Introduction - Where can my students do assignments that require

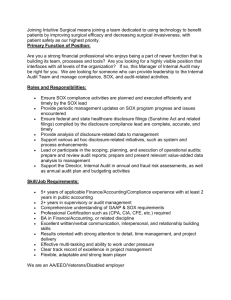

advertisement

Introduction.................................................................................................................................... 2 The Problem ................................................................................................................................... 3 Sarbanes-Oxley Act ........................................................................................................................ 5 PCAOB - Public Companies Oversight Board ....................................................................... 5 Section 101.............................................................................................................................. 5 Section 102.............................................................................................................................. 5 Section 103.............................................................................................................................. 6 Section 104.............................................................................................................................. 6 Section 105.............................................................................................................................. 7 Section 106.............................................................................................................................. 7 Section 107.............................................................................................................................. 7 Section 108.............................................................................................................................. 8 Section 109.............................................................................................................................. 8 Auditor Independence .............................................................................................................. 8 Section 201.............................................................................................................................. 8 Section 202.............................................................................................................................. 9 Section 203.............................................................................................................................. 9 Section 204.............................................................................................................................. 9 Section 205.............................................................................................................................. 9 Section 206............................................................................................................................ 10 Sections 207, 208, and 209 ................................................................................................... 10 Corporate Responsibility........................................................................................................ 10 Section 301............................................................................................................................ 10 Section 302............................................................................................................................ 11 Section 303, 304, 305, 306, 307, 308.................................................................................... 12 Enhanced Corporate Disclosures .......................................................................................... 12 Section 401............................................................................................................................ 12 Section 402............................................................................................................................ 13 Section 403............................................................................................................................ 13 Section 404............................................................................................................................ 13 Section 405............................................................................................................................ 14 Section 406............................................................................................................................ 14 Section 407............................................................................................................................ 14 Section 408............................................................................................................................ 14 Analyst Conflict of Interest .................................................................................................... 15 Section 501............................................................................................................................ 15 Commission Resources and Authority .................................................................................. 15 Section 601............................................................................................................................ 16 Section 602............................................................................................................................ 16 Section 603............................................................................................................................ 16 Section 604............................................................................................................................ 16 Studies and Reports ................................................................................................................ 17 Section 701............................................................................................................................ 17 Section 702............................................................................................................................ 17 Section 703............................................................................................................................ 18 Section 704............................................................................................................................ 18 Section 705............................................................................................................................ 