I. Introduction and Course Overview

advertisement

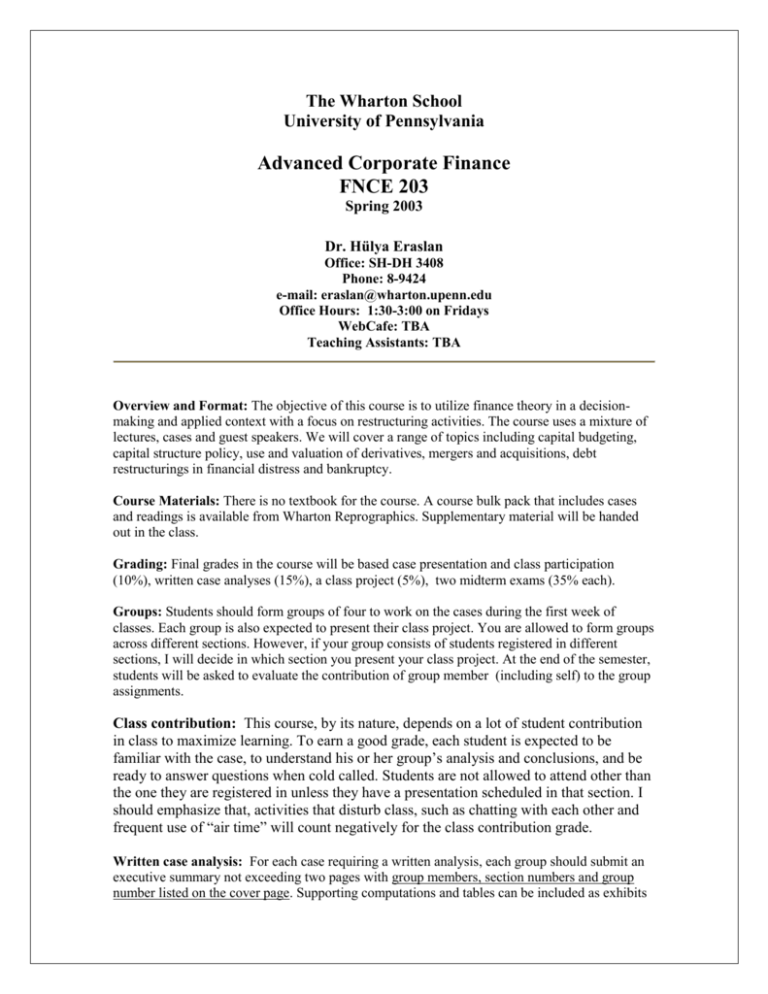

The Wharton School University of Pennsylvania Advanced Corporate Finance FNCE 203 Spring 2003 Dr. Hülya Eraslan Office: SH-DH 3408 Phone: 8-9424 e-mail: eraslan@wharton.upenn.edu Office Hours: 1:30-3:00 on Fridays WebCafe: TBA Teaching Assistants: TBA Overview and Format: The objective of this course is to utilize finance theory in a decisionmaking and applied context with a focus on restructuring activities. The course uses a mixture of lectures, cases and guest speakers. We will cover a range of topics including capital budgeting, capital structure policy, use and valuation of derivatives, mergers and acquisitions, debt restructurings in financial distress and bankruptcy. Course Materials: There is no textbook for the course. A course bulk pack that includes cases and readings is available from Wharton Reprographics. Supplementary material will be handed out in the class. Grading: Final grades in the course will be based case presentation and class participation (10%), written case analyses (15%), a class project (5%), two midterm exams (35% each). Groups: Students should form groups of four to work on the cases during the first week of classes. Each group is also expected to present their class project. You are allowed to form groups across different sections. However, if your group consists of students registered in different sections, I will decide in which section you present your class project. At the end of the semester, students will be asked to evaluate the contribution of group member (including self) to the group assignments. Class contribution: This course, by its nature, depends on a lot of student contribution in class to maximize learning. To earn a good grade, each student is expected to be familiar with the case, to understand his or her group’s analysis and conclusions, and be ready to answer questions when cold called. Students are not allowed to attend other than the one they are registered in unless they have a presentation scheduled in that section. I should emphasize that, activities that disturb class, such as chatting with each other and frequent use of “air time” will count negatively for the class contribution grade. Written case analysis: For each case requiring a written analysis, each group should submit an executive summary not exceeding two pages with group members, section numbers and group number listed on the cover page. Supporting computations and tables can be included as exhibits not exceeding four pages. All exhibits should be clearly labeled and easily readable. All the assumptions and formulas used should be provided in an appendix not exceeding one page. The written analyses should be submitted at the beginning of the class during which the case is to be discussed. If a group consists of members across different sections, that group should submit the case at the beginning of the earliest section for which a group member is registered. You may use any publicly available information about the case. You cannot, however, use old notes, handouts, or solutions to the cases (regardless of the source) for your written reports and/or for class discussions. The purpose of the written analyses is to motivate high level of class preparation. There are no single correct solutions for the cases and therefore you will not be graded for “correct” solutions in your case write-ups. WebCafe: There will be a webCafe room for this class to be announced in class. For fairness, any questions that are of interest to whole class will be answered only in webCafe room. The room will also be my primary source of communication for the announcements regarding the class. Regrading Policy: Regrading requests must be made within ten days after receiving the graded material. All such requests must be made in