Harley-Davidson Inc.

advertisement

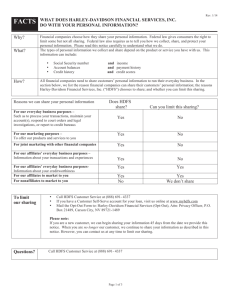

Student Managed Fund-Stock Analysis Report Prepared by: Patrick Mastan November 3, 2003 Harley-Davidson Inc. (NYSE-HDI) Large Cap: $14.6 billion Industry: Recreational Products Sector: Consumer Cyclical Valueline: Timeliness: 2 Safety: 3 Technical: 5 Business Summary Harley-Davidson, Inc. was incorporated in 1981, at which time it purchased the HarleyDavidson® motorcycle business from AMF Incorporated in a management buyout. In 1986, Harley-Davidson, Inc. became publicly held. Unless the context otherwise requires, all references to the “Company” include Harley-Davidson, Inc., all of its subsidiaries and all of its majority-owned affiliates. The Company operates in the Motorcycles & Related Products segment and the Financial Services segment. The Company’s reportable segments are strategic business units that offer different products and services. They are managed separately based on the fundamental differences in their operations. The Motorcycles & Related Products (Motorcycles) segment includes the group of companies doing business as Harley-Davidson Motor Company (Motor Company), subsidiaries of H-D Michigan, Inc., and Buell Motorcycle Company LLC (BMC). The Motorcycles segment designs, manufactures and sells primarily heavyweight (engine displacement of 651+cc) touring, custom and performance motorcycles as well as a complete line of motorcycle parts, accessories, clothing and collectibles. The Company, which is the only major American motorcycle manufacturer, has held the largest share of the United States heavyweight (651+cc) motorcycle market since 1986 and ended 2002 with a domestic market share of 47.5% (Harley-Davidson models only) (Data provided by the Motorcycle Industry Council). The Financial Services (Financial Services) segment consists of the Company’s subsidiary, Harley-Davidson Financial Services, Inc. and its subsidiaries (HDFS). HDFS is engaged in the business of financing and servicing wholesale inventory receivables and consumer retail installment sales contracts (primarily motorcycles and aircraft). Additionally, HDFS is an agency for certain unaffiliated insurance carriers providing property/casualty insurance and extended service contracts to motorcycle owners. Financial Data/Ratio Comparisons For the 9 months ended 9/28/03, sales rose 14% to $3.68B. Net income rose 35% to $578.5M. Revenues reflect increased Harley- Davidson unit shipments and an increase in financing income. Net income also reflects improved gross operating margins. Key Ratios & Statistics Price & Volume Valuation Ratios Recent Price $ 47.33 Price/Earnings (TTM) 52 Week High $ 54.94 Price/Sales (TTM) 3.03 52 Week Low $ 35.01 Price/Book (MRQ) 5.23 Avg Daily Vol (Mil) 2.03 Price/Cash Flow (TTM) Beta 1.28 Per Share Data 19.76 15.68 Share Related Items Earnings (TTM) $ Mkt. Cap. (Mil) $ 14,324.95 Sales (TTM) $ Shares Out (Mil) 302.66 Book Value (MRQ) $ 9.05 Float (Mil) 301.90 Cash Flow (TTM) $ 3.02 Cash (MRQ) $ 4.60 Dividend Information 2.40 15.64 Yield % 0.34 Mgmt Effectiveness Annual Dividend 0.16 Return on Equity (TTM) 30.30 Payout Ratio (TTM) % 4.77 Return on Assets (TTM) 17.88 Return on Investment (TTM) 23.63 Financial Strength Quick Ratio (MRQ) 2.24 Profitability Current Ratio (MRQ) 2.53 Gross Margin (TTM) % 33.58 LT Debt/Equity (MRQ) 0.14 Operating Margin (TTM) % 23.21 Total Debt/Equity (MRQ) 0.26 Profit Margin (TTM) % 15.31 Valuation Ratios RATIO COMPARISON