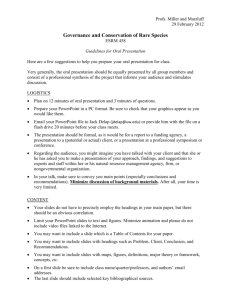

LESSON OUTLINE CHAPTER 3 Professional Ethics Brief Topical

advertisement

LESSON OUTLINE CHAPTER 3 Professional Ethics Brief Topical Outline A. Nature of Ethics 1. 2. B. The AICPA Code of Professional Conduct 1. 2. 3. 4. B. Purpose of the Code Two parts of the Code—Principles and Rules (PowerPoint 3-3) Applicability of Code Enforcement procedures Details of the Principles of the Code 1. 2. 3. 4. 5. 6. C. Ethical dilemmas Making ethical decisions (PowerPoint 3-2) Responsibilities—exercise sensitive professional and moral judgments The public interest Integrity—maintain highest level Objectivity and independence—to maintain objectivity and be free of conflicts of interest in all professional responsibilities; remain independent in fact and in appearance for attestation services Due care—to observe all of the profession's standards Scope and nature of services—to observe Principles in determining the nature and scope of work accepted. Details of the Rules (and related interpretations and rulings) of the Code (PowerPoint 3-4) 1. Independence — Independence in fact and independence in appearance (PowerPoint 3-5) — The AICPA Conceptual Framework for Independence (PowerPoints 3-6 through 3-9) — Independence terminology—covered member (PowerPoint 3-10), applicability of rules (PowerPoint 3-11), direct v. indirect financial interests (PowerPoint 3-12) — Stated prohibitions against financial interests and business associations (pages 77-79 of textbook) — Effects of partner and professional staff relationships on firm independence — Effects of business and financial relationships of relatives (PowerPoint 3-13) — Difference between AICPA and SEC/PCAOB positions with respect to nonattest work — Does rendering nonattest services impair CPA independence? — Independence requirements for audits of public companies (PowerPoint 3-14) 2. Integrity and objectivity — Prohibition of misrepresentation applies to all aspects of public accounting — When rendering tax services, doubt may be resolved in favor of client Compliance with standards and accounting standards — Brings Auditing Standards Board, Management Consulting Services Executive Committee, Accounting and Review Services Committee, FASB and GASB pronouncements under the Code (PowerPoint 3-15) — Members must justify departures from these pronouncements Confidential client information — Does not reduce responsibility for adequate disclosure — Rule does not relieve auditors from responsibilities under auditing and accounting standards, requirements to respond to subpoena or complaint, and allows them to divulge information to inspectors or peer reviewers during practice review (see Rule 301) — Privileged communications only exists under certain state laws Contingent fees (PowerPoint 3-16) — Not permissible for (1) preparation of tax returns and (2) when CPA performs financial statement audits, reviews or independent compilations, or forecast examinations for a client — Not allowed for tax matters for public companies Other topics — Rule 501 prohibits discreditable acts Retaining client records (PowerPoint 3-17) — Rule 502 allows advertising which is not false, misleading, or deceptive — Rule 503 prohibits commissions for referral of products or services when CPA performs financial statement audits, reviews or independent compilations, or forecast examinations for a client. Form of practice and name — Professional corporations vs. partnerships vs. limited liability companies. 3. 4. 5. 6. 7. D. Ethics for internal auditors (PowerPoints 3-18, 3-19 and 3-20) Comments and Observations Too often students approach ethics as a set of rules to be memorized. While such an approach may be sufficient in terms of preparing for the CPA Examination, I believe that it overlooks the basic relationship between ethical conduct and the practice of a profession. In addition, it is not likely to give you much insight into resolving the issues concerning questionable practices which are not specifically prohibited by the Code of Professional Conduct. The AICPA's Code of Professional Conduct has two sections—Principles and Rules. It is much more important that CPAs strive to "do the right thing" rather than merely attempt to avoid those actions specifically prohibited by the Code. In reviewing the Rules, I emphasize independence. The AICPA Conceptual Framework for Independence provides overall guidance. Rule 101 on independence and its first interpretation are particularly important. I stress the importance of an appearance of independence. After all, a principal purpose of the Code is to inspire public trust and confidence in the practitioners of the profession. In this regard, the appearance of independence is of critical importance. It is of little consolation that auditors are in fact independent, if in the public's mind, they do not appear to be independent of their clients. We also stress that despite the fact that clients pay the auditors' fees, they must strive to maintain their independence. The Code distinguishes between independence and integrity-objectivity responsibilities. The auditor must remain independent for auditing and other attestation services. Integrity and objectivity must be maintained for all professional services. One issue that is always of interest to students is: To whom does the independence rule apply? Partners? Everyone in the office? Everyone in the firm? This brings forth a discussion of the concept of a covered member. You should be able to determine who is a covered member. It is particularly important to know the effects of the SEC and PCAOB on the independence rules for auditors of public companies. Please review of how the SEC has developed regulations on auditor independence over the years. The PCAOB is now responsible for development of independence and other ethical rules. The primary differences between AICPA rules for auditors and those applying to auditors of public companies currently relates to the types of nonattest services that CPAs are allowed to perform for their audit clients. . Rule 505 allows the organization of a CPA firm in any manner permitted by state law. The practical effect of this has been to allow the formation of limited liability partnerships (companies). The legal liability may affect personal assets of CPAs as well as CPA firm assets. Stockholders (partners) of professional corporations retain personal liability for the acts of the corporation, regardless of whether they have participated on an engagement resulting in liability. On the other hand, stockholders (partners) of a limited liability company may generally escape personal liability when they have not participated on such an engagement. But, regardless of the form of association, stockholders (partners) and staff participating on an engagement have potential personal legal liability.