Document

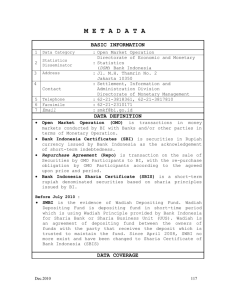

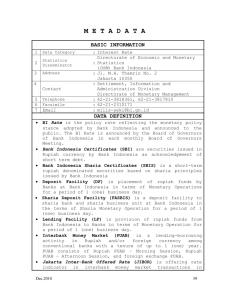

advertisement

M E T A D A T A BASIC INFORMATION 1 Data Category 2 Statistics Disseminator 3 Address 4 Contact 5 6 7 Telephone Facsimile Email : Interest Rate Directorate of Economic and Monetary : Statistics (DSM) Bank Indonesia : Jl. M.H. Thamrin No. 2 Jakarta 10350 : Settlement, Information and Administration Division Directorate of Monetary Management : 62-21-3818361, 62-21-3817810 : 62-21-2310171 : smkf@bi.go.id DATA DEFINITION Bank Indonesia Certificates (SBI) are securities issued in Rupiah currency by Bank Indonesia as acknowledgement of short term debt. Jakarta Inter-Bank Offered Rate (JIBOR) is offering rate indicator in interbank money market transactions in Indonesia submitted by JIBOR contributor banks. Insured Interest Rate is fair maximum interest rate to be guaranteed. Bank Indonesia Sharia Certificates (SBIS) is a short-term rupiah denominated securities based on sharia principles issued by Bank Indonesia. Interbank Money Market (PUAB) is a lending-borrowing activity in Rupiah and/or foreign currency among conventional banks with a tenure of up to 1 (one) year. PUAB consists of Rupiah PUAB – Morning Session, Rupiah PUAB – Afternoon Session, and foreign exchange PUAB. DATA COVERAGE Coverage : The data of Interest Rate, Discount and Rate consist of: SBI (in period of 1 and 3 period) SBI REPO Time Deposit (in period of 1 and 3 period) JIBOR (in period of 1 and 3 period) Guarantee Program Maximum Dec.2010 of Return 114 SBIS PUAB Rupiah – Morning Session (over night and maturity) PUAB Rupiah – Afternoon Session (over night and maturity) all all Unit : per cent (per hundred) PUBLICATION PERIODICITY Weekly TIMELINESS 2 (two) weeks after the end of reference period ADVANCE RELEASE CALENDAR (ARC) ARC (attached) will disclose every year by December. SOURCE OF DATA Bank Indonesia (BI) : LBU, LHBU, BI-SSSS, BI website Indonesia Deposit Interest Rate Insurance Corporation (LPS): Insured METHODOLOGY The data recording process are : Recording process - The data of SBI and SBIS are obtained from SBI auction results published at BI website. - The data of PUAB, PUAS, and JIBOR are obtained from LHBU that delivered by Reporting Bank to BI online through extranet. Data submitted by the banks are entered to the OLTP (Online Transaction Processing) server after being validated for data accuracy. The business validations are done by the system based on parameter settings. Those Parameter Settings previously have been set especially for transactional data. Some data need to be confirmed to the relevant bank for validity and related to the sanction imposed. Data that has passed technical validation will be automatically moved to the portal. - All data entered to the portal can be accessed directly by the users and BI through EDW, which is Dec.2010 115 including the aggregated data, the detailed data by each Banks and inter-bank transaction data. Rupiah PUAB – Morning Session is started at 07.00 WIB – 12.00 WIB, PUAB – Afternoon Session at 12.00 – 18.00 WIB and Foreign exchange PUAB at 07.00 WIB - 18.00 WIB. - Calculation Method - SBI Interest Rate SBI Interest Rate is calculated using weighted average method by weighting the rate by the volume of SBI transaction in each bidding rate which is not exceeded the SOR conducting in the reference period. Stop-Out Rate (SOR) is the highest discount rate resulted from auction in order to achieve SBI quantity target which will be published by Bank Indonesia. The SBI Interest Rate formula is as follows: (vol1 x rate1) + (vol2 x rate2) + (vol3 x rate3) + (vol N x rate N) SBI Interest Rate = -----------------------------------------------------------------Total Volume SBI Interest Rate is established by Fixed Rate and Variable Rate method. SBI Interest Rate with Fixed Rate method was stipulated by BI and referred to BI Rate (conducted since Mei 2006 through January 2008). SBI Interest Rate with Variable Rate method is calculated using weighted average (conducted since January 1998 through April 2006 and reenacted since February 2008 until now). - SBIS Rate of Return The SBIS rate of return is refered to the discount rate resulting from the auction of SBI with the same maturity that is issued simultaneously with the issuance of the SBIS under the following provisions: a. If the SBI auction applies a fixed rate tender method, the SBIS rate of return will be the same as the discount rate of the SBI auction b. If the SBI auction applies a variable rate tender method, the SBIS rate of return will be the same as the weighted average of discount rate resulting from Dec.2010 116 the SBI auction. If SBI auction is not conducted in the reference period, the SBIS rate of return will refer to the latest SBIS rate of return or SBI discount rate with the same maturity. - PUAB PUAB overnight (O/N) interest rate is monthly PUAB rate with 1 day maturity calculated by weighting avarage method in the reference period. The all maturity of PUAB interest rate is monthly PUAB rate with all maturity calculated by weighting avarage method in the reference period. - JIBOR JIBOR is calculated from the average Interest Rate indicator offered by JIBOR bank members. It is excluding the highest and the lowest offered rates. - Guarantee Program Maximum Guarantee Program Maximum is determined by BI since Juny 1st 1998 through September 21st 2005 including the maximum of Third Party Deposit Rate and PUAB in Rupiah and foreign currency (USD). The maximum Insured Third Party Deposit Rate in Rupiah and foreign currency (USD) is calculated by the average of term deposit rate for each maturity in Rupiah and foreign currency (USD) from JIBOR bank members appointed by Bank Indonesia within 1 (one) week period plus point based margin. The maximum PUAB Rate in Rupiah and foreign currency (USD) is calculated by the average of PUAB O/N rate in Rupiah and foreign currency (USD) from JIBOR bank members appointed by BI within 1 (one) week period. With the establishment of Indonesia Deposit Insurance Corporation (LPS), since September 22nd, 2005, the maximum insured interest rate is determined by LPS and limited to the third party deposit (PUAB rate is no longer insured). From September 22nd, 2005 through May 9th, 2006, the maximum insured interest rate is calculated by the average of term deposit rate for each maturity in Rupiah and foreign currency (USD) from selected banks in a certain period. Since May 9th, 2006, the insured interest rate is equal to BI Rate or a certain rate determined by LPS, whereas the USD insured interest rates is determined by LPS. Dec.2010 117 - PUAS Rate of Return The PUAS rate of return is monthly PUAS rate of return with all maturity calculated by weighting avarage method in the reference period. (Total (Indication Rate of IMA Certificate each bank x profit loss sharing nisbah for Fund Investment Bank of each bank x volume transaction of each bank)) PUAS Rate of Return = ---------------------------------------------------------------------------------------------------------------x 100 (Total volume of transaction in all banks) Information : Indicator rate of IMA certificate = Indicator rate of IMA certificate rate of return before distributed to fund’s manager Bank in previous month. DATA INTEGRITY The data are final when first disseminated. Changes in methodology are noted along the data with the new methodology published for the first time. PUBLIC ACCESS TO DATA Data is disseminated through: BI’ Website http://www.bi.go.id/web/id/Statistik/Metadata/SEMI/ Indonesian Monetary Economic Statistics Dec.2010 118