run and long-run aggregate supply 3) Analyze the impact of unanticipated changes in aggregate demand and short run aggregate supply 4) Consider whether market forces will return the economy to equilibrium without government intervention It’s important to remember what we’re doing We are using a model of the economy (the AD-AS model) to begin to explain and understand the business cycle The actual economy is very complex and internationally integrated This is a principles class- not an advanced theory class Anticipated and Unanticipated Changes People react and behave differently to events that are foreseen (anticipated) and events that are surprising (unanticipated) Factors that Shift Aggregate Demand Recall two things: (1) Chapter 3 – change in demand vs. change in quantity demanded (2) Chapter 9 – four key markets Remember circular flow diagram- four key markets are connected; a change in one will impact the others Don’t memorize lists from the book Think about changes in the world that will cause lots of consumers to change their behavior; i.e. buy more or buy less Q10.1 (MA) If Asian economies suffer a serious economic slump, 1. US net exports will rise 2. US net exports will fall 3. AD will shift right 4. AD will shift left 5. US unemployment will rise 6. US unemployment will fall Q10.2 Which of the following will most likely increase aggregate demand? 1. 2. 3. 4. a decrease in stock market prices a lower real interest rate a decrease in the expected inflation rate a decrease in real GDP 6 factors that shift AD listed in text: 1) 2) 3) 4) 5) 6) Changes in real wealth Changes in the real interest rate Change in expectations Change in the expected rate of inflation Changes in incomes abroad Changes in exchange rates Shifts in Aggregate Supply Remember to distinguish between the short run and the long run For the long run, think about capacity (What are we able to produce or how much can we produce? Also remember shifting the PPC) For the short run, think about profits Q10.3 (PMA) If an improvement in the quality of education in the United States increases the productivity of labor, this will 1. Increase SRAS 2. Decrease SRAS 3. Increase LRAS 4. Decrease LRAS Q10.4 Other things constant, an increase in resource prices will 1. decrease short-run aggregate supply. 2. increase short-run aggregate supply. 3. decrease long-run aggregate supply. 4. increase long-run aggregate supply. Factors that shift SRAS: 1) Changes in resource prices 2) Changes in the expected rate of inflation 3) Supply shocks Factors that shift LRAS: 1) Changes in the resource base 2) Changes in technology 3) Changes in institutional arrangements (i.e. the “rules”) Steady Economic Growth and Anticipated Changes in Long-Run Aggregate Supply Steady economic growth is desirable because: (1) Output growth leads to income growth (2) People will make better decisions than if faced with highly variable changes (3) More people will be employed Unanticipated Changes And Market Adjustments Surprising events happen all the time. This section addresses how the economy reacts to such changes. The reactions are multiple-step processes that usually involve all four key markets What if AD surprisingly increases? (1) Firms will increase production (move along SRAS) – Actual output > potential output – Actual unemployment < natural rate (2) Resources prices will begin to rise (3) Interest rates will rise as demand for loanable funds increases (4) Foreigners will purchase more US assets; the dollar will appreciate (5) SRAS will begin to fall (shift left) and consumers will buy less (move along AD) (6) The economy will return to long run equilibrium What if AD surprisingly decreases? (1) Firms will decrease production (move along SRAS) – Actual output < potential output – Actual unemployment > natural rate (2) Resources prices will begin to fall (3) Interest rates will fall as demand for loanable funds decreases (4) Foreigners will purchase fewer US assets; the dollar will depreciate (5) SRAS will begin to rise (shift right) and consumers will buy more (move along AD) (6) The economy will return to long run equilibrium Summary Points: Generally, if AD increases, then SRAS will eventually decrease Generally, if AD decreases, then SRAS will eventually increase Sometimes a change in AD is temporary and will quickly move back to its original position so SRAS need not change Q10.5 Which of the following will most likely occur as the result of an unanticipated increase in aggregate demand that pushes output beyond long-run capacity? 1. 2. 3. 4. An increase in the unemployment rate. An increase in the real interest rate. A decrease in resource prices An appreciation of the dollar Q10.6 (MA) Which of the following will most likely accompany an unanticipated increase in aggregate demand? 1. 2. 3. 4. 5. 6. a decrease in resource prices an increase in resource prices a decrease in real GDP an increase in real GDP the dollar will appreciate the dollar will depreciate What if SRAS surprisingly changes? You must first ask yourself, is the change temporary or permanent? If temporary, then SRAS will shift back; no change in LRAS If permanent, then SRAS will shift and stay; LRAS will also shift Q10.7 (MA) For an oil-importing country such as the United States, the effects of a supply shock caused by an increase in the price of imported oil would tend to be 1. 2. 3. 4. an increase in real output. a decrease in real output. a decrease in resource prices. an increase in resource prices. Q 10.8 In the aggregate demand/aggregate supply model, when the output of an economy is less than its long-run potential, the economy will experience 1. declining real wages and interest rates that will stimulate employment and real output. 2. rising interest rates that will stimulate aggregate demand and restore full employment. 3. a budget surplus that will stimulate demand and, thereby, help restore full employment. 4. rising real wages and real interest rates that will restore equilibrium at a higher price level. Key Points: The U.S. economy is large and complex. It’s affected by billions of people and worldwide events. “Real” changes such as exchange rates, resources prices, and interest rates are important. Expectations, sentiment, and the political climate are factors that are impossible to measure but critical to decision-making and economic outcomes. Cause and effect relationships are difficult to identify. Ceteris paribus is difficult to use. Unanticipated Changes, Recessions, and Booms Will the economy move from a disequilibrium point back to longrun equilibrium “on its own”? That is, does the economy have a “selfcorrecting mechanism”? Arguably yes The four key markets are tightly connected such that a change in one market will cause a reaction in another market 2 Key Components: (1) Interest rate changes are key incentives – Higher (lower) interest rates cause less (more) consumption and investment (2) Resource price changes redirect production – Higher (lower) resource prices in one market will lower (raise) production there and increase (decrease) production somewhere else The big question is, how quickly does it work? – If it works slowly, something else must be done to restore long run equilibrium (fiscal and monetary policy, i.e. stimulus) – If it works quickly, then nothing else needs to be done Question Answers 10.1 = 2, 4, 5 10.2 = 2 10.3 = 1, 3 10.4 = 1 10.5 = 2 10.6 = 2, 4, 6 10.7 = 2, 4 10.8 = 1