Tel Aviv University

advertisement

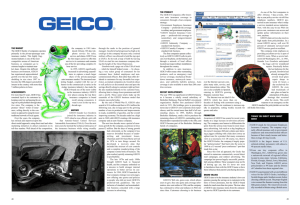

Tel Aviv University Recanati Graduate School of Business Administration 3340-01-b-z 1231.3340 - Corporate Financial Policy Spring 2001 Dr. Shlomith Zuta Office: Recanati 442 Phone: (03) 640-8191 E-mail: szuta@glue.umd.edu Office Hours: Tuesday, 3-4 PM and by appointment Teaching Assistant: Moti Topaz Phone: (03) 546-6656 Cell phone: (052) 553-378 E-mail: motitopaz@bezeqint.net TA’s Office Hours: Sunday, 8-9 PM and by appointment Textbook: Ross, Westerfield, and Jaffe, Corporate Finance, Fifth Edition, Chicago: Irwin/McGraw-Hill, 1999 (henceforth RW&J), ISBN 0-256-24640-8. Grading: Three case write-ups, 5% each One case presentation or Q&A Final examination 15% 15% 70% Class participation can lead to a bonus of 5%. Homework: Homework is assigned throughout the semester. You are required to turn in these problems. Failure to turn in at least 90% of the homework will result in 10 points being taken off your final grade. Homework will not be graded. However, note that the homework is indicative of your ability to understand the material covered in class. In addition, the solution manual to the book problems will be available in the library. I highly recommend that you solve as many of those problems as your time permits. Case Studies: Three case write-ups and one presentation or critique (Q&A) are required. There will be three groups, each consisting of 3 or 4 members, preparing to analyze each case. Following a lottery at the beginning of class, two groups will be presenting each case and one group will be doing the critique (Q&A). The case studies are placed at the end of a particular topic and are to be used as analytical and discussion tools. The objective in using case studies is to provide examples of companies or individuals that have faced the topic at hand and to apply theoretical tools to real problems. Included in this syllabus are questions and ideas that you may use as guidelines for analyzing the case. Do not just answer the questions in a 1,2,3,4 format. Write up the case analysis as an essay/executive memo. The content of the case write-up is as follows: 1. The cases should be done in groups with all group members receiving the same grade for the write-up. If your name is on the report as part of the group, it means you participated in the analysis. 2. The case write-up should be a two-page single-spaced (maximum) report. The two-page maximum does not apply to exhibits such as graphs and tables, but please keep these to a minimum. You may use as many exhibits as necessary to make your point but the exhibits must be referred to in your write-up. The case write-up should be typed in a 12 point font. 3. The case questions are designed to help you streamline the issues to be addressed. If you believe that these questions do not effectively address the problems in the case, feel free to go outside the parameters of the questions. 4. It is not necessary to rehash the case situation in your write-up. Do not, however, assume that I know every single number and detail. Use your judgment on how much of the case to include in your write-up. 5. Most importantly, you must take a position regarding the problem in the case and make specific recommendations on how to solve it. Support your recommendation as succinctly and as effectively as you can. Please note that while cases tend to be very open-ended, you need to make reasonable assumptions and proceed logically. Please state your assumptions clearly and substantiate them if appropriate. The presentations and write-ups can be done in English or Hebrew. I encourage you to do them in English for your own benefit (but your choice will not affect the grade). Class Participation: It is important that everyone come prepared to "open the case" and to discuss in detail the problem and its potential resolution. Each team presentation will consist of an analysis concerning the problem facing the firm and their proposed “solution”. Each group will be responsible for one case presentation or one critique (Q&A). All group members should be present at the presentation or Q&A. Note that groups presenting the case or doing the Q&A need not turn in that particular case write-up. However, they are required to turn in a hardcopy of their slides. The ideal of case discussion is for the class to interactively come to an appreciation of the various avenues that can be explored to understand the case problem and its possible resolution. Good Internet Finance Sites that are useful for getting stock price data and company information. Many others are available. 1. 10K’s, Annual Reports at the Securities Exchange Commission: http://www.sec.gov/edgarhp.htm 2. Nasdaq Stock Market: http://www.nasdaq.com 3. Quote Com Stock Quotes: 2 http://www.quote.com Financial Calculator: Although a financial calculator is not required for this course, the student may find it helpful to purchase one. . Exams: Makeup exams are only allowed for medical emergencies or reserve duty. Plan other events in your schedule accordingly. A doubled-sided, standard size formula sheet will be allowed in the exam. 3 Overview of Course and Readings Readings - RW&J Chapter 13 Chapter 15 Chapters 15, 16 Chapter 18 Topic Introduction and Overview Efficient Markets Introduction to Capital Structure Capital Structure – Taxes and Financial Distress Dividend Policy Chapters 16,18, 21 Chapter 32 Chapter 30 Agency Problems, Options in a Corporate Finance Framework Mergers, Acquisitions and Restructuring International Corporate Finance Please note that topics may be added or deleted with an advance notice of at least a week. -----------------------------------------------------------------------------------------------------------------Cases: Questions and Approximate Dates ------------------------------------------------------------------------------------------------------------------ Case 1: Warren E. Buffet, 1995 (Week 4) Case Questions: 1. What is the possible meaning of the changes in stock price for GEICO and Berkshire Hathaway on the day of the acquisition announcement? Specifically, what does the $718 million gain in Berkshire’s market value of equity imply about the intrinsic value of GEICO? (Note that Berkshire owned 33.25 million shares before the acquisition was announced.) 