Bainbridge-Accounting

advertisement

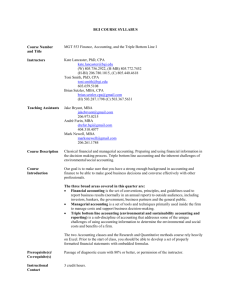

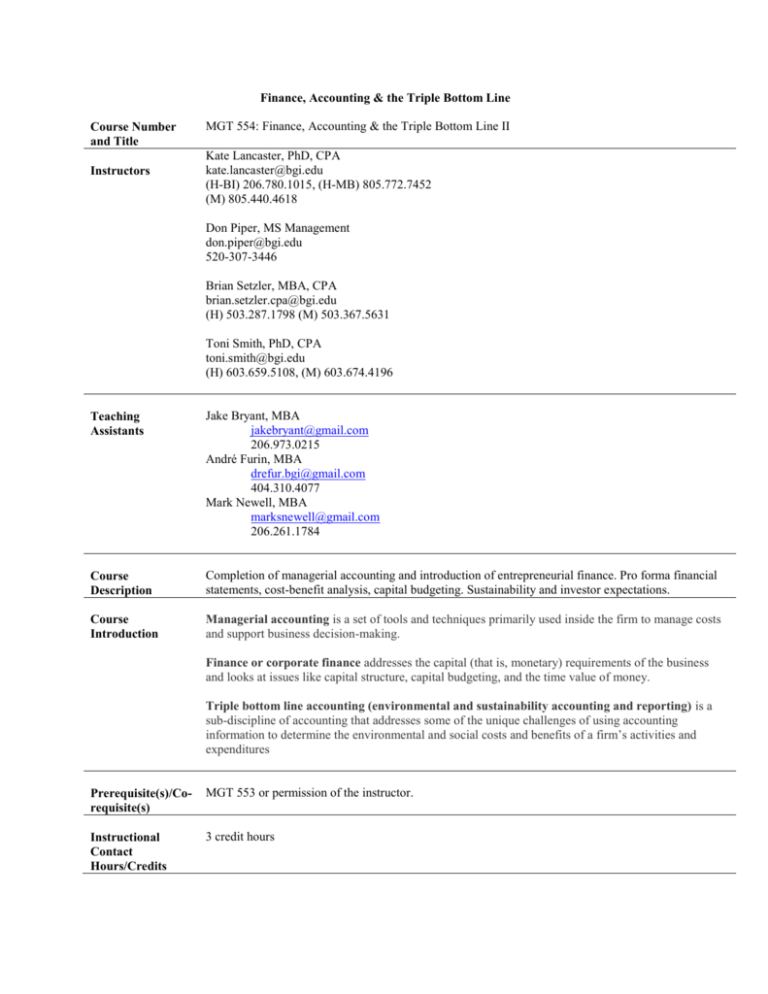

Finance, Accounting & the Triple Bottom Line Course Number and Title Instructors MGT 554: Finance, Accounting & the Triple Bottom Line II Kate Lancaster, PhD, CPA kate.lancaster@bgi.edu (H-BI) 206.780.1015, (H-MB) 805.772.7452 (M) 805.440.4618 Don Piper, MS Management don.piper@bgi.edu 520-307-3446 Brian Setzler, MBA, CPA brian.setzler.cpa@bgi.edu (H) 503.287.1798 (M) 503.367.5631 Toni Smith, PhD, CPA toni.smith@bgi.edu (H) 603.659.5108, (M) 603.674.4196 Teaching Assistants Jake Bryant, MBA jakebryant@gmail.com 206.973.0215 André Furin, MBA drefur.bgi@gmail.com 404.310.4077 Mark Newell, MBA marksnewell@gmail.com 206.261.1784 Course Description Completion of managerial accounting and introduction of entrepreneurial finance. Pro forma financial statements, cost-benefit analysis, capital budgeting. Sustainability and investor expectations. Course Introduction Managerial accounting is a set of tools and techniques primarily used inside the firm to manage costs and support business decision-making. Finance or corporate finance addresses the capital (that is, monetary) requirements of the business and looks at issues like capital structure, capital budgeting, and the time value of money. Triple bottom line accounting (environmental and sustainability accounting and reporting) is a sub-discipline of accounting that addresses some of the unique challenges of using accounting information to determine the environmental and social costs and benefits of a firm’s activities and expenditures Prerequisite(s)/Corequisite(s) MGT 553 or permission of the instructor. Instructional Contact Hours/Credits 3 credit hours Learning Objectives Managerial Accounting Analyze cost behavior, identify and quantify cost drivers, and perform cost estimation by product, segment or activity. Recognize and identify the elements of product cost and differentiate between product and period costs. Determine the cost of providing a good or service using various indirect cost allocation tools. Develop spreadsheets and use several Excel tools to analyze cost/volume/profit relationships and perform breakeven analysis. Perform incremental analysis in various managerial decisions such as make-or-buy and sell-or process- further. Corporate Finance Prepare a master operating budget, use this information to evaluate performance and identify management implications. Evaluate capital budgeting decisions, particularly those related to environmental issues using Excel tools to calculate IRR, NPV, payback, and net cash flow. Understand capital structuring options. Become familiar with the business valuation process. Understand how business risks affect financing and investing decisions. Triple Bottom Line Accounting and Environmental and Social Accounting and Reporting Discuss environmental accounting issues, including implications for reporting and decision-making. Understand the inherent difficulties of addressing environmental issues within conventional accounting frameworks. Analyze environmental projects using accounting tools and methods. Become familiar with examples of social and environmental decision models Identify quantitative and qualitative measures for assessing an organization's ESR/triple bottom line performance. Instructional Materials and References Books and Course Materials Nemrow, N. (2006). Introduction to Accounting: The Language of Business, Lesson 14, Operational Budgeting and Lesson 17, Capital Budgeting. (www.accountingthelanguageofbusiness.com) Welch, N. (2008). Corporate Finance: An Introduction. Selected chapters are required (2, 4, 6, 12, 13, 14, 20). You may find other chapters interesting and helpful, depending on your interest. PrenticeHall, ISBN 0321277996. This textbook may be accessed for FREE at http://book.ivo-welch.info/. You may also purchase parts of the book for $15-$18. Harvard Business Online with Case Numbers Abelli, H. (2007). Mountain Man Brewing Company: Bringing the Brand to Light. 2069. Erold, A., F. Reinhardt, and M. Hyman. (2008). International Carbon Finance and EcoSecurities 9-208151. Grasby E., and A. Smith. (2009). Try Recycling Inc. - The South London Expansion 909B02-PDFENG Lassiter, J., J. Corcoran, M. Gazor, D. Hogarty, and A. Somers Jr. (2010) The Fox Islands Wind Project. 