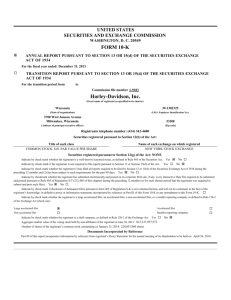

FINANCE 210 _H.D. RATIO ANALYSIS & STOCK VALUATION_

advertisement

Financial Follow Up OUR MISSION WE FULFILL DREAMS THROUGH The EXPERIENCES of MOTORCYCLING by PROVIDING To MOTORCYCLISTS and to the GENERAL PUBLIC An EXPANDING LINE of MOTORCYCLES, BRANDED PRODUCTS and SERVICES in SELECTED MARKET SEGMENTS. Prepared For: Dr. Hanin Abdallah American University of Beirut Prepared By: Abdul Aziz Al Hariri Jamal Haidar Hazem Taha March 22, 2004 1 Harley Davidson Foundation The mission of the Harley-Davidson Foundation is to support the communities in which we have facilities with funding and employee volunteerism. The Foundation reaches out to build healthy, thriving communities by placing an emphasis on Education, Community Revitalization, Arts & Culture, Health and the Environment. The Harley-Davidson Foundation targets areas of greatest need among under-served populations to enhance the quality of life in our communities. The Foundation also supports selected national causes, including Veterans initiatives. Brief History (1903) It’s a history no one on earth could have made up. Four young men experiments with internal combustion in a tiny wooden shed. Not only does the shed not burn down, but the motorcycle they build goes on to serve for over 100,000 miles, under five owners. And that is just the beginning. Financials Harley-Davidson has delivered 18 consecutive years or record revenues and earnings. In 2003, shareholders realized a five-year total return of 101%. While there are impressive results, we remain focused on sustainable growth, and our principle objectives are to grow value and further strengthen the brand. 2 Financial Statements Harley-Davidson’s financial statement for the past 5 years is shown as follows: a- Balance Sheet Harley-Davidson, Inc. Comparative Consolidated Balance Sheets Unaudited December 31 (In thousands) ASSETS 2003 2002 2001 2000 1999 $812,449 $280,928 $439,438 $419,736 $183,415 Marketable Securities 510,211 514,800 196,011 Accounts receivable, net 112,406 108,694 118,843 98,311 101,708 Finance receivables, net 1,001,990 855,771 656,421 530,859 440,951 207,726 218,156 181,115 191,931 168,616 Deferred income taxes 51,156 41,430 38,993 28,280 29,434 Prepaid expenses 33,189 46,807 34,443 28,147 24,870 — — — — — Total current assets 2,729,127 2,066,586 1,665,264 1,297,264 948,994 Finance receivables, net 735,859 589,809 379,335 234,091 354,888 1,046,310 1,032,596 891,820 754,115 681,741 — — — — — 53,678 49,930 49,711 54,331 55,408 358,114 122,296 132,365 96,603 71,046 — — — — — Current assets: Cash and cash equivalents Inventories Net assets from discontinued op's Property, plant and equip, net Deferred income taxes Goodwill Other assets Net assets from discontinued op's Total assets $4,923,088 $3,861,217 $3,118,495 $2,436,404 $2,112,077 3 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Notes payable, including current maturities of long-term debt $— $— $— $— $— Accounts payable 223,902 226,977 194,683 169,844 137,660 Accrued & other liabilities 407,566 380,496 304,376 238,390 199,331 Current portion of finance debt 324,305 382,579 217,051 89,509 181,163 955,773 990,052 716,110 497,743 518,154 Finance debt 670,000 380,000 380,000 355,000 280,000 Other long-term liabilities 212,179 152,831 176,190 97,340 77,124 Postretirement health care benefits 127,444 105,419 89,912 80,666 75,719 3,266 3,254 3,242 3,210 1,592 419,455 386,284 359,165 285,390 236,540 3,074,037 2,372,095 1,833,335 1,431,017 1,113,376 47,174 (46,266) (13,728) 308 (2,067) (586,240) (482,360) (425,546) (313,994) (187,992) — (92) (185) (276) (369) 2,957,692 2,232,915 1,756,283 1,405,655 1,161,080 Total current liabilities Shareholders' equity: Common stock Additional paid in capital Retained earnings Accumulated other comprehensive income (loss) Treasury stock Unearned compensation Total shareholders' equity Total liabilities and shareholders' equity $4,923,088 $3,861,217 $3,118,495 $2,436,404 $2,112,077 4 b- Income statement HARLEY-DAVIDSON, INC. ANNUAL INCOME STATEMENTS Unaudited YEAR ENDED DECEMBER 31 (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) 2003 2002 2001 2000 1999 NET REVENUE: H-D Motorcycle $3,621,488 $3,161,046 $2,671,314 $2,246,403 $1,890,932 Parts & Accessories 712,829 629,202 509,624 447,846 362,598 General Merchandise 211,388 231,503 163,909 151,438 132,705 76,064 66,949 61,672 58,053 63,474 2,505 2,270 267 2,625 3,230 4,624,274 4,090,970 3,406,786 2,906,365 2,452,939 3,814,651 3,422,204 2,818,492 2,320,991 1,915,631 809,623 668,766 588,294 585,374 537,308 4,624,274 4,090,970 3,406,786 2,906,365 2,452,939 1,665,566 1,417,841 1,152,970 963,774 835,686 668,677 626,720 539,660 476,289 438,085 15,498 12,646 12,083 9,691 9,427 167,873 104,227 (61,273) (37,178) (27,685) 1,149,264 882,702 662,501 514,972 415,859 (6,317) (13,416) (6,524) 16,001 (3,081) 1,142,947 869,286 655,977 530,973 412,778 23,088 16,541 17,478 17,583 8,014 1,166,035 885,827 673,455 548,556 420,792 760,928 580,217 437,746 347,713 267,200 — — — — — 760,928 580,217 437,746 347,713 267,200 — — — — — $760,928 $580,217 $437,746 $347,713 $267,200 Buell Motorcycle Defense and Other Domestic International Gross Profit Operating Exp—Motorcycle Operating Exp—Corporate H-D Financial Services Operating Profit Other EBIT Interest PreTax Income Net Income from Continuing Ops Extraordinary Items Net Income Before Disc Ops Net Income (Loss) from Disc Ops Net Income 5 Basic/Primary Earnings per Common Share: Income from continuing operations $2.52 $1.90 $1.45 $1.15 $0.88 Extraordinary items — — — — — Income from discontinued operations — — — — — $2.52 $1.92 $1.45 $1.15 $0.88 $2.50 $1.89 $1.43 $1.13 $0.86 Extraordinary items — — — — — Income from discontinued operations — — — — — $2.50 $1.89 $1.43 $1.13 $0.86 — — — — — Basic 302,271 302,297 302,506 302,691 304,748 Diluted 304,470 305,158 306,248 307,470 309,714 $0.195 $0.14 $0.115 $0.098 $0.088 Net income Diluted Earnings per Common Share: Income from continuing operations Net income Weighted Ave Shares: Primary Dividends Paid 2 for 1 stock splits: 6/90, 6/92, 9/94, 9/97, and 4/00. Note: Per FASB's Emerging Issues Task Force on "Accounting for Shipping and Handling Fees and Costs" and "Accounting for Certain Sales Incentives", certain 2000 and 2001 year balances have been reclassified. 6 c- Stock Price HDI – NYSE 4:00 PM ET - Mar 22 2004 $ 51.35 $ -0.87 1,467,300 2,860 $ 51.10 $ 52.22 $ 37.25 $ 54.42 7 Financial Analysis Liquidity Ratios and analysis Year CR QR Current Ratio Quick Ratio 2003 2.85541337 2.63807515 2002 2.08735097 1.86700295 2001 2.32543045 2.0725154 2000 2.60629281 2.2206902 Therefore, we conclude that in year 2000 H.D. liquidity represented by its current ratio has slightly improved from the previous year (1999). However, the company approximately follows a constant trend across the years of 2000 till 2003 fluctuating from 2 to 2.8 in 2003 which proves that the company is raising or making enough cash to satisfy any of its liabilities. Looking in the cash sector on the balance sheet, we see the accumulation of cash from year to year the fact that strengthens H.D. position to meet its accrual expenses and thus showing its investors how much the company is gaining. As the leading Motor Cycle Co. in the US and other regions of the world, Harley Davidson still face a growing number of rivals in the global Market like Honda and BMW to name a few. But its differentiated and luxurious products puts H.D. at the top were its predictable manufactures limited number of vehicles consistent with the market demand the fact that insures it sales and easily forecasts it future profitability. H.D. quick ratio shows how increasing inventories affect its liquidity. Moreover, its high level of inventories explains how much it is effecting the company’s assets compared to it liabilities. From 2002 to 2003, we say that the company did really well by decreasing its accumulated level of inventory. 