18 Corporate and Criminal Fraud Accountability ................................................................... 18 Section 801............................................................................................................................ 18 Section 802............................................................................................................................ 18 Section 803............................................................................................................................ 19 Section 804............................................................................................................................ 19 Section 805............................................................................................................................ 19 Section 806............................................................................................................................ 19 Section 807............................................................................................................................ 20 White Collar Crime Penalty Enhancements ........................................................................ 20 Section 901............................................................................................................................ 20 Section 902............................................................................................................................ 20 Section 903............................................................................................................................ 20 Section 904............................................................................................................................ 20 Section 905............................................................................................................................ 21 Section 906............................................................................................................................ 21 Corporate Tax Returns .......................................................................................................... 21 Section 1001.......................................................................................................................... 21 Corporate Fraud and Accountability ................................................................................... 21 Section 1101.......................................................................................................................... 21 Section 1102.......................................................................................................................... 22 Section 1103.......................................................................................................................... 22 Section 1104.......................................................................................................................... 22 Section 1105.......................................................................................................................... 22 Section 1106.......................................................................................................................... 22 Section 1107.......................................................................................................................... 23 Conclusions .................................................................................................................................. 23 References .................................................................................................................................... 28 Appendix ....................................................................................................................................... 29 Exhibit 1 - PCAOB registration form ................................................................................... 30 Exhibit 2 - Sample internal control questionnaire - expenditure cycle.............................. 31 Exhibit 3 - Sarbanes-Oxley compliance timeline ................................................................. 32 1 Introduction The Sarbanes-Oxley Act of 2002 (SOX) was created as corporate reform legislation in response to corporate fraud from “several high profile companies, such as, Enron, WorldCom, Tyco International, and Adelphia Communications” [The Good]. In the past few years we have seen five out of ten of the largest bankruptcies in the history of the United States. The SarbanesOxley Act of 2002 added many and changed many existing provisions of the federal securities laws. The Act is to establish governance and ethical business practices over public corporations, auditors, attorneys, brokers, investment bankers, and financial analysts. “The principal objectives of the Act are to strengthen and restore confidence in the accounting profession, strengthen enforcement of the federal securities laws, improve the executive responsibility, and improve disclosure and financial reporting [Guerra]. This legislation will change the interaction and accountabilities between corporate executives, auditors, boards of directors, and securities analysts. The regulatory environment has changed due to the SOX legislation with the introduction of the Public Company Accounting Oversight Board (PCAOB). Changes in the CPA profession have seen a split in the service offerings it provides to public clients and increased accountability due to a required increase in audit evidence and knowledge of internal control. Management responsibilities and accountability have increased regarding knowledge of corporate financial statements and corporate internal controls. New criminal penalties have also been imposed through this legislation. The government has enacted several legislative packages to solve the problems that plague corporate America. Corporations have been required to comply with numerous laws and social 2 requirements regarding standards and ethical behavior. However, every decade America is plagued with new corporate scandals. What is the problem, what is the Sarbanes-Oxley Act, and how will this new legislation begin to resolve the conflicts that arise as corporations continue on in the future? The Problem Corporate governance has been around for over a century in the United States. In 1890 the Sherman Act was enacted to stop corporations from becoming monopolies. The Securities Act of 1933 was created to “prohibit deceit, misrepresentations, and other fraud in the sale of securities” [Wikipedia]. The 1934 Securities Exchange Act created the Securities and Exchange