Chapter 11 The Banking System and the Money Supply

advertisement

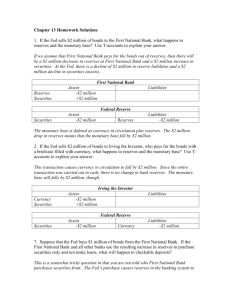

Chapter 11 The Banking System and the Money Supply Review Questions 2. M1 includes cash in the hands of the public, demand deposits, other checking account deposits, and travelers checks. M2 includes cash in the hands of the public, demand deposits, other checking account deposits, travelers checks, savings-type accounts, retail MMMF balances, and small denomination time deposits. 4. Net worth is listed on the liabilities side of a balance sheet because it is, in a sense, what the bank would owe to its owners if it went out of business. 6. The important difference between the Board of Governors and the FOMC is that the FOMC has the important task of establishing U.S. monetary policy, while the Board of Governors supervises and regulates member banks, supervises the 12 Federal Reserve District Banks, and sets reserve requirements and approves the discount rate. 8. When the Fed wants to increase the money supply, it purchases bonds from a bond dealer, and pays with a Federal Reserve check. When the bond dealer deposits the check in its bank account, it counts as reserves for the bank. The bank has excess reserves, which it lends out. The reserves will find their way to another bank, leading to excess reserves at that bank, and so on. Each time a bank obtains new reserves and lends out the excess, it ends up with more deposits than it started with. As the process continues, the total quantity of demand deposits—and with it the money supply—increases. When the Fed wants to decrease the money supply, it sells bonds to a bond dealer, and makes the bank pay with reserves. The bank has deficient reserves, so it must decrease its volume of loans, and decrease the volume of its deposits at the same time. As loans are paid back to this bank, some other bank in the system will develop deficient reserves, and have to decrease the volume of its loans and deposits, and so on. As the process continues, the total quantity of demand deposits—and with it, the money supply—decreases. 10. Governments have more than one measure of the money supply because measuring the money supply is harder than it might seem. For example, while you can’t use funds in a savings account to buy things directly, you can easily move those funds into a checking account, so the question arises as to whether savings account balances are money. 12. Banks cannot create wealth when they create money. “Creating money” is different from “creat-ing wealth.” When a bank creates money by giving someone a loan, that person has extra money in his account, but owes the same amount to the bank. The net change in their wealth is $0. Problems and Exercises 2. The money supply can increase by a maximum of ((1/0.15) x $50 million = $333.33 million. If the required reserve ratio is 0.18, the money supply can increase by a maximum of ((1/0.18) x $50 = $277.78 million. 4. M1 = cash in hands of public + demand deposits + other checkable deposits + travelers’ checks = $400 billion + $400 billion + $250 billion + $10 billion = $1,060 billion. 6. With no excess reserves, each dollar of reserves supports 1/RRR in demand deposits. Initially, with the required reserve ratio of 0.2, $200 billion in reserves supports $200 billion x (1/0.20) = $1000 billion in demand deposits. To decrease demand deposits by $50 billion (to $950 billion), solve this equation for RRR: $950 = (1/RRR) x $200 billion RRR = 0.21. The Fed must increase the required reserve ratio to 0.21. 8. To find the answer, substitute the desired change in the money supply ($500 billion) and the demand deposit multiplier (10 = 1/0.10) into the equation for the change in the money supply, and solve for the change in reserves: $500 billion = 10 x Reserves Reserves = $500 billion/10 = $50 billion The Fed will need to increase initial deposits by $50 billion. It can do this by buying government bonds worth $50 billion from the public. If the required reserve ratio is 0.15 (so that the demand deposit multiplier = 1/0.15 = 6.67), the Fed will need to increase initial deposits by $500 billion/(6.67) = $74.96 billion. It can do this by buying government bonds worth $74.96 billion from the public. 10. a. First National Bank Assets Liabilities Fed buys bond, +$1,000 in reserves Bond seller deposits the Fed’s check: Bank makes loan: –$800 in reserves +$800 in loans Total effect: +$200 in reserves +$800 in loans +$1,000 in demand deposits +$1,000 in demand deposits Second United Bank Assets Borrower deposits $800 loan: +$800 in reserves Bank makes loan: –$640 in reserves +$640 in loans Total effect: +$160 in reserves +$640 in loans Liabilities +$800 in demand deposits +$800 in demand deposits Third State Bank Assets Borrower deposits $640 loan: +$640 in reserves Bank makes loan: –$512 in reserves +$512 in loans Total effect: +$128 in reserves +$512 in loans Liabilities +$640 in demand deposits +$640 in demand deposits b. When the Fed buys the $1,000 bond, and its check is deposited at First National Bank, the money supply increases by $1,000 (since $1,000 in demand deposits that didn’t exist before have been created). When First National Bank lends out $800 in reserves, the money supply increases by another $800. When Second United lends out $640 and Third State lends out $512, the money supply increases by $640 and $512, respectively. c. In the end, demand deposits will rise by $1,000 (1/0.2) = $5,000. 12. a. The Fed will have to reduce the required reserve ratio. b. The Fed will have to increase the required reserve ratio. Challenge Questions 2. a. The effects of the Fed’s purchase of a $100,000 bond, when each depositor holds half of his money as cash, and the required reserve ratio is 0.1: Bank #1 Assets Liabilities Fed buys bond, +$50,000 in reserves Bond-seller deposits half of the Fed’s check: Bank makes loan: –$45,000 in reserves +$45,000 in loans Total effect: +$5,000 in reserves +$45,000 in loans +$50,000 in demand deposits +$50,000 in demand deposits Bank #2 Assets Borrower deposits half of $45,000 loan: Liabilities +$22,500 in reserves Bank makes loan: –$20,250 in reserves +$20,250 in loans Total effect: +$2,250 in reserves +$20,250 in loans +$22,500 in demand deposits +$22,500 in demand deposits Bank #3 Assets Borrower deposits half of $20,250 loan: +$10,125 in reserves Bank makes loan: –$9,112.50 in reserves +$9,112.50 in loans Total effect: +$1,012.50 in reserves +$9,112.50 in loans Liabilities +$10,125 in demand deposits +$10,125 in demand deposits b. Starting with the original increase in bank #1’s reserves of $50,000, demand deposits increase by $50,000 + $33,500 + . . . = $50,000 (1 + 0.5 + 0.52 + 0.53 + …) = $50,000 [1/(1 – 0.5)] = $50,000 [1/0.5] = $50,000 (2) = ΔReserves x 2. The demand deposit multiplier is 2 in this example. It is smaller than in the case when depositors hold no cash. With an RRR = 0.1, and no additional cash holding by the public, the demand deposit multiplier was 1/0.1 = 10. c. The ultimate change in demand deposits will be $50,000 2 = $100,000. Economic Applications Exercises 2. a. Answers may vary. b. This article concludes that risk and uncertainty are two concepts that emanate from randomness. Although risk is quantifiable, uncertainty is not and it arises from imperfect knowledge about the way the world behaves. Uncertainty relates to the questions of how to deal with the unprecedented, and whether the world will behave tomorrow the way it behaved in the past. For investors, not being able to distinguish between risk and uncertainty is hazardous to their financial health. Although we have a fairly good understanding of stock market risk, assessing stock market uncertainty is incomparably harder. The function of Federal Reserve System as the lender of last resort encourages banks to take on more risk. Given the stock market risk and uncertainty, absence of regulations separating commercial from investment banking would exacerbate the moral hazard problem and lead to more instability