8 1999 1.83149025 1.50607348 ASSET MANAGEMENT RATIOS: Inventory Turnover Ratio :( Sales/Inventory) 2003 2002 2001 2000 1999 4624274/207726 4090970/218156 3406786/181115 2906365/191931 2452939/168616 =22.16times 18.75times 18.81times 15.14times 14.54times Days of Sales Outstanding-DSO: (Receivables/ Sales/365) 2003 2002 2001 2000 1999 112406/12669.24 108694/11208.13 118843/9333.66 98311/7962.64 101708/6720.3 8.87times 9.69times 12.73times 12.34times 15.13times Fixed Assets Turnover Ratio FATO: (Sales/Fixed Assets) 2003 2002 2001 2000 1999 4624274/1046310 4090970/1032596 3406786/891820 2906365/754115 2452939/681741 4.41times 3.96times 3.82times 3.85times 3.59times Total Assets Turnover Ratio TATO (Sales/Total Assets) 2003 2002 2001 2000 1999 4624274/4923088 4090970/3861217 3406786/3118495 2906365/2436404 2452939/2112077 0.93times 1.06times 1.09times 1.19times 1.16times Inventory turnover which is the sales over the inventory, appears to be progressing in the last 5 years, which means that the management in HarleyDavidson, Inc. are doing well and taking good decisions about the timing of buying inventory which allows them not to keep inventory high when sales are going down and such managerial approach help in maintaining a good inventory turnover ratio. From the Accounts receivable, we notice that Harley-Davidson, Inc sell on account in its daily operating activities, but it is not a problem because the receivables section, as shown in the balance sheet and the income statement, are using a good policy for collecting their accounts receivables and that is shown by the decrease in the DSO ratio from 1999 to 2003. The Harley-Davidson, Inc. is a very efficient company. Its employees are using the available fixed assets in a proper way and by adapting to them we see that during the previous five years their fixed assets turnover ratio increased by around0.82 times and that is something good. On the other hand, we can easily see that the company is not using or benefiting well 9 from all of their assets (total assets), that is noticed by looking to the TATO ratio which is decreasing. Maybe that is because of the expired or the old assets. One solution to such a problem is that managers at Harley-Davidson, Inc. sell the assets that are not beneficial anymore so that to total assets will decrease and TATO increase again. DEBT RATIOS: Debt Ratio: Total Debt/ Total Assets 2003 2002 2001 2000 1999 1837952/4923088 152833.6/3861217 1272300/3118495 950083/2436404 875278/211077 0.3 0.39 0.4 0.38 0.41 Times Interest Ratio: EBIT/ Interest 2003 1142947/23088 49.5% 2002 869286/16541 52.55% 2001 655977/17478 37.53% 2000 530973/17583 30.19% 1999 412778/8014 51.5% According to Harley-Davidson, Inc. the company’s interest is recovered 51 times during 1999 and then decreased in the following two years before it come again the same as 1999 and we can refer that to the decrease in sales during 2000 and 2001. And as shown in the above tables, the company didn’t add its debt or remove any of the assets which lead the debt ratio be relatively the same. Profitability: Profit margin of sales =NI /SALES 2003 760,928 /4,624,274 2002 580217 /4,090,970 2001 437746 /3,406,786 2000 347713 /2,906,365 1999 267200 /2,452,939 0.16 0.14 0.12 0.12 0.10 BEP = EBIT /total assets 2003 2002 2001 2000 1999 10 1,142,947/4923088 869,286/3861217 655,977/3118495 530,973/2436404 412,778/2112077 0.23 0.22 0.21 0.21 0.19 ROA = NI /total assets 2003 $760,928/4923088 2002 $580,217/3861217 2001 $437,746/3118495 2000 $347,713/2436404 1999 $267,200/2112077 0.15 0.15 0.14 0.14 0.12 ROE =NI /common equity 2003 2002 $760,928/ $580,217/ 3266 3254 232 178 2001 2000 $437,746/ 3242 135 1999 $347,713/ 3210 108 $267,200/ 1592 167 We can see that the first three ratios of profitability are increasing in increasing rate from 1999 to 2003 and the vise versa for the last one. According to the profit margin of sales, we see that it is increasing during the last 5 years because both the income and number of sales were increasing due to the decrease in cost. And that gradual increase in profit margin, affect directly if we want to say the BEP in the company which show that the earnings before any taxes or paying for any interest divided by the total assets, also increase. All of the previous facts, helped the ROA to increase accordingly and we should say that if the managers sell or donate the unbeneficial assets, this ratio will increase and show again that the company is better and better. When the PM, ROA, BEP, are increasing, then it is very difficult that the equity holders are not gaining or that their ROE will not increase. Market value Price/earning (P/E) = price per share /earning per share 2003 2002 2001 2000 1999 $ 51.35/2.50 $ 51.35/1.89 $ 51.35/1.43 $ 51.35/1.13 $ 51.35/0.86 