Commission (SEC), and empowered the SEC with broad authority over registration of securities, regulation of public companies, and to oversee brokerage firms, transfer agents, and clearing agencies to ensure fair business practices in the United States” [Huddart]. In the 1960’s we saw the price-fixing crisis, the 1970’s we saw the foreign payment crisis and the insider trading crisis, and in the 1980’s the RICO prosecutions and defense procurement fraud [The Good]. One answer to these crises included the creation of the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in 1985. The committee was established as an independent private sector initiative, which studied causal factors that can lead to fraudulent financial reporting. COSO undertook an extensive study of internal control to establish a common definition of internal control for companies, public accounting firms, legislators and regulatory agencies. This should have provided solid frameworks of internal control to manage the way companies operate. However, COSO was not an authoritative body and its recommendations were not consistently used and implemented. Self-regulation has not been effective. Additional laws have been enacted in response to these crises, and many more which have not been 3 mentioned. The collapse of corporations like Enron and WorldCom, which caused billions of dollars of losses to investors, led to public outcry for more government protection. The seriousness of these corporate misdeeds is promulgated because involvement was not only of corporate executives, but also boards of directors, securities analysts, and CPA firms. According to SEC Commissioner Harvey J. Goldschmid, “The corporate and financial scandals of the 1990’s and early 2000’s are the most serious that have occurred in this country since the scandal of the Great Depression” [Guerra]. How did this happen again? There were several problems that led to the creation of the Sarbanes-Oxley Act of 2002. Executive compensation is grossly disproportionate to corporate results. Management would misrepresent true earnings and financial conditions in order to gain stock options or bonuses. Management teams placed their personal interests above investor demand. Passive, nonindependent boards of directors were made up of members selected by the CEO or chairman of the board. In one instance WorldCom’s Board of Director’s authorized a $6 billion bid for Intermedia Communications with only 2 hours notice during a telephonically organized meeting. Investment bankers and investment analysts presented biased or non-independent company information focusing only on increasing their profits. No corporate executive would give investment-banking business to a financial institution after one of their securities analysts just trashed their stock value. Public accounting firms generated so much revenue from consulting services from corporations that a conflict of interest arose during attestation services. Some firms went so far as to obstruct justice by concealing activities or destroying evidence [Guerra]. 4 Will SOX be enough regulation to stop corporate fraud? What are the intended or unintended consequences due to the enactment of Sarbanes-Oxley? Will these new regulations stop the unethical/illegal behaviors that been seen throughout the last five years or just make it more difficult for honest corporations to continue on in the future? Sarbanes-Oxley Act PCAOB - Public Companies Accounting Oversight Board The Public Accounting Oversight Board (The Board) came into existence with Title One of the Sarbanes-Oxley Act. Section 101 Section 101 created the PCAOB and its governing rules. There are five full-time members on the Board, but only two are certified public accountants. The other three members are noncertified public accountants. The Securities and Exchange Commission selects the members, with input from the Chairman of the Board of Governors of the Federal Reserve System and the Secretary of the Treasury. Section 102 Section 102 requires that any public accounting firm that prepares or issues an audit report must complete an application to register with the PCAOB (Exhibit 1). Each firm also must file an annual report in order to maintain a current record with the Board. An initial registration fee and an annual fee are required with each application. 5 Section 103 Auditing standards, quality control and independence standards, and rules are defined in Section 103. Auditing standards include: retaining relevant documents that support the audit report for not less than seven years, providing a second review by a partner not associated with the audit, and identifying the scope of tests of internal control by the auditor. The quality control standards reflect upon the auditors ethical and independence standards when issuing an audit report. The auditor must not have consulted with the client regarding accounting and/or auditing issues. The audit must be properly supervised and the public accounting firm must employ professional employees who have been properly trained and who will continue to receive proper training regarding accounting/auditing issues and problems. Section 104 If a public accounting firm completes audit reports for more than 100 issuers, then according to Section 104, they are to be inspected annually. If there are less than 100 issuers, the public accounting firm will be inspected at least once every three years. The PCAOB will provide all public accounting firms with an inspection report prior to the inspection. The PCAOB will randomly select and review audits completed by the public accounting firm. Each review will evaluate the quality control, documentation, and communications systems of the client and the public accounting firm. The Board will look for any activity or procedure that is in violation of the Act. If any violation is found it will be reported to the SEC and the correct State Regulatory Commission. A full investigation will then be undertaken. The PCAOB’s final written report will include any notes, as well as any correspondence from the public accounting firm. All confidential information would be withheld from the public report. 