Bainbridge-Accounting

advertisement

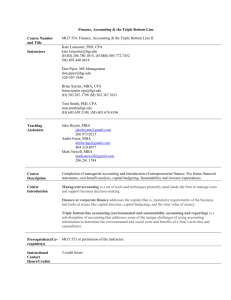

BGI COURSE SYLLABUS Course Number and Title MGT 553 Finance, Accounting, and the Triple Bottom Line I Instructors Kate Lancaster, PhD, CPA kate.lancaster@bgi.edu (W) 805.756.2922, (H-MB) 805.772.7452 (H-BI) 206.780.1015, (C) 805.440.4618 Toni Smith, PhD, CPA toni.smith@bgi.edu 603.659.5108 Brian Setzler, MBA, CPA brian.setzler.cpa@gmail.com (H) 503.287.1798 (C) 503.367.5631 Teaching Assistants Jake Bryant, MBA jakebryant@gmail.com 206.973.0215 André Furin, MBA drefur.bgi@gmail.com 404.310.4077 Mark Newell, MBA marksnewell@gmail.com 206.261.1784 Course Description Classical financial and managerial accounting. Preparing and using financial information in the decision making process. Triple bottom line accounting and the inherent challenges of environmental/social accounting. Course Introduction Our goal is to make sure that you have a strong enough background in accounting and finance to be able to make good business decisions and converse effectively with other professionals. The three broad areas covered in this quarter are: Financial accounting is the set of conventions, principles, and guidelines used to report business results (normally in an annual report) to outside audiences, including investors, bankers, the government, business partners and the general public. Managerial accounting is a set of tools and techniques primarily used inside the firm to manage costs and support business decision-making. Triple bottom line accounting (environmental and sustainability accounting and reporting) is a sub-discipline of accounting that addresses some of the unique challenges of using accounting information to determine the environmental and social costs and benefits of a firm. The two Accounting classes and the Research and Quantitative methods course rely heavily on Excel. Prior to the start of class, you should be able to develop a set of properly formatted financial statements with embedded formulas. Prerequisite(s)/ Co-requisite(s) Passage of diagnostic exam with 80% or better, or permission of the instructor. Instructional Contact 3 credit hours. Hours/Credits Learning Objectives Financial Accounting Understand the basic accounting principles, such as double-entry record-keeping, the matching principle, realization of income and expenses, and determining values for assets and liabilities. Apply methods used to analyze and properly account for business transactions. Apply the correct accounting methods in the preparation of the balance sheet, the income statement, the statement of cash flows and the statement of stockholders’ equity. Analyze company performance using public financial data. Create a spreadsheet forecast for a company in which the income statement, balance sheet and cash flow statements intertwine and work together. Managerial Accounting Analyze cost behavior, identify and quantify cost drivers, and perform cost estimation by product, segment or activity. Recognize and identify the elements of product cost and differentiate between product and period costs. Determine the cost of providing a good or service using various indirect cost allocation tools. Develop spreadsheets and use several Excel tools to analyze cost/volume/profit relationships and perform breakeven analysis. Prepare a master budget and use this information to evaluate performance and identify management implications. Perform incremental analysis in various managerial decisions such as make-or-buy and sell-or process- further. Triple Bottom Line Accounting and Environmental and Social Accounting and Reporting Appreciate and recognize the ethical issues inherent in most business decisions and how information (both financial and otherwise) may be impacted. Incorporate environmental and social accounting issues, including implications for reporting and decision-making. Understand the inherent difficulties of addressing environmental issues within conventional accounting frameworks. Instructional Materials and References Required Books and Course Materials Erikson, G. (2004). Raising the Bar: Integrity and Passion in Life and Business: The Story of Clif Bar, Inc. San Francisco: JosseyBass. ISBN# 0787973653 CD’s: Introduction to Accounting: The Language of Business produced by Norm Nemrow and Brigham Young University. Erskine, J., L. Mauffette-Leenders, and M. Leenders. (2007). Learning With Cases. Ontario: Ivey Publishing. Required Articles and Book Chapters Hitchcock, D. E., & Willard, M. L. (2009). The business guide to sustainability: Practical strategies and tools for organizations, Chapter 13: Accounting and Finance: How to Account for Environmental and Social Impacts (pp. 245-265). London: Earthscan. Simons R. & Davila A. (1996). Preparing and Using a Statement of Cash Flows. Boston, MA: Harvard Business School case Source Purchase new or used or borrow from your public library. Purchase at http://accountingcds. com/index.html for $62.50 + shipping http://cases.ivey.uw o.ca/cases/pages/ho me.aspx BGI Library