Valuation Ratios Company Industry Sector S&P 500 P/E Ratio (TTM) 19.76 20.35 18.41 25.04 P/E High - Last 5 Yrs. 49.48 44.59 38.18 47.92 P/E Low - Last 5 Yrs. 18.80 14.12 9.79 16.16 Beta 1.28 0.85 1.03 1.00 Price to Sales (TTM) 3.03 2.17 1.13 3.30 Price to Book (MRQ) 5.23 4.19 3.17 4.29 Price to Tangible Book (MRQ) 5.23 4.75 7.44 7.21 Price to Cash Flow (TTM) 15.68 18.67 12.11 19.26 Price to Free Cash Flow (TTM) 23.65 27.07 17.39 31.31 % Owned Institutions 69.84 54.38 48.96 63.97 PERFORMANCE GRAPH Comparison of Five Year Cumulative Total Return* Harley-Davidson, Inc. S&P MidCap 400 S&P 500 1997 $100 $100 $100 1998 $175 $119 $129 1999 $237 $137 $156 *Assumes $100 invested on December 31, 1997 2000 $295 $160 $141 2001 $403 $160 $124 2002 $342 $135 $95 Chart Recent News New Issue-Harley-Davidson sells $300 M in asset-backed securities NEW YORK, Oct 16, 2003 (Reuters) -- Harley-Davidson Inc. (HDI) sold $300 million of asset-backed securities supported by motorcycle loans, syndicate sources said on Thursday. Wachovia Securities was lead manager of the deal, while J.P. Morgan was comanager. Harley-Davidson Financial Services Rides Away With the 2003 AFP Pinnacle Award Grand Prize (Buckeye Technologies and the Ohio State University Recognized for Outstanding Innovation and Technology in Treasury and Finance) BETHESDA, Md., Oct 15, 2003 (PRNewswire via COMTEX) -- Harley-Davidson Financial Services, Inc.(HDFS) received the 2003 Association for Financial Professionals (AFP) Pinnacle Award grand prize for its creation of EPAY, an Internet-based statement presentment and payment program for the nationwide Harley-Davidson dealer network. The award will be presented during the Opening General Session at The AFP 24th Annual Conference in Orlando, November 2-5. EagleRider, Renter of Harley-Davidson, Inc. Motorcycles, Adds New Choices to the Tours of Suntrek NEW YORK, Sep 30, 2003 (Reuters) -- Harley-Davidson, Inc. announced that it has joined forces with Suntrek in a new program that will offer Harley-Davidson motorcycles in Suntrek's new 2004 tour catalog. In the new Suntrek/EagleRider alliance, HarleyDavidson motorcycles will be made available to those Suntrek tour participants who would prefer the "open air" on a motorcycle. Risk Analysis Board of Directors Jeffrey L. Bleustein Donald A. James James A. Norling Barry K. Allen Chairman of the Board/President & CEO Chairman and Chief Executive Officer of Fred Deeley Imports Ltd. Retired as the Executive Vice President of Motorola, Inc Executive Vice President and Chief Human Resources Officer of Qwest Communications International Inc. Richard I. Beattie Partner of Simpson Thacher & Bartlett George H. Conrades Chairman and Chief Executive Officer of Akamai Technologies, Inc. Sara L. Levinson President of the Women’s Group of Rodale, Inc. George L. Miles President and Chief Executive Officer of WQED Multimedia The Board has determined that all current directors, other than Jeffrey Bleustein and Donald James, qualify as independent directors of the Company under the proposed rules of the New York Stock Exchange, Inc. Insider Trading INSIDER & RULE 144 TRANSACTIONS REPORTED - LAST TWO MONTHS Date 16-Oct-03 Insider Shares Transaction Value* BERRYMAN, GARRY S. 71,042 Planned Sale $3,491,7141 71,042 Option Exercise at $14.41 - $44.41 per share. N/A 71,042 Sale at $48.25 - $48.99 per share. $3,454,0002 10,000 Option Exercise at $14.41 per share. $144,100 10,000 Sale at $49.99 per share. $499,900 10,000 Planned