6 Section 105 Section 105 allows the PCAOB to investigate and take disciplinary actions toward any firm that is in violation of the Act. Penalties for violation include: 1. Temporary suspension or permanent revocation of registration, 2. Temporary or permanent suspension or bar of a person from further association with a registered public accounting firm, 3. Temporary or permanent limitation on activities, functions, or operations of the firm or person, 4. Civil monetary penalty: a) Not more than $100,000 for a natural person or $2,000,000 for any other person; and b) If intentional, not more than $750,000 for a natural person or $15,000,000 for any other person, 5. Censure, 6. Required additional professional education or training, or 7. Any other appropriate sanction provided for in the rules of the PCAOB [United States]. Section 106 Foreign public accounting firms that issue audit reports for U.S. listed companies are treated as if they are U.S. public accounting firms. Under certain circumstances the foreign firm may be exempt from the Act or parts of the Act. Section 107 Section 107 dictates that the SEC will approve and/or amend all rules proposed by the Board. The SEC will only approve rules that are in compliance with the Act and all securities laws that are in the best interest of the general public or to protect corporate investors. At any time the SEC may remove a member of the Board if they are in violation of the Act, fail to follow the rules of the Board, or fail to comply with the laws set forth by the SEC. Abuse of authority or failure to comply and enforce standards could also result in a member’s removal. 7 Section 108 Accounting standards are established in Section 108. The Board is charged with “keeping standards current in order to reflect changes in the business environment, the extent to which international convergence on high quality accounting standards is necessary or appropriate in the public interest and for the protection of investors” [United States]. The PCAOB is also required to submit annually their audited financial statements to the SEC and make them available to the public. Also in this section the SEC is instructed to complete an analysis on the effect of moving from a rules-based accounting system to a principles-based system. Section 109 Section 109 creates the funding components of the PCAOB. The Board is required to generate a budget each year that is approved by the SEC. Registration and annual fees will offset expenses. The fees will not exceed the budget expenses. A scholarship program for undergraduate and graduate students, who are enrolled in an accredited accounting degree program, will be funded by the monetary penalties assessed by the Board. Auditor Independence Title Two of the Sarbanes-Oxley Act addresses an auditor’s independence in nine sections. Section 201 Section 201 states that it is illegal for a registered public accounting firm to complete an audit for any issuer if the accounting firm has completed any non-audit services for the issuer. Non-audit services include: bookkeeping/services related to accounting records or financial statements; design and implementation of financial information systems; appraisal/valuation services, 8 fairness opinions, or contribution-in-kind reports; actuarial services; internal audit outsourcing services; management or human resources functions; broker/dealer, investment adviser or investment banking services; legal/expert services unrelated to the audit; and other services that the Board determines are not appropriate [United States]. Section 202 The audit committee of the issuer must approve all auditing and non-auditing services of a registered accounting firm. In addition, the audit committee is required to reveal to investors any non-audit services that an accounting firm has been requested to complete. Section 203 Section 203 focuses on audit partner rotation. The lead audit partner and the reviewing audit partner cannot perform or review an audit for a period of more than five consecutive years. Section 204 An auditor is required to report to the audit committee on a timely basis: 1. All critical accounting policies and practices to be used, 2. All alternative treatments of financial information within generally accepted accounting principles that have been discussed with management officials of the issuer, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the registered public accounting firm, and 3. Other material written communications between the registered public accounting firm and the management of the issuer (i.e. management letter or schedule of unadjusted differences) [United States]. Section 205 The audit committee of an issuer is created by the board of directors and is composed of members of the board of directors. The audit committee is responsible for supervising their 9 accounting and financial reporting processes, as well as any audits completed on their financial statements. Section 206 Conflicts of interest are addressed in Section 206. A registered public accounting firm is prohibited from completing an audit for an issuer if the issuer’s chief executive officer, controller, chief financial officer, chief accounting officer, or any other person serving in an equivalent position was employed by the accounting firm and had any role in the audit of the issuer during the one-year period preceding the current audit [United States]. Sections 207, 208, and 209 Sections 207, 208, and 209 focus on important, but lesser known parts of the Act. Section 207 calls for the Comptroller of the General Accounting Office to conduct a study on the outcome of the mandatory rotation of registered public accounting firms. This study is to be reviewed by the Committee on Financial Services of the House of Representatives. Section 208 states that it is against the law for a registered accounting firm to issue an audit report if they are not in compliance with the Act and Section 209 mandates that each State’s regulatory commission monitor the non-registered public accounting firms of that state. Corporate Responsibility The responsibilities of corporations are listed in the eight sections of Title 3 of the Act. Section 301 Section 301 outlines the duties and responsibilities of the audit committee. As stated previously, the audit committee is responsible for supervising the accounting and financial reporting 10 processes of the accounting firm; each board of director member is independent of the accounting firm; and, each accounting firm reports directly to the audit committee. The committee is also responsible for the accounting firm’s compensation. Procedures for the receipt, retention, and treatment of complaints received by the issuer regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by employees of the issuer of concerns regarding questionable accounting or auditing matters are handled under the direction of the audit committee as well [United States]. Section 302 Financial report standards are noted in Section 