eReserves Harvard Business Online #196108 Hansen, F. (2007). Sustainability Reporting: Straight to the Bottom Line. Business Finance Magazine (February), 18-22. Sulaiman, M. & N. Ahmad. (2006). Environmental Management Accounting: Towards a Sustainable Future. Accountants Today (March): 22-33. White A. (2007). Quiet Revolution in Business Reporting. Boston, MA: Ceres, Inc. (6 pages). Retrieved September 3, 2008 from: http://www.incr.com/NETCOMMUNITY/Document.Doc?id=17 0 Required Cases (Case No.) Bruns Jr, W. (1997) Lille Tissages, S.A. (198005) BGI Library eReserves BGI Library eReserves BGI Library eReserves Bruns Jr, W. (2001) Maria Hernandez & Associates. (902401) Used for the Summer Accounting Prep, but purchased now. Keating, E. (2003) New York City Audubon Society. KEL143 Plambeck, E., and Denend L. (2007) Wal-Mart's Sustainability Strategy OIT71 Rankine G. (2009) Primo Benzina AG. TB0013-PDF-ENG Simons, D, and A. Davila. (1995) Chemalite, Inc. (B): Cash Flow Analysis. 195130-PDF-ENG Thompson, D. (2009) Cariboo Industrial Ltd. 905B21-PDF-ENG Wilson, D. (2008) Chemalite, Inc. 177078-PDF-ENG Source Harvard Business Online Harvard Business Online Harvard Business Online Harvard Business Online Harvard Business Online Harvard Business Online Harvard Business Online Harvard Business Online Instructional Methods The course will be taught using four integrated components: the course material as laid out in the CDs, additional reading, case discussions, and application of concepts. Prior to each intensive, you will work through assigned lessons on the “Introduction to Accounting” CD and complete the online quizzes pertaining to the material. Also prior to the intensive, you are required to read and prepare the assigned case(s), which will be discussed during the intensive. We will devote a short amount of time during each intensive to respond to specific questions on the reading material. The majority of intensive time will be devoted to case analysis and discussion. During the intensive, we will give you time to discuss the case issues with your team members; then reconvene to discuss the case issues as a class. The remaining time will be spent describing upcoming assignments. Topical Outline A breakdown of the course into its major topics with specific learning objectives, including instructor and student activities that support those objectives. Week 1 2 Topic Lesson 5 Sales Revenues & Receivables (2:50) Lesson 6 Cost of Goods Sold (2:38) Simons and Davila, Preparing and Using a Statement of Cash Flows Chapter 13: Accounting and Finance: How to Account for Environmental and Social Impacts from The business guide to sustainability: Practical strategies and tools for organizations. Intensive Week – Prepare Case Analyses Activities Elluminate Lesson Quizzes Elluminate Chemalite (Full case 3 4 5 6 7 8 9 10 11 Lesson 7 Operating Expenses & Internal Controls (1:32) Lesson 8 Long-Term Assets (2:32) Raising the Bar (Chaps 1 - 3) Lesson 9 Debt and Equity Financing (3:19) Sustainability Reporting: Straight to the Bottom Line. Raising the Bar (Chap 4) Lesson 10 Financial Statement Analysis (4:15) Quiet Revolution in Business Reporting Raising the Bar (Chap 5 & 6) Lesson 11 Introduction to Managerial Accounting (1:05) Intensive Week – Prepare Case Analyses Lesson 12 Cost Accounting (3:23) Lesson 13 Cost Volume Profit Analysis (3:53) Raising the Bar (Chap 7) Thanksgiving Week Raising the Bar (Chap 8) Lesson 15 Non-routine Business Decisions (3:23) Environmental Management Accounting Intensive Week – Prepare Case Analyses 12 Assessment Criteria and Methods of Evaluating Students analysis) Chemalite B (through part 6 of case analysis) Primo Benzino (through part 6 of case analysis) Elluminate Lesson Quizzes Article Discussion Lesson Quizzes Article Discussion Elluminate Lesson Quizzes Prepare for Exam Article Discussion Exam Lesson Quizzes Elluminate New York Audubon Society (Full case analysis) Cariboo Industrial (through part 6 of case analysis) Elluminate Lesson Quizzes Article Discussion Clif Bar and Article Discussion Elluminate Lesson Quizzes Article Discussion Elluminate Lille Tissages (Full case analysis) Wal-Mart's Sustainability Strategy (Full case analysis) Discussion team's CVP Analysis CVP Analysis due You will be evaluated on your work in the following categories: Individual Assignments Quizzes Exams Case write-ups Participation Team Assignments and Case PowerPoint Presentations Total Grading Scale 20% 30% 20% 10% 20% 100% Exceptional Work Meets Expectations Unsatisfactory An overall 80% is the minimum acceptable level required to pass the course. BGI Final Grading Scale CR Credit (A through B) NC No Credit (C through F) I Incomplete Policies Please refer to the BGI Catalog for current academic policies regarding attendance, grading, academic honesty, students with disabilities, intellectual property and any other pertinent information. Disclaimer The content of this syllabus or course outline may change during the quarter. Date Syllabus Was Last Reviewed Jill Bamburg, 9-6-10