Sale $498,2001 6,200 Sale at $50.21 per share. $311,302 Vice President 16-Oct-03 BERRYMAN, GARRY S. Vice President 16-Oct-03 BERRYMAN, GARRY S. Vice President 28-Aug-03 HUTCHINSON, RONALD M. Vice President 28-Aug-03 HUTCHINSON, RONALD M. Vice President 28-Aug-03 HUTCHINSON, RONALD M. Officer 21-Aug-03 BROSTOWITZ, JAMES M. Controller 21-Aug-03 BROSTOWITZ, JAMES M. 6,200 Option Exercise at $6.09 per share. $37,758 29,144 Planned Sale $1,448,7481 4,000 Sale at $50 per share. $200,000 600 Sale at $50 per share. $30,000 4,000 Planned Sale $200,0001 600 Planned Sale $30,0001 59,500 Sale at $49.26 per share. $2,930,970 61,812 Option Exercise at $14.41 - $25.8 per share. N/A Controller 21-Aug-03 BROSTOWITZ, JAMES M. 19-Aug-03 ZIEMER, JAMES L. Chief Financial Officer 19-Aug-03 ZIEMER, JAMES L. Chief Financial Officer 19-Aug-03 ZIEMER FAMILY LIMITED PARTNERHIP 19-Aug-03 ZIEMER FAMILY FOUNDATION 15-Aug-03 HEVEY, JOHN A. Vice President 15-Aug-03 HEVEY, JOHN A. Vice President Models: Risk Free Rate: 4.18% S&P 500 10 Year Return: 7.93% Beta: 1.28 1. Required Rate of Return k = rf+ β(rm-rf): 8.98% Earnings 1994: 0.34 Earnings 2002: 1.90 ge = (1.90/0.34) ^(1/9)-1= 21.07% Average growth in EPS from 1994-2002 Average ROE: 23.06% (8 year average) Average Retention: 1-[(19.7%+19.1%+18.5%+18.4%+20.7%+22.6%+22.9%+24.1%)/8] =79.25% Gr: ROE*retention ratio (b)= 23.06%*79.25%= 18.28% Average g: (29.89%+26.55%+32.87%)/3 = 29.77% k<g Since the growth rate is higher than the required rate of return, the investment should be made. 2. P/E Model Avg P/E ratio 30.0 Expected EPS (VLIS) = $2.65 5-Year Horizon: 3.75 P/E Ratio: 22.36 Projected high price for the next 5 years: 22.36 * $3.75 = $83.85 Lowest price in the last 3 years: $35.01 Current Price: $47.33 Quartiles Strong buy: $ 35.01 - $47.22 Weak buy: $ 47.22 - $59.43 Hold: $ 59.43 - $71.64 Sell: $ 71.64 - $83.85 Upside potential: $83.85-47.33 = $36.52 Downside potential $47.33-35.01 = $12.32 Upside/Downside potential: 2.96 We recommended buying Harley-Davidson on October 23, when the current price was $47.33, which puts this investment within $.11 of a strong buy based on historical figures. 3. Valuepro.net Intrinsic Value Growth Rate Risk Free Rate WACC 84.33 16.5% 4.18 7.91 4. Valueline Model HDI: Long Term Debt + Shareholder Equity: Growth Rate: Common Shares Outstanding: Average Annual P/E Ratio: Return on Total Capital: The Future Price: 2,612.9 * 1.165^10 / 302.66 * .18 * 25 = 100 / 1.15^10 (Discount the future price) = 2,612.9 (million) 16.5% 302.66 (million). 25 18% $178.91 $44.22 At the current price we are overpaying for Harley-Davidson using conservative estimates. With a required rate of return of 14%, our buy price would be $48.26, which is greater than the current price. We feel that purchasing Harley-Davidson will add substantial value to our portfolio because of the company’s future earnings potential. We feel confident that Harley-Davidson will continue to grow at similar rates evidenced in the past 10 years due to the company’s incredible market share. Harley-Davidson is the only major American manufacturer of heavyweight motorcycles. The company not only has a 48.2% market share for heavyweight motorcycles (651 +cc) in the United States, but also a 30.8% market share in the world. 5. Recommendation Buy 317 shares at $47.33 = $15,003.61 Downside review: $ 42.60 (-10%) Stop loss: $ 40.23 (-15%) Upside review: $ 54.43 (15%) Vote results for: 10 against: 0 Abstain: Trade executed by: Dr. Ghosh