302. The principal executive officer and the principal financial officer are to certify that: 1. The signing officer has reviewed the report, 2. The report does not contain any untrue statements of material fact or omit to state a material fact necessary in order to not make the statements misleading, based upon the officer’s knowledge, 3. The financial statements, and other financial information included in the report, fairly present in all material respects the financial condition and result of operations of the issuer as of and for the time presented in the report, based upon the officer’s knowledge, 4. The signing officers are responsible for establishing and maintaining internal controls; have designed such internal controls to ensure that material information relating to the issuer and its consolidated subsidiaries is made known to such officers by others within those entities; have evaluated the effectiveness of the issuer’s internal controls as of a date within 90 days prior to the report; and have presented in the report their conclusions about the effectiveness of their internal controls based on their evaluation as of that date, 5. The signing officers have disclosed to the issuer’s auditors and the audit committee all significant deficiencies in the design or operation of internals controls and any fraud that involves management or other employees who have a significant role in the issuer’s internal controls, and 6. The signing officers have indicated in the report whether or not there were significant changes in internal controls or in other factors that could significantly affect internal controls [United States]. 11 Section 303, 304, 305, 306, 307, 308 If an officer, in any manner, acts fraudulently or tries to pressure, influence, or misinform the auditor then they have violated Section 303. If an accounting firm is required to complete a restatement of financial documents due to material non-compliance, the officer or officers will be required to reimburse the company for any bonuses, equity-based compensation, or profits received in the twelve months following the date of the initial audit report (Section 304). The SEC can block an individual from working as director or officer of a company if that person has broken any anti-fraud laws (Section 305). Also, directors and officers will not be able to purchase, sell, acquire, or transfer any equity security of the company during any blackout period (Section 306). Section 307 establishes rules of conduct for attorneys appearing or practicing before the SEC. Attorneys are to report any material violation of securities law to the company’s chief legal counsel or chief executive officer, and if not acted upon by legal counsel or the executive officer, the attorney is required to report the infraction to the audit committee of the board of directors. Section 308 instructs the SEC to complete a study of events over the last five years to determine appropriate restitution methods for injured investors. Enhanced Corporate Disclosures Title 4 sets forth the requirements for corporate disclosures, conflicts of interest, and assessment of internal controls. Section 401 All corrective material adjusting entries in accordance with GAAP identified by a registered public accounting firm shall be reflected in the financial statements. Disclosure will be made for 12 any off-balance sheet transactions that have a current or future effect on the financial condition of company operations. Section 402 All direct or indirect personal loans or extension of credit to executives are prohibited. Section 403 Directors, officers and principal stockholders who own more than 10 percent of any class of security must file a statement of ownership at the time of registration of the securities, within 10 days after ownership of securities, or after a change in ownership of securities. Disclosure contents include the amount of all equity securities and ownership of the securities at the date of filing the disclosure. Section 404 Section 404 prescribes management’s assessment of internal controls. A company’s annual report is required to include an internal control report of management that includes the following: 1. A statement of management’s responsibilities for establishing and maintaining adequate internal controls and procedures for financial reporting; 2. Conclusions about the effectiveness of the company’s internal controls and procedures for financial reporting based on management’s evaluation of those controls; and 3. A statement that the registered public accounting firm that prepared or issued the company’s audit report relating to the financial statements included in the company’s annual report has attested to, and reported on, management’s evaluation of the company’s internal controls and procedures for financial reporting. See Exhibit 2 for an example of questions to be answered regarding the expenditure cycle that would facilitate management establishment of internal controls. 13 Section 405 Any investment company registered under Section 8 of the Investment Company Act of 1940 is not subject to sections 401, 402 or 404 [United States]. Section 406 Section 406 requires that a company disclose its code of ethics for senior financial officers. If the company has not adopted a corporate code of ethics then the company must disclose reasons for not adopting a corporate code of ethics. Changes in an established code of ethics or any waiver of the code to a corporate officer must be immediately disclosed on Form 8-K. Section 407 A public company is required to have at least one member that is considered a “financial expert” on its audit committee. A financial expert as defined by SOX is someone with the following knowledge: 1. An understanding of generally accepted accounting principles and financial statements; 2. Experience in preparation of auditing of financial statements of generally comparable issuers and the application of such principles in accounting for estimates, accruals, and reserves; 3. Experience with internal accounting controls; and 4. An understanding of audit committee functions [United States]. Section 408 Section 408 requires the SEC to review corporate financial statements. The review shall include: 1. Financial statements of companies that have issued material re-statements of financial results; 2. Companies that experience significant volatility in stock price compared to other companies; 3. Companies with the largest market capitalism; 4. Emerging companies with disproportionate price to earnings ratios; 5. Companies whose operations significantly affect any material sector of the economy; and 6. Any other factors the commission considers relevant [United States]. 