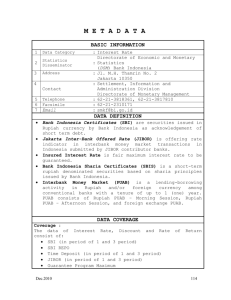

No - Bank Indonesia

advertisement

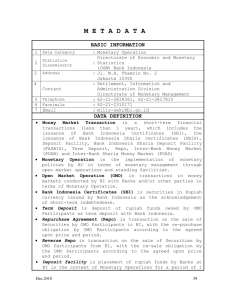

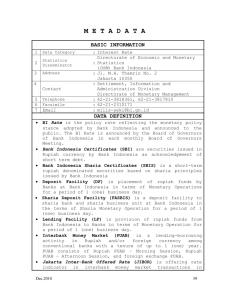

M E T A D A T A BASIC INFORMATION 1 Data Category 2 Statistics Disseminator 3 Address 4 Contact 5 6 7 Telephone Facsimile Email : Open Market Operation Directorate of Economic and Monetary : Statistics (DSM) Bank Indonesia : Jl. M.H. Thamrin No. 2 Jakarta 10350 : Settlement, Information and Administration Division Directorate of Monetary Management : 62-21-3818361, 62-21-3817810 : 62-21-2310171 : smkf@bi.go.id DATA DEFINITION Open Market Operation (OMO) is transactions in money markets conducted by BI with Banks and/or other parties in terms of Monetary Operation. Bank Indonesia Certificates (SBI) is securities in Rupiah currency issued by Bank Indonesia as the acknowledgement of short-term indebtedness. Repurchase Agreement (Repo) is transaction on the sale of Securities by OMO Participants to BI, with the re-purchase obligation by OMO Participants according to the agreed upon price and period. Bank Indonesia Sharia Certificate (SBIS) is a short-term rupiah denominated securities based on sharia principles issued by BI. Before July 2010 : SWBI is the evidence of Wadiah Depositing Fund. Wadiah Depositing Fund is depositing fund in short-time period which is using Wadiah Principle provided by Bank Indonesia for Sharia Bank or Sharia Business Unit (UUS). Wadiah is an agreement of depositing fund between the owners of funds with the party that receives the deposit which is trusted to maintain the fund. Since April 2008, SWBI no more exist and have been changed to Sharia Certificate of Bank Indonesia (SBIS) DATA COVERAGE Dec.2010 117 Coverage : The OMO outstanding and money market transactions consist of: SBI (Issuance, Redemption, Outstanding in the period of 1,3 and 6 month) Repurchase Agreement SBI (Issuance, Redemption, Outstanding) Bank Indonesia Sharia Certificate (SBIS) (Issuance, Redemption, Outstanding) Unit : Billion and Thousand Currency : Rupiah PUBLICATION PERIODICITY Weekly TIMELINESS 2 (two) weeks after the end of reference period ADVANCE RELEASE CALENDAR (ARC) ARC (attached) will disclose every year by December. SOURCE OF DATA Bank Indonesia (BI) : LBU, LHBU, BI-SSSS METHODOLOGY The data recording process are : Recording process - The data of SBI, SBI Repo, and SBIS are obtained from BI-SSSS Information System. - All data entered to the portal can be accessed directly by the users and BI through EDW, which is including the aggregated data, the detailed data by each Banks and inter-bank transaction data. Calculation Method - SBI SBI is Issued and traded with discount system, SBI cash value is calculated based on true discount with formula as follows: Dec.2010 118 Cash Value = Nominal Value x 360 360 + (Discount Rate x Time Period) Discount Value = Nominal Value – Cash Value The outstanding of SBI is monthly total nominal value of SBI. Repo The repo transaction is conducted with sell and buy back principle. It is conducted through an auction mechanism with a fixed or variable rate tender method. The outstanding of Repo is monthly total nominal value of Repo. - - SBI Repo The SBI repo transaction is conducted with sell and buy back principle. The outstanding of SBI Repo is monthly total nominal value of SBI Repo. - SBIS The outstanding of SBIS is monthly total nominal value of SBIS. DATA INTEGRITY The data are final when first disseminated. Changes in methodology are noted along the data with the new methodology published for the first time. PUBLIC ACCESS TO DATA Data is disseminated through: BI’ Website http://www.bi.go.id/web/id/Statistik/Metadata/SEMI/ Indonesian Monetary Economic Statistics Dec.2010 119