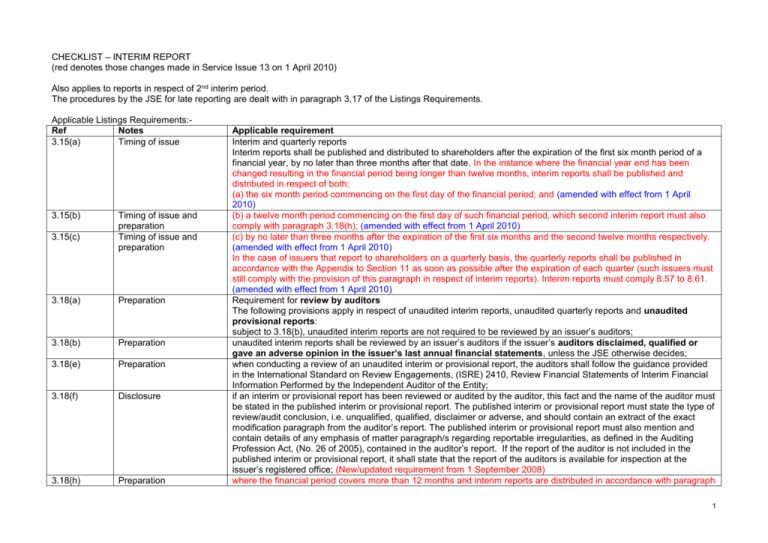

Interim Report requirements

advertisement

CHECKLIST – INTERIM REPORT (red denotes those changes made in Service Issue 13 on 1 April 2010) Also applies to reports in respect of 2nd interim period. The procedures by the JSE for late reporting are dealt with in paragraph 3.17 of the Listings Requirements. Applicable Listings Requirements:Ref Notes 3.15(a) Timing of issue 3.15(b) 3.15(c) Timing of issue and preparation Timing of issue and preparation 3.18(a) Preparation 3.18(b) Preparation 3.18(e) Preparation 3.18(f) Disclosure 3.18(h) Preparation Applicable requirement Interim and quarterly reports Interim reports shall be published and distributed to shareholders after the expiration of the first six month period of a financial year, by no later than three months after that date. In the instance where the financial year end has been changed resulting in the financial period being longer than twelve months, interim reports shall be published and distributed in respect of both: (a) the six month period commencing on the first day of the financial period; and (amended with effect from 1 April 2010) (b) a twelve month period commencing on the first day of such financial period, which second interim report must also comply with paragraph 3.18(h); (amended with effect from 1 April 2010) (c) by no later than three months after the expiration of the first six months and the second twelve months respectively. (amended with effect from 1 April 2010) In the case of issuers that report to shareholders on a quarterly basis, the quarterly reports shall be published in accordance with the Appendix to Section 11 as soon as possible after the expiration of each quarter (such issuers must still comply with the provision of this paragraph in respect of interim reports). Interim reports must comply 8.57 to 8.61. (amended with effect from 1 April 2010) Requirement for review by auditors The following provisions apply in respect of unaudited interim reports, unaudited quarterly reports and unaudited provisional reports: subject to 3.18(b), unaudited interim reports are not required to be reviewed by an issuer’s auditors; unaudited interim reports shall be reviewed by an issuer’s auditors if the issuer’s auditors disclaimed, qualified or gave an adverse opinion in the issuer’s last annual financial statements, unless the JSE otherwise decides; when conducting a review of an unaudited interim or provisional report, the auditors shall follow the guidance provided in the International Standard on Review Engagements, (ISRE) 2410, Review Financial Statements of Interim Financial Information Performed by the Independent Auditor of the Entity; if an interim or provisional report has been reviewed or audited by the auditor, this fact and the name of the auditor must be stated in the published interim or provisional report. The published interim or provisional report must state the type of review/audit conclusion, i.e. unqualified, qualified, disclaimer or adverse, and should contain an extract of the exact modification paragraph from the auditor’s report. The published interim or provisional report must also mention and contain details of any emphasis of matter paragraph/s regarding reportable irregularities, as defined in the Auditing Profession Act, (No. 26 of 2005), contained in the auditor’s report. If the report of the auditor is not included in the published interim or provisional report, it shall state that the report of the auditors is available for inspection at the issuer’s registered office; (New/updated requirement from 1 September 2008) where the financial period covers more than 12 months and interim reports are distributed in accordance with paragraph 1 3.18(i) Submission 3.59(a) Disclosure 3.59(b) 3.59(c) Disclosure Disclosure 8.57(a) Statement 8.57(c) Disclosure 8.58(a) Disclosure 8.58(b) Mineral entity disclosure 8.58(c) Disclosure Proforma effects will normally have been 3.15, a review opinion must be obtained for the second interim period, which is a twelve month period and (amended from 1 April 2010) if a review is required in terms of the above, a signed copy of the auditor’s review opinion must be submitted to the JSE within 24 hours of the publication of the results. (amended with effect from 1 April 2010), it shall state that the report of the auditors