14 Analyst Conflict of Interest Title 5 addresses conflicts of interest regarding security analysts. Section 501 This section has several requirements in order to maintain independence and objectivity of research and dissemination of information to investors. Section 501 also created several rules regarding analyst protection and disclosure requirements. Three main issues surround analyst protection. First, analysts are not to be subject to “prepublication” clearance by anyone not directly responsible for investment research. Brokers or dealers are not to threaten or retaliate against analysts for an adverse research report that could cause negative consequences to the broker or dealer. Brokers or dealers involved with a public offering are not to distribute research reports related to the issuance of the securities. Regarding disclosure, brokers or dealers must disclose any conflicts of interest in the research reports provided by securities analysts. Disclosures must include whether the securities analyst has any debt or equity investments in the securities be reported on, whether the analyst, broker or dealer has received compensation from the issuer of the security, whether the issuer of the security has ever been a client of the broker or dealer and the types of services provided, and whether the securities analyst has been paid for services rendered for the research report. Commission Resources and Authority Title 6 discloses the resources and the authority of the Securities and Exchange Commission. 15 Section 601 The SEC has been authorized for an appropriation of $776,000,000 for fiscal year 2003. The funds appropriated for 2003 were as follows: $102,700,000 for salaries and benefits; $108,400,000 for information technology, security enhancements, and recovery and mitigation of terrorist attack activities; and $98,000,000 for additional manpower resources for additional supervision of auditors and audit services. Section 602 If anyone is found not to have qualifications to represent others, to be lacking in character or integrity, has behaved unethically, or has willfully violated or aided in the violation of any of the securities laws they can be censured by the SEC. Negligent conduct includes any registered accounting firm not conducting itself within the boundaries of professional accounting standards. Any repeat offense in violation of professional accounting standards can warrant denial of practice before the SEC. Section 603 The court may stop any person from dealing with a broker, dealer or issuer in the issuance of penny stock offerings. Section 604 Section 604 states that the SEC has the authority to suspend the right of any person to be associated with a broker or dealer of securities. It also gives a State’s commission the authority to supervise or examine banks, savings associations, or credit unions [United States]. 16 Studies and Reports Title 7 of the Sarbanes-Oxley Act identifies five studies that are to be undertaken by various government entities. Section 701 The General Accounting Office is requested to identify: why numerous public accounting firms have consolidated since 1989 (which reduced the number of firms available to complete audits for large corporations); the impact on domestic and international capital formation and securities markets; and any resolutions to problems discovered (especially methods of increasing competition among accounting firms who are able to complete audits for large corporations). The study is also to include the impact on corporations due to the decrease in competition among accounting firms. Issues that are to be addressed include high costs, poor quality of service, lack of auditor independence, and choice of auditors. In addition, Federal and State regulations are to be studied to determine their effect on competition. Section 702 According to Section 702 credit rating companies are to be studied by the SEC. The SEC is to research the role credit rating agencies play in evaluating issuers of securities and how much weight investors place on that information. Additionally, the SEC is to determine if there are any barriers to entry for new credit rating agencies and to information resources. 17 Section 703 The SEC is required to complete a study on the number of securities professionals who have been in violation of any securities law, identify who they are, which law/laws were violated, how many times multiple violations occurred, and what, if any, disciplinary actions were taken. Section 704 Areas of reporting that are vulnerable to fraud or manipulation are to be investigated by the SEC for the time period from 1997-2001. Recommendations to correct any areas are to be included in the report. Section 705 The General Accounting Office is to determine if investment bankers and financial advisors encourage companies to alter financial records to hide the actual condition of the company. Corporate and Criminal Fraud Accountability Title 8 of the Sarbanes-Oxley Act creates amendments to the United States Code to focus on the criminal activities addressed in the Act and sets forth penalties for violation of the Act. Section 801 Corporate and Criminal Fraud Accountability Act of 2002 Section 802 If anyone knowingly alters, destroys, covers up, or falsifies records during the course of a Federal investigation, that person will be fined and/or imprisoned for not more than 20 years. An auditor is required to maintain audit work papers for a period of five years after the audit is 18 completed. If the papers are destroyed, the auditor will be fined and/or imprisoned for not more than 10 years. Section 803 Section 803 states that any debt that is the result of fraudulent practices cannot be discharged if the corporation declares bankruptcy. Section 804 The statute of limitations for securities fraud is set in Section 804. Action regarding securities fraud must be taken by the earlier of: 1. 2 years after discovering facts that indicate a violation, or 2. 5 years after the violation. Section 805 This section directs the United States Sentencing Commission to review and/or amend the Federal Sentencing Guidelines based upon possible violations of the Act. The punishments are to be severe enough to keep the violations from reoccurring. Section 806 Section 806 prohibits companies from discharging, demoting, or discriminating against any employee who provides information regarding conduct the employee believes is in violation of securities laws or fraud statutes. If an employer is found to be in violation, they must reinstate the employee at the same level; they must reimburse the employee for all back pay with interest; and they must pay the employee’s court costs, reasonable attorney fees, and any other damages determined to be a result of the actions taken against the employee. 