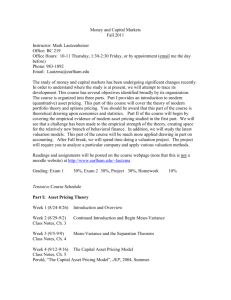

Course Syllabus and Overview

advertisement

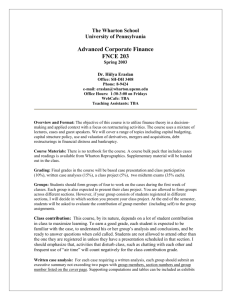

Professor Kose John Spring 2003 Corporate Finance Course Overview Corporate Finance is an introductory course in finance, specifically designed for MBA participants with no prior exposure to finance. It provides an overall perspective of finance, both in investments and corporate finance. In the first part of the course we will develop valuation rules, which are general methods to determine the current value of risky assets. These assets may be assets that are traded on financial markets or real assets that include the projects being considered for investment by corporations. In either case the risky asset may be thought of as a multiplied sequence of uncertain cashflows. Coming up with a valuation rule involves understanding how markets price risk and return. Ideas of present value computations, systematic risk and the capital asset pricing model (CAPM) are components of a very general valuation rule. Notes #1 gets into more details. Methods for pricing options give rise to another valuation rule. In the second part of the course we will see applications of the valuation methodology to come up with decision criteria in corporate finance. The net present value rule is a simple application of the valuation rule to take investment (or capital budgeting) decisions optimally in corporate finance. Similar ideas will be used to come up with criteria for financing (and dividend) decisions for the corporation. The valuation rules will be modified to take into account many real-world features such as corporate and personal taxes, bankruptcy cost, agency cost, and the possibility that corporate insiders may be better informed than the investors in the market. These features will affect the optimal debt/equity decisions and the optimal dividend decisions of the corporation. Notes#2 on Capital Structure gets into details of this application. These ideas are then used to study some practical issues in investment, capital budgeting, real options and corporate finance. These topics include valuation of stocks and bonds, valuation of corporate assets with option features, valuation of companies, capital budgeting, corporate financing and capital structure issues, agency problems and corporate governance. Materials Required: Text: R. Brealey and S. Myers: Principles of Corporate Finance, Seventh Edition, McGraw-Hill 2003 Two Cases: 1. The Super Project 2. Marriott Corporation: The Cost of Capital (Abridged). A selected set of PowerPoint slides most useful for following my lectures for the five sessions are available on the course material website. Three teaching notes will also be used: Notes #1: Managerial Objectives and Valuation Rules Notes #2: Capital Structure Notes #3: Notes on Capital Budgeting All the lecture notes are available on the web below. Problem Sets: Two problem sets (problem set and APV-WACC problems) containing selected questions from the textbook and practice questions of the studied material are available on the web below. The student should try and solve the problems without using the solutions. Brief solutions to the problems sets will be handed to students. Grading: The grade in the course will be determined based on the final examination and the case report. 80% Final Exam Grade 20% Case Report Outline of Topics Course Overview Overview of Finance 1. Financial Markets and Net Present Value Rule, How to Calculate Net Present Values. Applications: Stock and Bond Valuations. 2. Risk and Return, The Capital Asset Pricing Model, Risk-Adjusted Discount Rate. Applications: Capital Budgeting. 3. Advanced Issues, Real Options 4. An Overview of Corporate Financing, How Corporations Issue Securities Capital Structure Issues in Perfect Markets, Corporate Taxes, Personal Taxes, Bankruptcy Costs, Agency Costs and Corporate Governance. 5. Interactions of Investment and Financing Decisions, Adjusted Present Value. Corporate Finance Course Outline and Readings Topics Session 1 Course Overview Overview of Finance, Financial Markets and Net Present Value Rule How to Compute Net Present Values Applications Stock and Bond Values Valuing a business Readings Notes#1 BM Chapters 1,2,3,4 BM Section 4-5 Session 2 Risk and Return, Systematic Risk Beta, Measuring Beta,CAPM The Capital Asset Pricing Model Risk in Capital Budgeting BM Chapters 7 BM Chapters 8 BM Chapters 9 Session 3 Capital Budgeting Criteria NPV, IRR, and Equivalence Capital Budgeting Examples Real Options, Decision Trees BM Chapter 5 Chapter 6 BM Chapter 10-3 Session 4 Capital Structures Issues in Perfect Markets Corporate Taxes, Personal Taxes Interaction of Investment and Financing Decisions Adjusted Present Value BM Chapters 17, 18 Notes on Capital Structure Discuss Case 1: The Super Project Session 5 An Overview of Corporate Financing BM Chapters 14, 15, 34 Corporate Governance in Different Countries Discuss Case2: Marriott Corporation How Corporations Issue Securities Venture Capital, IPOs, International Security Issues _____________ BM = Brealy and Myers, Principles of Corporate Finance, Seventh Edition (Text book).