810129-PDF-ENG Narayanan V. R. Moore, and L. Brem. (2002) Cambridge Hospital Community Health Network: The Primary Care Unit. 100054-PDF-ENG. Phills J. Unitus (2007). Microfinance 2.0--Reinventing an Industry. S187A. Reisen de Pinho, R. and R. Kaplan. (2007). Amanco: Developing the Sustainability Scorecard. 107038. Sahlman, W., and E. Richardson. (2010). Venture Capital Valuation Problem Set. 807036-PDF-ENG. Other Case Material, Available Through eReserves Anonymous. Date unknown. Lasting Impressions. Articles and Chapters, Available Through eReserves, except where noted de Graaf, F. and A. Slager. (2009). Guidelines for Integrating Socially Responsible Investment in the Investment Process. Journal of Investing Fall, Vol. 18 Issue 3, 70-78, 9 pages. Figge, F., T. Hahn, S. Schaltegger, and M. Wagner. (2002). The Sustainability Balanced Scorecard – linking sustainability management to business strategy. Business Strategy & the Environment Sep/Oct, Vol. 11 Issue 5, 269-284. 16 pages. Hawken, P. and The Natural Capital Institute. (2004). Socially Responsible Investing. Retrieved, December 19, 2010 from http://www.naturalcapital.org/docs/SRI%20Report%2010-04_word.pdf. 40 pages. Kreuze, J., and G. Newell. (1994). ABC and life-cycle costing for environmental expenditures. Management Accounting, Feb, 75, 8, 38-42. 6 pages. McGregor, R. (date unknown). Social and Ethical Accounting, Auditing, and Reporting. 6 pages. McCluskey, A. (2010) Knowns and unknowns -- the challenges for long-term sustainability and responsible investment. Keeping Good Companies Apr, Issue 3, 136-140, 5 pages. Robinson, C. (1996). Can we reconcile finance with nature? International Review of Financial Analysis, Vol. 5 Issue 3, 185-196. 11 pages. Statman, M. (2003). The religions of social responsibility. Journal of Investing. ISSN# 1068-0896, Fall, 14-22. 9 pages. Supplemental Resources Anonymous. (1998). Snapshots of Environmental Cost Accounting A Report to: US EPA Environmental Accounting Project. May. Retrieved, November 25, 2008 from http://www.dep.state.pa.us/dep/deputate/pollprev/pdf/ALLSNAPS.pdf Provides numerous case examples. Anonymous. (2002). Toward a Sustainable Cement Industry: Adding Sustainability to Your Bottom Line Sustainable Business Decision Framework User Manual for the Cement Industry. Battelle. The Business of Innovation. Anonymous. (2006). Investment Strategist: Understanding Risk. Stifel Nicolaus. EPA. (1995). An Introduction to Environmental Accounting As A Business Management Tool: Key Concepts And Terms. Retrieved, November 25, 2008 from http://www.epa.gov/oppt/library/pubs/archive/acct-archive/resources.htm. 39 pages, skim. Harrington, C. (2003). “Socially Responsible Investing” Online Publications of the Journal of Accountancy. January. Retrieved, November 25, 2008 from http://www.aicpa.org/PUBS/JOFA Course Material Information Learning Resource Packet (you should already have this from your MGT 553 resources) The Learning Resource Packet (LRP) is the document to be used as you watch the CD lectures and take notes. Make sure you have the BGI-specific course pack, which is available for download at: https://www.accountingthelanguageofbusiness.com/download/Learning%20Resource%20Packet%20(al l%20PDFs)%20for%20BGI.pdf. You can freely print this document; however, it is 281 pages, which can be very cumbersome to print. You may find it possible to use it electronically. The LRP contains the following: Lesson Notes for lessons 1-15, the Statement of Cash Flows, and lesson 17 Financial Practice Set and Solution Sample Exams (the same questions are available in the Practice Problem Module) Exam Review Topics Instructional Methods The course will be taught using four integrated components: the course material as laid out in the CDs, additional reading, case discussions, and application of concepts. Prior to each intensive, you will work through assigned lessons on the “Introduction to Accounting” CD and complete the online quizzes pertaining to the material. Also prior to the intensive, you are required to read and prepare the assigned case(s), which will be discussed during the