writing. Any exam or case submitted for regrading of a question will be subjected to a complete regrading. In the past, this resulted in lower grades for some students. Makeup Exams: If you miss one of the exams due to a documented serious emergency, I will allow you to take a make up exam for the missed exam. Serious emergency is a subjective concept, and I will be the judge of that after the emergency has occurred. Minor illnesses, conflicts with other classes, interviews, and travel plans are not serious emergencies. Religious Holidays: If your religion interferes with one of the midterm dates or assignment dates, please let me know within two weeks from the first day of class. Course Outline and Readings I. Introduction and Course Overview II. Financial Analysis and Planning “Note on Bank Loans” Business Week, “How Efficient Is That Company?” Clarkson Lumber Company III. Capital Budgeting, Cost of Capital and Valuation A. Capital Budgeting Higgins Chapter 7 Empirical Chemicals (A & B) B. Cost of Capital Bruner, Eades, Harris, Higgins, “Best Practices in Estimating the Cost of Capital” Marriott Corporation: Cost of Capital C. Review of Valuation Methods Luehrman, “What’s It Worth” Inselbag and Kaufold, “How to Value Recapitalizations and Leveraged Buyouts” Kaplan and Ruback, “The Market Pricing of Cash Flows Forecasts: Discounted Cash Flow versus the Method of Comparables” American Chemical Corporation RJR Nabisco Southport Minerals, Inc. IV. Mergers and Acquisitions Regulatory Considerations Common Takeover Tactics and Defenses Wall Street Journal, “Why All Takeovers Aren’t Created Equal” The Acquisition of Consolidated Rail Corp. (A) The Acquisition of Consolidated Rail Corp. (B) V. Restructurings and Bankruptcy Reorganization Note on Bankruptcy in the United States Valuation of Companies within Workout and Turnaround Situations Loan Workouts: What They Are and Why They Are Needed. Franks and Torous, “A Comparison of Financial Recontracting in Distressed Exchanges And Chapter 11 Reorganizations” Gilson, John and Lang, “Troubled Debt Restructurings: An Empirical Study of Private of Firms in Default” Asquith, Gertner and Scharfstein, “Anatomy of Financial Distress: An Examination of Junk-Bond Issuers” National Convenience Stores Marvel Entertainment Cumberland Worldwide Corporation (A) VI. Financial Policy The Economist, “Corporate Finance Survey” Structuring Corporate Financial Policy: Diagnosis of Problems and Evaluation of Strategies Smith, “Raising Capital: Theory and Evidence” Coleco Industries, Inc VII. Warrants and Convertibles Brennan and Schwartz, “The Case for Convertibles” Stein, “Convertible Bonds As Backdoor Equity Financing” Chrysler’s Warrants Due to the uncertainty of the date of availability of the guest speakers, the course schedule is tentative. An updated schedule will be announced on the first day of classes. The cases with “w” next to it require written analysis. 14-Jan 16-Jan 21-Jan 23-Jan 28-Jan 30-Jan 4-Feb 6-Feb 11-Feb 13-Feb 18-Feb 20-Feb 25-Feb 27-Feb 4-Mar 6-Mar 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 18-Mar 20-Mar 25-Mar 27-Mar 1-Apr 3-Apr 8-Apr 10-Apr 15-Apr 17-Apr 22-Apr 24-Apr 17 18 19 20 21 22 23 24 25 26 27 28 Introduction Clarkson Lumber Company Capital Budgeting Empirical Chemicals Cost of Capital Marriott Corporation: Cost of Capital Review of Valuation American Chemical Corporation RJR Nabisco Southport Minerals, Inc The Acquisition of Consolidated Rail Corp. (A) The Acquisition of Consolidated Rail Corp. (B) Midterm Bankruptcy Valuation in Financial Distress Guest Speaker-TBA Spring Break Marvel Entertainment National Convenience Stores Guest Speaker-TBA Workouts and Distressed Exchange Offers Cumberland—A Capital Structure Policy Coleco Industries, Inc. Warrants and Convertibles Chrysler Midterm Project presentation Project presentation w w w w w w w w