20.54 27.1 35.9 45.44 59.7 Price / cash flow = price per share / cash flow per share 11 2003 2002 2001 2000 1999 $ 51.35/2.50 $ 51.35/1.89 $ 51.35/1.43 $ 51.35/1.13 $ 51.35/0.86 20.54 27.1 35.9 45.44 59.7 12 In 2003, the Company's net revenue and net income grew 13.0 percent and 31.1 percent, respectively, making 2003 the 18th consecutive year of record net revenue and net income. Net revenue of over $4.6 billion was $533 million higher than in 2002, while 2003 net income of $761 million was $181 million higher than last year. Revenue from sales of Harley-Davidson® motorcycles grew to over $3.6 billion in 2003, an increase of 14.6 percent over 2002. Buell motorcycle revenue of $76 million was up 13.6 percent. Revenue of Genuine Parts and Accessories in 2003 totaled $713 million, a 13.3 percent increase over the previous year, and General Merchandise revenue was $211 million or 8.7 percent lower than in 2002. Harley-Davidson continues to effectively allocate its capital investments and realized a return on invested capital (ROIC) of nearly 21 percent in 2003, which compares favorably with an estimated 6-8 percent ROIC for the S&P 500. The Company's share price increased 2.9 percent during 2003 and underperformed the S&P 500, which was up 26.4 percent. The Company increased its dividend for the 11th consecutive year in 2003 and doubled its quarterly payout in the fourth quarter. Since HarleyDavidson, Inc. became a public company in 1986, shareholders have enjoyed a compound annual growth rate of over 31 percent, along with five 2-for-1 stock splits. Harley-Davidson Motorcycles Worldwide retail registrations of Harley-Davidson motorcycles grew 8.7 percent and exceeded the worldwide market growth rate for heavyweight motorcycles for the sixth year in a row. In North America, 2003 retail registrations of Harley-Davidson motorcycles increased 8.2 percent over 2002. In Europe, registrations of Harley-Davidson motorcycles increased 11.8 percent, and in the Asia/Pacific region, where the major markets are Japan and Australia, retail registrations of Harley-Davidson motorcycles increased 11.7 percent over 2002. 13 Last year, Harley-Davidson motorcycle shipments were a record 291,147 units, up 10.4 percent over 2002. This shipment increase and growing worldwide demand allowed Harley-Davidson motorcycles to achieve a greater than 30 percent share of the worldwide heavyweight market. Looking ahead to 2004, the Company expects demand for its products to continue. As a result, the Company set a production target of 317,000 Harley-Davidson motorcycles. To ensure leadership in this attractive market, Harley-Davidson will continue to increase production capacity and to introduce exciting new products and services that appeal to a diverse and growing motorcycle enthusiast population. Harley-Davidson Financial Services Harley-Davidson Financial Services, Inc. (HDFS) continued a 10 year run of strong earnings growth. Operating income increased from $104 million in 2002 to $168 million in 2003 as HDFS benefited from strong motorcycle retail lending and a low interest rate market. 14 15 16 The 13.0% increase in net revenue for the Motorcycles segment during 2003 was led by a $460.5 million, or 14.6%, increase in Harley-Davidson motorcycle net revenue. Harley-Davidson motorcycle revenue was driven by the 10.4% increase in HarleyDavidson motorcycle unit shipments, but also benefited from wholesale price increases, a slightly favorable product mix and favorable foreign currency exchange rates during 2003. Wholesale price increases for the 100th Anniversary models provided for higher average selling prices on units sold during the first half of 2003 when compared to the same period in 2002. As a result of the extended 100th Anniversary model year, wholesale shipments of 100th Anniversary models, carrying the same pricing, occurred in the third quarters of both 2003 and 2002. Finally, revenue in the fourth quarter of 2003 was only slightly impacted by the lower wholesale prices associated with the 2004 model year motorcycles. Wholesale prices on the 2004 models reflect the elimination of 100th Anniversary special edition features and as a result are slightly lower than the wholesale prices for the 100th Anniversary