Exam 1 30%

advertisement

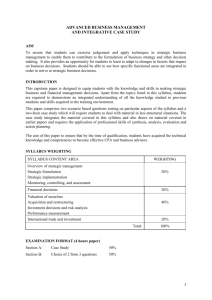

Money and Capital Markets Fall 2011 Instructor: Mark Lautzenheiser Office: BC 219 Office Hours: 10-11 Thursday, 1:30-2:30 Friday, or by appointment (email me the day before) Phone: 983-1892 Email: Lautzma@earlham.edu The study of money and capital markets has been undergoing significant changes recently. In order to understand where the study is at present, we will attempt to trace its development. This course has several objectives identified broadly by its organization. The course is organized into three parts. Part I provides an introduction to modern (quantitative) asset pricing. This part of this course will cover the theory of modern portfolio theory and options pricing. You should be award that this part of the course is theoretical drawing upon economics and statistics. Part II of the course will begin by covering the empirical evidence of modern asset pricing studied in the first part. We will see that a challenge has been made to the empirical strength of the theory, creating space for the relatively new branch of behavioral finance. In addition, we will study the latest valuation models. This part of the course will be much more applied drawing in part on accounting. After Fall break, we will spend time doing a valuation project. The project will require you to analyze a particular company and apply various valuation methods. Readings and assignments will be posted on the course webpage (note that this is not a moodle website) at http://www.earlham.edu/~lautzma Grading: Exam 1 30%, Exam 2 30%, Project 30%, Homework Tentative Course Schedule Part I: Asset Pricing Theory Week 1 (8/24-8/26) Introduction and Overview Week 2 (8/29-9/2) Class Notes, Ch. 3 Continued Introduction and Begin Mean-Variance Week 3 (9/5-9/9) Class Notes, Ch. 4 Mean-Variance and the Separation Theorem Week 4 (9/12-9/16) The Capital Asset Pricing Model Class Notes, Ch. 5 Perold, “The Capital Asset Pricing Model”, JEP, 2004, Summer. 10% Week 5 (9/19-9/23) Introduction to Derivatives Powerpoint Presentation Stultz, “Should We Fear Derivatives?”, JEP, 2004, Summer. Week 6 (9/26-9/30) Options Pricing Darden, “Binomial Option Pricing” Jarrow, “In Honor of the Nobel Laureates Robert C. Merton and Myron S. Scholes: A Partial Differential Equation That Changed the World”, JEP, 1999, Autumn. Week 7 (10/3-10/7) Review and Exam 1 on Friday, 10/7 Part II: Towards Fundamental Analysis Week 8 (10/10-10/14) Empirical Issues with Asset Pricing Theory Lo, “Efficient Market Hypothesis” Fama & French, “CAPM: Theory and Evidence”, JEP, 2004, Summer Malkiel, “The Efficient Market Hypothesis and Its Critics”, JEP, 2003, Winter Week 9 (10/17-10/21) Behavioral Finance st (No Class on Friday, Oct. 21 --- Early Semester Break) Thaler, “Behavioral Economics” Shiller, “From Efficient Markets Theory to Behavioral Finance”, 2003, Winter. Week 10 (10/24-10/28) Behavioral Finance and Intro to Valuation Shliefer & Summers, “The Noise Trader Approach to Finance”, JEP, 1990, Spring Class Notes, Chapter 9 Week 11 (10/31-11/4) Two Valuation Models Class Notes, Chapter 9 Damodaran, “Valuation Approaches and Metrics: A Survey of the Theory and Evidence” Week 12 (11/7-11/11) Relative Valuation Class Notes, Chapter 9 Damodaran, “What is the riskfree rate? A Search for the Basic Building Block” and “Equity Risk Premiums (ERP): Determinants, Estimation and Implications” Week 13 (11/14-11/18) Review and Exam 2 on Friday 11/18 Week 14 (11/21-11/25) No Class --- Fall Break Part III: Valuation Project Week 15 (11/28-12/2) Week 16 (12/5-12/9) Week 17 (12/12-12/16) Valuation Project Valuation Project Valuation Project due on Wednesday, Dec. 16 by Noon