intensive. We will devote a short amount of time during each intensive to respond to specific questions on the reading material. The majority of intensive time will be devoted to case analysis and discussion. During the intensive, we will give you time to discuss the case issues with your team members; then reconvene to discuss the case issues as a class. The remaining time will be spent describing upcoming assignments. Topical Outline A breakdown of the course into its major topics with specific learning objectives, including instructor and student activities that support those objectives. Week 1 1/3-9 Topic Syllabus, Operational budget 2 1/10-16 Cost Allocation: Activity Based Costing Performance Evaluation: Balanced Scorecard Decision Making: Operational Budget Exam, Lessons 11-15 3 1/17-23 4 1/241/30 Pro forma 5 1/312/6 Capital budgeting 6 2/72/13 Capital Budgeting, continued Activities Elluminate Session: Intro to class and operating budgets LOB 14 – Budgeting lesson (4:20:01) Weekly quizzes Readings: Figge et al, Krueze & Newell Engage in Forum Discussion on Readings Elluminate Session (Case Q&A, optional) Intensive Cases: Cambridge Hospital (full), Amanco (partial) Elluminate Session: (Exam Q&A, optional) Exam (Lessons 11-15) Elluminate Session : Pro forma Welch, Chapter 20 - Pro Forma Financial Statements, 37 pages Weekly quizzes Individual Assignment: High Country Biking Elluminate Session : Capital Budgeting LOB 17, NPV & IRR: Accounting for Time lesson DO NOT PURCHASE CALCULATOR, pay attention to the concepts, we’ll learn how to do this using Excel formulas (3:00:30) and/or Welch, Chapter 2 - The Time Value of Money and Net Present Value (28 pages) and Welch, Chapter 4 - A First Encounter with Capital Budgeting Rules (23 pages) Weekly quizzes Team Assignment: Pro forma Elluminate Session (Case Q&A, optional) Intensive 7 2/14-20 Capital Budgeting, continued Uncertainty and Risk 8 2/21-27 Business Valuation SRI 9 2/283/6 TBL and SRI Fox Island – SRI and Finance Topics Capital Structure SRI reporting 10 3/73/13 Microfinance Capital Budgeting Decision making 11 3/143/19 TBL and SRI Assessment Criteria and Methods of Evaluating Students Cases: Mountain Man Brewing (full), Try Recycling (partial and have the financials entered into Excel) Elluminate Session – Capital Structure Welch, Chapter 12 – Capital Budgeting Applications and Pitfalls (56 pages) Welch, Chapter 6 – Uncertainty, Default, and Risk (36 pages) Weekly quizzes Engage in Forum Discussion on Readings Individual Assignment: Lasting Impressions, Elluminate Session – Business Valuation Welch, Chapter 13 – From Financial Statements to Economic Cash Flows (46 pages) Welch, Chapter 14 – Valuation from Comparables and Some Financial Ratios (40 pages) Weekly quizzes Readings: Statman, Robinson Engage in Forum Discussion on Readings Elluminate Session – Capital Structure Welch, Chapter 21 – Capital Structure Dynamics (34 pages) Weekly quizzes Readings: McGregor, Hawken Engage in Forum Discussion on Readings Team Assignment: Fox Island Sunday Elluminate Session (Case Q&A, optional) Elluminate Session - Microfinance Intensive Cases: Unitus Microfinance (full), International Carbon (partial and have assumptions captured in Excel)Bring Venture Capital Valuation Problem Set to intensive. Elluminate Session: TBL McCluskey, de Graaf Engage in Forum Discussion on Readings Basis for determination of final grade, along with grading scale if different from what is published in the catalog. Class Participation 4% Quizzes 16% Individual assignments 12% Team assignments 20% Case write-ups and discussion 24% Individual exam 24% 100% BGI Assignment Grading Scale Exceptional Work 81% - 100% Meets Expectations 80% Unsatisfactory <80% ‘Meets Expectations’ is the minimum acceptable level required to pass the course. BGI Final Grading Scale CR Credit (A through B) NC No Credit (C through F) I Incomplete Policies Please refer to the BGI Catalog for current academic policies regarding attendance, grading, academic honesty, students with disabilities, intellectual property and any other pertinent information. Disclaimer The content of this syllabus or course outline may change during the quarter. Date Syllabus Was Last Reviewed Last modified 12/20/10