Introduction - ManagementParadise.com

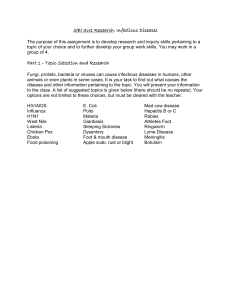

advertisement