Ch 7

advertisement

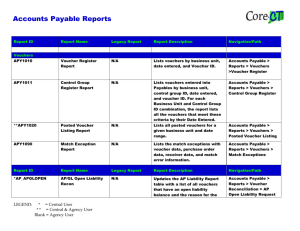

CHAPTER 7 ACQUISITION/PAYMENT PROCESS AFTER STUDYING THIS CHAPTER YOU SHOULD BE ABLE TO: 1. IDENTIFY THE MAJOR ACTIVITIES OF THE ACQUISITION/PAYMENT PROCESS 2. EXPLAIN HOW GOODS AND SERVICES ARE PROCURED FROM VENDORS 3. ****DESCRIBE THE FLOW OF TRANSACTIONS THROUGH THE ACQUISITION/PAYMENT PROCESS 4. ****SPECIFY THE PRINCIPAL MASTER AND TRANSACTION FILES IN THE ACQUISITION/PAYMENT PROCESS AND EXPLAIN THEIR CONTENT AND USE 5. ****IDENTIFY THE PRINCIPAL DOCUMENTS AND REPORTS IN THE ACQUISITION/PAYMENT PROCESS 1 THE ACQUISITION/PAYMENT PROCESS IS CONCERNED WITH THE PROCUREMENT OF RESOURCES BY THE ORGANIZATION BOTH TANGIBLE AND INTANGIBLE ALSO CALLED EXPENDITURE OR PURCHASING CYCLE INCLUDES PURCHASING ACCOUNTS PAYABLE CASH DISBURSEMENT APPLICATIONS INCLUDES RECEIVING - INTERFACES WITH CONVERSION PROCESS (INVENTORY) AND CASH DISBURSEMENTS - INTERFACES WITH THE FINANCING PROCESS PERSONNEL AND PAYROLL SHOWN AS A SEPARATE PROCESS IN THE HOLLANDER TEXT CALLED THE HUMAN RESOURCE PROCESS 2 DATA STORAGE, INPUTS, AND OUTPUTS IN THE ACQUISITION/ PAYMENT PROCESS MASTER FILES 1. VENDOR MASTER FILES TWO FILES: A. SUPPLIER MASTER FILE: NAME, ADDRESS, TERMS .EACH RECORD CORRESPONDS TO A PARTICULAR VENDOR - ORDERED ON VENDOR # .RECORDS RETRIEVED BY VENDOR # B. SUPPLIER HISTORY FILE: (SUPPLIER REFERENCE AND HISTORY FILE) VENDOR PERFORMANCE HISTORY RETURNS, DELIVERY TIME 2. INVENTORY MASTER FILE 3. (SUPPLIER) ACCOUNTS PAYABLE MASTER FILE 4. GENERAL LEDGER MASTER FILE 3 TRANSACTION FILES 1. OPEN PURCHASE ORDER FILES .CONTAINS DATA ON ALL PURCHASE ORDERS THAT REMAIN OPEN BECAUSE THE ORDER HAS NOT BEEN FILLED .RECORD IS WRITTEN WHEN THE PURCHASE ORDER IS ISSUED .REMAINS OPEN UNTIL THE ENTIRE ORDER HAS BEEN RECEIVED .COPIES OF PURCHASE ORDERS ARE HARD COPY BACK UP .ORDERED ON PURCHASE ORDER # .CLOSED RECORDS PURGED AT POINT IN TIME 2. OPEN VOUCHER FILE .CONTAINS DATA ON OUTSTANDING ACCOUNTS PAYABLE VOUCHERS .RECORDS ARE ADDED UPON RECEIPT OF VENDOR INVOICES AND REMAIN OPEN UNTIL INVOICE IS PAID .PARTIAL PAYMENT LEAVES THE RECORD OPEN .PURPOSE TO TRACK VOUCHERS UP TO THE TIME OF PAYMENT .PERMITS PREPARATION OF CASH REQUIREMENTS FORECAST 3. CASH DISBURSEMENTS TRANSACTION FILE 4 .ALSO CALLED CHECK FILE .RECORDS CASH DISBURSEMENTS TO VENDORS .INTERFACES WITH REPORTING AND INVESTMENT CYCLES .PROVIDES A BASIS FOR POSTING CASH DISBURSEMENTS TO THE CASH ACCOUNT IN THE GENERAL LEDGER APPLICATION - WHICH IS WHERE? .FIELD FOR VENDOR OR OTHER PAYEE 4. RECEIVING REPORT TRANSACTION FILE .USED TO RECORD RECEIPT OF GOODS AND VENDOR SERVICES - INTERFACE WITH THE CONVERSION PROCESS 5. BACK ORDER TRANSACTION FILE 6. JOURNAL VOUCHER (GENERAL LEDGER) TRANSACTION FILE 7. BACK UP FILES: ONE HOLDS CLOSED RECORDS FROM 5 OPEN PURCHASE ORDER FILE CHANGE THE NAME FROM SUPPLIER HISTORY FILE TO PURCHASE ORDER HISTORY FILE THE OTHER CLOSED RECORDS FROM OPEN VOUCHER FILE CHANGE THE NAME FROM SUPPLIER HISTORY FILE TO VOUCHER HISTORY FILE INPUT DOCUMENTS 1. PURCHASE REQUISITION issued by managers, listing goods and services needed 2. VENDOR SHIPPING DOCUMENTS prepared by vendors to accompany shipped goods 3. BILLS OF LADING prepared by common carriers as shipment contracts 4. VENDOR INVOICES submitted by vendor list quantity and price of items purchased, shipping and 6 handling charges, sales tax include terms of payment, due date, allowable discounts, discount dates OUTPUT DOCUMENTS 1. PURCHASE ORDERS issued to vendors to order goods or services and imply a commitment to make payment according to agreed upon terms and conditions multiple copies to where? 