helps.doc - BYU Marriott School

advertisement

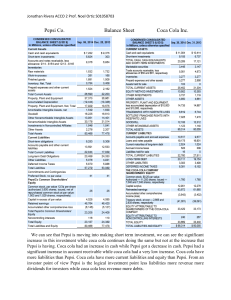

Class Preparation Helps 1. 2. 3. 4. 1. 2. 3. 1. 2. 3. Case: Wal-Mart Stores Discount Operations Discussion Questions: Why is Wal-Mart so successful? How would you characterize its strategy? What is Wal-Mart’s competitive advantage? How likely is it that Wal-Mart can sustain its advantage over time? Why are Wal-Mart’s costs lower than its competitors? Why don’t Walmart’s competitors (e.g., K-Mart, Target) imitate Wal-Mart and realize similarly high profits? Note: Wal-Mart's labor costs were calculated at 10.1 percent of sales versus an industry average of 11.2 percent in 1990. Cases: Cola Wars Continue: Coke vs. Pepsi in the 1990s Discussion Questions: Analyze the structure of the soft drink industry in the mid 1980s. Why are Coke and Pepsi so profitable? What prevents other firms from entering this industry and accessing some of those high profits? Compare the economics (costs and profits) of soft drinks (concentrate) versus bottlers? Why are Coke & Pepsi in the bottling business? Calculate the size of the barrier to entry into the soft drink (concentrate) industry? What would it cost a new entrant to build a competitive position (marketshare) similar to Pepsi or Coke? Case: Intel Corporation: 1968-1997. Discussion Questions Why has Intel been so successful? What are its sources of competitive advantage? What is (are) the company’s most valuable resource(s) Is Intel’s competitive advantage sustainable? Case: Honda A Discussion Questions: 1. Why didn't U.S. and British motorcycle producers respond to the Japanese competition? 2. Why would they have probably been at a competitive disadvantage even if they had responded by producing lightweight bikes for the U.S. market? How large of an experience curve advantage did Honda enjoy? 3. How large do you think the Japanese consumer market for motorcycles is relative to the U.S. consumer market? 1. 2. 3. 4. Case: Southwest Airlines 1993 A Discussion Questions What are the key sources of Southwest’s competitive advantage? Are Southwest’s cost advantages sustainable? What prevents larger competitors (e.g., American, Delta, United) from imitating Southwest’s approach? What prevents new entrants from successfully imitating Southwest’s approach? Create a chart that plots the relationship between relative marketshare in this industry and firm profitability. Based upon the analysis to question 3: What role, if any, does the experience curve play in explaining competitive advantage in this industry? What role dies the experience curve play in explaining Southwest’s cost advantage? Case: Leadership Online: Barnes & Noble vs. Amazon. com (A) Discussion Questions: 1. Why is Amazon.com’s market value so high relative to Barnes & Noble and Borders which have greater revenues, profits and assets? 2. Is Amazon.com’s online advantage sustainable? Why or why not? (Will Barnes & Noble and Borders be able to imitate Amazon.com=s business model?) 3. At what point in time do you project that Amazon.com will be profitable? Do you think it will be more profitable than Barnes & Noble? In which company would you prefer to own stock today? Case: Dell Corporation Discussion Questions: How did Dell come from nowhere to challenge computer giants Compaq and IBM? How is their strategy (business model) different from these larger competitors? What are their sources of competitive advantage? Why haven’t these larger competitors been able to quickly imitate Dell=s approach? 1. 2. Case: Ready-to-Eat Breakfast Cereal Industry in 1994 (A) 1. 2. 3. 4. 5. Discussion Questions: Why has RTE creal been such a profitable business? What changes have led to the current industry “crisis”? Why have private labels been able to enter this industry successfully? How do the cost structures of private label and branded cereal manufacturers differ? What does General Mils hope to accomplish with its April 1994 reduction in trade promotions and prices? What are the risks associated with those actions? How do you expect General Mills’ competitors to respond? What should General Mills do? Case: Power Play (A): Ninetendo in 8-bit Video Games Discussion Questions: 1. Nintendo successfully recreated the home video game business following the Atari-era boom and bust. How? 2. How was Nintendo able to capture value from the home video game business? Case: Disruptive Technology a Heartbeat Away: Ecton, Inc. Discussion Questions: 1. How does the Ecton machine differ from existing technology in the market? What characteristics/applications does it have that are similar to the conventional machines? What characteristics/applications are different? 2. Where is Ecton positioning itself in the current ultrasound imaging marketplace? Is it a sustaining or disruptive technology? Cases: Lincoln Electric Reading: “Organizational Alignment: The 7-S Model” Discussion Questions: 1. How successful has Lincoln been? Why? Where are the vulnerable? What future challenges could they have? Case: Pepsi’s Regeneration: 1990-1993 Reading: “Leading Change: Why Transformation Efforts Fail” Discussion Questions: 1. What challenges did Pepsi face in the early 1990s? How did these challenges shape the agenda and tasks of Craig Weatherup? 2. How did Weatherup gain buy-in and acceptance of his approach: a. from his direct reports? b. from the organization as a whole? 3. What is your evaluation of the reorganization? Would you want the job of Market Unit manager? Why or why not? 4. What were the major steps in Pepsi’s change process? Do you agree with the way events were sequenced? Why or why not? 5. How would you describe Weatherup’s approach to leading change? Case: GE’s Two-Decade Transformation: Jack Welch’s Leadership Discussion Questions: 1. How difficult a challenge did Welch face in 1981? How effectively did he take charge? 2. What is Welch’s objective in the series of initiatives he launched in the late 1980s and 1990s? 3. How does such a large, complex diversified conglomerate defy the critics and continue to grow so profitably? 4. What is your evaluation of Welch’s management approach? How important is he to GE’s success? What implications for his replacement? Case: Tom Monaghan: In Business for God Discussion Questions: 1. Compare Tom Monaghan’s philosophy of business and wealth with what you know about “Ben & Jerry’s” or “The Body Shop”? 2. What is appropriate about his behavior? Inappropriate