2. Based on Value Line’s forecasted information, what is the range of possible intrinsic values for GEICO? What questions might you have about this estimated range? 3. How well has Berkshire Hathaway performed? In the aggregate? In its investment in Scott & Fetzer? In its investment in earlier purchases of GEICO stock? In its investments in convertible preferred securities? 4 4. What is “intrinsic value” in Warren Buffet’s perspective, and why is it accorded such importance? How is it estimated? What are the alternatives to intrinsic value, and why does Buffet reject them? 5. Please critically assess Buffet’s investment philosophy, and prepare to identify points where you agree and disagree with him. 6. Should Berkshire shareholders endorse the acquisition of GEICO? Case 2: Marriott Corporation: The Cost of Capital (Week 6) Case Questions: 1. Are the four components of Marriott’s financial strategy consistent with its growth objective? 2. How does Marriott use its estimate of its cost of capital? Does this make sense? 3. What is the weighted average cost of capital for Marriott Corporation? i) What risk-free rate and risk premium did you use to calculate the cost of equity? ii) How did you measure Marriott’s cost of debt? iii) Did you use arithmetic or geometric averages to measure rates of return? Why? 4. What type of investments would you value using Marriott’s WACC? 5. If Marriott used a single corporate hurdle rate for evaluating investment opportunities in each of its lines of business, what would happen to the company over time? 6. What is the cost of capital for the lodging and restaurant divisions of Marriott? i) What risk-free rate and risk premium did you use in calculating the cost of equity for each division? Why did you choose these numbers? ii) How did you measure the cost of debt for each division? Should the debt cost differ across divisions? Why? iii) How did you measure the beta of each division? 5 7. What is the cost of capital for Marriott’s contract services division? How can you estimate its equity costs without publicly traded comparable companies? Case 3: American Home products (Week 8) Case Questions: 1. How much business risk does American Home Products face? 2. How much financial risk would AHP face at each of the proposed levels of debt in exhibit 3? 3. How much potential value, if any, can AHP create for its shareholders at each of the proposed levels of debt? 4. What capital structure would you recommend as appropriate for AHP? What are the advantages and disadvantages? 5. How might AHP implement a more aggressive capital structure policy? What are the alternative methods for leveraging up? Case 4: Dividend policy at FPL Group (Week 10) Case Questions: 1. What are the most important issues confronting FPL Group in May, 1994? 2. From FPL management’s perspective, is FPL’s current dividend ratio appropriate? What factors should be considered in determining its dividend policy? 3. Would you recommend a change in FPL’s dividend policy? If so, how would you implement the change? 4. Answer questions 2,3 from an investor’s perspective. 5. As Kate Stark, what would you recommend regarding investing in FPL’s stock – buy, sell, or hold? 6 Case 5: Interco (Week 12) Case Questions: 1. 2. 3. 4. 5. Assess Interco’s financial performance. Why is the company a target of a hostile takeover attempt? As a member of Interco’s board are you persuaded by the premiums paid analysis (Exhibit 10) and the comparable transactions analysis (Exhibit 11)? Why? Wasserstein, Perella & Co. established a valuation range of $68-$80 per common share for Interco. Show that this valuation range can follow from the assumptions described in the discounted cash flow analysis section of Exhibit 12. As a member of Interco’s board, which assumptions would you have questioned? Why? How would you advise the Interco board on the $70 per share offer? How would you assess the actions of Interco’s board up to August 8, 1988? Wasserstein, Perella & Co.’s? The Rales brothers? Drexel Burnham’s? HONOR CODE Corporate Financial Policy 1. I agree to only submit work that is based on my own efforts. I will not copy any other past or current student’s work or submit group work if I did not participate actively in the analysis or writeup. 2. I agree not to include as members of a group any students who did not actively participate in analyzing or writing up that assignment. This includes cases in which one or more group members are out of town on work or otherwise unable to participate. 7 Students who are unable to participate in a group assignment need to make alternative arrangements with the instructor. 3. I will not use any handouts or solutions from prior year’s courses to help with any assignment. This includes prior students’ work on the cases as well as any other material. 4. I will not talk with any other student in Corporate Financial Policy about any exams, makeup exams and assignments until all students have completed and handed in the exam/assignment concerned. 5. I will not use any other materials in and for the exams beyond what is allowed on a formula sheet as stated in the syllabus. I commit to follow this honor code explicitly and will also report any violations of this code to the instructor. I understand that any violations of this code will at minimum result in a zero on the exam/assignment concerned and may result in a failing grade in the course and/or referral to the Honor Committee of the Business School for further review. Signed: __________________________________ 8