models. During 2003 the Company experienced product mix changes both within and between its motorcycle families. Changes in product mix within the Company's motorcycle families generally resulted in higher revenue during 2003 17 when compared to 2002. The net result of mix changes between motorcycle families did not have a significant net impact on Harley-Davidson motorcycle revenue in 2003. Finally, foreign currency exchange rates had a favorable effect on revenue of approximately $60 million in 2003, primarily as a result of stronger foreign currencies in Europe and Japan, when compared to 2002. During 2003, Buell® motorcycle net revenue was up $9.2 million, compared to 2002, on 969 fewer unit shipments. The average selling price per unit was higher in 2003 than in the prior year due to a change in the mix of units sold. Buell shipments in 2003 included a higher percentage of the more expensive XB models when compared to 2002. Buell shipments in 2003 consisted of 8,784 XB models and 1,190 Blast models compared to 6,887 XB models and 4,056 Blast models in 2002. During 2003, net revenue from Parts and Accessories (P&A) totaled $712.8 million, a 13.3% increase over 2002. The 2003 increase in P&A revenue was driven primarily by higher motorcycle shipments. P&A revenue was positively impacted in 2003 and 2002 by sales of 100th Anniversary P&A products. Total P&A revenue for 2003 included $32.1 million from sales of 100th Anniversary P&A products compared to $34.0 million last year. Excluding the impact of 100th Anniversary revenue from both 2003 and 2002 the P&A revenue growth rate for 2003 is 14.4%. On a longer-term basis the Company expects that the growth rate for P&A revenue will be slightly higher than the growth rate for HarleyDavidson® motorcycle units (1). General Merchandise revenue during 2003 was $211.4 million, down 8.7% from the same period last year. Sales from 100th Anniversary General Merchandise products accounted for $9.3 million of total General Merchandise revenue during 2003 compared to $52.2 million during 2002. Sales of 100th Anniversary General Merchandise were more heavily concentrated in 2002 in order to prepare the Company's independent dealers for the fourteen-month-long 100th Anniversary celebration. 18 Excluding the revenue from the sale of 100th Anniversary products from both 2003 and 2002 the General Merchandise revenue growth rate for 2003 is 12.7%. The Company expects that the long-term growth rate for General Merchandise will be lower than the growth rate for Harley-Davidson motorcycle units(1). Gross Profit Gross profit in 2003 of $1.7 billion was $247.7 million or 17.5% higher than gross profit in 2002. The increase in gross profit is primarily related to the increase in net revenue. The gross profit margin was 36.0% in 2003 compared to 34.7% in 2002. The increase in gross margin in 2003 was driven by wholesale price increases on 2003 models, favorable motorcycle product mix and foreign currency exchange rates. Gross profit was higher in 2003 when compared to 2002 by approximately $38 million from foreign currency exchange rate changes to both revenue and costs. Financial services income in 2003 was $279.5 million, an increase of $68.0 million over 2002. Operating income from financial services in 2003 was $167.9 million, an increase of $63.7 million over 2002. The increase in operating income in 2003 was driven by continued strong marketplace acceptance of HDFS' finance and insurance products as well as increased securitization related income. During 2003, HDFS sold $1.7 billion of retail motorcycle 19 loans through securitization transactions resulting in gains of $82.2 million. During 2002, HDFS sold approximately $1.3 billion of retail motorcycle loans resulting in gains of $56.1 million. The net gain as a percentage of the amount of loans securitized increased from 4.39% in 2002 to 4.70% in 2003 as HDFS continued to benefit from a favorable interest rate environment. Gains on securitization transactions are based on certain assumptions (credit loss, prepayment speed, and discount rate) which are outlined in Note 3 to the Consolidated Financial Statements. During 2003, income on investment in retained securitization interests increased $13.4 million