19 Section 807 Anyone who knowingly or attempts to defraud anyone involved with the securities of the issuer will be fined and/or imprisoned for not more than 25 years. White Collar Crime Penalty Enhancements The six sections of Title 9 of the Sarbanes-Oxley Act outline additional penalties for violation of the Act. Section 901 White-Collar Crime Penalty Enhancement Act of 2002 Section 902 Section 902 states that anyone who attempts to commit fraud will be treated as if they had committed fraud. Section 903 The maximum penalties for mail and wire fraud have been increased from 5 years to 20 years. Section 904 The penalty for violating the Employee Retirement Income Act of 1974 has also been changed. Imprisonment is now for period of 10 years instead of 1 year and the fine has increased from $100,000 to $500,000. 20 Section 905 This section directs the United States Sentencing Commission to review and/or amend the Federal Sentencing Guidelines related to white-collar crimes. Once more, the punishments are to be severe enough to keep the violations from reoccurring. Section 906 Section 906 mandates that all reports filed by the issuer to the SEC include a statement from the CEO and the CFO. The statement must state that the information complies with the requirements of SEC and that the information is a fair representation of the financial condition of the issuer. Failure to comply will result in a fine of not more than $1,000,000 and/or imprisonment of not more than 10 years. Willful failure to comply will result in a fine of not more than $5,000,000 and/or imprisonment of not more than 20 years. Corporate Tax Returns Section 1001 The Federal income tax return of a corporation is to be signed by the CEO of that corporation. Corporate Fraud and Accountability Title 11 of the Sarbanes-Oxley Act contains 7 sections that specify additional fines and prison sentences for those who violate the Act. Section 1101 Corporate Fraud Accountability Act of 2002 21 Section 1102 Anyone who intentionally alters, destroys, or conceals information from and/or for an official proceeding will be fined and/or imprisoned for not more than 20 years. Section 1103 If the SEC suspects that an issuer will make special payments to any employee under investigation, the SEC can petition a Federal district court to place the funds in an escrow account for a period of 45 days. Section 1104 The United States Sentencing Commission is required to review and/or amend the Federal Sentencing Guidelines related to corporate fraud. Once again, the punishments are to be severe enough to keep the violations from reoccurring and be consistent with other jail sentences and fines. Section 1105 Section 1105 allows the SEC to bar anyone from serving as a director or officer if that person has violated the rules and regulations of this title. Section 1106 The fines and penalties for an individual in violation of the SEC Act of 1934 include: 1. Maximum fine of $5,000,000, and 2. Imprisonment of not more than 20 years. The fines and penalties for an individual in violation of the SEC Act of 1934 include: 1. Maximum fine of $25,000,000, and 2. Imprisonment of not more than 20 years. 22 Section 1107 Anyone who interferes with another person’s employment or livelihood, while that person is providing information in regards to a violation, will be fined and/or imprisoned for not more than 10 years. Conclusions What have been the intended or unintended consequences due to the enactment of SarbanesOxley? Will SOX be enough regulation to stop corporate fraud? Some of the intended consequences have been an increase in active participation by boards of directors and audit committees; an increase in criminal action, fines and penalties against those who do not comply with SOX; and an increase in internal control procedure documentation and attestation to those internal controls. Studies completed by governmental entities have provided insight into what and who facilitated the breakdown in corporate controls. Increases in salaries and auditing costs also have been an intended consequence of SOX regulation, even though this is not a welcome consequence for most corporations. An increase in corporate disclosure is another intended consequence as well. One of the issues cited as problematic was non-independence of boards of directors, audit committees and public accounting firms. Section 404 of SOX required that the board of directors take an active role in effecting the process of internal control within a company. 86% of Enron’s board of directors was independent. A former dean of the Stanford Business School and professor of accounting chaired Enron’s audit committee [Berlau]. Enron’s board of 23 directors and audit committee should inherently have been considered independent and true representatives of Enron’s shareholders; however, their performance showed this was not the case. This was evident when Enron’s Chairman authorized a waiver of Enron’s code of ethics to its CFO to participate in partnerships, which cost Enron millions of dollars. Section 406 will also mitigate situations such as these due to forced disclosure of any waiver of corporate codes of ethics. How has SOX affected the way the audit committees and board of directors operate within a company? According to a survey done by Deloitte and Touche, LLP, “before Sarbanes-Oxley, 11 of 66 companies surveyed met more than six times per year. Since the Act, 39 companies have met that frequently. Before the Act, half of the companies surveyed met for one hour or less. Since the Act, only 10% have met for such a short time” [Koehn]. In addition, as more and more pressure is being placed upon the board of directors to comply with SOX, their workloads have increased significantly. However, there have only been small increases in compensation for members according to a study by PricewaterhouseCoopers. The study indicated that only 20% of board members received increases, while 47% remained the same. Compensation for audit committee members remained the same for 41% of the companies surveyed, while 22% received increases. In order to have a competent board of directors and audit committee, compensation levels will need to be increased to reflect the level of work required. Garrett