2. RECEIVING DOCUMENTS issued upon receipt of goods purchased, goods received on consignment, goods returned by dissatisfied customers prenumbered multiple copies to .......... 3. DISBURSEMENT VOUCHERS prepared to initiate disbursement to vendors and other authorized payees prenumbered voucher package - attached to po, receiver, and vendor invoice 4. CHECKS drawn on organization's bank account to disburse cash to vendors, other payees accounts payable checks supported by copy of the 7 voucher REPORTS 1. OPEN PURCHASE ORDERS lists open purchase order file with some supplementary data from vendor master file 2. OPEN VOUCHERS SCHEDULE OF AGED ACCOUNTS PAYABLE 3. CASH REQUIREMENTS FORECAST total dollar amount required to pay outstanding vouchers MAJOR RISKS IN THE ACQUISITION/PAYMENT PROCESS 1. Risks concerning procurement of goods and services from vendors 8 . purchases of unneeded goods - excessive inventory, storage . personal use of company purchase . intentional misclassification to conceal unauthorized purchase .unfavorable payment terms .recorded in wrong amount, not recorded at all, recorded in wrong period - "shifting" or "smoothing" 2. Risks concerning disbursement of cash . payments made for goods and services not authorized .lost purchase discounts .available discounts taken are not recorded .duplicate payments .checks made out to or sent to wrong payee .alteration of vendor invoice .check signature forged - or void notation erased .improper or illegal check requests or payments .cash disbursements incorrectly recorded or not recorded .disbursement and distribution of checks occur in different periods .check is made out to unauthorized individual .manipulation of bank reconciliation to offset misappropriations against old outstanding checks CONTROLS 1. ORGANIZATIONAL CONTROLS segregation of duties 9 .segregation of purchasing, receiving, and preparation of AP vouchers .authority to approve vouchers should be separated from authority to sign checks if number of employees is too small to achieve proper segregation of duties...... 2. Program and Data Access Controls user identification codes passwords - levels of access file and record locks designated terminal access data read-write privilege 3. Authorization Controls to ensure that input data are authorized proper authorization for ordering goods and services for receiving goods and services for disbursing cash. authorization for ordering goods and services 10 resides with dept. originating transaction use of scratch or suspense file reorder report batch of purchase requisitions exception reports of rejected transactions authorization for receiving goods and services receiving dept. and quality control receiving verify po, compare goods received to po and vendor's shipping document withholding quantity information? authority to disburse cash lies with accounts payable for vendor payments treasurer has ultimate responsibility po compared to vendor invoice countersignature on all checks over certain amount check signing machine & signature plates locked 4. Data Verification Controls reasonableness checks - positive / negative quantities supervisory approval is mandatory on all exception items 5. Processing Controls a. batch controls record counts control totals 11 cross footings hash totals extend throughout processing b. prenumbered documents - all processing is complete po, receivers, vouchers, checks boxes of blank checks control of check inventory 6. File Controls protect data from loss, damage, improper processing ensure that correct master or table files are used file maintenance 7. Output Controls output from system is complete, accurate, appropriately used-check register, check forms bank reconciliation independent of check printing and signing 12