over 2002 as the portfolio continued to perform better than anticipated. Changes in HDFS' allowance for credit losses during 2003 and 2002 were as follows: HDFS' periodic evaluation of the adequacy of the allowance for credit losses is generally based on HDFS' past loan loss experience, known and inherent risks in the portfolio, and current economic conditions. HDFS believes the allowance is adequate to cover the losses of principal and accrued interest in the existing portfolio. Total operating expenses during 2003 increased $44.9 million or 7.0% compared to last year. Operating expenses as a percent of net revenue were 14.8% and 15.6% for 2003 and 2002, respectively. Operating expenses, which include selling, administrative and engineering expenses, increased in connection with the 20 Company's ongoing investment in initiatives designed to support its current and future growth objectives. However, the increase in 2003 was partially offset by lower net expenditures related to the Company's 100th Anniversary celebration as compared to 2002. The Company began its fourteen-month-long 100th Anniversary celebration during the third quarter of 2002 and net expenses associated with the celebration were most heavily concentrated in 2002. Comparatively, costs incurred during 2003 for the 100th Anniversary celebration were mostly offset by event proceeds and sponsorships. 21 22 23 24 Stocks Harley Davidson is a brand name for a company specializing in motorcycle industry. This company has started its business since 18, and until now it has shown progress in its manufacturing of a special taste if motorcycles. In the past few years, the company has witnessed up and downs in its stock price, and that is related to several reasons. But with this analysis, we will focus on the years 2002 and 2003. In the beginning of year 2002, the company’s stock price exceeded 55$ and it went down all the way below 35$ at the end that same year. At this latter price, the company was selling in the first quarter of 2003, then it started to increase gradually to set at a price of 50$ at the end of the year. And nowadays, it has already crossed above 55$ and very close to the 60s. Now we can shed light using some of the financial statements available for the years 2002 and 2003. As we said before, the company was suffering in 2002 which caused a decrease in its stock price and which is evident in its revenue section. It was about 4 million dollars in 2002 and while it grew up to 4.6 million dollars in 2003. This led to an increase in gross profit of 247,725 $ and net income also increased by 180,711 $ in 2003. This increase in the production and sale of motorcycles must have contributed to an increase in the company’s cash which is also clear in its cash section where there is an increase of 531,521 $. A large portion of this increase in cash was used to buy new assets maybe to enlarge and expand the company’s plant, and this is clear in the 1 million $ increase in total assets. 25 Another portion of the cash was used to pay part of the company’s debt (short term and long term liabilities). This is true in the decrease of 34,279 $ of current liabilities, and the decrease of 37,016 $ of long term liabilities. This shows that the company is producing more, selling more, earning more and able to pay part of its debt. All these factors increased its earning per share from 1.92$ to 2.52$ and they increased their dividends per share from 0.135$ to 0.195$. Finally, we will present some of the ratios computed between 2002 and 2003. Year: 2002 Current ratio: 2.08X (Current assets/ current liabilities) 2003 2.85X This liquidity ratio shows how the borrower’s liquidity position reflects his/her ability to raise cash on time at reasonable cost, including ability to meet payments where they are due. Year: 2002 Leverage ratio: 3.19% (Total liabilities/ Total assets) 2003 1.75% It shows how much debt a borrower has taken in addition to the loan being applied for. Year: 2002 2003 26 Inventory Turnover ratio: 12.25X (Total liabilities/ Total assets) 14.24X This operating efficiency ratio measures the effective performance of a business firm, i.e. how effectively are assets being utilized to generate sales and cash flows for the firm. 27