is available for inspection at the issuer’s registered office; Directors An issuer, through its sponsor, must notify the JSE of any change to the board of directors or company secretary including: the appointment of a new director (including the director’s capacity in terms of paragraph 3.84(f)) or company secretary; (amended with effect from 1 April 2010); the resignation, removal, retirement or death of a director or of the company secretary; and/or changes to any important functions or executive responsibilities of a director; without delay and no later than by the end of the business day following the decision or receipt of notice detailing the change. Such changes must be announced as soon as practically possible and also included in the issuer’s next publication of listing particulars, interim report or annual financial statements. Where a director retires and is reappointed at an annual or other general meeting, no notification is required as this does not result in a change to the board of directors. Minimum contents of interim reports, preliminary reports, provisional annual financial statements (“provisional reports”) and abridged annual financial statements (“abridged reports”) Every listed company, in addition to complying with the statutory requirements concerning interim reports, preliminary reports, provisional reports and abridged reports must prepare and present such financial information as follows: interim reports must be prepared in accordance with and containing the information required by IAS 34:Interim Financial Reporting, as well as the AC 500 standards as issued by the Accounting Practices Board or its successor, and a statement confirming that it has been so prepared must be included in the report; and (amended with effect from 1 April 2010) a statement must be included confirming that the accounting policies are in terms of IFRS and are consistent with those of the previous annual financial statements (or include details of the changes). (amended with effect from 1 April 2010) Supplementary information In addition to the requirements of IFRS and the AC 500 standards as issued by the Accounting Practices Board or its successor on Interim Financial Reporting and Schedule 4 of the Act, the following supplementary information must, where applicable and material, be included: in respect of the period under review and the immediately preceding comparable period, a headline earnings per share and a diluted headline earnings per share figure must be disclosed, in addition to the required IFRS earnings per share figures, together with an itemised reconciliation between headline earnings and the earnings used in the calculation of earnings per share; with respect to Mineral Companies, summary information must be provided in the interim report disclosing any material changes to the information disclosed in compliance with 8.63(l) for the prior year/period ended, or an appropriate negative statement where there have been no material changes; and disclosure where there is a material change to the initial estimates of a contingent consideration payable or receivable in terms of an acquisition or disposal, as used in the pro forma financial effects calculations. 2 8.60 included in an earlier category transaction announcement. Disclosure 16(2)(kk) Submission 16.21(a) Submission Audited/reviewed interim, provisional and abridged annual reports If an interim, preliminary, provisional or abridged report has been audited or reviewed by an auditor, this fact and the name of the auditor shall be stated in such published report. Although the report of the auditor need not be included in the published report, if such report is modified, details of the nature of such modification shall be stated therein. If the report of the auditor is not included in the published report, it shall state that the report of the auditor is available for inspection at the company’s registered office. If such report has not been audited or reviewed by an auditor, an appropriate negative statement must appear in such published report. All documentation relating to the following must be submitted to the JSE through the medium of a sponsor: (kk) the signed audit report referred to in Section 3.25. The JSE must be promptly furnished with the following: 100 copies of: (v) interim and provisional reports; 3