Stauffer, leader of PricewaterhouseCoopers’ US Corporate Governance Practices, sums this all up, “The new regulations have increase the time demands for audit committee members even more than for other directors. Directors generally are not serving on boards because of the pay. However, with the time commitment for board’s service increasing, compensation for directors will have to 24 reflect the amount of effort involved” [Collins]. This shows that audit committees are working more to facilitate monitoring the internal control process due to the enactment of SarbanesOxley. However, a consequence to the increased involvement is an increase in salaries, therefore, an increased cost of doing business. Richard Scrushy, former HealthSouth CEO, is the first corporate executive to face charges under the Act. He faces 85 charges, including conspiracy to commit fraud, filing false financial statements, money laundering, and securities and wire fraud [Taub], which are in violation of several sections of the Act. This is a giant step in proving that increased regulation and penalties for non-compliance of regulation is making considerable leaps towards improving behavior regarding fair reporting practices. One study completed by the SEC identified 1596 securities professionals who were in violation of any securities law from 1998-2001. Registered representatives and branch managers of broker-dealers comprised the largest group offenders. At least four more studies will be completed to help provide information regarding the lack of controls within various organizations. A major increase in disclosure is another consequence of SOX due to sections 401-406 compliance. This includes disclosure of all corrective material adjusting entries, management assessment of internal controls, and disclosure its code of ethics for senior financial officers. If the company has not adopted a corporate code of ethics then the company must disclose reasons for not adopting a corporate code of ethics. According to the 2004 CPA Journal the size of 25 annual reports, quarterly filings, and proxy statements has increased significantly. General Electric’s latest report is 160 pages, double the previous year, Kodak’s annual report is 45% larger and General Motor’s report is 28% larger. One of the biggest increases in costs is due to Section 404 compliance, which requires increased documentation for internal control processes and the registered audit firm’s attestation for that internal control. According to The CPA Journal, the cost of SOX compliance personnel will increase 266.7% and accounting personnel will increase 105.3% due to this regulation alone. Audit fees are expected to increase from 25% to 33% [Kroehn]. There have been several unintended consequences due to SOX compliance. One effect has been contraction in the audit market. Public accounting firms are required to be registered with the PCAOB as a condition for providing attestation services to public companies. Due to registration costs and increased liability insurance costs, training costs, and liability risk, more firms are weighing the option of not becoming registered with the PCAOB. There has also been an increase in corporate executive D&O insurance premiums. Insurance has increased by as much as 100% to 400%. In addition, if a company has restated earnings some insurance companies will drop coverage altogether for corporate executives. An increase in accounting education has been one beneficial unintended consequence of the Act. Educational institutions are seeing an increase in attendance for accounting courses. Universities are also focusing more on classes related to fraud. With the increase in audit work needed for 26 SOX compliance, hopefully, individuals will enter the profession with more refined course work to match today’s accounting environment. There has been an increased awareness of compliance levels that must be met. Corporate executives, boards of directors, audit committee personnel, public accounting firms, and securities analysts are all becoming aware of the accountability that exists with each of their positions. It does seem that Sarbanes-Oxley will be very expensive to set up and maintain in the years to come. However, is it as costly as the decline in stock market, the loss of jobs due to downsizing and bankruptcies because of inaccurate financial reporting, and the creditor losses due to bankruptcies? Is Sarbanes-Oxley the answer to all the problems that have inundated corporations? Only time will tell. 27 References Berlau, John. “Sarbanes-Oxley is Business Disaster.” Insight on the News. 13-16 February 2004: 24-26. Collins, Pet. “Sarbanes-Oxley Making Directors Work Harder.” 28 January 2004. <http://srimedia.com/artman/publis/printer_728.shtml> “The Good, the Bad, and Their Corporate Codes of Ethics: Enron, Sarbanes-Oxley, and the Problems with Legislating Good Behavior.” Harvard Law Review, May 2003: 2123+. Guerra, Jorge E. “The Sarbanes-Oxley Act of 2002 and Evolution of the Corporate Governance Process. Part 1: Overview.” 1 February 2001. <www.imaknowledge.org/sox> Guerra, Jorge E. “The Sarbanes-Oxley Act of 2002 and Evolution of the Corporate Governance Process. Part 2: What Went Wrong? Who were the transgressors? Why did this happen again?” 1 February 2001. <www.imaknowledge.org/sox>? Guerra, Jorge E. “The Sarbanes-Oxley Act of 2002 and Evolution of the Corporate Governance Process. Part 3: What Needs to Be Done Now.” 1 February 2001. <www.imaknowledge.org/sox> Guerra, Jorge E. “The Sarbanes-Oxley Act of 2002 and Evolution of the Corporate Governance Process. Part 4: Sarbanes-Oxley - A Giant First Step In The Right Direction.” 1 February 2001. <www.imaknowledge.org/sox> Huddart, Steven. Penn State Smeal College of Business. 15 March 2004. <www.smeal.psu.edu/faculty/huddart/OptionGlossary/SecuritiesExchangeAct34.shtml> Koehn, Jo Lynn and Stephen C. Del Vecchio. “Ripple Effects of the Sarbanes-Oxley Act.” The CPA Journal. February 2004: 36+. Stelzer, Irwin M. “The Corporate Scandals and American Capitalism.” Public Interest. Winter 2004: 19+. Taub, Stephen. “Scrushy to Challenge Sarbox.” 11 December 2003. <http://www.cfo.com /Printarticle/0,5317,11519\C,00,html?f=options> United States. Sarbanes-Oxley Act of 2002. 107th Congress, Second Session. Washington. 23 January 2002. Wikipedia Encyclopedia. 12 March 2004. <http://en.wikipedia.org/wiki/Securities_Act_of_1933> 28 Appendix 29 Exhibit 1 - PCAOB registration form 30 Exhibit 2 - Sample internal control questionnaire - expenditure cycle 31 Exhibit 3 - Sarbanes-Oxley compliance timeline 32